When someone owes you money and won't pay, the frustration can feel overwhelming. Whether it's an unpaid invoice from a client, a personal loan to a friend, or outstanding payment for services rendered, unpaid debts can strain relationships and damage your bottom line. Before resorting to expensive legal action or aggressive collection tactics, a well-crafted debt recovery letter often provides the most effective and professional first step toward getting paid.

Understanding the Debt Recovery Letter

A debt recovery letter is a formal written communication sent to someone who owes you money, requesting payment of the outstanding debt. This document serves multiple purposes: it reminds the debtor of their obligation, provides a clear record of your collection attempt, and demonstrates your willingness to resolve the matter professionally before escalating to legal proceedings.

Unlike informal text messages or verbal reminders, the debt recovery letter carries weight because of its official nature. It shows you're serious about collecting what you're owed while maintaining professional standards. The letter typically includes details about the original transaction, the amount owed, payment deadline, and consequences for continued non-payment.

The debt recovery letter works because it formalizes your request in a way that casual communication cannot. Many people ignore texts or verbal requests but respond more seriously to written documentation. The act of receiving a formal letter often prompts debtors to prioritize your payment, especially when they realize you're documenting everything and prepared to take further action.

This approach benefits both creditors and debtors by creating an opportunity for resolution before relationships deteriorate further or legal costs accumulate. A thoughtfully written debt recovery letter can preserve business relationships while still asserting your right to payment.

When to Send Your Debt Recovery Letter

Timing matters significantly when pursuing debt recovery. Send your letter too early, and you risk appearing impatient or damaging relationships unnecessarily. Wait too long, and you signal that payment deadlines don't matter, encouraging future delays.

After Payment Becomes Overdue

The ideal time to send a debt recovery letter is typically 7-14 days after the payment due date has passed. This gives the debtor a reasonable grace period for payments that might be delayed by processing times, mail delivery, or simple oversight. However, don't wait so long that the debt feels forgotten or negotiable.

Before Legal Action

Always send at least one debt recovery letter before pursuing legal remedies like small claims court or hiring a collection agency. Courts and arbitrators look favorably on creditors who've made good-faith attempts to resolve matters directly. Your debt recovery letter demonstrates reasonable effort and strengthens your position if litigation becomes necessary.

When Informal Attempts Fail

If you've already sent friendly reminders via email or phone without results, a debt recovery letter represents the next escalation level. The formal tone signals that you're moving from casual follow-up to serious collection mode.

Before the Statute of Limitations Expires

Different types of debts have different timeframes within which you can legally pursue collection. Research your jurisdiction's statute of limitations and send your debt recovery letter well before this deadline. Once the statute expires, your leverage diminishes significantly.

Core Components of an Effective Debt Recovery Letter Template

Crafting a persuasive debt recovery letter requires including specific elements that establish credibility and create urgency while maintaining professionalism.

Professional Header and Date

Begin your debt recovery letter with your business letterhead or complete contact information, followed by the date. This establishes the document's official nature and creates a timeline for your collection efforts. Include the debtor's name and address to ensure proper documentation.

Clear Debt Identification

Specify exactly what the debt is for, when it originated, and any agreement or invoice numbers. Your debt recovery letter should reference the original transaction so precisely that the debtor cannot claim confusion about what you're collecting. Include dates, services provided, products delivered, or loan terms as applicable.

Exact Amount Due

State the precise amount owed, breaking down principal, interest, late fees, or other charges if applicable. Transparency about how you calculated the total strengthens your position and reduces disputes. Your debt recovery letter should leave no ambiguity about what you expect to receive.

Payment Deadline

Provide a specific date by which payment must be received, typically 14-30 days from the letter date. Phrases like "as soon as possible" or "at your earliest convenience" lack the urgency that specific deadlines create. Your debt recovery letter should make clear that time-sensitive action is required.

Payment Instructions

Make it easy for the debtor to pay by including detailed payment methods, account numbers, mailing addresses, or online payment links. Removing friction from the payment process increases the likelihood of receiving your money. Your debt recovery letter should anticipate and answer "how do I pay?" questions.

Consequences for Non-Payment

Clearly but professionally state what will happen if payment isn't received by the deadline. This might include reporting to credit bureaus, pursuing legal action, adding collection fees, or terminating business relationships. The debt recovery letter should create motivation without making threats you can't or won't follow through on.

Professional Tone

Even when frustrated, maintain courteous, businesslike language throughout your debt recovery letter. Aggressive, insulting, or threatening language can backfire legally and practically. You can be firm about expectations while remaining respectful in delivery.

Strategic Approaches for Your Debt Recovery Letter Template

Different situations call for different strategies when crafting your debt recovery letter.

The Reminder Approach

For first-time collection attempts or reliable clients who've simply forgotten, use a gentler debt recovery letter that assumes good faith. Emphasize the oversight nature of the situation while still being clear about expectations. This preserves relationships while securing payment from those who genuinely forgot.

