In the interconnected world of finance, trust requires verification. Whether you're applying for a visa, securing a mortgage, proving financial stability for business contracts, or facilitating an audit, the bank confirmation letter stands as the gold standard for validating your financial position. This seemingly simple document carries significant weight precisely because it comes directly from your financial institution rather than from you, eliminating concerns about altered or fabricated financial statements.

Understanding the Bank Confirmation Letter

A bank confirmation letter is an official document issued by a financial institution that verifies specific information about your accounts, balances, credit facilities, or banking relationship. Unlike bank statements that you can download or print yourself, the bank confirmation letter bears the bank's official letterhead, authorized signatures, and often security features that authenticate its legitimacy.

The power of the bank confirmation letter lies in its third-party verification nature. When you present financial information yourself, recipients must trust your honesty and accuracy. When your bank provides that same information through an official confirmation letter, it carries institutional credibility and legal accountability that self-reported data cannot match.

Banks issue confirmation letters for various purposes, each serving distinct verification needs. A balance confirmation letter might verify your account balance as of a specific date for visa applications. A credit facility confirmation letter could outline your available credit lines for business negotiations. A relationship confirmation letter might simply verify that you maintain accounts in good standing for background checks or rental applications.

The bank confirmation letter process typically requires your formal request, often on prescribed forms that specify exactly what information needs verification. This request triggers internal bank procedures to verify the data, prepare official documentation, obtain authorized signatures, and deliver the confirmation through secure channels that prevent tampering or fraud.

When You Need a Bank Confirmation Letter

Recognizing situations requiring bank confirmation letters helps you plan ahead and avoid last-minute scrambles that could delay important transactions or applications.

