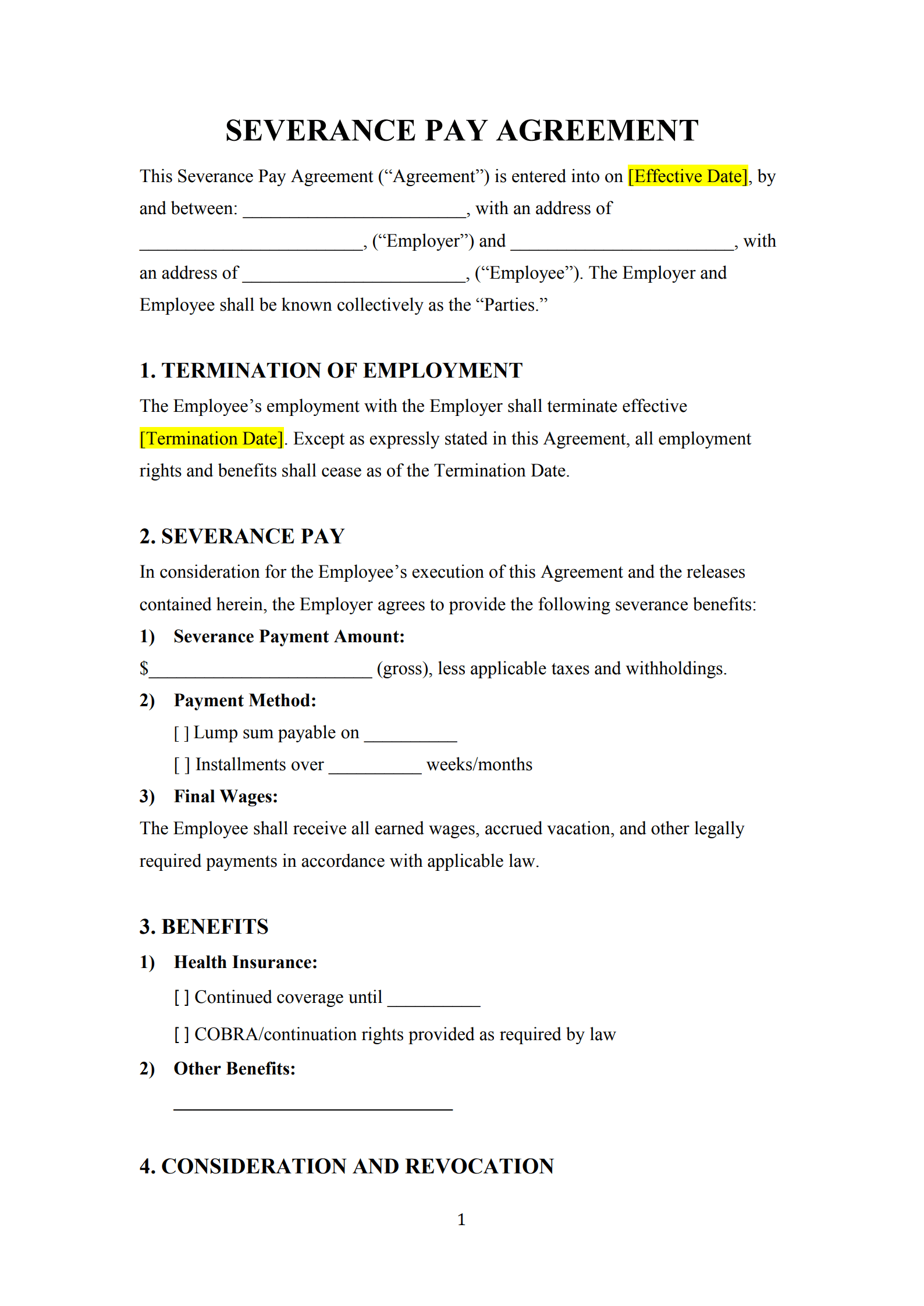

Ending an employment relationship can be a delicate process. A Severance Pay Agreement ensures that both the company and the departing employee clearly understand their rights and obligations. It defines payment terms, confidentiality clauses, and any post‑employment restrictions, helping avoid future legal or financial confusion.

