In today's credit-driven economy, your financial reputation is often reduced to a three-digit number and a multi-page document known as a credit report. This document acts as a gatekeeper for some of life’s most significant milestones, from purchasing a home to securing a competitive interest rate on a car loan. However, data entry is a human process, and errors are remarkably frequent. When you identify an inaccuracy that threatens your financial standing, the most effective tool at your disposal is a formal dispute credit report letter. This editorial guide explores the strategic importance of this document, how to utilize a template effectively, and the legal framework that supports your right to an accurate credit history.

What is a Credit Dispute Letter?

A dispute credit report letter is a formal, written request used to challenge inaccurate, incomplete, or outdated information found on a consumer credit report. While we live in an increasingly digital world where credit bureaus offer online "dispute portals," the traditional written letter remains a widely used and highly recommended option. This is because a physical letter allows for clearer, more nuanced explanations and provides a superior method for submitting supporting documentation.

When you send a dispute credit report letter, you are initiating a statutory process. Under federal law, credit reporting agencies (Equifax, Experian, and TransUnion) are required to maintain accurate files. When a consumer identifies a discrepancy, the bureau must investigate the claim, usually within a 30-day window. This editorial explains the mechanics of the dispute credit report letter, why it is a critical component of credit health, and how to use a template to respond to errors in a structured and informed way.

Why Sending a Dispute Credit Report Letter?

Your credit report is your financial resume. Errors can lower your score, making it difficult to:

- Get approved for loans or credit cards.

- Secure low interest rates.

- Rent an apartment or even get certain jobs.

- Identity Theft Protection: Often, an unrecognized account is the first sign that your identity has been stolen.

You might also wonder if a small error is worth the effort of a dispute credit report letter. However, the "ripple effect" of even a minor inaccuracy can be profound. For instance, an incorrectly reported 30-day late payment can stay on your report for seven years, potentially knocking 50 to 100 points off your score. This score drop can move you from a "Prime" borrower category to "Subprime," effectively doubling your interest rates on an auto loan or personal line of credit.