- Visa and Immigration Applications

- Mortgage and Loan Applications

- Audit and Compliance Processes

- Business Contracts and Partnerships

- Real Estate Transactions

- Scholarship and Grant Applications

- Legal Proceedings and Settlements

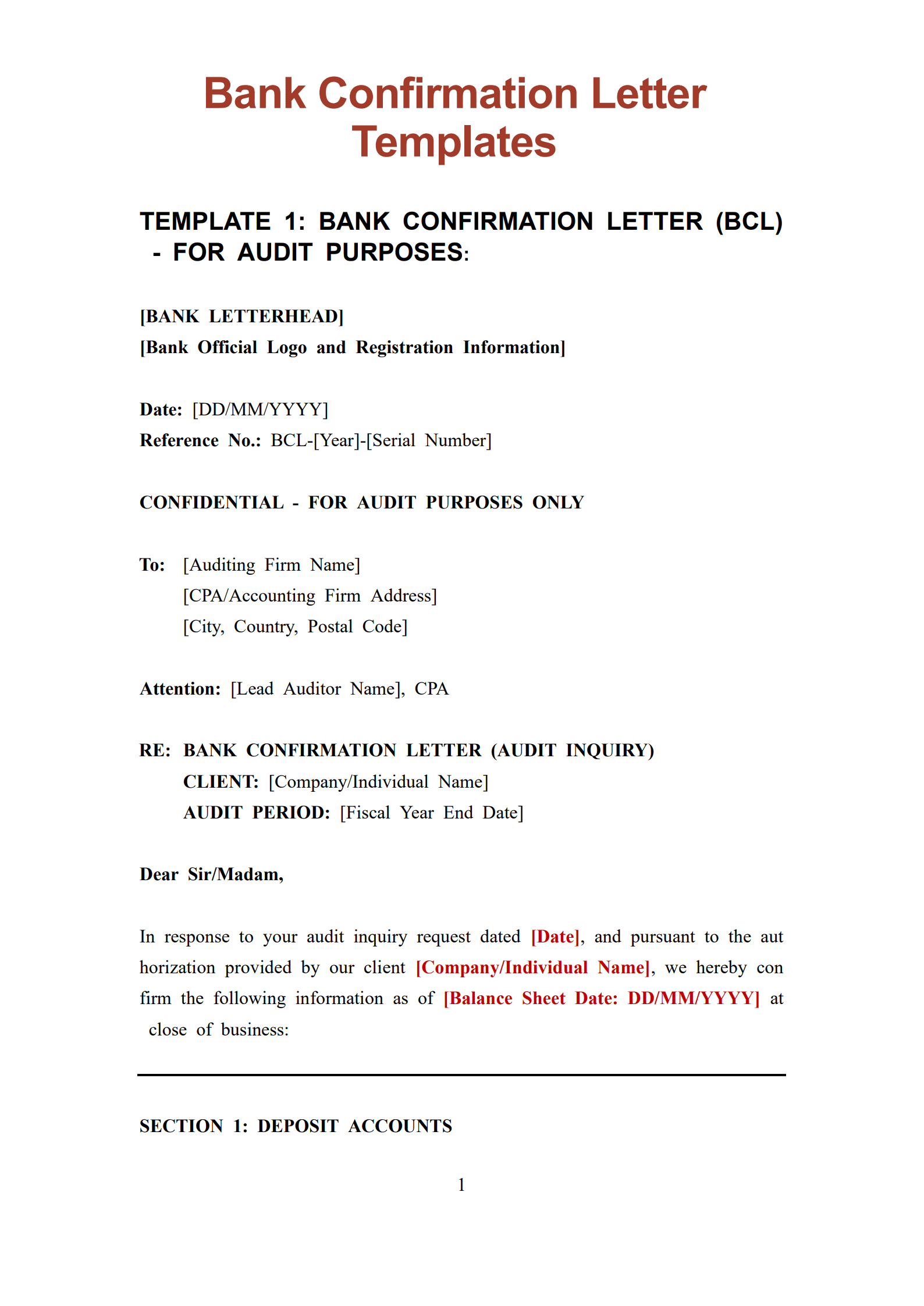

Key Elements Within a Bank Confirmation Letter

Effective bank confirmation letters contain specific information presented in standardized formats that meet recipient requirements while protecting sensitive details.

Official Bank Identification

Every bank confirmation letter must display the financial institution's official letterhead, including full legal name, branch address, contact information, and often the bank's logo and registration details. This branding establishes authenticity and provides channels for verification if recipients have questions.

Clear Recipient Identification

The bank confirmation letter should identify who requested the confirmation and, if different, who should receive it. For visa applications, this might be the embassy. For audits, it's the auditing firm. Clear recipient identification prevents misdirection and ensures proper routing.

