Sales receipts are one of the fundamental pillars of any business. Just as writing invoices is crucial, so are sales receipts. To help you understand better, a sales receipt is a document that a seller prepares in order to verify the service or product offered and the cost of it. The sales receipt goes to a buyer, and it's the buyer who has to pay the amount mentioned on the receipt.

Keeping track of every sale is vital for a business, and to prepare a sales receipt, one must know about the small business sales receipt templates that will suit a company.

What is a Sales Receipt Template?

Before this post explains what a sales receipt is, what is important to note here is that a sales receipt and sales invoice are two different things. Many people often inquire what is a sales invoice, so let's help you understand what both are.

When you hear the term invoices for small businesses, it is essentially a document sent to request payment. On the contrary, a small business sales receipt is proof of payment. So, once the exchange of payment transaction is complete, the seller will send the sales receipt to the buyer. Sales receipts are required for tax purposes.

Why Use Sales Receipts?

As said earlier, sales receipts are a crucial piece of documents that confirms the transaction between a seller and a buyer of a service or product. It demonstrates that a payment has been made for a product or service. This document will have the proper break-up of the cost, date and time, items purchased or service received, seller details, buyer details, and the mode of payment.

Sales receipts can help a small business do accurate bookkeeping. For bookkeeping, any transaction that takes place must be taken care of. Using these sales receipts, one can prepare their balance sheet and figure out the data of profit and loss. Another reason why sales receipts are necessary is for tax returns. Such documents can throw some light on how much tax needs to be paid.

Sales receipts are also helpful for tracking one's inventory. Moreover, these small business receipts are essential for legal matters as well. In case of any issue with the buyer, a sales receipt can help the small business present accurate documents when needed during legal issues. These are some reasons why a small business should use a sales receipt.