The Firm Business Approach

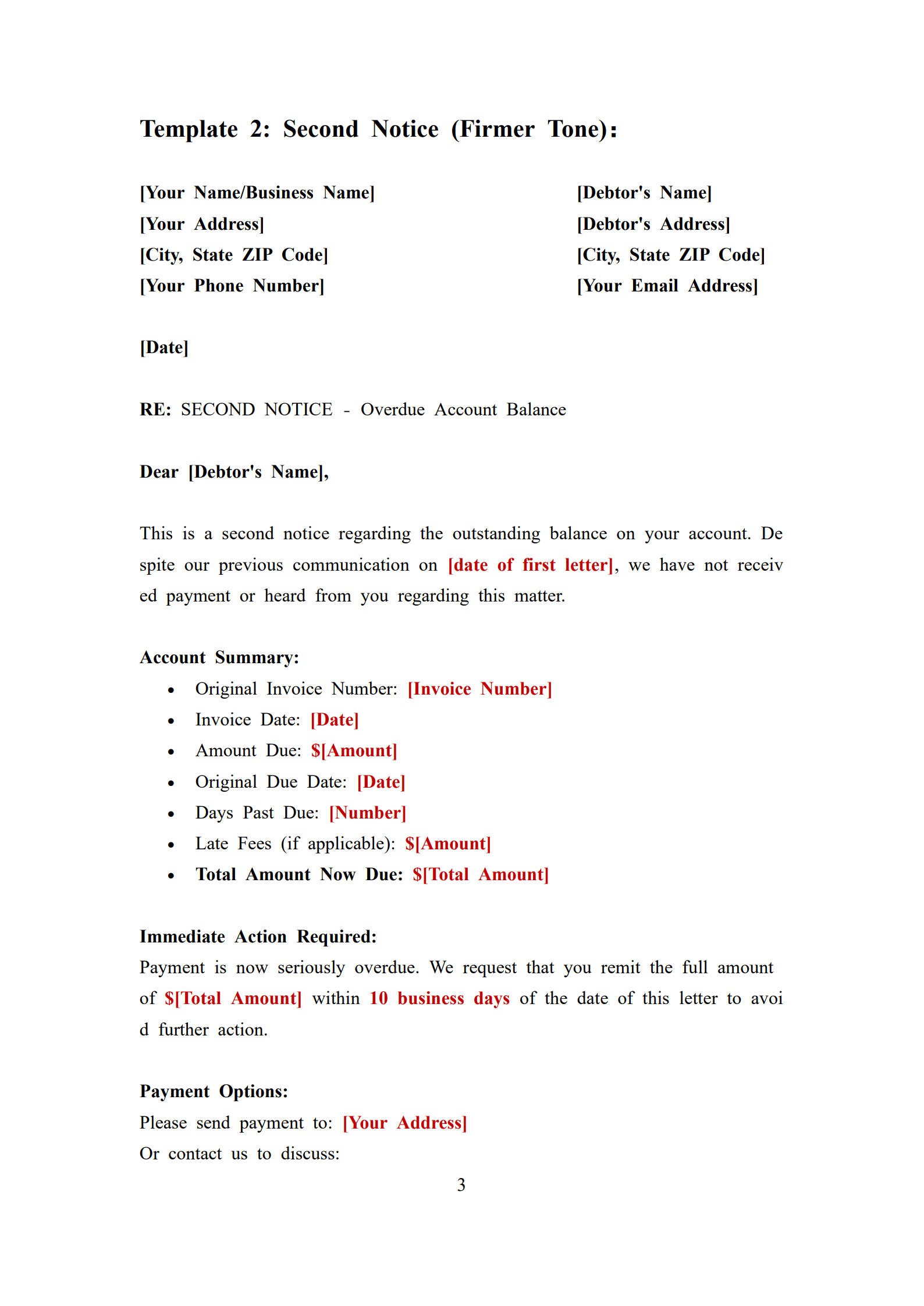

When dealing with repeat offenders or substantial amounts, your debt recovery letter should be more direct and formal. Reference previous attempts to collect, outline specific consequences, and set shorter deadlines. This approach works well in business-to-business contexts where professionalism is expected.

The Personal Relationship Approach

Collecting from friends or family requires special consideration in your debt recovery letter. Acknowledge the personal relationship while asserting that the debt still requires repayment. You might offer flexible payment plans while being clear that the money must be repaid to preserve the relationship.