With PDF Agile’s editable Severance Pay Agreement Template, HR departments and business owners can easily create a professional and compliant agreement that supports both transparency and mutual respect during transitions.

1. What Is a Severance Pay Agreement?

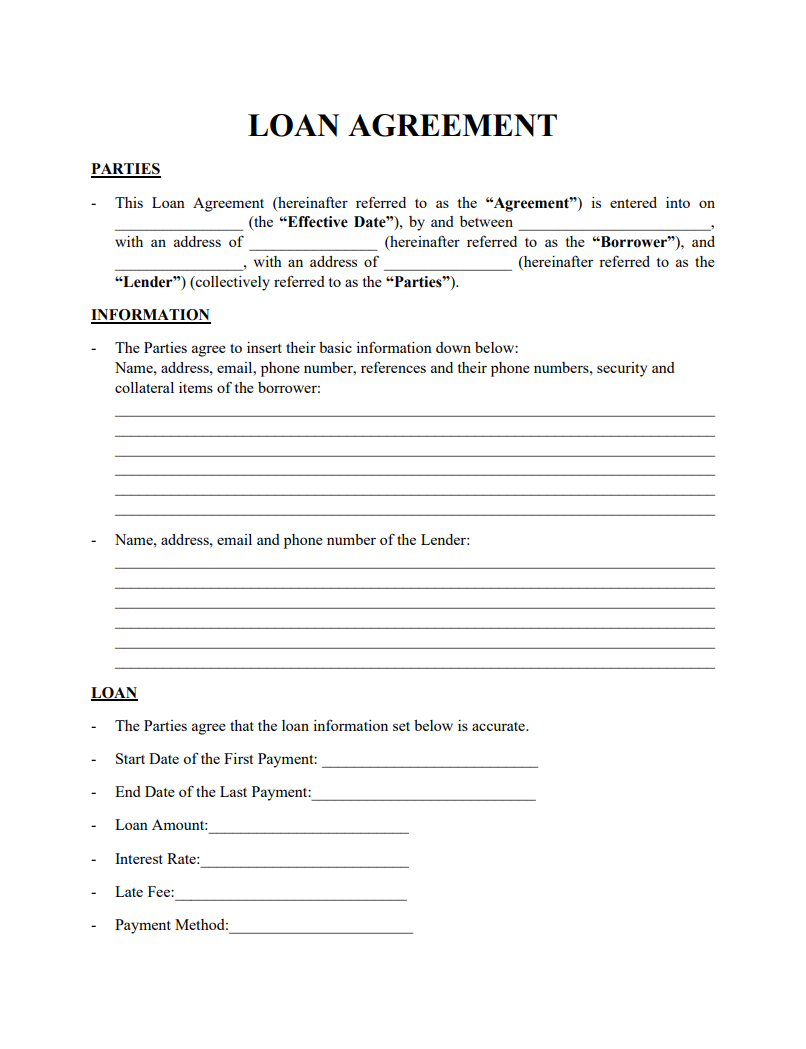

A Severance Pay Agreement is a legally binding document outlining the compensation and conditions provided to an employee after their employment ends.

It details the severance amount, payment schedule, and other relevant terms—such as non‑disparagement, confidentiality, or non‑compete clauses—in exchange for the employee’s release of potential claims against the employer.

This agreement not only clarifies financial arrangements but also helps avoid misunderstandings or disputes during offboarding.

