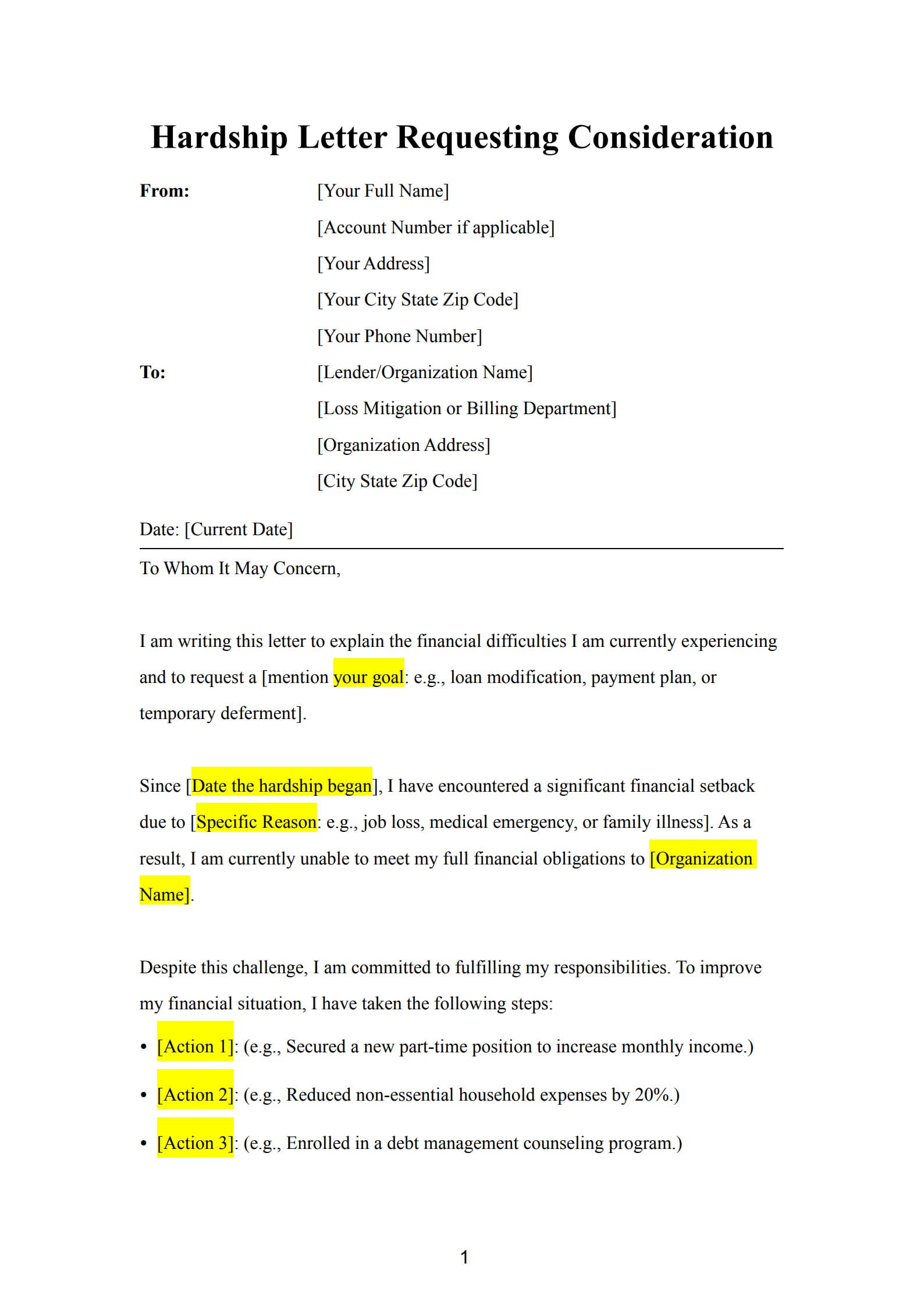

A hardship letter, sometimes called a letter of explanation, allows you to communicate financial or personal difficulties that affect your ability to meet financial obligations. Whether you are requesting loan modification, mortgage assistance, or debt relief, a well-written hardship letter explains your situation honestly and helps creditors understand your current challenges.

Using PDF Agile’s editable and printable template ensures that your hardship letter remains structured, professional, and easy to submit.

1. Understanding What a Hardship Letter Is

A hardship letter is a brief written statement describing the circumstances that caused financial strain and explaining your request for assistance. It identifies the reason for hardship, outlines the impact on your finances, and includes a proposed solution or request from the creditor, lender, or service provider.

2. When to Write a Hardship Letter

You may need to write a hardship letter when you face situations such as:

- Loss of employment or income

- Medical emergency or unexpected expenses

- Divorce or family separation

- Natural disaster or property damage

- When applying for loan modification, forbearance, or payment deferral

The goal is to show genuine effort and willingness to resolve your financial obligation despite temporary difficulties.