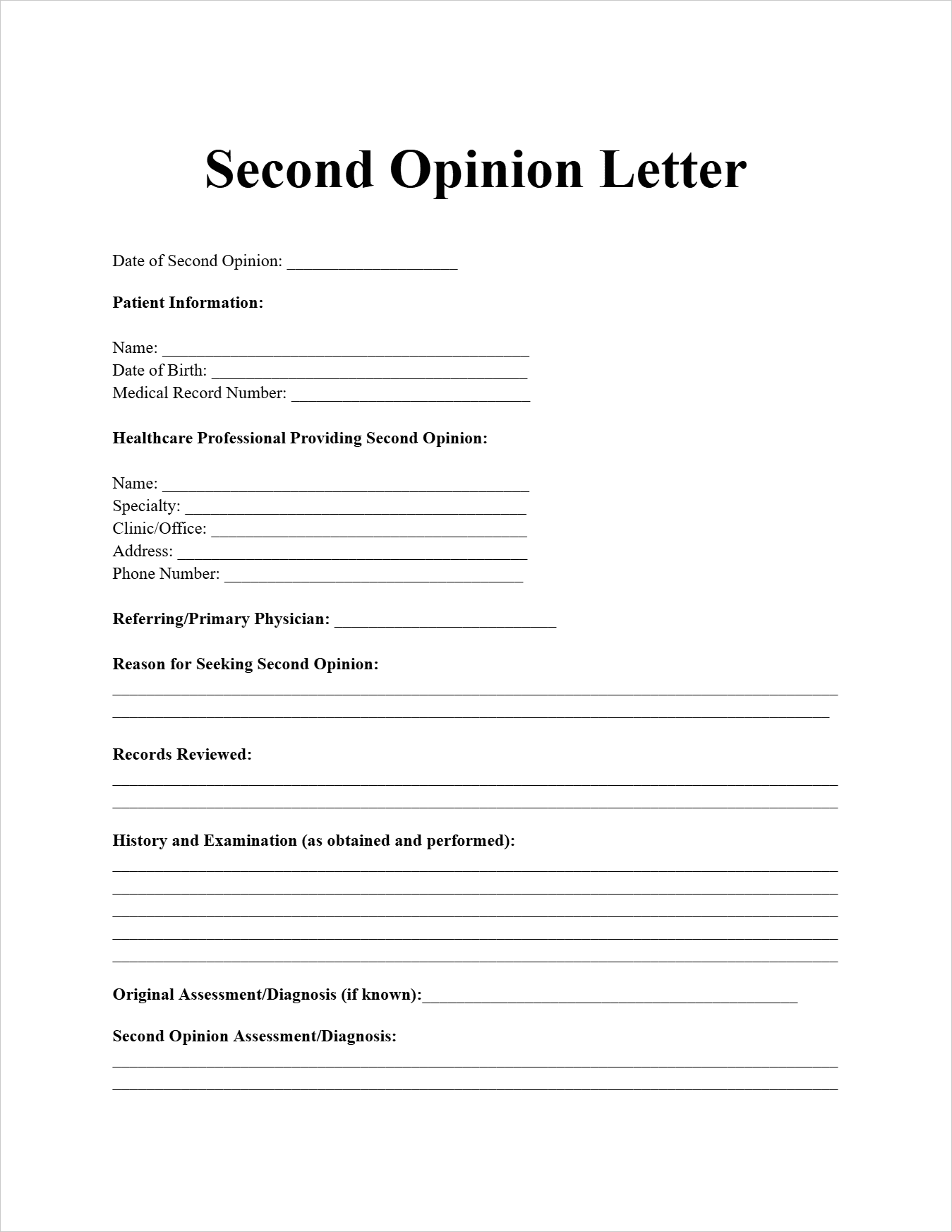

Furthermore, disputing errors via a dispute credit report letter is a vital defense against identity theft. Many victims first notice fraudulent activity not through a phone call from their bank, but by seeing an unfamiliar address or an unknown inquiry on their credit report. Formally disputing these entries helps clear your name and prevents identity thieves from further leveraging your credit. Finally, there is the principle of accountability; credit bureaus are multi-billion dollar entities that profit from selling your data. Sending a dispute credit report letter is your way of ensuring that the product they are selling—your financial history—is actually true.

Common Errors For a Credit Dispute Letter

A dispute credit report letter can be used to challenge a wide variety of reporting issues. These are not limited to major cases of identity theft or fraud; even small, clerical inaccuracies can have a measurable impact on your credit score. Understanding what to look for is the first step in crafting an effective letter.

Frequently disputed items that warrant a dispute credit report letter include:

- Identity Errors: Often caused by "mixed files" where information from someone with a similar name is merged into your report, or incorrect name spellings and addresses.

- Incorrect Account Status: Such as a settled debt still showing as "past due" or a closed account appearing as "active."

- Balance and Limit Inaccuracies: Which can negatively affect your credit utilization ratio, a major factor in your credit score.

- Late Payments Reported in Error: Where you have bank statements or receipts proving the payment was made on time.

- Duplicate Accounts: Where the same debt is listed multiple times by different collection agencies, making you appear more indebted than you are.

- Outdated Information: Negative information that should no longer appear because it has passed the 7-year (or 10-year for some bankruptcies) legal reporting limit.

A dispute credit report letter works best when it focuses on these clearly identifiable, factual errors rather than general dissatisfaction with your financial history.

Dispute Credit Report Letter: Written vs Online

A common question among consumers is whether a physical dispute credit report letter is still necessary in an age of high-speed internet. While online systems are undeniably faster, they often restrict how much information you can provide. Most online portals use drop-down menus with pre-set reasons for a dispute, which may not accurately capture the complexity of your specific issue. If your reason for disputing doesn't fit into their "box," your dispute may be miscategorized.

A written dispute credit report letter offers several distinct advantages:

- More space to explain issues: You are not limited by character counts or pre-defined categories, allowing for a full narrative of the facts.

- The ability to attach documents: You can include physical copies of bank statements, cancelled checks, or court records that provide undeniable proof.

- A clear record of communication: By sending the letter via certified mail, you create a paper trail that is legally verifiable—crucial if you ever need to take legal action.

- Greater control over wording: You can ensure your argument is framed exactly as you intend, without being forced into the bureau's proprietary software logic.

For consumers who prioritize clarity, documentation, and a thorough investigation, a dispute credit report letter template is often a more practical and effective choice than an online form.