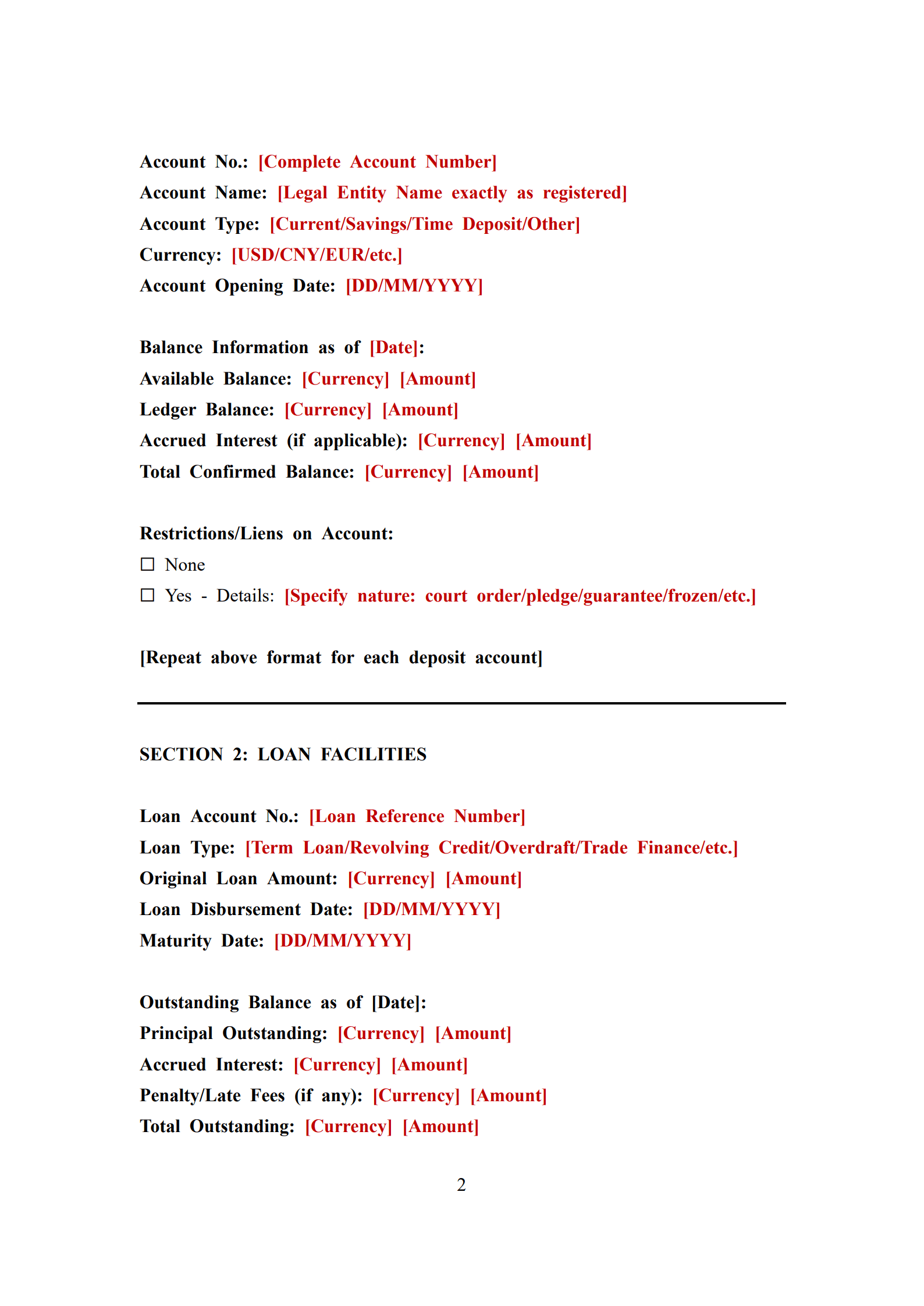

Account Holder Information

Your bank confirmation letter includes your full legal name exactly as it appears in bank records, your account numbers (sometimes partially masked for security), and the type of accounts being confirmed. This personal identification links the confirmation to your specific banking relationship.