3. Why is a Financial Hardship Letter Template Helpful?

With PDF Agile’s hardship letter template, you can:

- Use a professional, ready-to-edit structure

- Clearly communicate key information without missing important details

- Save time while keeping a consistent, polished layout

- Quickly prepare multiple versions for different creditors or organizations

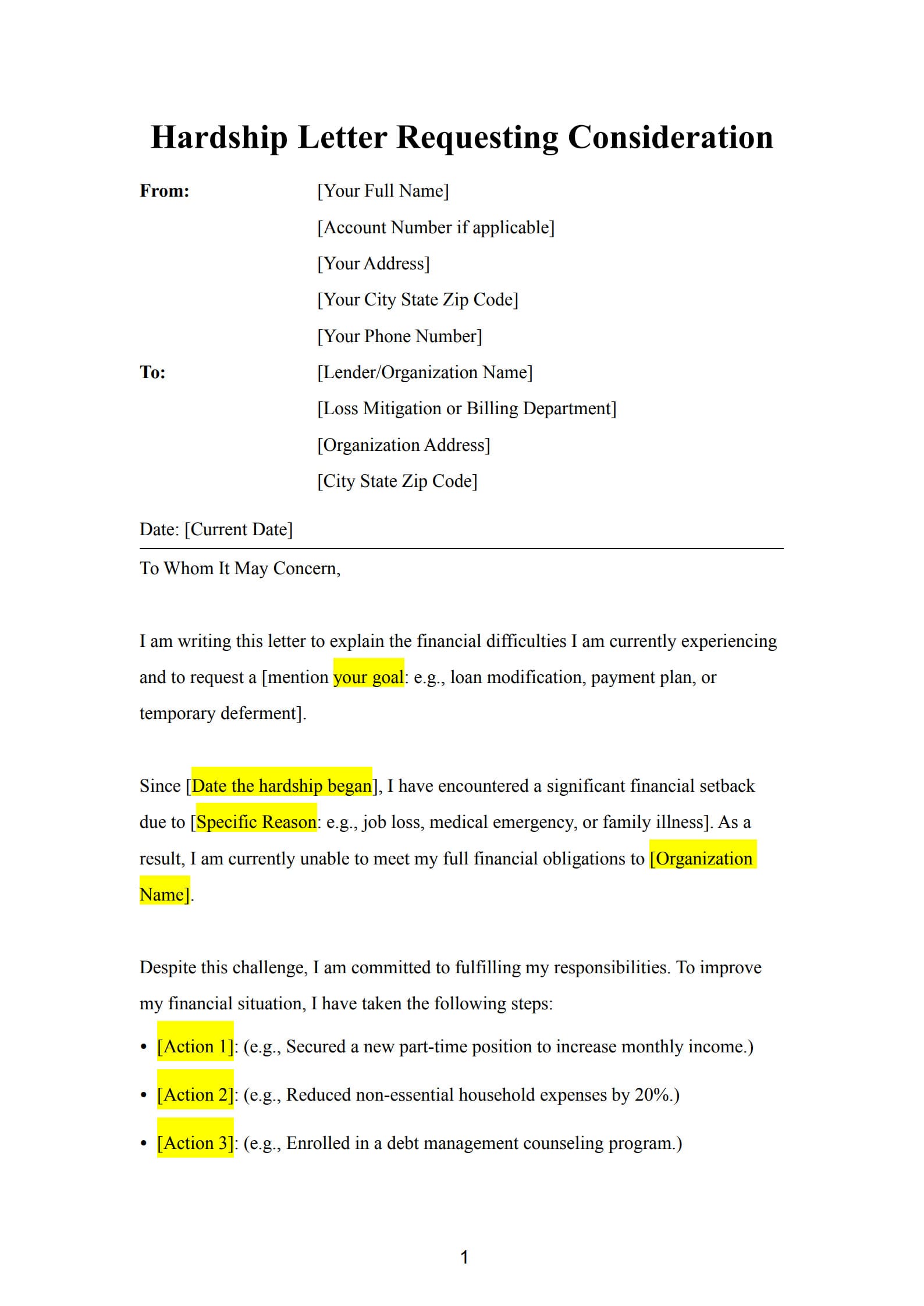

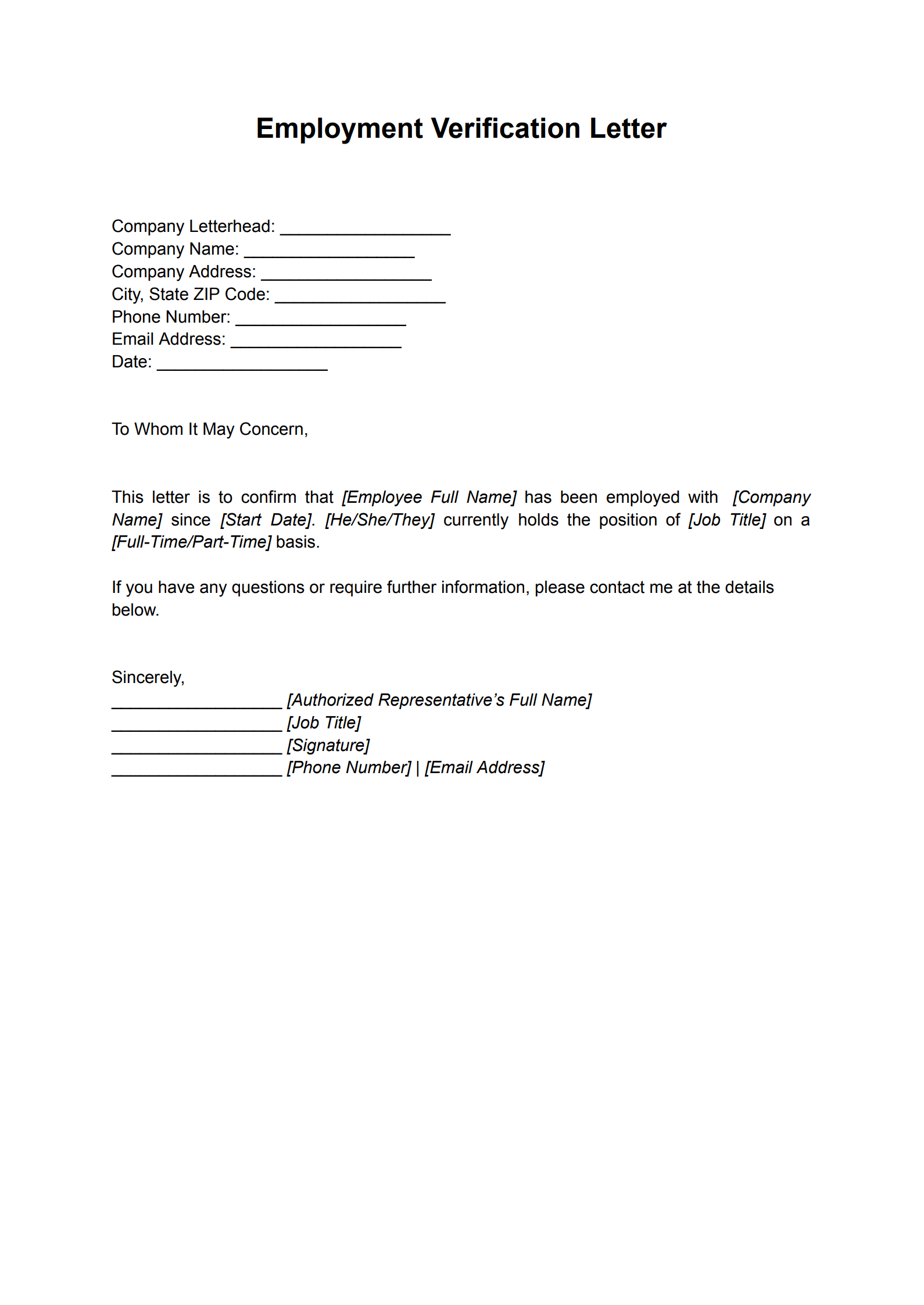

4. What to Include in an Effective Hardship Letter

An effective hardship letter should include:

