Outstanding invoices and unpaid bills represent more than just numbers on a spreadsheet—they directly impact your cash flow, operational capacity, and business sustainability. While many creditors hope that friendly reminders will prompt payment, the reality is that systematic collection letter campaigns often make the difference between recovering funds and writing off losses. Understanding how to craft and deploy collection letters strategically transforms your accounts receivable process from reactive to proactive.

Defining the Collection Letter and Its Role

A collection letter is a formal written communication sent to a debtor requesting payment for an outstanding obligation. Unlike single-instance debt recovery correspondence, the collection letter typically exists as part of a series that progressively escalates in tone and urgency as the debt ages. This graduated approach balances maintaining customer relationships with protecting your financial interests.

The collection letter serves multiple strategic functions beyond simply asking for money. Each letter documents your collection efforts, creating a paper trail that demonstrates good faith attempts to resolve matters before pursuing legal remedies. This documentation can prove invaluable if disputes arise or if you eventually need to engage collection agencies or attorneys.

Psychologically, collection letters work by creating increasing pressure that motivates payment without burning bridges. The first letter might gently remind the debtor of their oversight, while subsequent collection letters progressively emphasize consequences and urgency. This tiered system gives debtors multiple opportunities to settle voluntarily before relationships deteriorate completely.

Effective collection letters also segment debtors based on their behavior and payment history. A long-term reliable customer who's suddenly 15 days late receives different messaging than a new client who's 90 days overdue with a history of late payments. This nuanced approach in your collection letter strategy acknowledges that different situations require different tactics.

The Collection Letter Series: A Strategic Framework

Rather than sending random demands when you remember, successful collection letter programs follow a systematic timeline that corresponds with debt aging.

Initial Reminder Collection Letter (1-15 Days Past Due)

Your first collection letter should arrive shortly after the payment due date passes, typically within 7-10 days. This communication assumes good faith—that the debtor simply forgot or their payment got lost in processing. The tone remains friendly and professional, almost apologetic for bothering them about what you assume is an oversight.

This initial collection letter serves primarily as a gentle nudge rather than a demand. You're preserving the relationship while establishing that you track payments carefully and expect timely settlement. Many debtors respond immediately to this first reminder, making it one of your most cost-effective collection tools.

Second Notice Collection Letter (15-30 Days Past Due)

When payment still hasn't arrived after your initial reminder, a second collection letter goes out with a slightly firmer tone. While still professional and courteous, this communication makes clear that the situation requires immediate attention. You might reference your previous collection letter to establish that this isn't the first contact.

This second collection letter typically offers assistance if circumstances are preventing payment, such as payment plan options or the opportunity to discuss difficulties. By providing problem-solving alternatives, you demonstrate flexibility while maintaining that payment remains non-negotiable.

Urgent Demand Collection Letter (30-60 Days Past Due)

As accounts age into serious delinquency, your collection letter messaging must shift noticeably. This communication adopts a more direct, business-focused tone that emphasizes the seriousness of the situation. The friendly assumption of good faith gives way to clear statements about consequences and expectations.

This urgent collection letter should specify exactly what actions you'll take if payment isn't received, whether that means suspending services, reporting to credit bureaus, engaging collection agencies, or pursuing legal action. Specificity matters—vague threats carry less weight than concrete consequences with specific timelines.

Final Notice Collection Letter (60-90 Days Past Due)

Your final collection letter before escalating to external collection or legal action must be unmistakably clear about next steps. This communication states explicitly that this is the last opportunity to resolve the matter directly before you transfer the account to collections or file legal proceedings.

The tone of this final collection letter is serious and formal without being hostile or insulting. You're making a business decision based on the debtor's failure to respond to multiple previous opportunities. This letter often includes specific dates by which action will be taken, removing any ambiguity about your intentions.