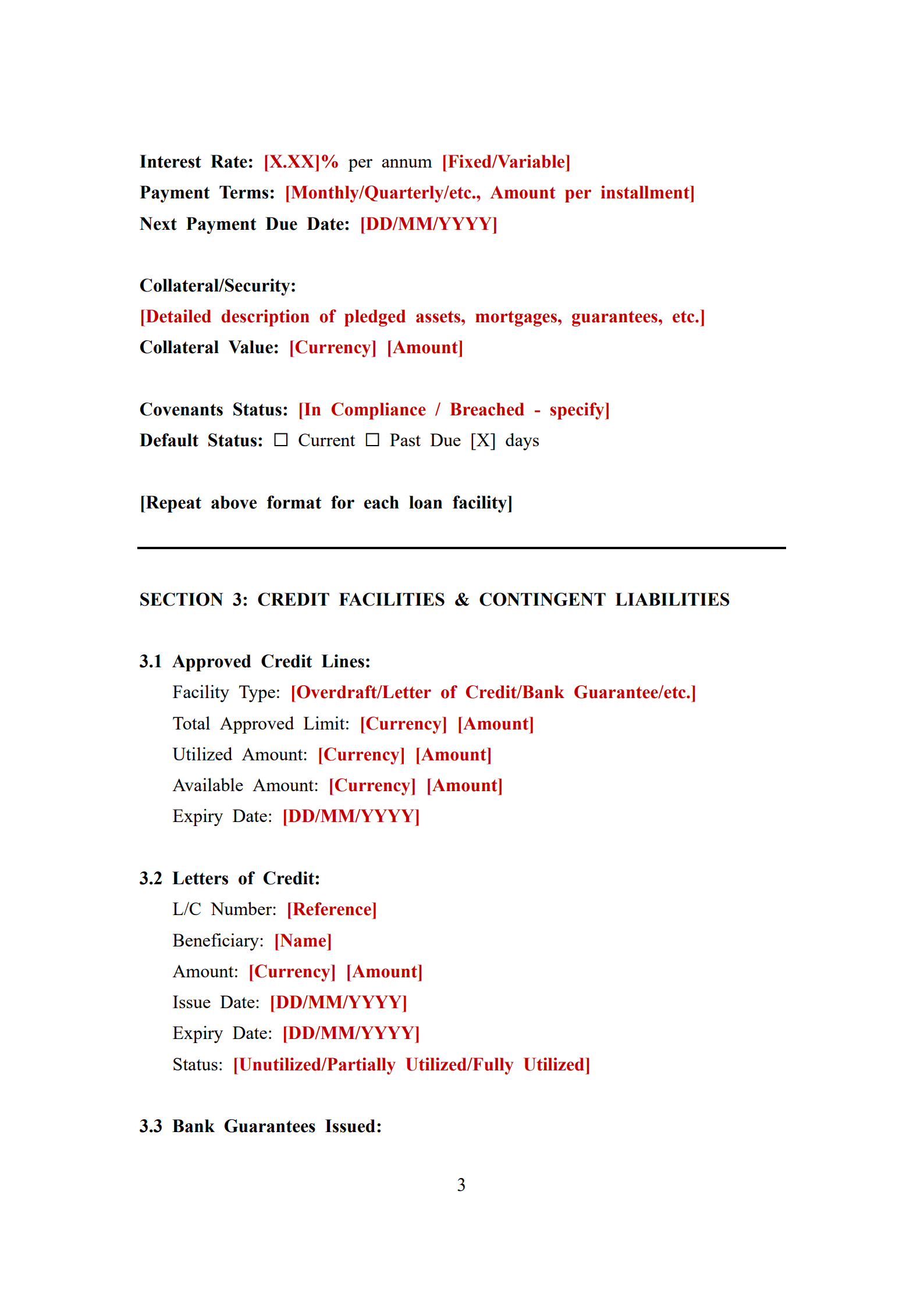

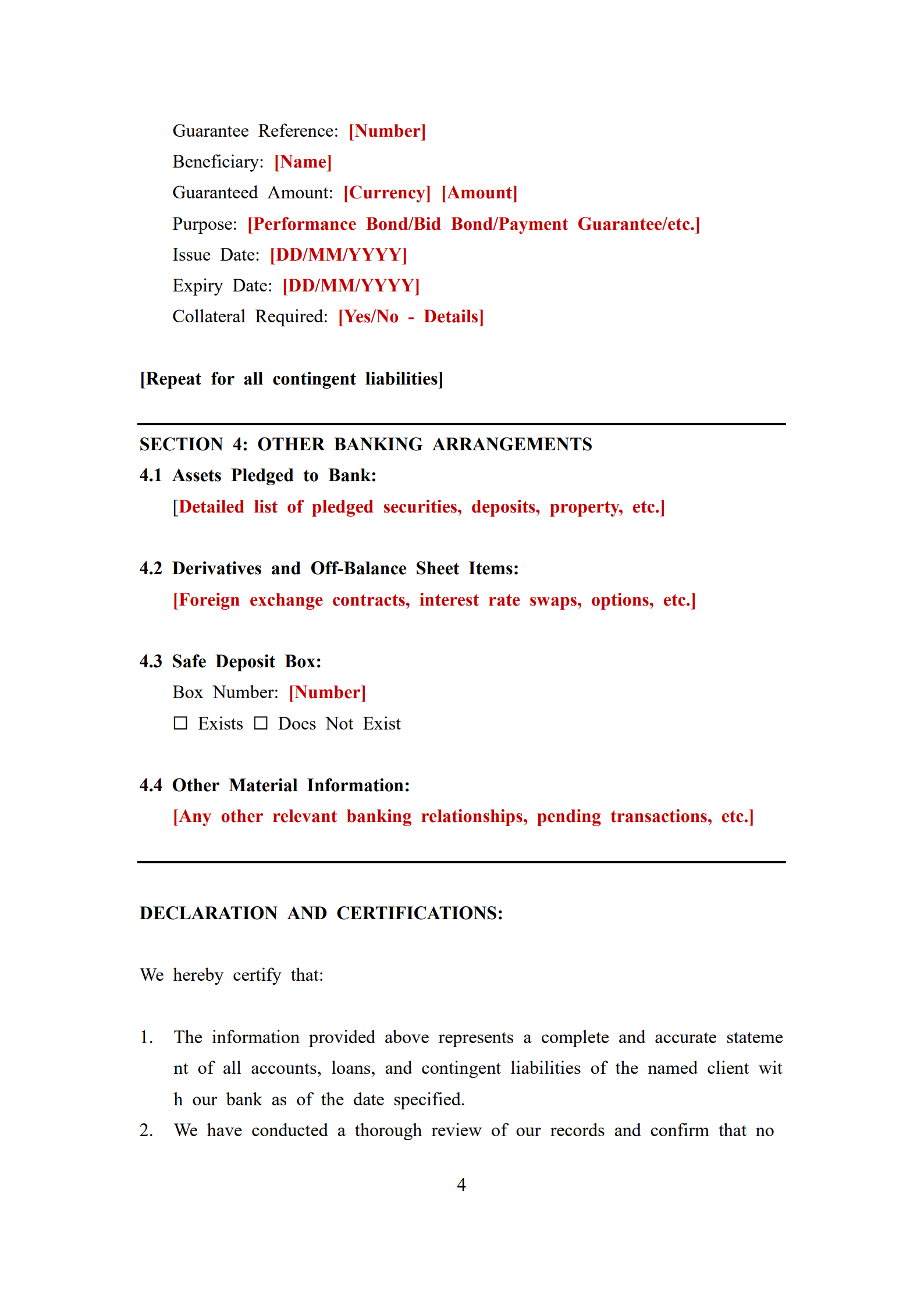

Specific Verified Information

The core content of your bank confirmation letter depends on what you requested. Balance confirmations state exact amounts as of specific dates. Credit facility confirmations outline approved limits, outstanding balances, and terms. Relationship confirmations might simply state that accounts exist in good standing without disclosing specific balances.

Date and Validity Period

Bank confirmation letters include issue dates and often specify how long the information remains valid. Since account balances fluctuate, confirmations typically note that verified information is accurate "as of [specific date]" rather than making ongoing claims about your financial position.