- Your name, address, and contact details

- The recipient’s name and organization

- The loan, account, or case reference number

- A clear explanation of your hardship circumstances

- Supporting facts and timeline of events

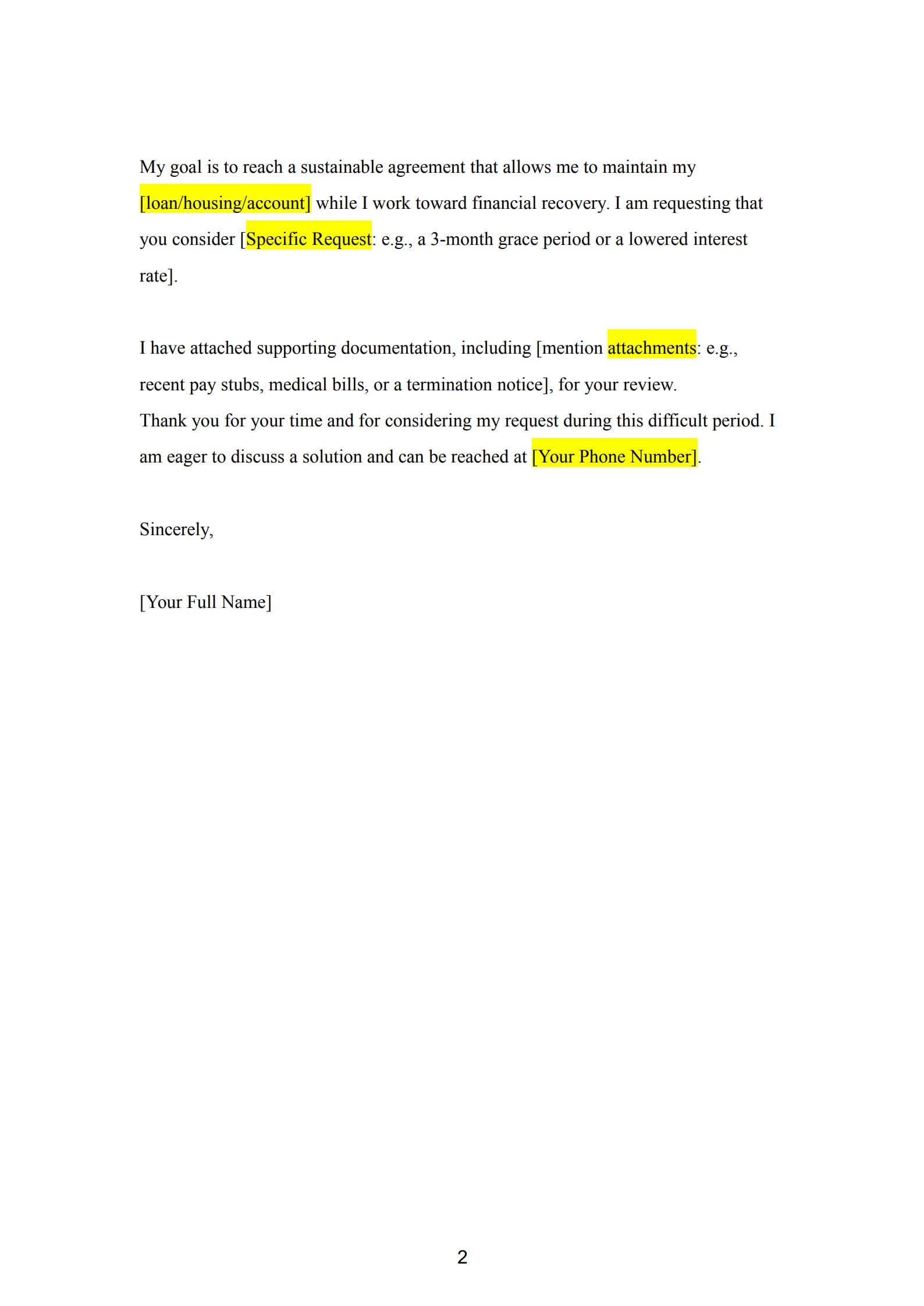

- A specific request or proposed solution

- Gratitude for the reader’s time and consideration

PDF Agile provides a straightforward, editable format so you can easily fill in each section and produce a clean, professional document.