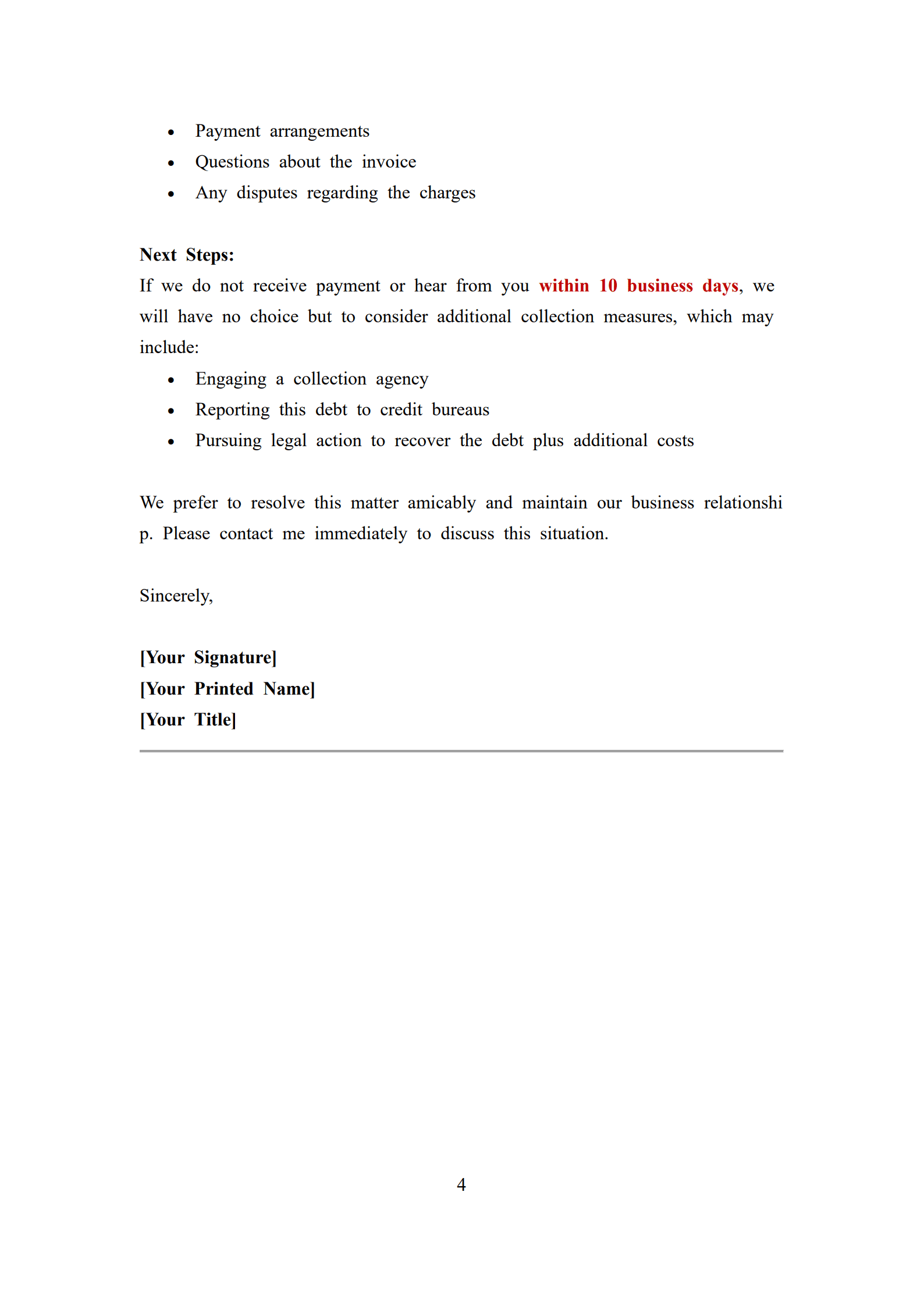

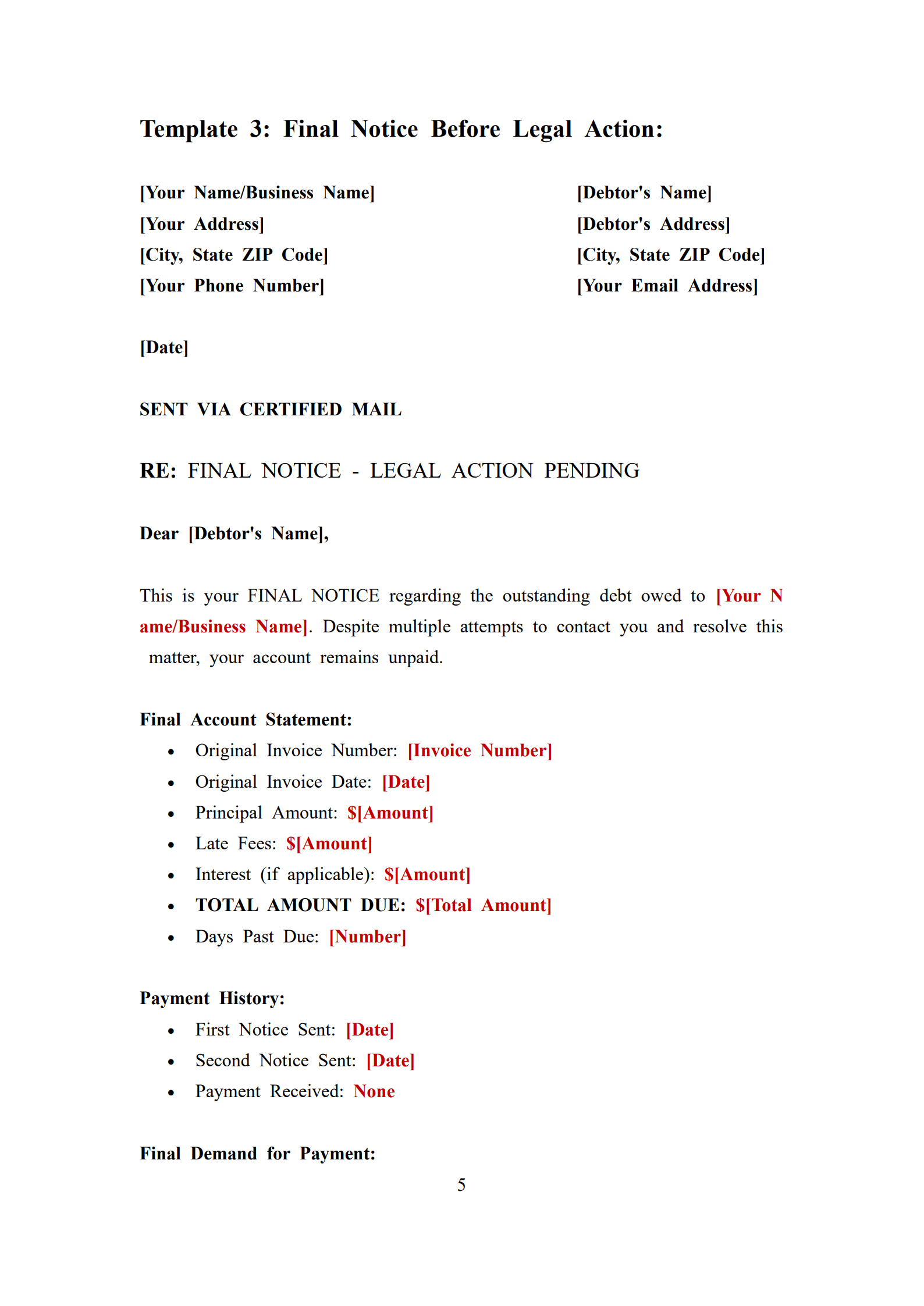

The Legal Preparation Approach

If this is your final attempt before pursuing legal action, your debt recovery letter should explicitly state this intention. Reference specific legal remedies you'll pursue and deadlines that align with filing requirements. This approach often motivates payment from debtors who've ignored previous letters.