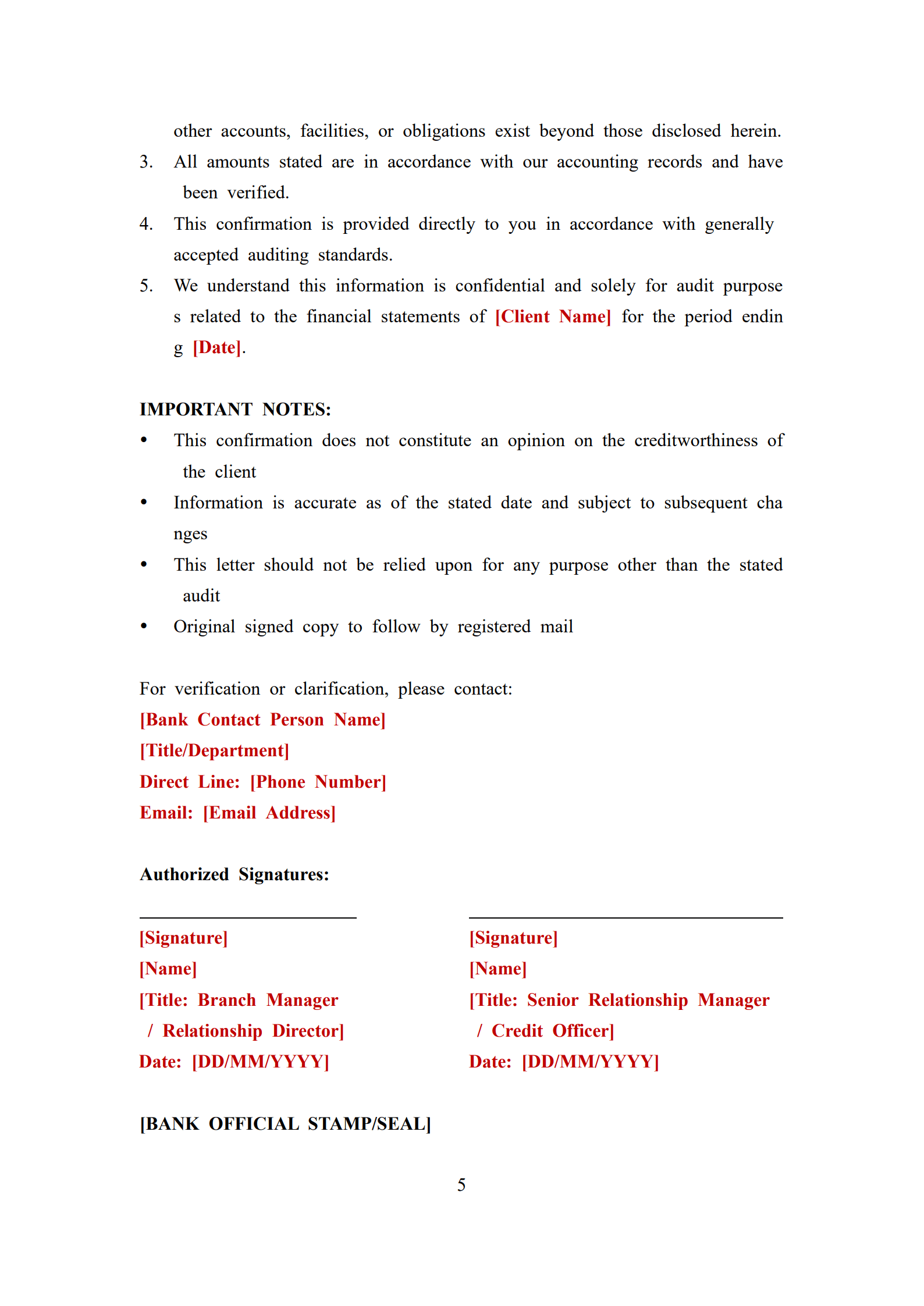

Authorized Signatures and Security Features

Legitimate bank confirmation letters bear signatures from authorized bank officials, often with titles and contact information included. Many banks incorporate security features like watermarks, unique reference numbers, or QR codes that recipients can use to verify authenticity directly with the bank.

Official Bank Stamp or Seal

In many jurisdictions, bank confirmation letters include official stamps or embossed seals that serve as additional authentication. These physical security elements help prevent forgery and signal that the document went through proper institutional channels.

The Process: How to Request Your Bank Confirmation Letter

Obtaining bank confirmation letters involves specific procedures that vary by institution but generally follow predictable patterns.

Step One: Understand Your Needs

Before approaching your bank, clarify exactly what information your bank confirmation letter must verify and who will receive it. Different situations require different confirmation types. Visa applications might need average balance confirmations over several months, while auditors might request detailed information about all accounts and credit facilities.