5. Common Mistakes to Avoid in a Hardship Letter

- Writing an overly long or emotional letter

- Blaming others or offering excuses instead of facts

- Forgetting to include identifying details such as the account number

- Submitting without reviewing for clarity or grammar errors

- Being vague about your request or timeline

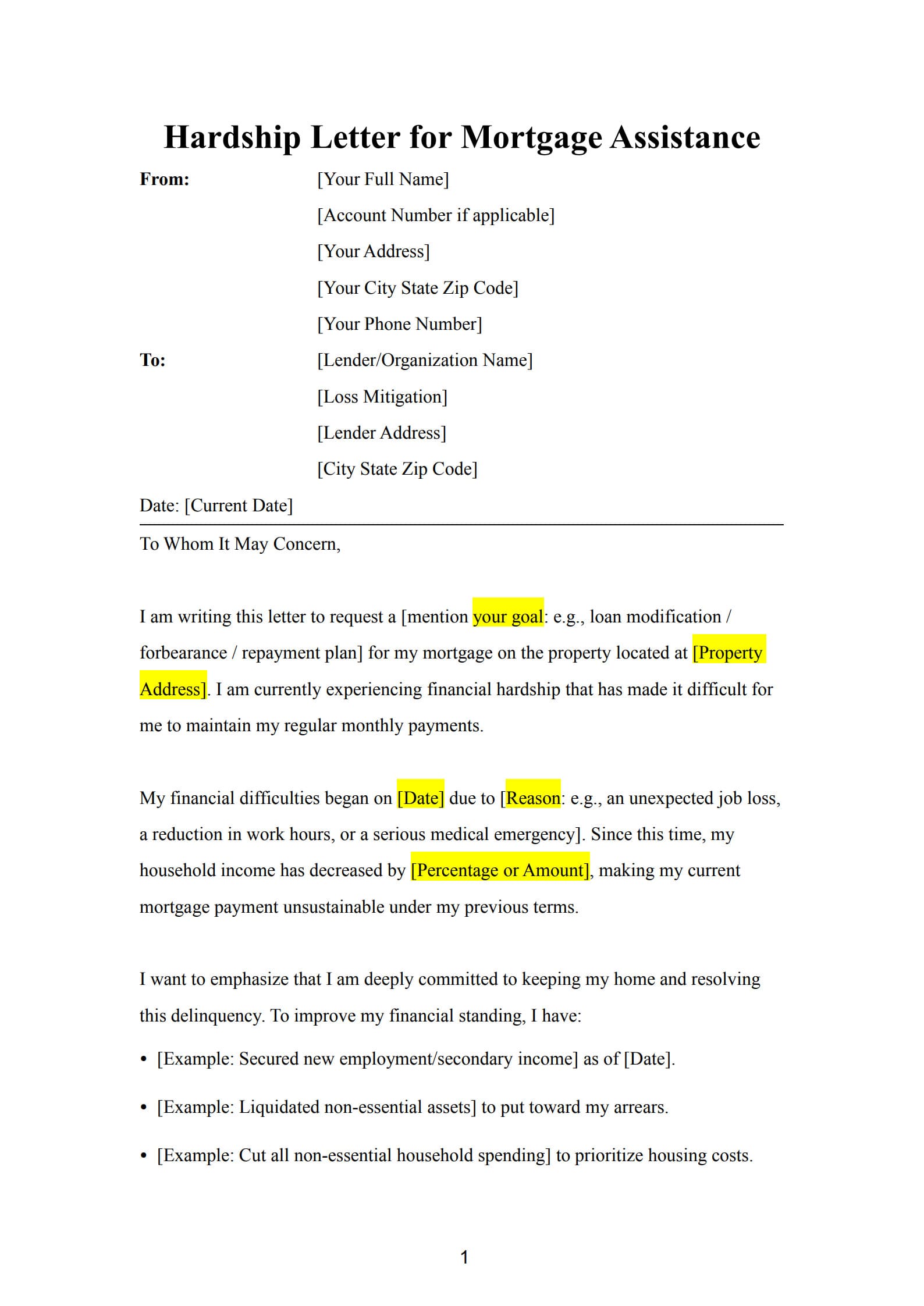

