Credit reports play a crucial role in your financial life, influencing everything from loan approvals to interest rates. When inaccuracies appear on your credit report, they can unfairly damage your creditworthiness and cost you thousands of dollars. The 609 dispute letter offers consumers a powerful tool to challenge questionable items and request verification of information on their credit reports.

What Is a 609 Dispute Letter?

A 609 dispute letter is a formal written request sent to credit bureaus that references Section 609 of the Fair Credit Reporting Act (FCRA). This section grants consumers the right to know what information credit reporting agencies have on file and to request copies of documents used to verify that information.

Unlike standard dispute letters that simply claim an error exists, a 609 dispute letter specifically asks the credit bureau to provide proof of the method of verification for items on your report. The letter requests documentation showing how the bureau verified the accuracy of disputed accounts, including original contracts, payment histories, or other supporting documents.

This approach puts the burden of proof on the credit bureau to demonstrate they have properly verified the information they're reporting. If they cannot provide adequate documentation, the disputed item may need to be removed from your credit report according to FCRA guidelines.

Why Use a 609 Dispute Letter?

The 609 dispute letter strategy has gained popularity among consumers seeking to clean up their credit reports for several compelling reasons.

Legal Foundation

Section 609 of the FCRA provides a statutory basis for your request, giving your dispute letter more weight than a simple complaint. Credit bureaus are legally obligated to respond to proper 609 requests within 30 days, and failure to comply can result in violations of federal law.

Documentation Requirements

By requesting specific documentation and verification methods, you're asking the credit bureau to prove they've done their due diligence. Many disputed items lack proper documentation, particularly older debts or accounts that have been sold multiple times between collection agencies.

Empowers Consumers

The 609 dispute letter puts you in the driver's seat of your credit repair journey. Rather than passively accepting what appears on your credit report, you're actively exercising your consumer rights and demanding accountability from credit reporting agencies.

Cost-Effective Solution

Unlike hiring credit repair companies that can charge hundreds or thousands of dollars, sending a 609 dispute letter costs only the price of postage. This makes it an accessible option for anyone looking to improve their credit profile without breaking the bank.