Essential Components Every Collection Letter Should Include

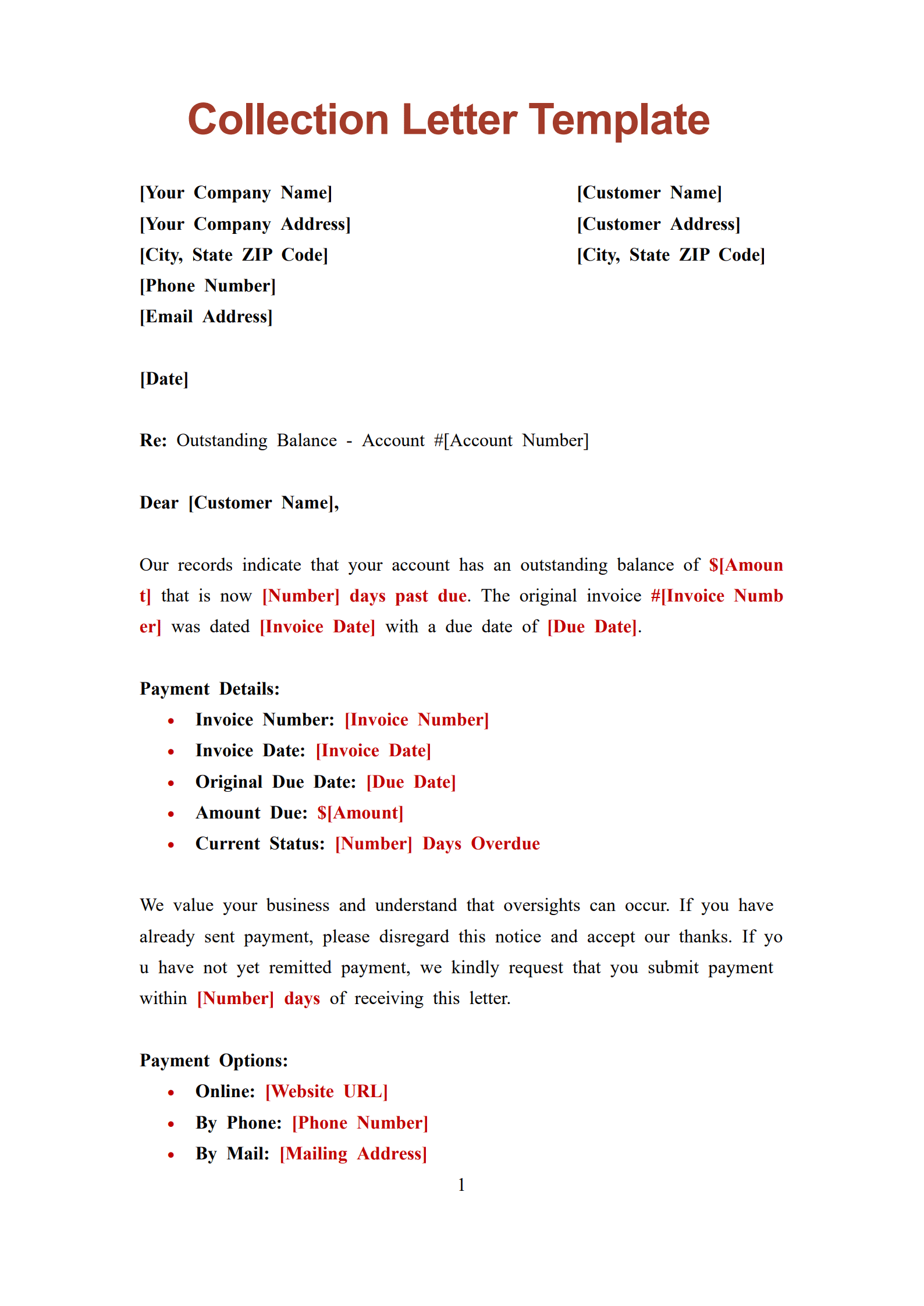

Regardless of where a collection letter falls in your series, certain elements should appear consistently to maintain professionalism and legal compliance.

Professional Formatting and Branding

Your collection letter should use your company letterhead or include your complete business information, logo, and contact details. Professional presentation reinforces that this is official business correspondence, not a casual note. Consistent branding across all collection letters creates a cohesive, credible campaign.