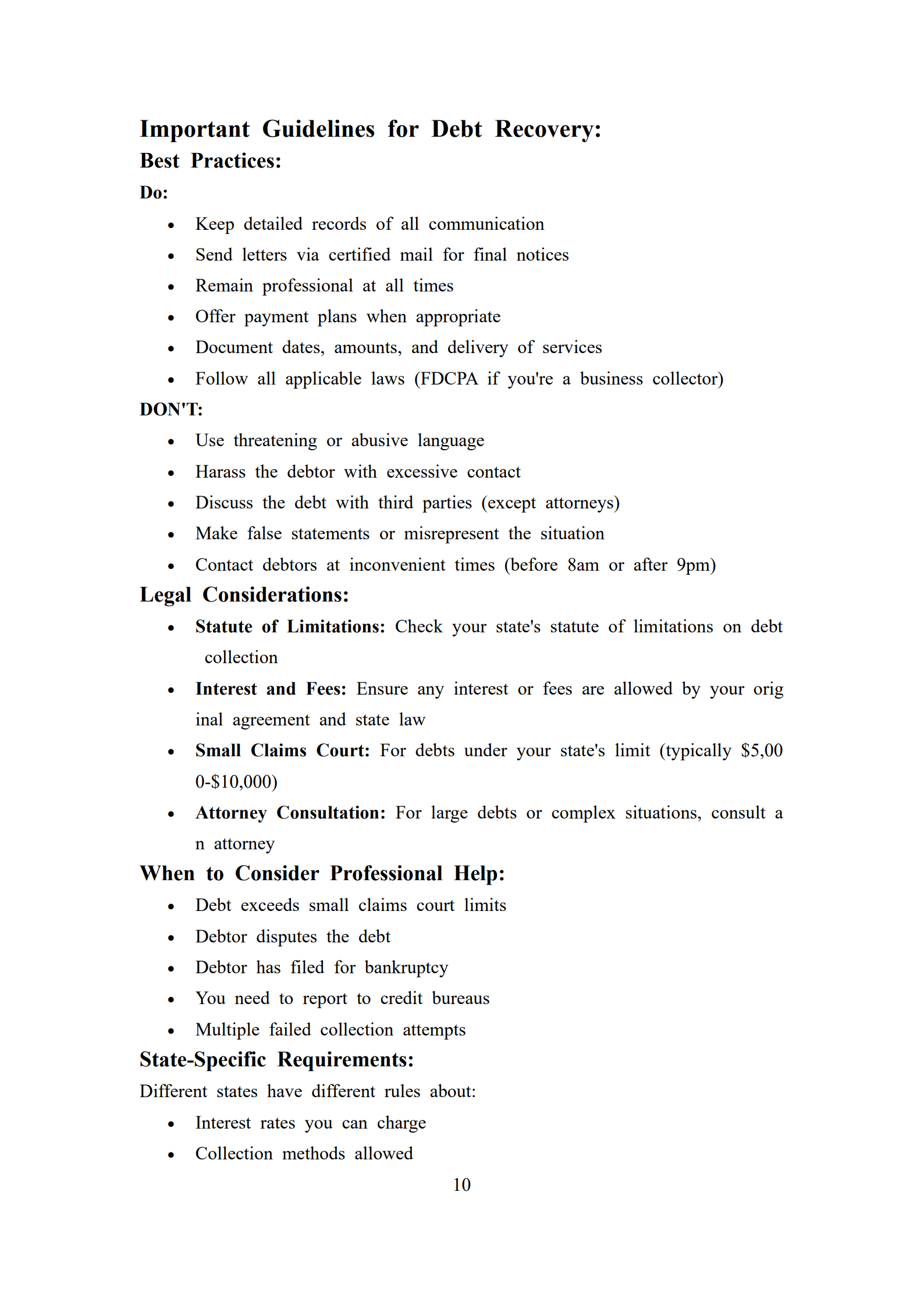

Best Practices for Debt Recovery Letter Success

Maximize your chances of collecting payment by following proven strategies.

Document Everything

Keep copies of your debt recovery letter along with proof of delivery. Send via certified mail or email with read receipts to prove the debtor received your communication. This documentation becomes critical if you later pursue legal remedies or need to prove collection efforts.

Use Multiple Contact Methods

While your formal debt recovery letter should go via postal mail, consider sending a courtesy email or making a phone call to alert the debtor that official correspondence is coming. Multiple touchpoints increase the likelihood of response without appearing harassing.

Offer Payment Plans

Including payment plan options in your debt recovery letter can dramatically increase collection rates. Many debtors who can't pay the full amount immediately can handle installments. Flexibility on payment terms often means the difference between getting something and getting nothing.

Research Relevant Laws

Before sending your debt recovery letter, understand debt collection laws in your jurisdiction. Regulations like the Fair Debt Collection Practices Act apply primarily to professional collection agencies, but knowing these standards helps you avoid problematic language or tactics even as an individual creditor.

Follow Through on Consequences

If your debt recovery letter states specific consequences for non-payment, you must follow through if the deadline passes without payment. Empty threats in one situation train debtors to ignore future collection attempts. Consistency between your words and actions builds credibility.

Keep Emotions in Check

Personal feelings about the debtor or situation should never appear in your debt recovery letter. Anger, disappointment, or frustration weaken your position and can create legal vulnerabilities. Stick to factual statements about the debt and required actions.