Step Two: Contact Your Bank Branch

Visit your branch in person or call to inquire about bank confirmation letter procedures. Many banks have dedicated departments handling these requests, particularly larger institutions with business banking divisions. Ask about required forms, processing times, fees, and identification documents you'll need.

Step Three: Complete Required Forms

Most banks require formal request forms for bank confirmation letters that specify what needs verification, who should receive the confirmation, and your authorization for information release. Complete these forms accurately and thoroughly to avoid processing delays or inadequate confirmations.

Step Four: Provide Supporting Documentation

Bring valid government-issued identification to verify your identity when requesting your bank confirmation letter. If someone requests confirmation on behalf of your company, provide corporate documentation and authorization letters proving authority to request such information.

Step Five: Pay Applicable Fees

Banks typically charge fees for preparing bank confirmation letters, ranging from nominal amounts for simple balance confirmations to higher fees for complex confirmations requiring extensive research or legal review. Understand fee structures before requesting multiple confirmations.

Step Six: Specify Delivery Method

Indicate how you want to receive your bank confirmation letter. Some situations require banks to send confirmations directly to third parties like auditors or embassies. Other times, you can collect sealed letters personally for submission. Clarify delivery requirements upfront to ensure proper routing.

Step Seven: Allow Adequate Processing Time

Bank confirmation letters rarely issue instantly. Processing times range from same-day service for premium customers to several business days for standard requests. Plan ahead and request confirmations well before deadlines to accommodate potential delays.

Practical Tips for Bank Account Verification Letter Success

Strategic approaches help you navigate the confirmation process efficiently while ensuring you receive appropriate documentation.

Build Banking Relationships

Customers with established relationships, multiple accounts, or premium banking tiers often receive faster processing, waived fees, and more accommodating service when requesting bank confirmation letters. Cultivating good banking relationships pays dividends when you need official documentation.

Request Confirmations in Advance

Never wait until the last minute to request your bank confirmation letter. Processing delays, missing information, or need for corrections could derail time-sensitive applications. Request confirmations at least two weeks before submission deadlines when possible.

Verify Recipient Requirements

Before requesting your bank confirmation letter, confirm exactly what the recipient needs. Does the embassy require confirmation on official letterhead sent directly from the bank? Does the auditor need specific language about liabilities? Understanding requirements prevents inadequate confirmations that need reissuing.

Keep Multiple Certified Copies

If you're submitting bank confirmation letters to multiple parties, request additional certified copies during your initial request rather than going through the entire process repeatedly. Banks often provide multiple copies more efficiently when requested together.

Maintain Records

Keep copies of your bank confirmation letters and related correspondence in organized files. These records might be needed for follow-up questions, future applications requiring historical financial documentation, or tax purposes if confirmations were obtained for business reasons.

Understand Privacy Implications

Bank confirmation letters reveal sensitive financial information. Consider what details are necessary versus what simply satisfies curiosity. Request confirmations that provide required verification without unnecessarily disclosing comprehensive financial positions to parties who don't need complete visibility.

Coordinate with Other Documentation

Your bank confirmation letter often supplements other financial documents. Ensure consistency between confirmation letters, tax returns, financial statements, and other submitted documentation. Discrepancies raise red flags with reviewers and might trigger additional scrutiny.

Common Challenges with Bank Confirmation Letters

Anticipating potential obstacles helps you navigate the confirmation process more smoothly and avoid frustrating delays.

Inconsistent Bank Policies

Different banks, and even different branches of the same bank, sometimes have varying procedures for issuing bank confirmation letters. What works with one institution might not apply to another. Always verify specific procedures with your particular bank rather than assuming standardized processes.

Language and Translation Issues

If you need your bank confirmation letter in a language different from your bank's primary operating language, coordinate translation requirements early. Some banks provide multilingual confirmations, while others require you to arrange certified translations of their standard-language documents.