6. Mortgage Hardship Letter Template

6.1 What Is a Mortgage Hardship Letter

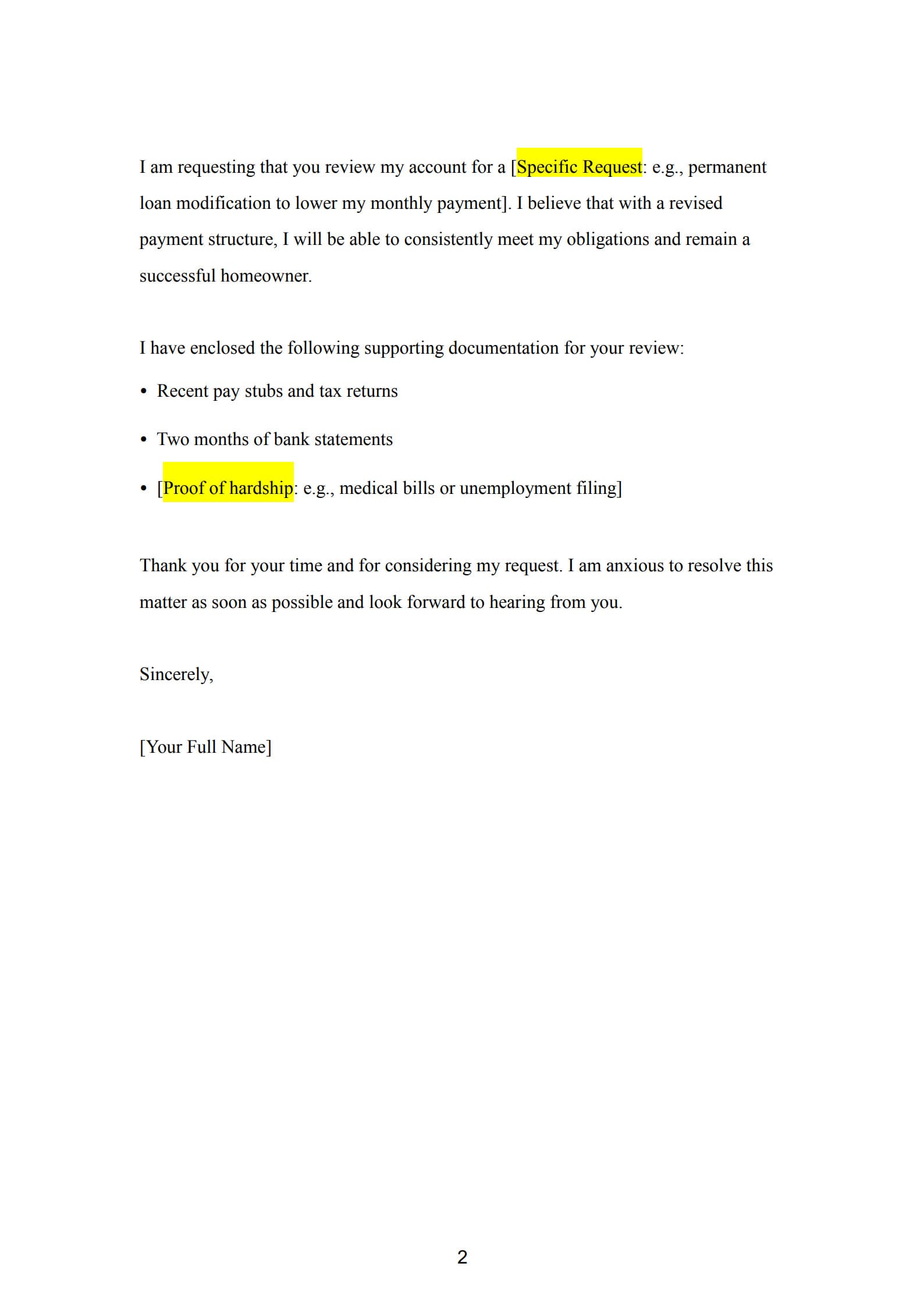

A mortgage hardship letter is written to your mortgage lender to explain financial challenges affecting your ability to make monthly mortgage payments. It provides evidence of genuine hardship and often forms part of an application for loan modification or forbearance.