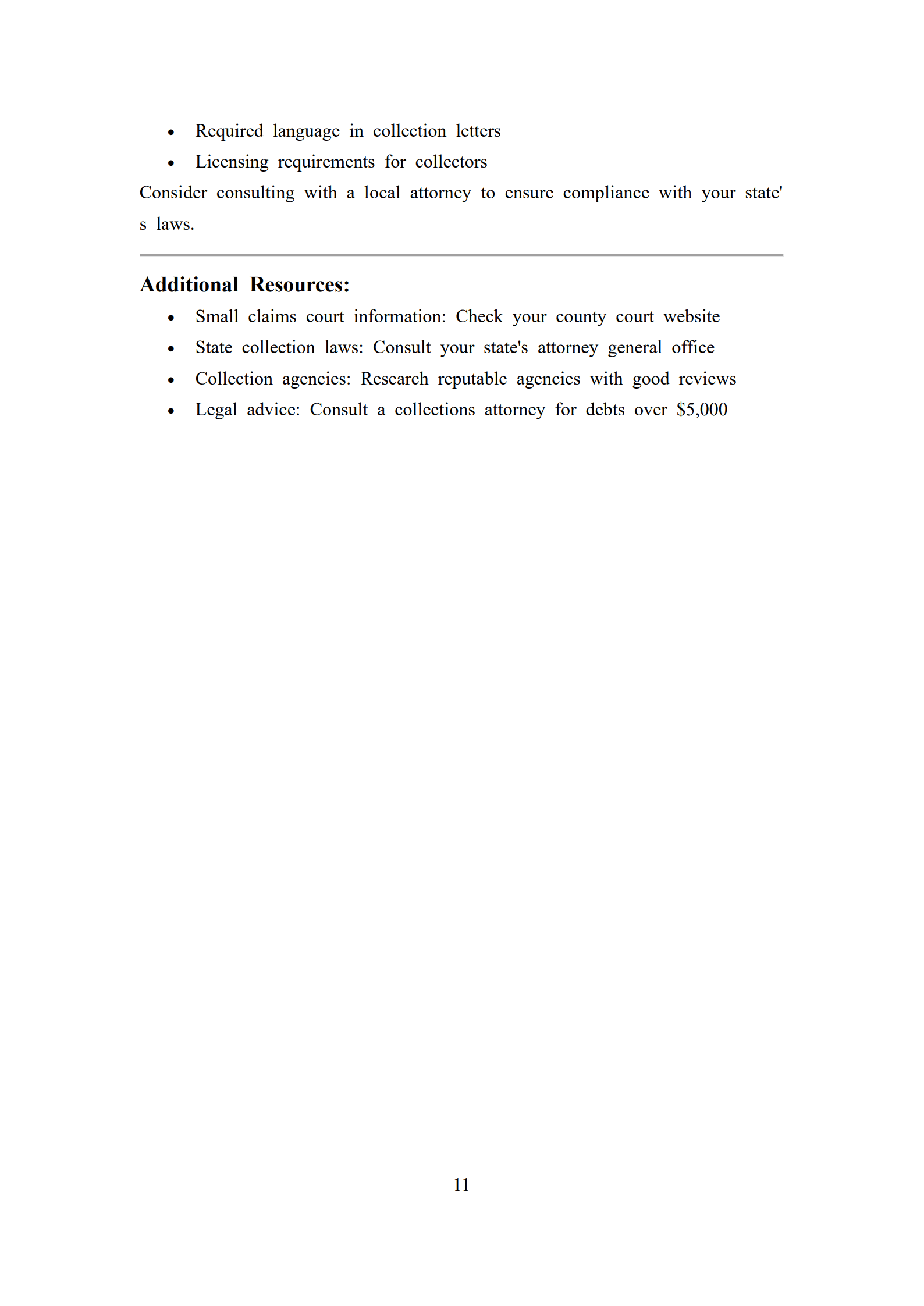

Common Mistakes That Undermine Debt Recovery Letters

Avoid these errors that reduce collection effectiveness and create potential problems.

Vague or Inaccurate Information

Nothing weakens a debt recovery letter faster than incorrect amounts, wrong dates, or unclear references to the original debt. Double-check every detail before sending. Errors give debtors legitimate reasons to dispute or ignore your request.

Threatening Illegal Actions

Never include threats you cannot legally follow through on in your debt recovery letter. Claiming you'll garnish wages without a court order, report to credit bureaus without proper authority, or take other actions beyond your legal rights can expose you to liability and invalidate your collection efforts.

Overly Aggressive Language

While firmness is appropriate, harassing, abusive, or excessively aggressive language in your debt recovery letter can backfire spectacularly. Such communication may violate harassment laws and makes judges less sympathetic if you later pursue legal remedies.

Sending Too Many Letters

After sending your initial debt recovery letter and perhaps one follow-up, consider whether additional letters serve any purpose. Repeated correspondence without escalation signals that your deadlines and consequences aren't serious. Know when to move beyond letters to other collection methods.

Ignoring Dispute Claims

If the debtor responds to your debt recovery letter claiming they don't owe the money or the amount is wrong, address these disputes rather than ignoring them. Continued collection attempts without investigating legitimate disputes can create legal problems.

Forgetting to Keep Copies

Always retain copies of every debt recovery letter you send along with proof of delivery. Without documentation, you'll struggle to prove your collection attempts if you later need to pursue legal action or defend against counterclaims.