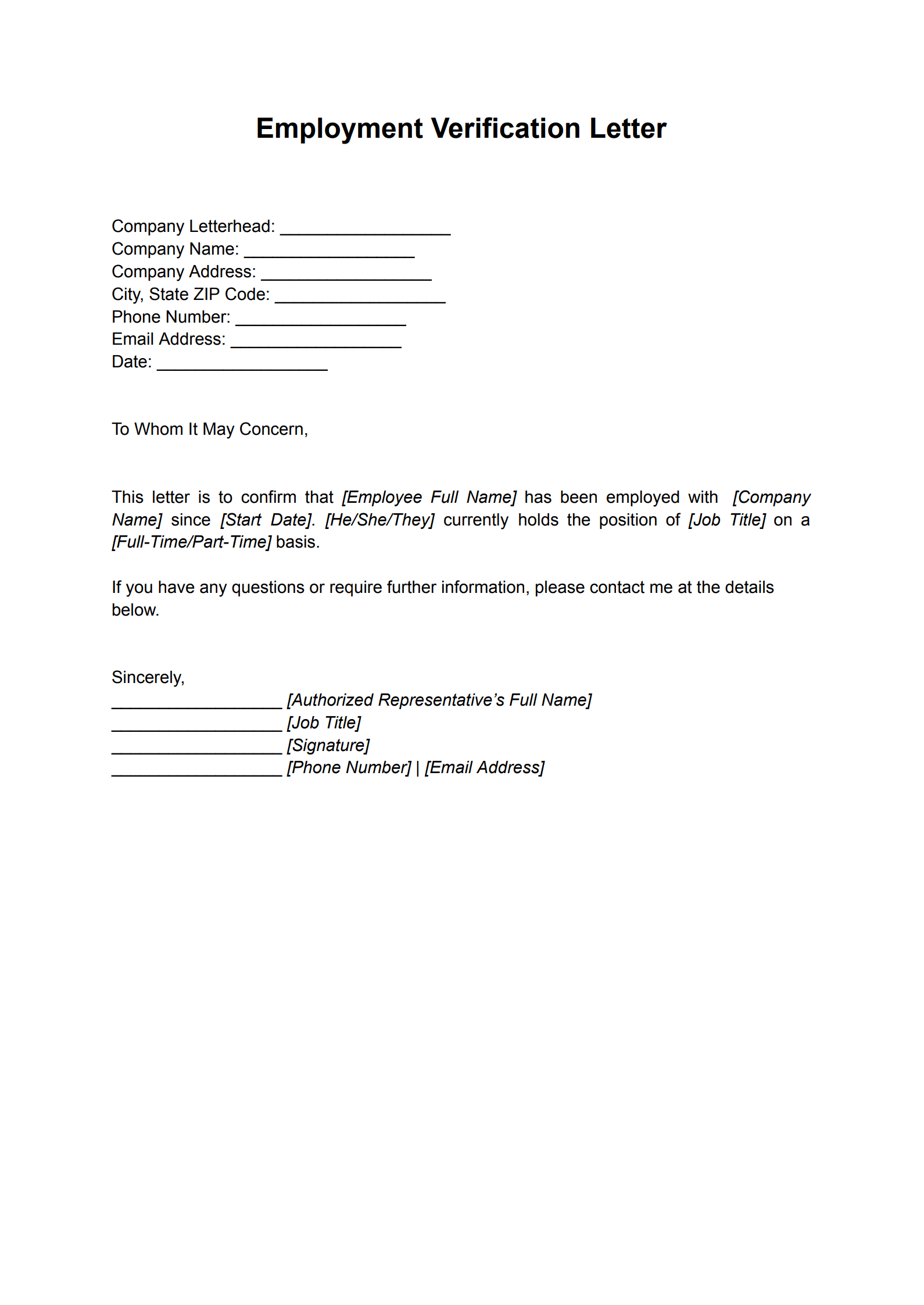

Key Components of an Effective 609 Dispute Letter

A well-crafted 609 dispute letter should include several essential elements to maximize its effectiveness.

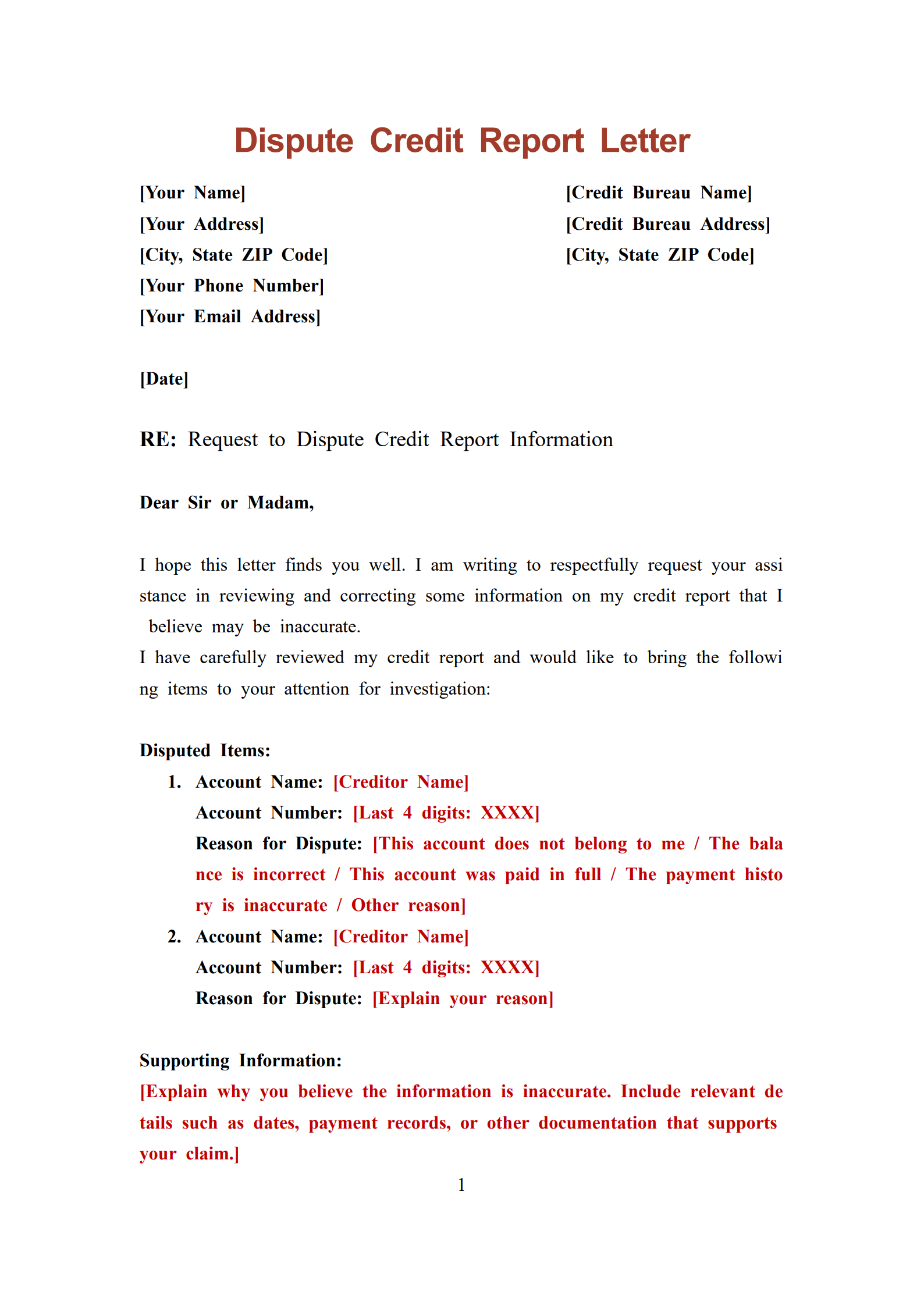

Your letter should begin with your complete identifying information, including full name, current address, date of birth, and Social Security number. This helps the credit bureau locate your file quickly and prevents confusion with other consumers who may share your name.