6.2 What Makes a Mortgage Hardship Letter Different from a General Hardship Letter

While a general hardship letter can address various debts or obligations, a mortgage hardship letter specifically focuses on your home loan. It includes precise details such as:

- Loan number and property address

- Mortgage servicer’s name

- Duration of financial hardship

- Request for a specific solution such as modified loan terms or payment plan

6.3 How to Write an Effective Mortgage Hardship Letter Using Template

Step 1: Download the editable hardship letter template from PDF Agile

Step 2: Fill in your personal and mortgage details

Step 3: Briefly describe the cause of your hardship, such as job loss or medical expenses

Step 4: Explain what steps you have taken to manage your finances

Step 5: State your request, for example, loan modification or payment relief

Step 6: Review, save, and print your letter for submission

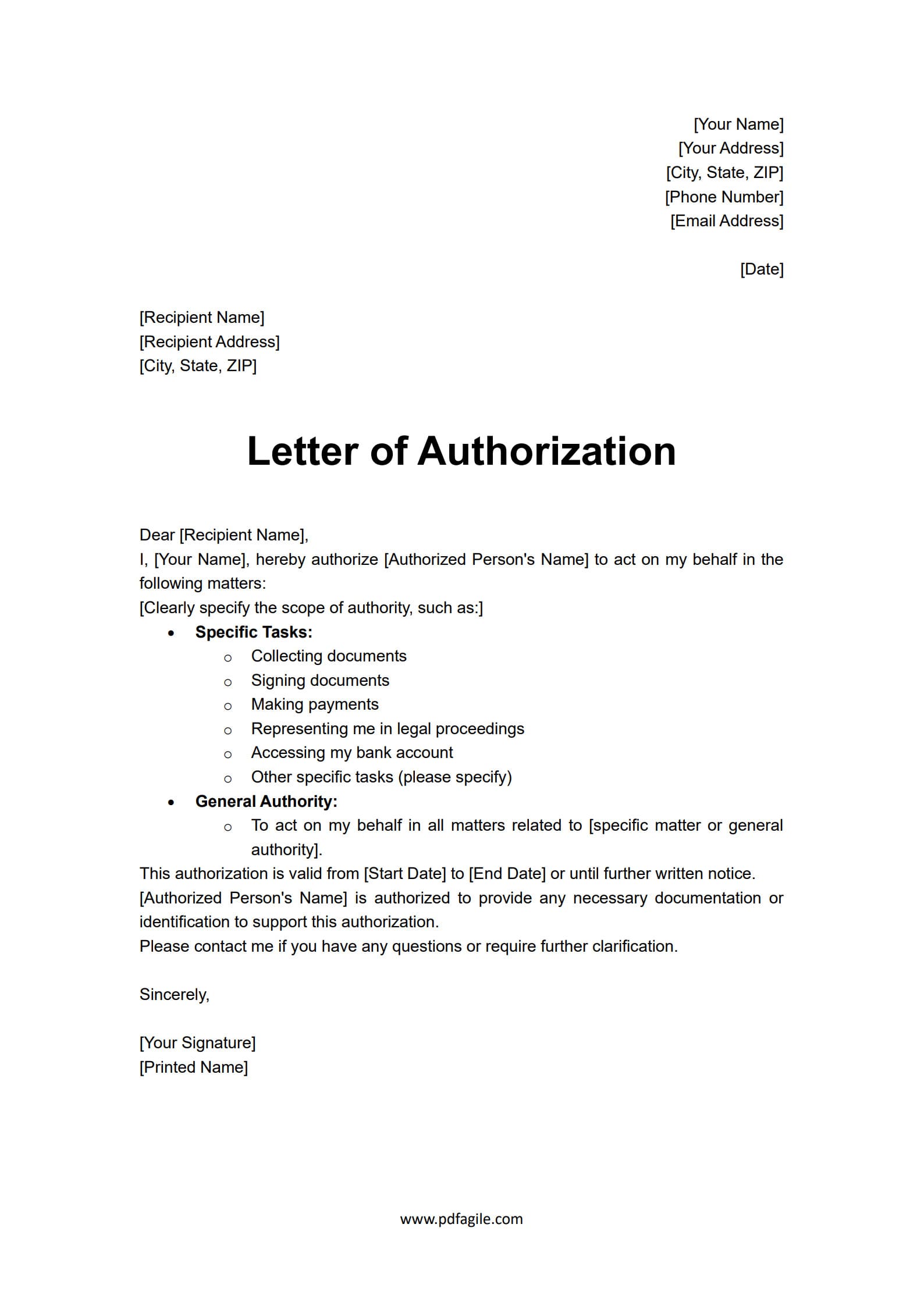

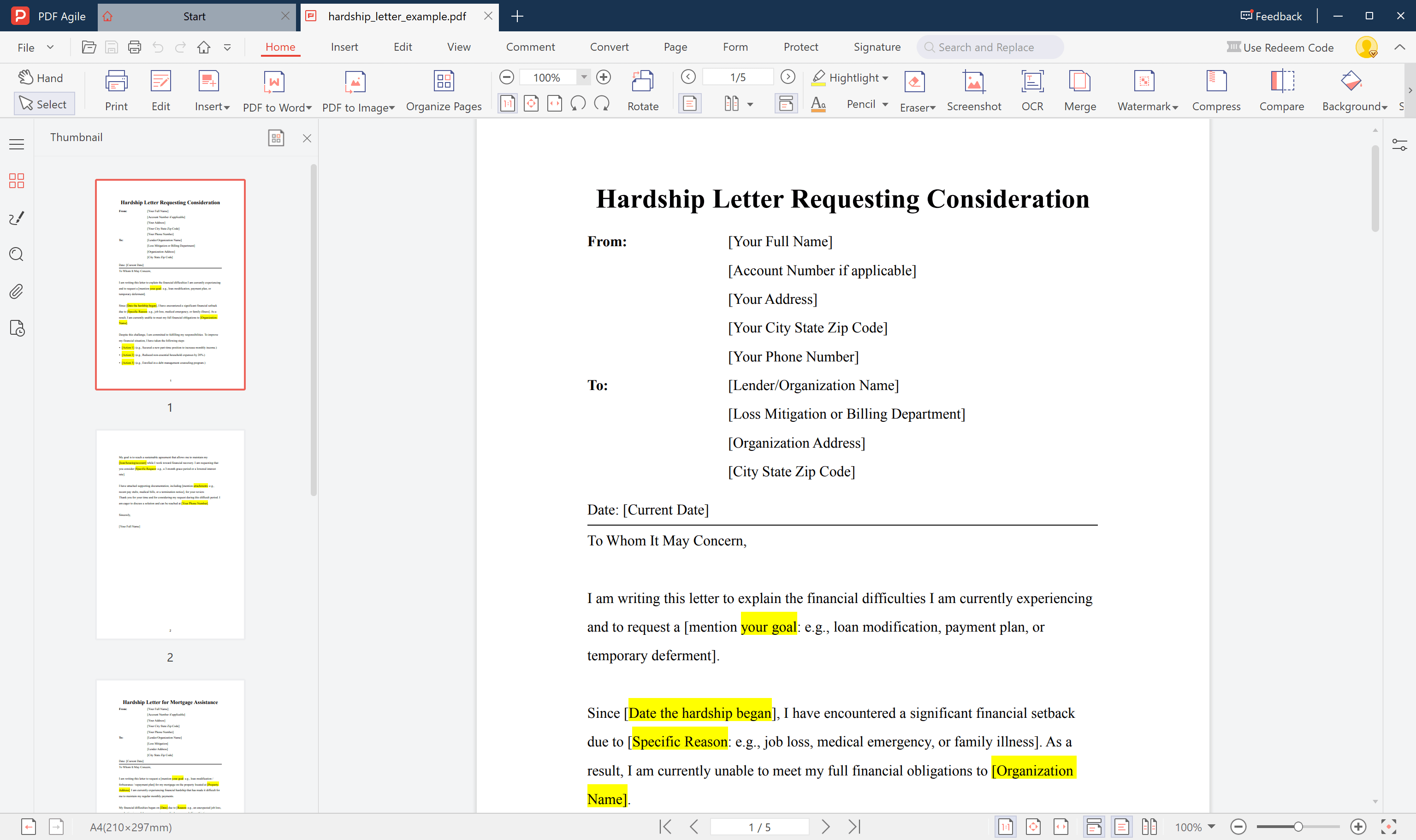

7. How to Customize Your Own Hardship Letter with Template Step by Step?

Follow these simple steps to create a personalized hardship letter using PDF Agile’s editable template:

Step 1. Download the Template Start by downloading the free printable and editable hardship letter template from PDF Agile.

Step 2. Gather Your Information Collect all relevant details such as account numbers, dates, financial documents, and contact information.

Step 3. Describe Your Hardship Clearly Explain what event or situation caused your financial difficulty. Keep the explanation brief, factual, and honest.

Step 4. Add Supporting Details Describe how the hardship has affected your finances and what steps you have taken to improve the situation.

Step 5. State Your Request Clearly mention what kind of help you are requesting — such as a payment reduction, loan modification, or temporary relief.

Step 6. Review and Edit Read through your letter carefully to ensure clarity and accuracy. Use PDF Agile’s editing tools to make quick changes.