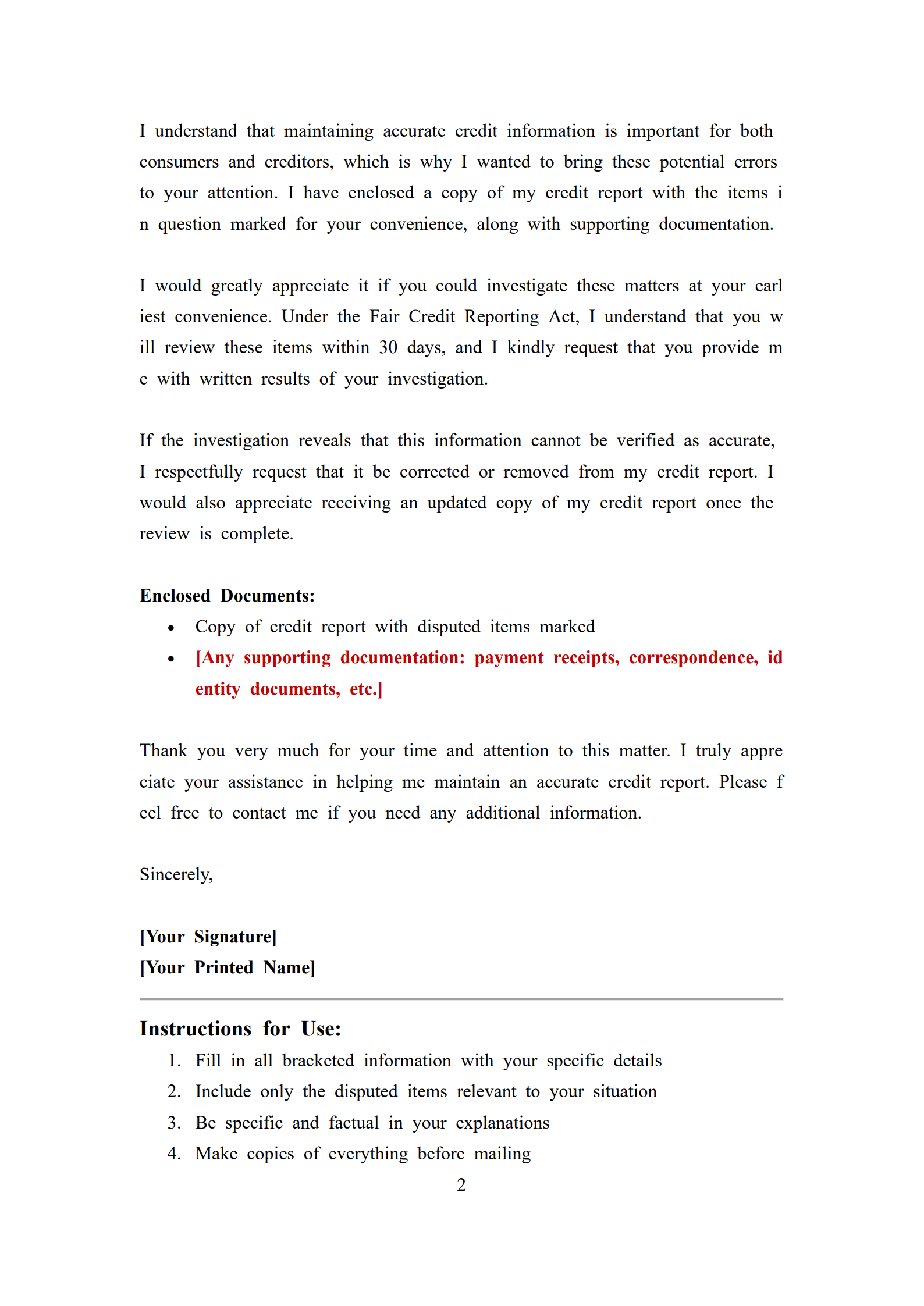

Free Download: Your Credit Dispute Letter Template

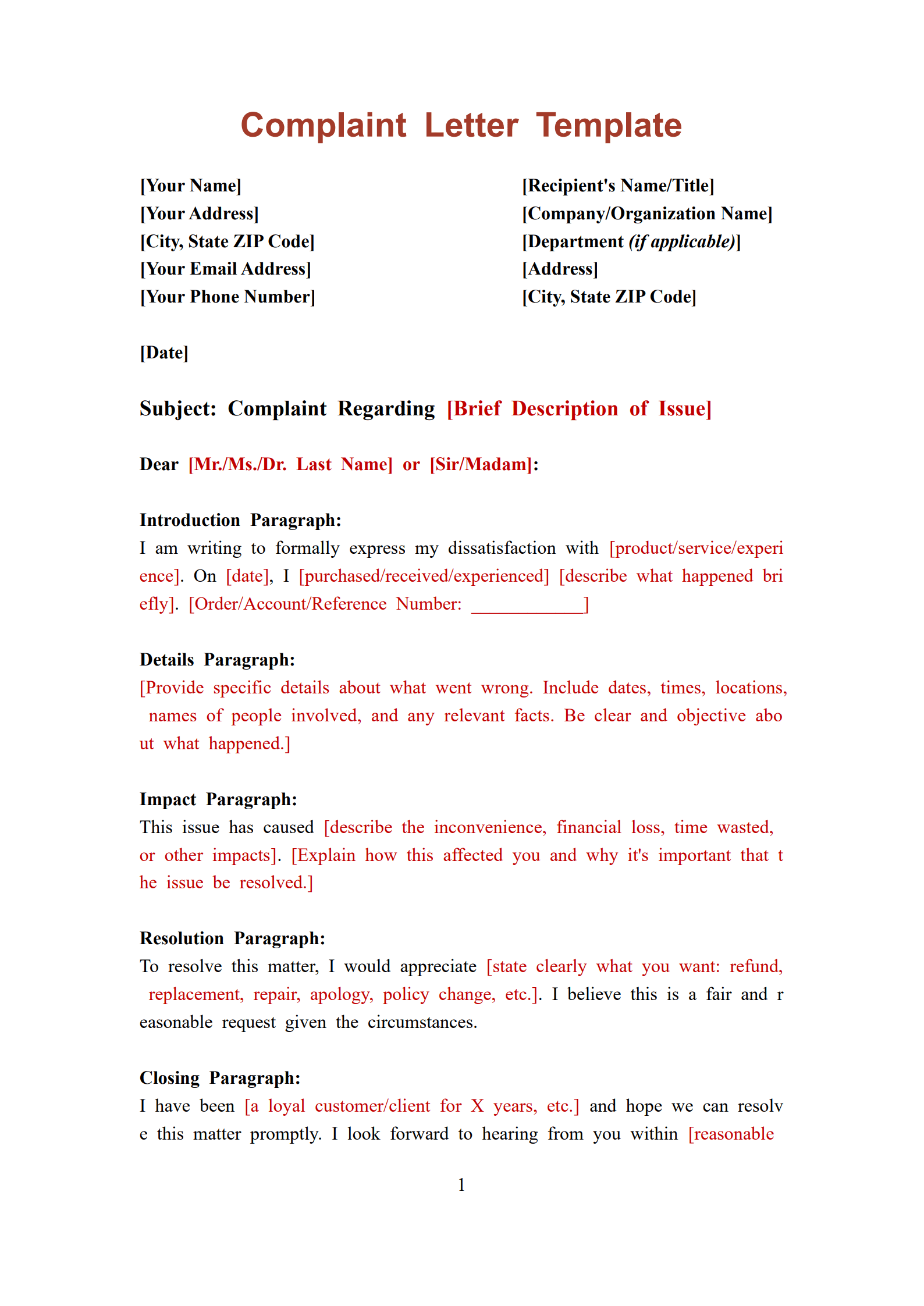

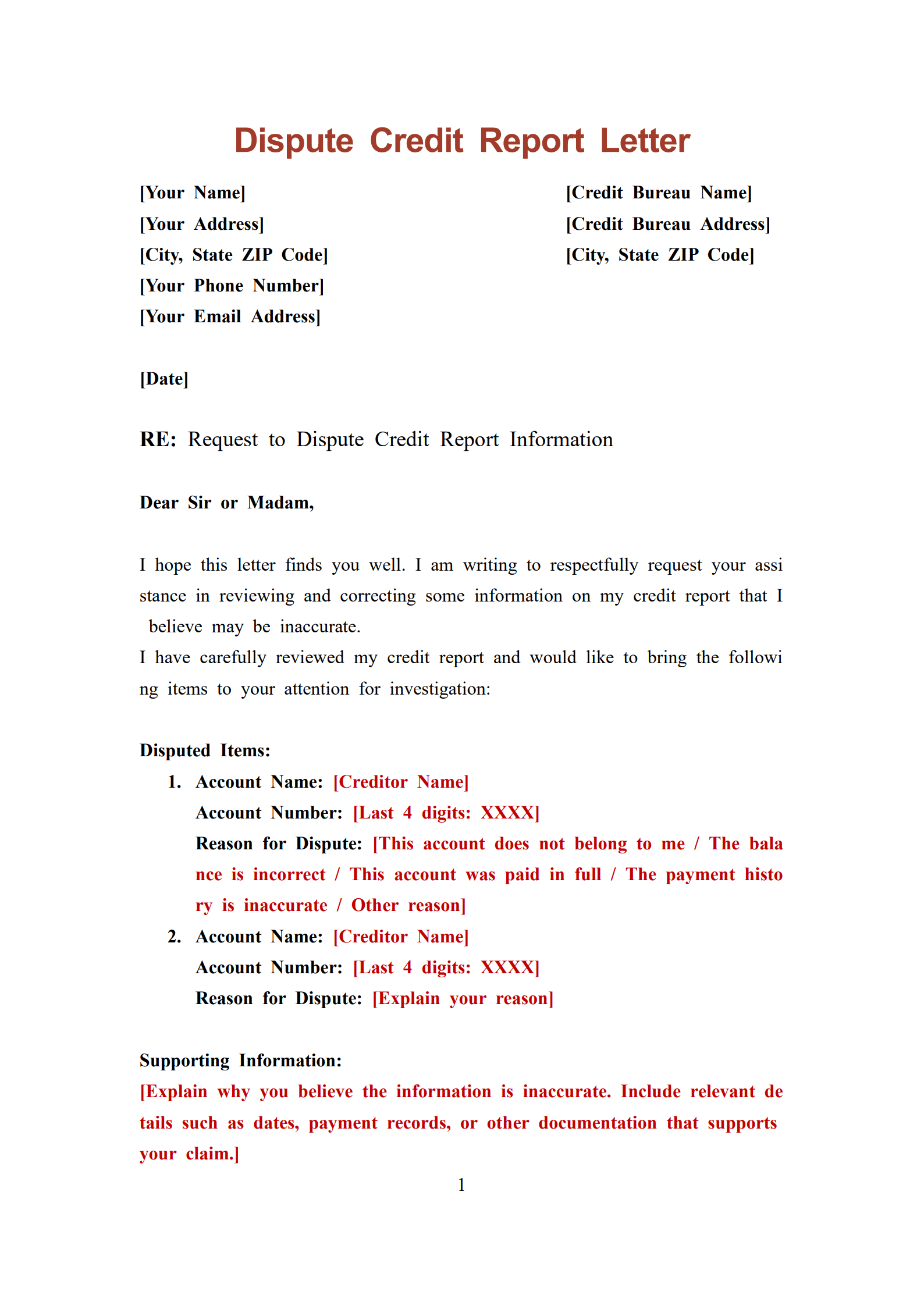

Ready to challenge inaccurate information on your credit report? Our comprehensive dispute credit letter template provides you with a professionally structured document that includes all the essential components credit bureaus expect to see. This customizable template can help you clearly communicate your dispute while documenting your efforts to correct errors that may be affecting your credit score. Simply personalize the template with your specific account details and disputed items, then send it to the appropriate credit bureau via certified mail. Taking control of your credit report accuracy starts with one simple download.

How to Use the Dispute Credit Letter Template (Step-by-Step)

- Identify the Error: Circle or highlight the mistake on your actual credit report.