Clearly reference Section 609 of the Fair Credit Reporting Act to establish the legal basis for your request. Specify which credit reporting agency you're addressing—Equifax, Experian, or TransUnion—as you'll need to send separate letters to each bureau.

Identify the specific items you're disputing with precise details such as account numbers, creditor names, and the exact information you're challenging. Vague disputes are easier for bureaus to dismiss, so specificity matters.

Request copies of all documents used to verify the disputed information, including original creditor agreements, payment histories, and any documentation proving the account belongs to you. This is the core of the 609 dispute letter approach.

Include a deadline for response (typically 30 days as required by law) and specify how you'd like to receive the response. Always send your 609 dispute letter via certified mail with return receipt requested to create a paper trail proving the bureau received your request.

Tips for Maximizing Your 609 Dispute Letter Success

Following these strategic tips can significantly improve your chances of getting inaccurate items removed from your credit report.

Obtain All Three Credit Reports First

Before drafting your 609 dispute letter, request copies of your credit reports from all three major bureaus. Errors don't always appear on every report, so you'll need to know exactly what each bureau is reporting about you.

Dispute Items Separately

While it might seem efficient to challenge multiple items in one letter, credit bureaus may view mass disputes as frivolous. Focus on one to three items per 609 dispute letter to appear more credible and receive more thorough consideration.

Keep Detailed Records

Maintain copies of every 609 dispute letter you send, along with certified mail receipts and any responses received. This documentation becomes critical if you need to escalate your dispute or file a complaint with the Consumer Financial Protection Bureau.

Be Professional and Concise

Your 609 dispute letter should be businesslike in tone, free from emotional language or threats. Stick to the facts, cite the relevant law, and make your requests clear. A professional approach commands more respect than an angry rant.

Follow Up Promptly

If you haven't received a response within 30 days, send a follow-up letter referencing your original request. Credit bureaus are required to respond within this timeframe, and failure to do so strengthens your position if you need to file complaints with regulatory agencies.

Don't Dispute Accurate Information

The 609 dispute letter is designed to challenge items that cannot be properly verified or are genuinely inaccurate. Attempting to remove legitimate negative information that's correctly reported is unlikely to succeed and may damage your credibility in future disputes.

Common Mistakes to Avoid with Your 609 Dispute Letter

Even with a template, certain errors can undermine the effectiveness of your dispute efforts.

Many consumers make the mistake of using generic language that could apply to anyone's situation. Personalize your 609 dispute letter with specific details about your unique circumstances and the particular items you're challenging.

Failing to include adequate identification documentation is another common pitfall. Credit bureaus need to verify they're corresponding with the right person, so always include a copy of your driver's license or state ID and a recent utility bill showing your current address.

Some people send their 609 dispute letter via regular mail without tracking, then have no proof the bureau received it when they fail to respond. Always use certified mail with return receipt requested to create an indisputable record.

Another mistake is becoming discouraged after an initial denial. Credit bureaus sometimes reject first-time disputes hoping you'll give up. Persistence often pays off, especially when you provide additional documentation or rephrase your request in subsequent letters.

What Happens After You Send Your 609 Dispute Letter?

Understanding the timeline and process helps set realistic expectations for your credit repair journey.

Once the credit bureau receives your 609 dispute letter, they have 30 days to investigate and respond to your request. During this investigation period, the bureau should contact the creditor or data furnisher to verify the disputed information.

The bureau must provide you with written results of their investigation. If they cannot verify the disputed item with proper documentation, they're required to remove it from your credit report. If they verify the information as accurate, they'll notify you and the item will remain on your report.

You have the right to add a statement of dispute to your credit file if you disagree with the investigation results. This statement (limited to 100 words) will appear on your credit report when it's pulled by lenders, explaining your side of the story.

If the credit bureau violates your rights under the FCRA—such as failing to respond within 30 days or not properly investigating your dispute—you may have grounds to file a complaint with the Consumer Financial Protection Bureau or even pursue legal action.