Accurate Account Information

Every collection letter must include precise details about the debt: invoice numbers, original invoice dates, service or product descriptions, original amount, any payments received, current balance, and age of the debt. Accuracy prevents disputes and demonstrates that you maintain thorough records.

Clear Payment Instructions

Make payment as frictionless as possible by including multiple payment options in your collection letter. Provide bank account details for transfers, mailing addresses for checks, online payment portals, credit card payment options, and contact information for phone payments. The easier you make payment, the more likely you'll receive it.

Specific Call to Action

Each collection letter should tell the debtor exactly what you want them to do and by when. Vague requests like "please remit payment soon" lack urgency. Instead, use specific language: "Payment of $1,547.89 must be received by January 25, 2026 to avoid late fees and collection action."

Appropriate Tone for Stage

The collection letter tone should match where the debt falls in your series. Early letters remain friendly and helpful, middle-stage letters become firmer and more businesslike, and final letters adopt serious, consequence-focused language. This progression creates psychological pressure while remaining professional.

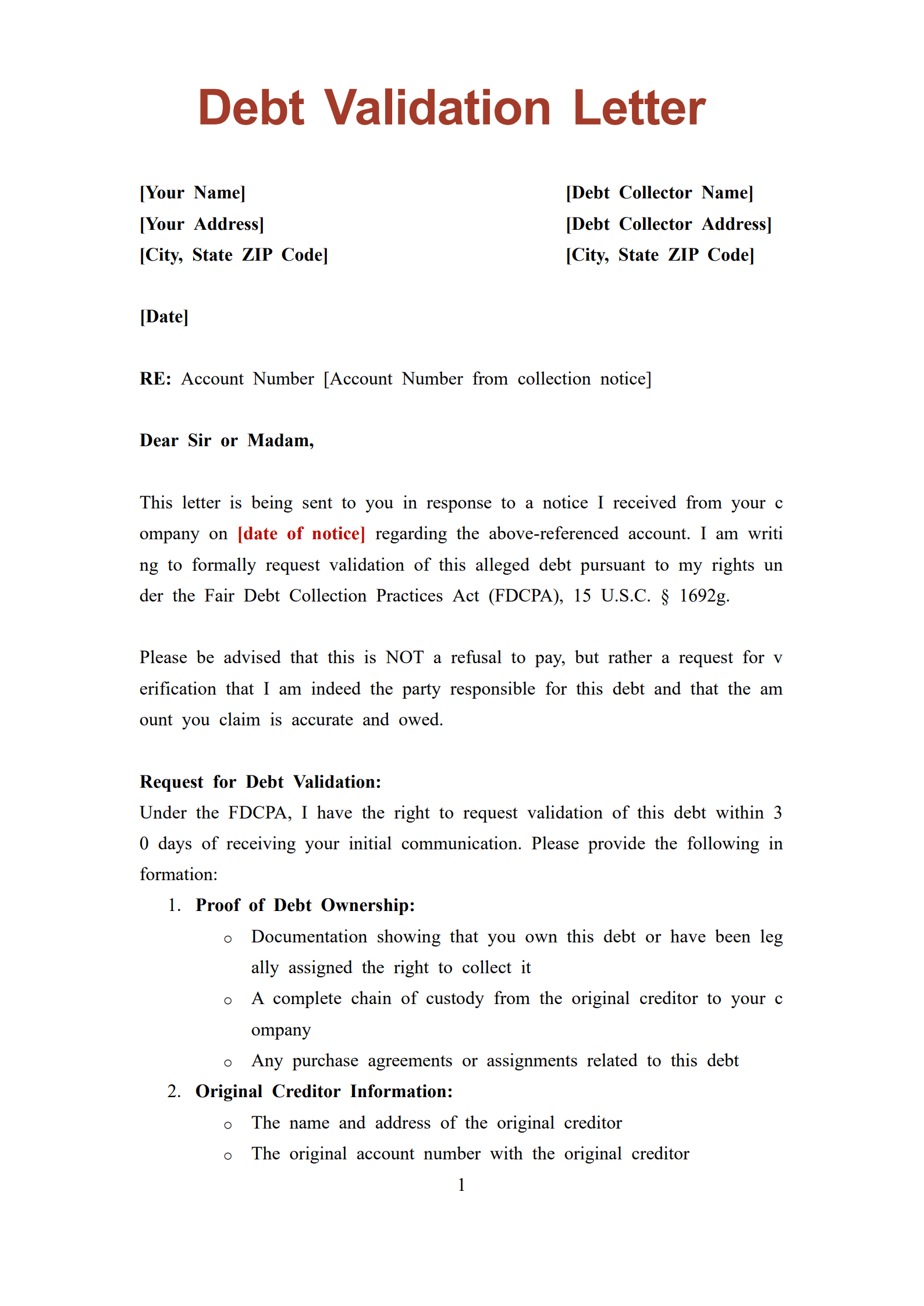

Compliance with Regulations

Ensure your collection letter complies with relevant laws like the Fair Debt Collection Practices Act (if you're a third-party collector) and state-specific requirements. Even as an original creditor, following FDCPA standards provides a good compliance framework and reduces legal risks.

Strategic Best Practices for Collection Letter Success

Maximizing collection rates requires more than just sending letters—it demands strategic thinking about timing, personalization, and follow-through.

Automate Your Collection Letter System

Manual collection processes often fail because busy staff forget to send letters or lack consistency in timing and messaging. Implementing automated systems that trigger collection letters at predetermined intervals ensures no account slips through cracks and that every debtor receives consistent treatment.

Personalize Despite Automation

While automation handles timing and delivery, your collection letter should still include personal touches like the debtor's name, specific account details, and references to their payment history. Templates work well as foundations, but customization increases response rates significantly.

Test Different Approaches

Not all debtors respond to the same messaging. Consider A/B testing different collection letter approaches to identify what works best for your customer base. You might test varying subject lines for emailed letters, different consequence emphases, or alternative tone progressions through your series.