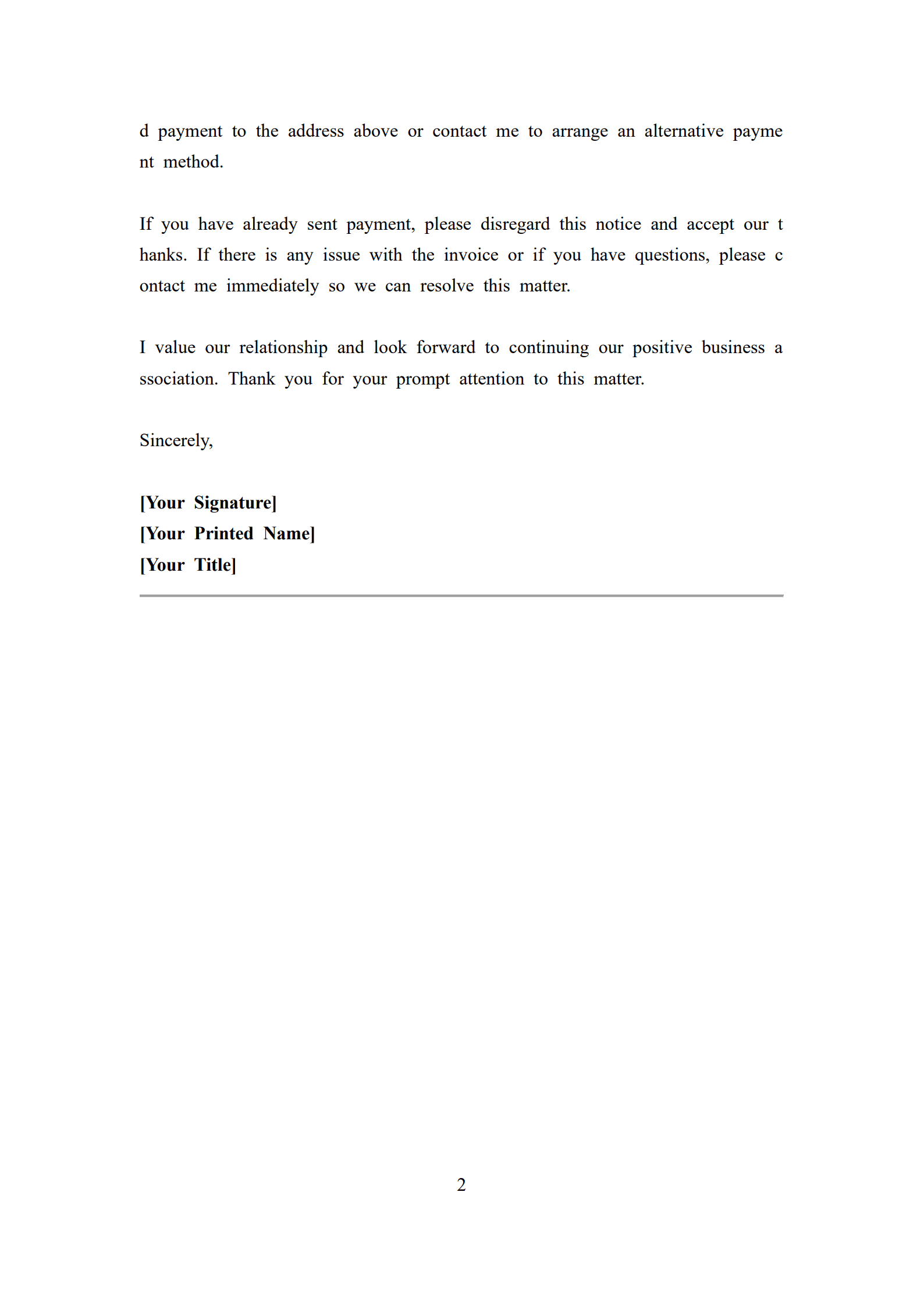

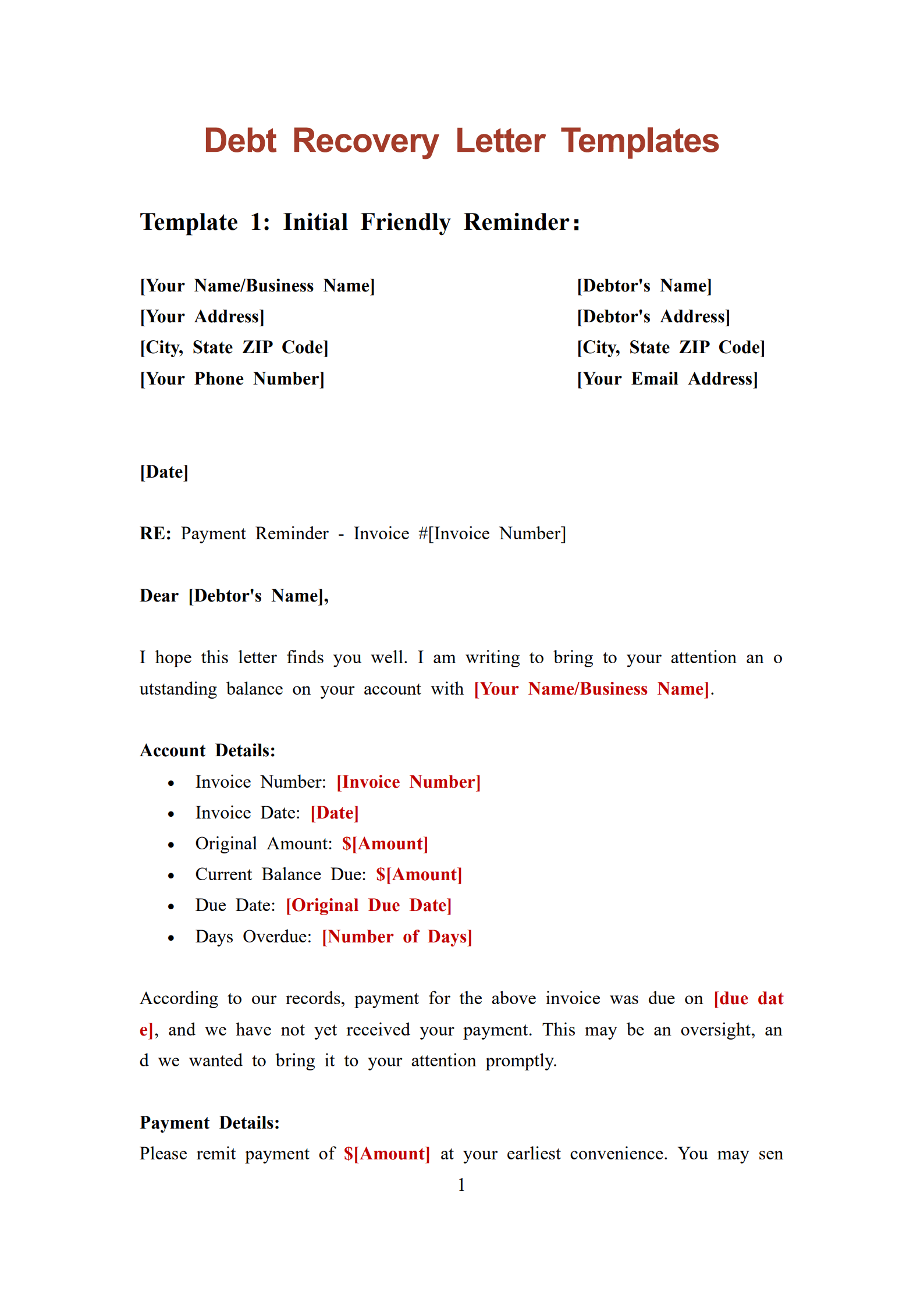

Free Download: Your Debt Recovery Letter Template

Ready to take professional action to collect money owed to you? Our comprehensive debt recovery letter template provides you with a proven format that balances firmness with professionalism. This customizable template includes all the essential elements that can help motivate payment while protecting your legal position. Whether you're a small business owner pursuing unpaid invoices or an individual collecting on a personal debt, our template can help you communicate your expectations clearly and effectively. Download now and take the first step toward recovering what you're owed.

Frequently Asked Questions About Debt Recovery Letters

Q: Can I charge interest or late fees in my debt recovery letter?

A: You can only charge interest or late fees if they were specified in your original agreement with the debtor. Your debt recovery letter should reference the contract clause that authorizes these charges. Without prior agreement, adding fees may be considered improper and could undermine your collection efforts.

Q: Should my debt recovery letter be sent via email or postal mail?

A: Postal mail via certified mail with return receipt provides the strongest documentation and carries more weight. However, sending both a physical debt recovery letter and an email copy can be effective. The email provides immediate notification while the postal letter creates an official record.

Q: How many debt recovery letters should I send before taking legal action?

A: Typically, one formal debt recovery letter followed by one final notice is sufficient before pursuing legal remedies. Sending more than two or three letters rarely produces better results and may make you appear unwilling to follow through on stated consequences.

Q: What should I do if the debtor disputes the amount in my debt recovery letter?