Information Limitations

Banks sometimes refuse to include specific information in bank confirmation letters due to internal policies, regulatory restrictions, or liability concerns. If your bank won't verify certain details you need confirmed, you might need alternative documentation or explanations to recipients about limitations.

Timing Constraints

When your bank confirmation letter must reflect information as of a specific date for audit purposes or regulatory requirements, timing becomes critical. Requesting confirmations too early means they won't reflect the correct date. Requesting too late risks missing deadlines. Careful timing coordination with your bank is essential.

Authentication Verification

Recipients sometimes struggle to verify bank confirmation letter authenticity, particularly with international documents or smaller financial institutions. Ensure your confirmation includes adequate contact information and reference numbers that facilitate verification by concerned parties.

Free Download: Your Bank Confirmation Letter Template

Streamline your financial verification process with our professionally designed bank confirmation letter template. While your bank will ultimately issue the official document, our template helps you understand what information should be included and can serve as a reference when communicating your needs to your financial institution. This resource can help you prepare more effectively for requesting confirmations by clarifying standard formats and content expectations. Understanding the structure and components of effective bank confirmation letters puts you in a stronger position when working with your bank to obtain the documentation you need. Download our template today and approach your next confirmation request with confidence.

Frequently Asked Questions About Bank Confirmation Letters

Q:How long does it take to receive a bank confirmation letter?

A: Processing times vary significantly by bank and request complexity. Simple balance confirmations might be available within 24-48 hours, while comprehensive confirmations for audits or complex transactions could take 5-10 business days. Premium banking customers often receive expedited processing. Always request your bank confirmation letter well ahead of deadlines to accommodate potential delays.

Q:How much do banks charge for issuing confirmation letters?

A: Bank confirmation letter fees vary widely depending on the institution, customer relationship, and confirmation type. Simple confirmations might cost $10-50, while complex confirmations for audits or legal proceedings could run $100-300 or more. Some banks waive fees for premium account holders. Contact your specific bank to understand their fee structure.

Q:Can I use the same bank confirmation letter for multiple purposes?

A: This depends on recipient requirements and confirmation content. A general balance confirmation letter might work for multiple similar applications, but specific confirmations tailored to particular recipients (like audit confirmations) typically can't be repurposed. Additionally, confirmations become outdated quickly as account balances change, limiting reusability.

Q:What if my bank refuses to issue a confirmation letter?

A: Banks rarely refuse legitimate confirmation letter requests from account holders in good standing. If refused, clarify why and what alternatives exist. You might need to provide additional authorization, adjust your request to meet bank policies, or escalate within the bank's hierarchy. For unreasonable refusals, consider regulatory complaints or switching banks.

Q:Do bank confirmation letters need to be notarized?

A: Most bank confirmation letters don't require notarization because the bank's official letterhead, authorized signatures, and institutional backing provide sufficient authentication. However, some jurisdictions or specific applications might require notarization. Check with the requesting party about their specific requirements before obtaining your bank confirmation letter.

Q:How current must the information in a bank confirmation letter be?

A: Requirements vary by purpose. Visa applications might accept confirmations up to 30 days old, while auditors need confirmations dated at the balance sheet date. Real estate transactions often require very recent confirmations showing current balances. Always verify acceptable timeframes with recipients before requesting your bank confirmation letter.

Q:Can someone else request a bank confirmation letter on my behalf?

A: Banks typically require account holders to request bank confirmation letters personally or to provide explicit written authorization for someone else to request confirmations on their behalf. This protects customer privacy and prevents unauthorized disclosure of financial information. Corporate accounts might have designated signatories authorized to request confirmations.

Q:What should I do if there's an error in my bank confirmation letter?

A: Contact your bank immediately if you discover errors in your bank confirmation letter. Request a corrected version explaining the discrepancy. Don't alter the document yourself or submit inaccurate confirmations, as this could be considered fraud. Banks typically correct legitimate errors quickly, though processing corrected confirmations might take additional time.