Maintain Detailed Records

Document every collection letter sent, including dates, methods of delivery (email, postal mail, certified mail), and any responses received. This recordkeeping proves crucial if accounts eventually go to collections or litigation. Your detailed documentation strengthens your legal position and demonstrates reasonable collection efforts.

Offer Solutions, Not Just Demands

Collection letters that only demand payment miss opportunities to actually recover funds. Include payment plan options, offer to discuss financial difficulties, or suggest partial payments if full payment isn't immediately possible. Flexibility often means receiving something rather than nothing.

Coordinate with Phone Contact

While collection letters provide documentation, combining written communication with strategic phone calls often yields better results. Your collection letter can reference phone conversations, and calls can alert debtors that formal letters are coming, creating multiple touchpoints that increase payment likelihood.

Know When to Escalate Beyond Collection Letters

Eventually, some accounts won't respond to any collection letter regardless of how well-crafted. Establish clear criteria for when you'll stop sending letters and escalate to collection agencies, attorneys, or write-offs. Knowing when to cut your losses prevents wasting resources on uncollectible accounts.

Common Pitfalls That Reduce Collection Letter Effectiveness

Avoiding these mistakes helps maintain both collection effectiveness and legal compliance.

Inconsistent Timing and Follow-Through

Sending a collection letter then waiting months before the next communication signals that deadlines don't matter. If your letter says "payment required within 10 days or we'll take action," you must follow through at day 11. Inconsistency trains debtors to ignore future correspondence.

Overly Aggressive Early Letters

Starting your collection letter series with threats and harsh language damages relationships with customers who might have simply overlooked payment. Escalate progressively rather than leading with maximum aggression. You can always increase pressure, but you can't undo damage from premature hostility.

Neglecting Legal Compliance

Collection letter language that violates debt collection laws exposes you to litigation and penalties. Avoid threats you can't legally execute, harassment language, disclosure of debt details to third parties, or communications at prohibited times. When in doubt, consult legal counsel about your collection letter content.

Ignoring Debtor Communications

When debtors respond to your collection letter with payment arrangements, disputes, or financial hardship explanations, acknowledge and address these responses promptly. Continuing to send collection letters to someone actively working with you on resolution damages goodwill and wastes resources.