A: If the debtor claims they don't owe the full amount, pause collection activities and investigate their dispute. Request their documentation and compare it to yours. If they're correct, send a revised debt recovery letter with the accurate amount. If they're wrong, respond with evidence supporting your original claim.

Q: Can I include collection costs in my debt recovery letter?

A: You can only recover collection costs if your original agreement specified this or if your jurisdiction's laws allow it. Some states permit creditors to add reasonable collection expenses to the debt amount. Your debt recovery letter should clearly indicate which costs are part of the original debt versus added collection expenses.

Q: Will sending a debt recovery letter hurt my relationship with the debtor?

A: A professional debt recovery letter can actually preserve relationships better than informal collection attempts. It demonstrates you're taking the matter seriously while providing clear expectations for resolution. The letter's formality often motivates payment without the personal confrontation that damages relationships.

Q: How long should I wait for a response to my debt recovery letter before escalating?

A: The deadline you specified in your debt recovery letter determines the waiting period. Typically 14-30 days is reasonable. If no payment arrives by the deadline, send one final notice giving an additional 7-10 days before pursuing other collection methods.

Q: What if the person who owes me money has moved and I don't have their address?

A: You can send your debt recovery letter to the last known address. Consider using skip tracing services, social media searches, or public records to locate the debtor's current address. If you cannot locate them, document your attempts as they support your collection efforts should you later find them or pursue legal remedies.