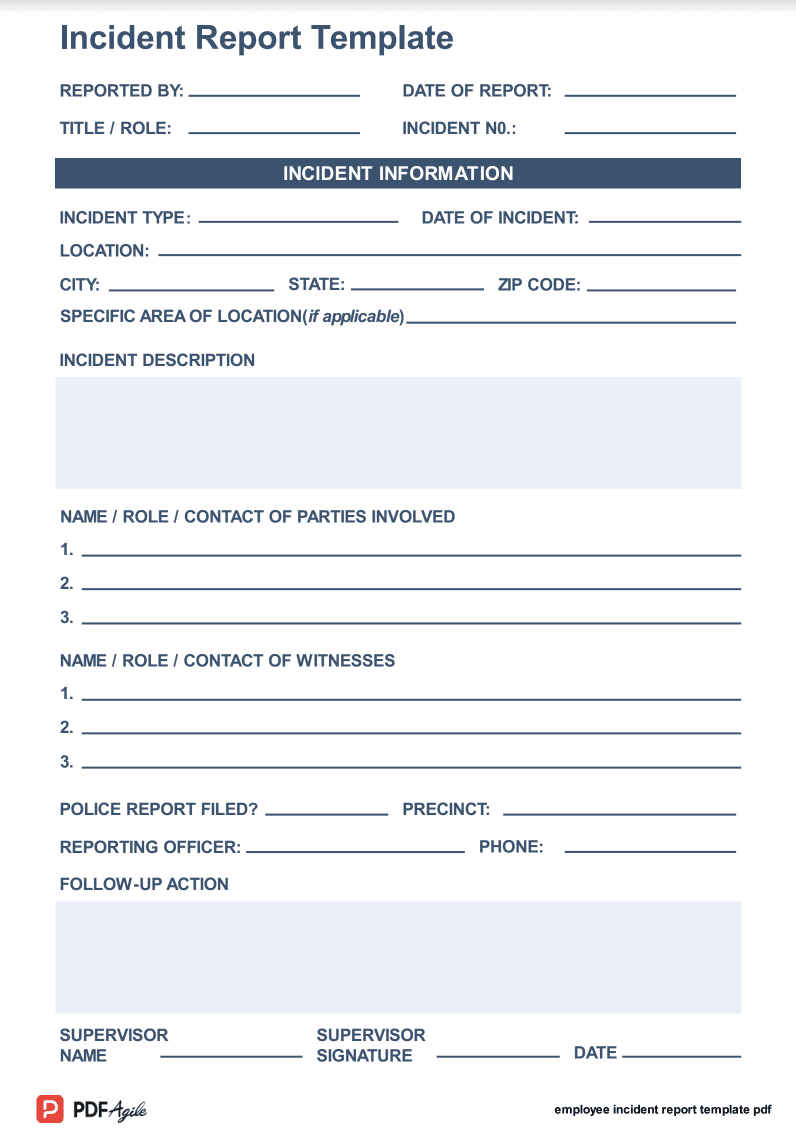

- Gather Evidence: Find bank statements, canceled checks, or letters from creditors that prove the information is wrong.

- Fill Out the Template: Be clear and factual. Avoid "emotional" language. Use the template to state exactly what is wrong and what you want them to do (e.g., "Delete this account" or "Update the balance to $0").

- Include Proof of Identity: To prevent fraud, credit bureaus require a copy of your driver’s license and a utility bill to prove your address.

- Send via Certified Mail: This is the "Golden Rule" of credit repair. Send your letter with a Return Receipt Requested. This gives you a paper trail and starts the legal "30-day clock" for the bureau to respond.

Pro Tips for Writing Credit Dispute Letters That Work

- Don't Send Originals: Always send copies of your evidence. You need to keep the originals for your own records.

- Be Specific: Instead of saying "This account is wrong," say "Account #12345 is listed as 30 days late in June 2024, but I have attached a bank statement showing the payment was cleared on June 1st."

- One Bureau at a Time: If the error appears on all three reports, you must send a separate letter to Equifax, Experian, and TransUnion.

Official Resources & Contact Info

Where to Send Your Letter:

- Equifax: P.O. Box 740256, Atlanta, GA 30374

- Experian: P.O. Box 4500, Allen, TX 75013

- TransUnion: P.O. Box 2000, Chester, PA 19016

Helpful Official Links:

- Consumer Financial Protection Bureau (CFPB) - File a complaint if a bureau refuses to fix a verified error.

- IdentityTheft.gov - Use this if the error is due to fraud.

Frequently Asked Questions on Dispute Credit Letters(FAQ)

Q: How long does the investigation take?

A: By law, credit bureaus generally have 30 days (sometimes 45) to investigate and respond to your dispute.

Q: Does disputing an error hurt my credit score?

A: No. Filing a dispute does not impact your score. If the error is successfully removed or corrected, your score will likely improve.

Q: Can I dispute online?

A: Yes, but many experts recommend mail. When you dispute online, you often waive your right to a full investigation or the ability to sue if they fail to follow the law. Mail provides a much stronger legal record.

Q: What if the bureau says the information is "verified" but it’s still wrong?

A: You can resubmit with new evidence, contact the creditor directly, or file a formal complaint with the CFPB.