Generic, Impersonal Messaging

Collection letters that read like obvious form letters with fill-in-the-blank fields often get ignored. While templates provide efficiency, customize enough that each collection letter feels individually addressed. Personal touches increase the likelihood debtors will engage with your communication.

Failure to Update Account Status

Nothing frustrates customers more than receiving collection letters for debts already paid. Ensure your accounts receivable system updates immediately when payments arrive so automated collection letter systems don't send inappropriate communications. These errors damage credibility and relationships.

Technology and Tools for Collection Letter Management

Modern collection letter programs benefit significantly from technology that streamlines processes and improves results.

Automated Collection Letter Software

Specialized software triggers collection letters automatically based on account aging, sends letters via multiple channels (email, postal mail, SMS), tracks delivery and open rates, and maintains comprehensive documentation. These systems ensure consistency while reducing administrative burden.

Payment Portal Integration

Including links to online payment portals in your collection letter makes settlement immediate and convenient. Integration between your collection letter system and payment processing reduces friction that might otherwise delay payment even when debtors are willing.

Customer Relationship Management Systems

CRM platforms that integrate with accounting software provide comprehensive views of customer payment histories, previous collection letter communications, and overall relationship value. This context helps you tailor collection letter approaches to different customer segments.

Analytics and Reporting Tools

Tracking metrics like collection letter open rates, response rates, payment rates by letter stage, and time-to-payment helps you optimize your collection letter strategy. Data-driven insights reveal which approaches work best and where your process needs refinement.