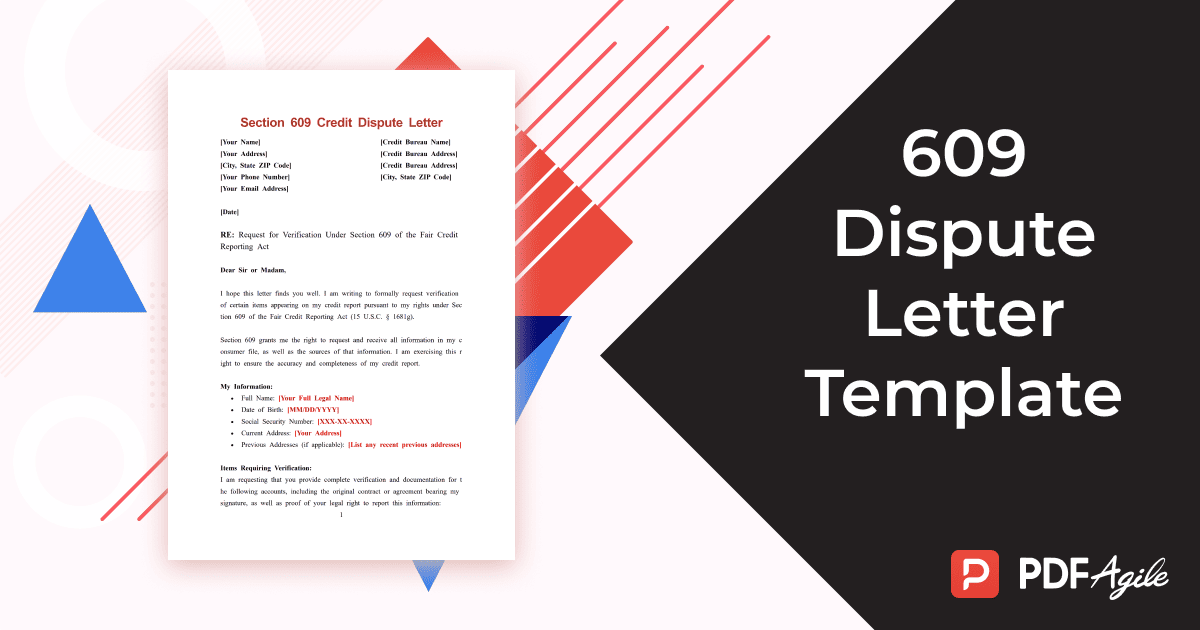

Free Download: Your 609 Dispute Letter Template

Ready to take control of your credit report accuracy? Our comprehensive 609 dispute letter template provides you with a professionally formatted document that includes all the necessary legal references and required components. This template can help streamline your dispute process and give you confidence that you're exercising your consumer rights effectively. Simply customize the template with your specific information and disputed items, then send it to the appropriate credit bureau. Starting your credit repair journey is just one click away.

Frequently Asked Questions About the 609 Dispute Letter

Q: How long does the 609 dispute letter process take?

A: Credit bureaus have 30 days from receiving your letter to complete their investigation and respond. However, the entire process from sending your letter to seeing changes on your credit report can take 45-60 days when accounting for mail delivery times and the bureau's processing schedule.

Q: Do I need to send a 609 dispute letter to all three credit bureaus?

A: Yes, if the inaccurate information appears on reports from multiple bureaus. Each credit reporting agency maintains its own database and doesn't automatically share dispute information with the others. You'll need to send separate letters to Equifax, Experian, and TransUnion.

Q: Can the credit bureau ignore my 609 dispute letter?

A: No, they cannot legally ignore a properly formatted 609 dispute letter. The FCRA requires credit bureaus to investigate disputes within 30 days. If they fail to respond, you can file complaints with the Consumer Financial Protection Bureau and potentially take legal action.

Q: Will using a 609 dispute letter hurt my credit score?

A: No, the dispute process itself doesn't impact your credit score. However, if negative items are successfully removed from your report, your score may improve. Conversely, if accurate negative information remains, your score won't change based on the dispute alone.

Q: What if my 609 dispute letter is rejected?

A: If your initial dispute is rejected, review the bureau's response carefully. They must explain why they verified the information as accurate. You can send a follow-up 609 dispute letter requesting more specific documentation, add a statement to your credit file, or file a complaint if you believe the bureau violated your rights.

Q: Can I dispute positive accounts with a 609 dispute letter?

A: While you technically have the right to dispute any information on your credit report, there's little reason to dispute accounts that are helping your credit profile. Focus your 609 dispute letter efforts on inaccurate negative items, errors in account details, or questionable collections that are dragging down your score.

Q: Are 609 dispute letters guaranteed to remove negative items?

A: No strategy for credit repair comes with guarantees. The success of your 609 dispute letter depends on whether the credit bureau can provide adequate documentation verifying the disputed information. Accurate, well-documented negative items will likely remain on your report, while items lacking proper verification may be removed.