Step 7. Save, Print, and Submit Save your completed hardship letter, print it if needed, and submit it to the appropriate organization or creditor.

By following these steps, you can create a clear, organized, and professional hardship letter tailored to your specific financial situation.

8. Frequently Asked Questions about Hardship Letters

8.1 How do I show proof of hardship?

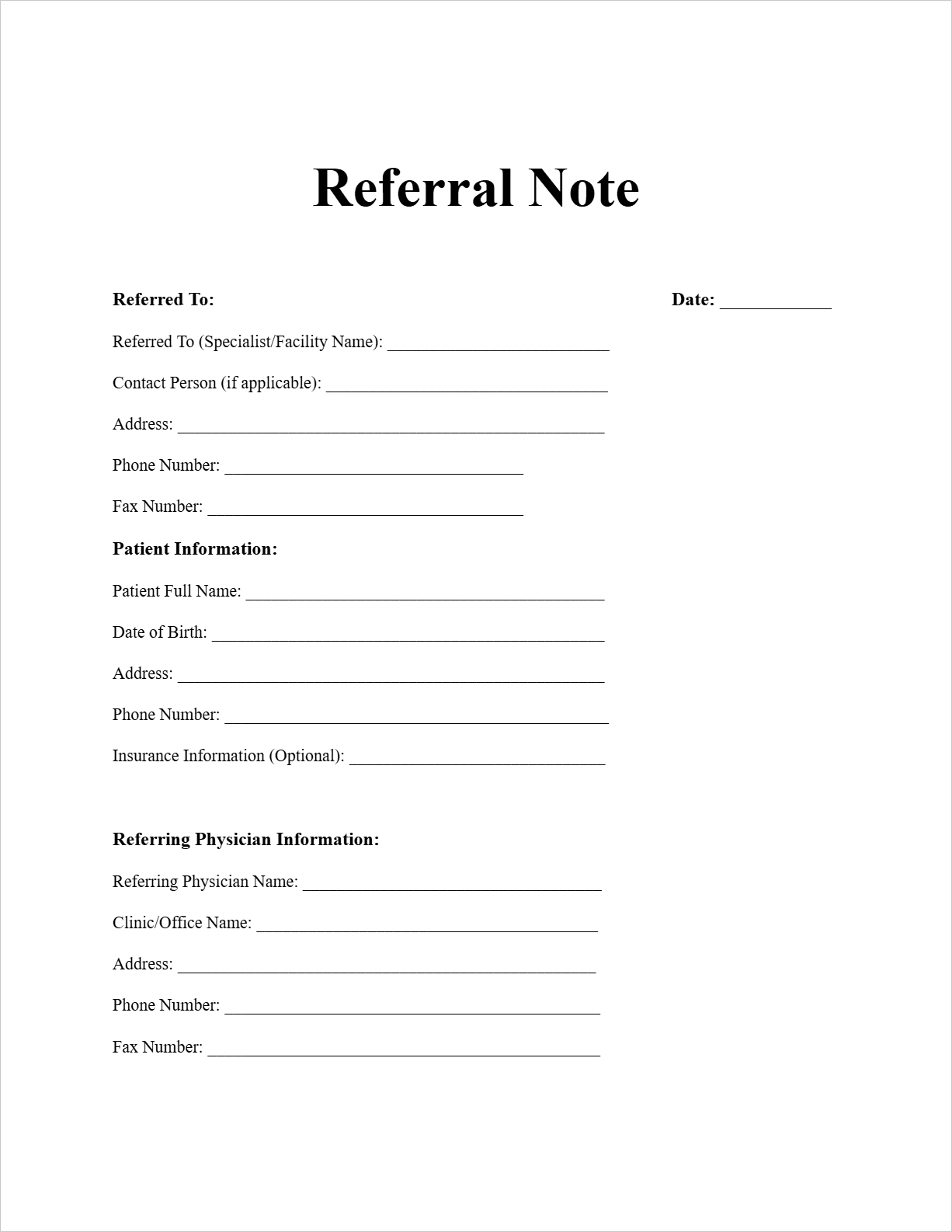

Provide supporting documentation such as pay stubs, termination letters, medical bills, or bank statements that demonstrate financial strain.

8.2 What not to put in a hardship letter?

Avoid blaming others, exaggerating your situation, or including unnecessary personal details. Focus only on facts that support your request.

8.3 How soon can I expect a response after submitting a hardship letter?

Depending on the organization, responses may take between one and four weeks. Follow up politely if you do not hear back.

Conclusion

A hardship letter is your opportunity to communicate real financial challenges with honesty and clarity. Writing a clear letter using a PDF Agile printable and editable template ensures a well-organized, professional format that highlights your sincerity and request for consideration.

By keeping your message concise, factual, and respectful, you increase your chances of receiving a positive response and practical support.

Free Download: Printable Financial Hardship Letter Template

You can download the Hardship Letter mentioned above by clicking Use Template button on this page. Customize it to fit your specific needs and preferences.