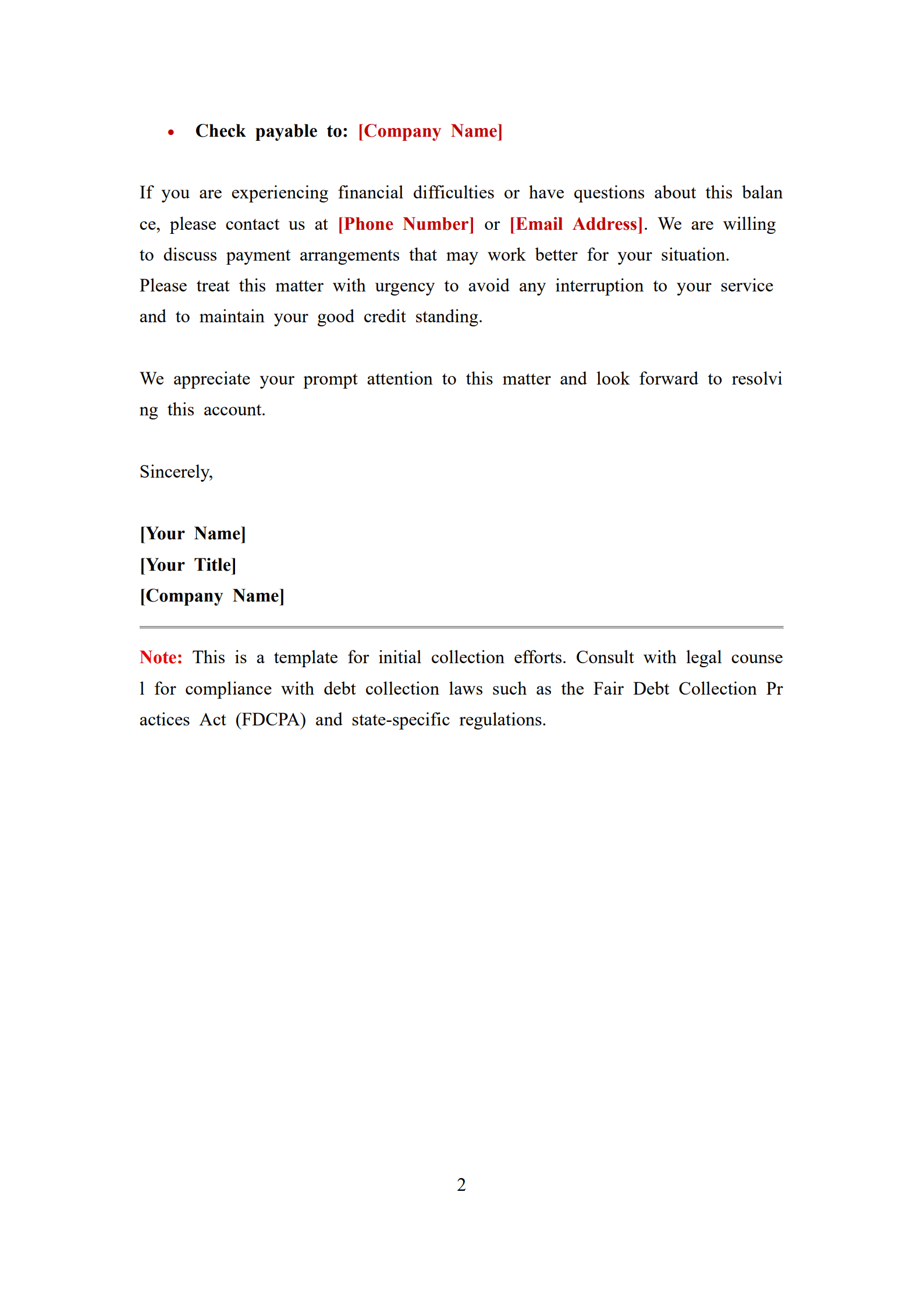

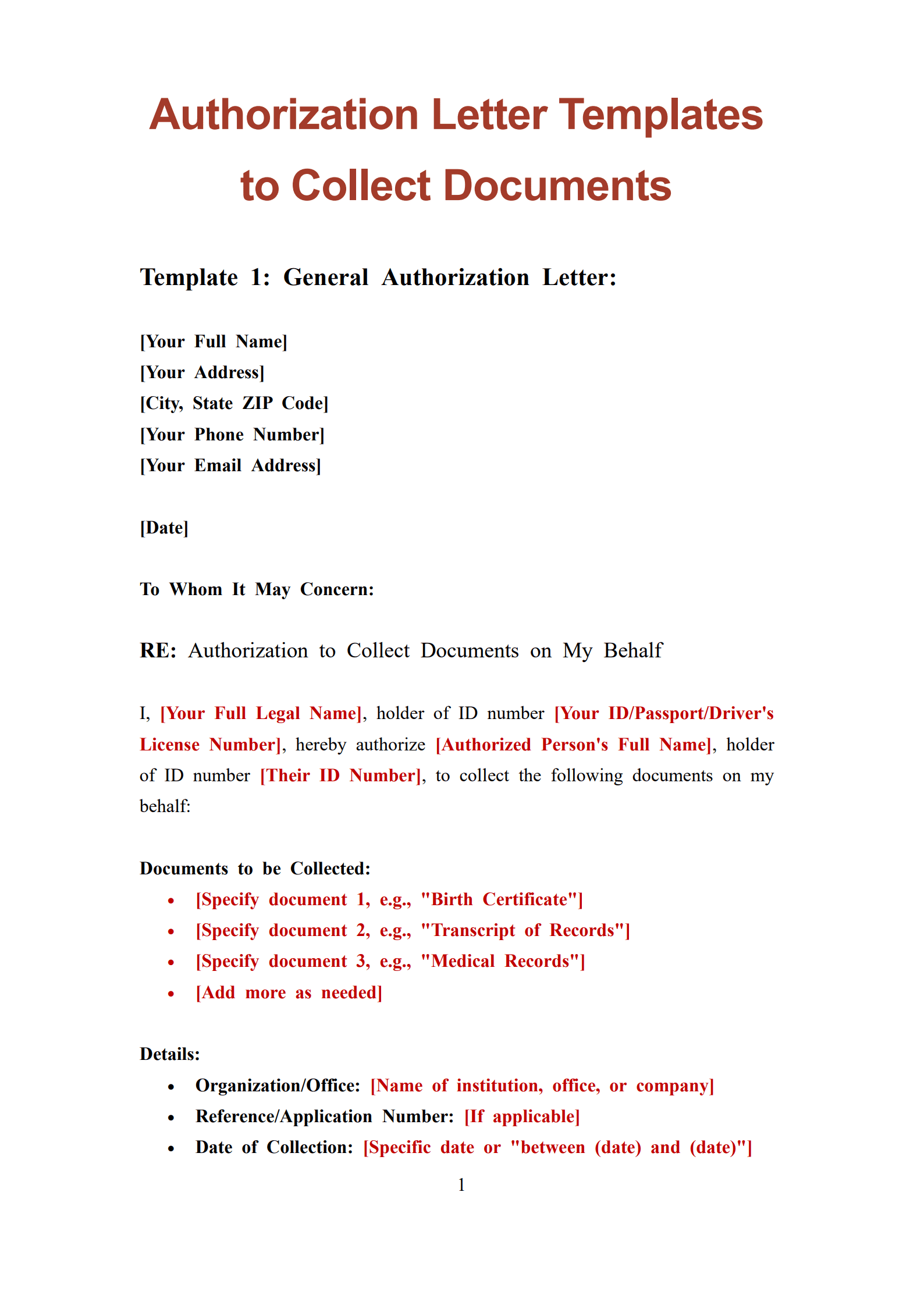

Free Download: Your Collection Letter Template

Transform your accounts receivable management with our professionally designed collection letter template series. This comprehensive resource includes templates for every stage of the collection process, from initial friendly reminders through final pre-legal notices. Our templates incorporate best practices in tone progression, legal compliance, and payment facilitation that can help improve your collection rates while maintaining valuable customer relationships. Each template is fully customizable to reflect your brand, policies, and specific situation. Download now and implement a systematic approach to collecting outstanding debts more effectively.

Frequently Asked Questions About Collection Letters

Q: How many collection letters should I send before pursuing legal action?

A: Most effective collection letter series include three to four communications over 60-90 days before escalating to legal action or collection agencies. This provides reasonable opportunity for voluntary payment while demonstrating good faith efforts to resolve matters amicably. However, high-value debts or particularly unresponsive debtors might warrant shorter timelines.

Q: Should collection letters be sent via email or postal mail?

A: The most effective collection letter strategies use both methods. Email provides immediate delivery and tracking, while postal mail carries more psychological weight and creates physical documentation. Certified mail with return receipt should be used for final collection letters before escalation to prove delivery if legal action follows.

Q: Can I charge interest and late fees in my collection letter?

A: You can include interest and late fees in your collection letter only if they were specified in your original agreement with the debtor. Reference the specific contract clause authorizing these charges. Adding fees without contractual basis can invalidate your collection efforts and potentially expose you to legal challenges.

Q: What happens if a debtor disputes the amount in my collection letter?