Components of a Sales Receipt Sample

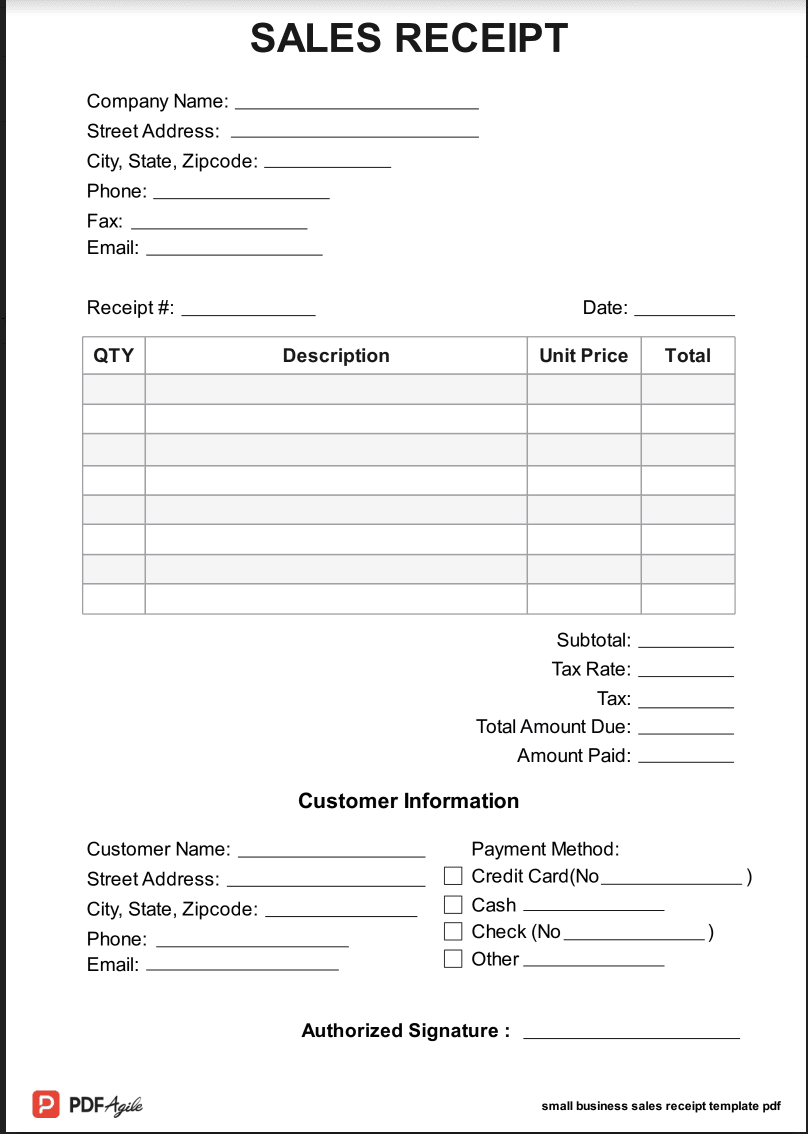

Sales receipts can vary from business to business. But there are a few basic things that every sales receipt will have. Small businesses can check a sales receipt sample to understand better. And once you find out how a sales receipt looks like, writing a sales receipt will become convenient. These components are crucial, and pay attention to each one while writing.

- The name of the payer has to be there. It can be a person or a company.

- Complete address and the payer's contact information, such as phone number, email ID, and fax, will be required.

- The receipt number needs to be there.

- The date of the sales receipt when it was created.

- List of products or services delivered to the payer, so they know what they paid for.

- Proper listing of the number of quantities, description of each product/service, unit price, and total.

- Subtotal of all the products, tax, and total amount.

- Contact information of the payee, including their name, address, phone number, email ID, and fax.

- Authorized signature of the payee.

Since sales receipts are essential for recording transactions, they must be 100% accurate.

How to Write a Receipt for a Small Business?

To help you with your preparation of sales receipts, let's help you with a sales receipt template that you can use. You will easily find multiple sales receipt templates online, but do learn about how to fill them up. You can use the template and download it either in Microsoft Word format or PDF. So, here's how each component of a sales receipt needs to be filled.

Contact Information of the Payer

Contact information of the payer is the first and the most critical component of a sales receipt. It needs to have the company's name, who has paid for the service or product, address of the company, email, phone number, and fax number (if available). Ensure to fill in the details correctly.

Any discrepancy in the sales receipt can make it void. Double-check the spelling and add the full address, including street name, city, state, and zip. After that, you need to mention the date when you will issue the sales receipt and the receipt number.

Product/Service Details

After the first component is complete, you will then move to the next component, which is product/service details. The sales receipt must clearly state the products/services the buyer needs to pay for. Typically, you will see a table where you need to enter the product/service details.

You will see a few columns, such as quantity, description, unit price, and total. Quantity will define the number of products. For example, if someone purchases two bottles of shampoo, you need to mention two in the quantity column. And if someone has purchased one face cream item along with the two bottles of shampoo, you need to mention one in the quantity tab, which will be to the left of the product name.

The description column is self-explanatory. This column will have the name of the products or services. Each column needs to be filled with one product/service. After that comes the Unit Price. This will be the cost per product/service. So, for two bottles of shampoo, one needs to add the price of only one bottle of shampoo. Whatever the value is, write it beside the description tab and under Unit Price.

Under the Total tab, you will write the total cost of each product. So, for two bottles of shampoo, you will add the price of one bottle under the Unit Price tab; now, in the Total tab, you need to add the cost of two bottles price since the buyer purchased two bottles from you.

Under this will be the Subtotal section. One needs to add the total amount in this section and write it here. Below will be the tax section, which you need to calculate again. Tax will be on the subtotal amount. Finally, in the Total section, write down the total cost, which will include the subtotal and tax amount.

Contact Information of the Payee

Just like the payer's details are needed, one must also provide the payee's details. The payee is the one who will receive the payment. This section will have the payee's name, company name, complete address, including street name, city, zip, phone number, and email ID.

Payment Method Details

After filling in the payee's information, the mode of payment has to be registered as well. Typically, in a sales receipt sample, one will see four boxes. One will be a credit/debit card, along with a space to write down the card number, cash, check with a space to write down the check number, and others. Choose the option through which the payer has paid.

Authorized Signature

Lastly, the authorized signature section, which needs to be filled by the payee only. The payee needs to confirm the authenticity of the sales receipt. In some sales receipts, a small business may also include the terms of sale.

Please check each component of the sales receipt before filling it up. Do read it thoroughly and gather all the information. Once everything is handy, start writing the receipt. This way, your company have less chance of making errors.

Even if one gets a printable receipt template from the internet, it must be double-checked and appropriately edited. Have several layers of checks in place. If one person writes it, let two other people cross-check it. This can prevent your business from litigation.