A: If a debtor disputes your collection letter claims, pause collection activities and investigate their concerns. Request documentation supporting their position and compare it with your records. If they're correct, send a revised collection letter with accurate information. If they're wrong, respond with evidence supporting your original claim and resume collection efforts.

Q: How should my collection letter approach differ for business versus individual debtors?

A: Business-to-business collection letters typically remain more formal and focus on business relationship impacts and credit reporting consequences. Collection letters to individuals might offer more payment flexibility and emphasize personal credit score impacts. Both should remain professional, but B2B communications generally avoid the softer, more personal tone appropriate for consumer debts.

Q: Do collection letters work better than phone calls for debt recovery?

A: Collection letters and phone calls serve complementary purposes. Letters provide documentation, legal compliance, and allow debtors to respond on their timeline. Calls enable immediate dialogue and relationship building. The most effective collection letter programs combine written communications with strategic phone outreach for optimal results.

Q: What should I do if my collection letter is returned as undeliverable?

A: If your collection letter returns undeliverable, attempt to locate updated contact information through skip tracing services, public records, or social media. Send the collection letter to any alternative addresses you discover. Document all attempts to locate the debtor, as this demonstrates good faith efforts valuable for eventual legal proceedings.

Q: Can I include collection letter costs in the amount demanded?

A: Collection costs can be included in your collection letter only if your original agreement specified this or if state law permits it. Some jurisdictions allow creditors to add reasonable collection expenses to outstanding balances. Clearly indicate in your collection letter which amounts represent original debt versus added collection costs to maintain transparency.