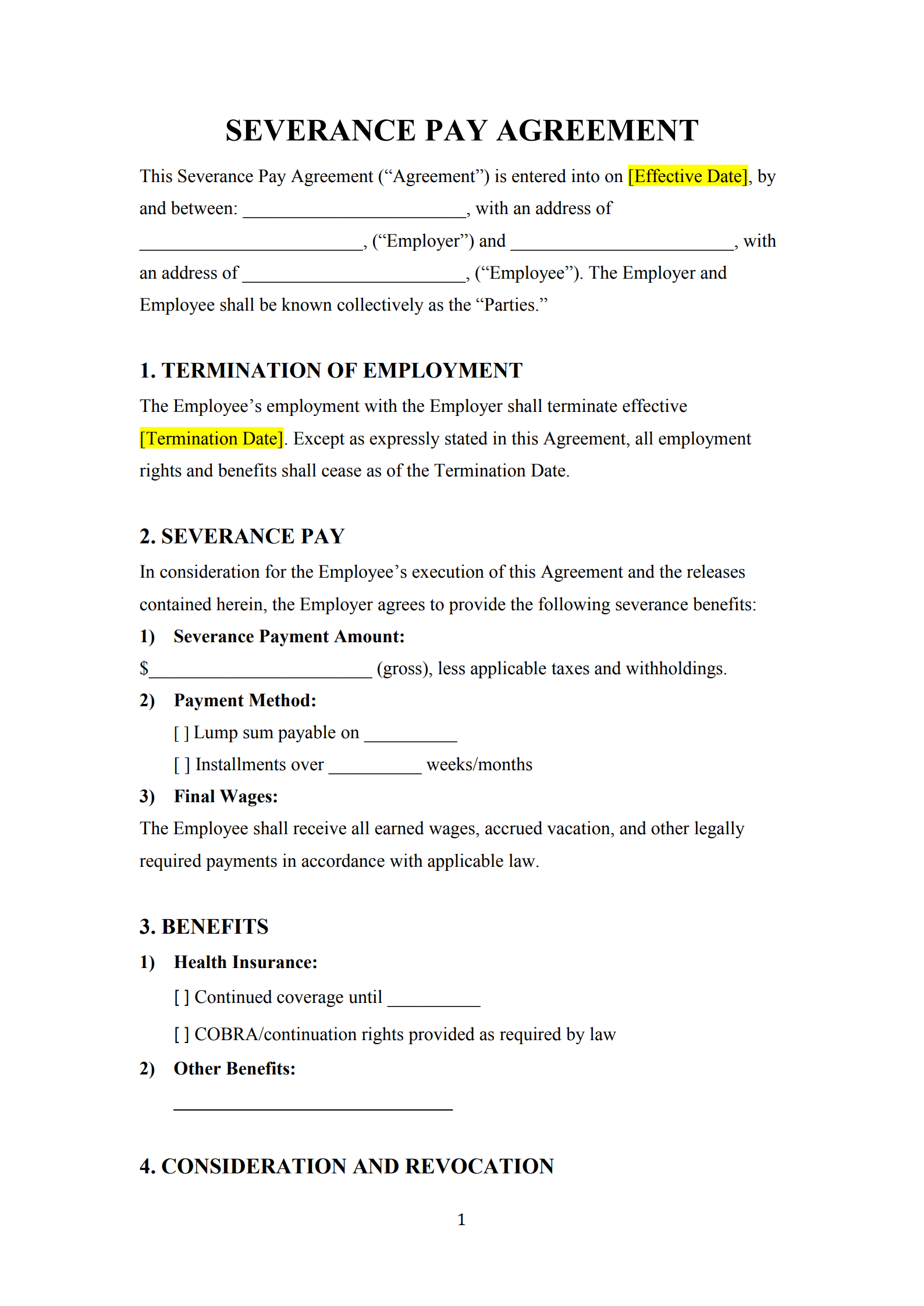

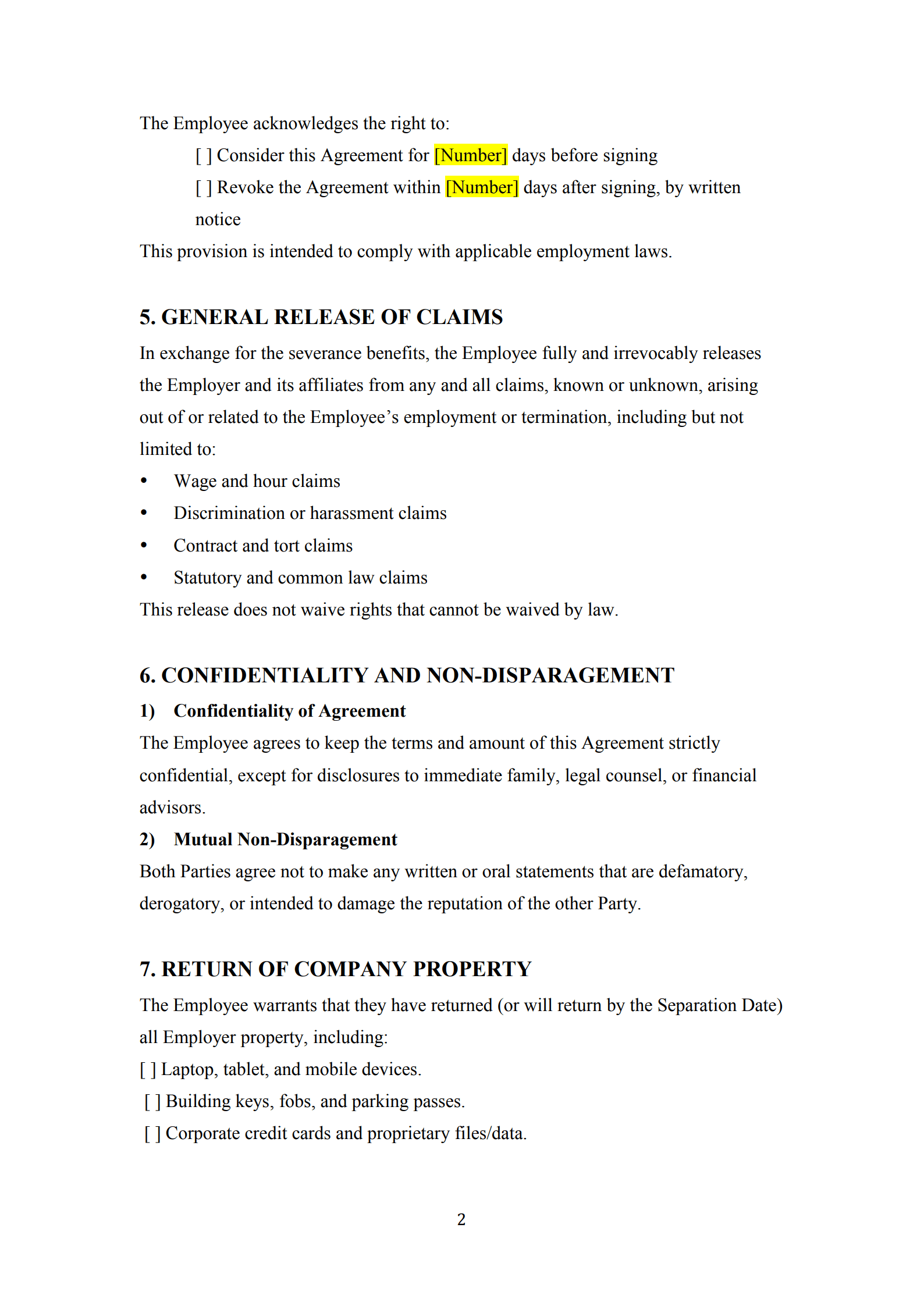

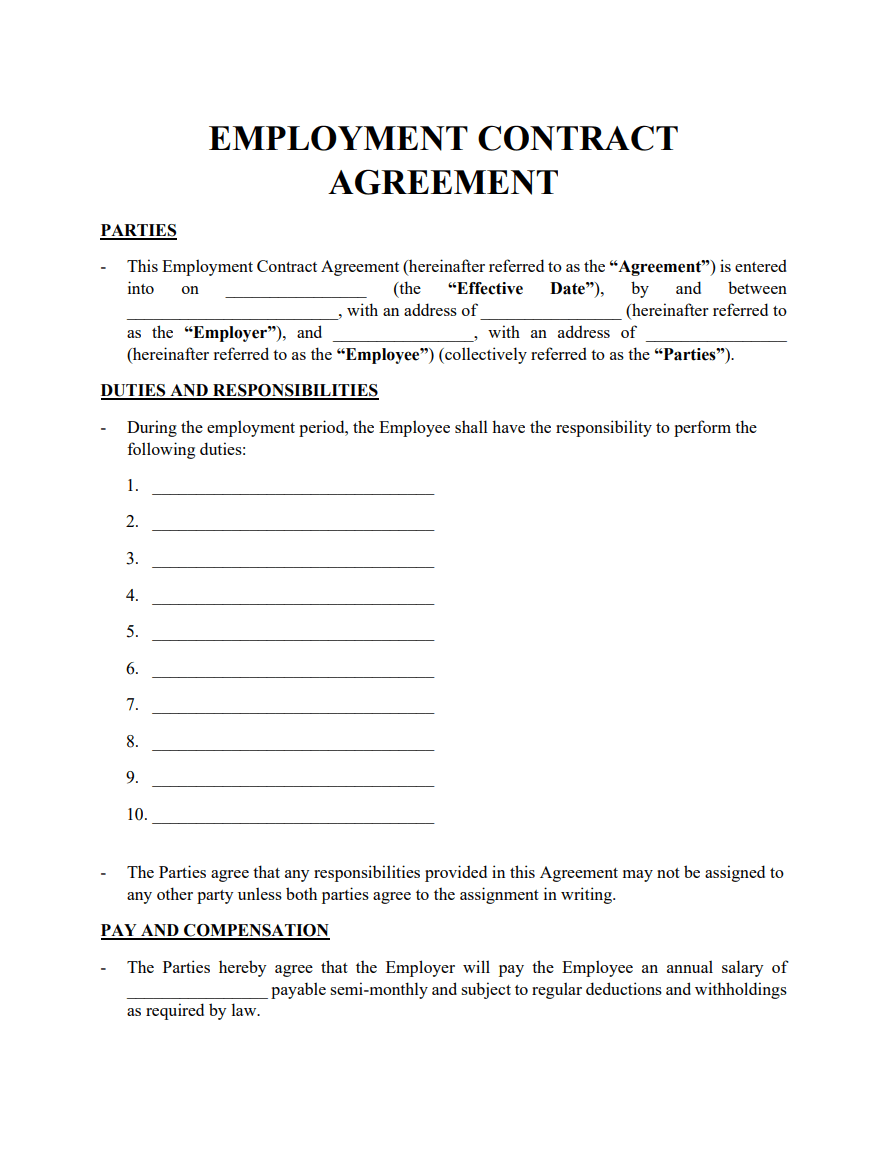

2. What Key Terms Should Be Part of the Severance Pay Agreement?

A clear severance package agreement typically includes:

- Employee and Employer Information – Names, positions, and contact details.

- Reason for Termination – Voluntary, involuntary, or mutual separation.

- Severance Amount and Payment Terms – Lump‑sum or installments, payment method, and timing.

- Benefits Continuation – Health insurance or retirement plan provisions, if applicable.

- Release of Claims – Confirmation that the employee waives any future legal actions related to employment.

- Confidentiality and Non‑Disparagement – Prevents disclosure of sensitive company data or negative statements.

- Return of Company Property – Requirements for returning equipment or documents.

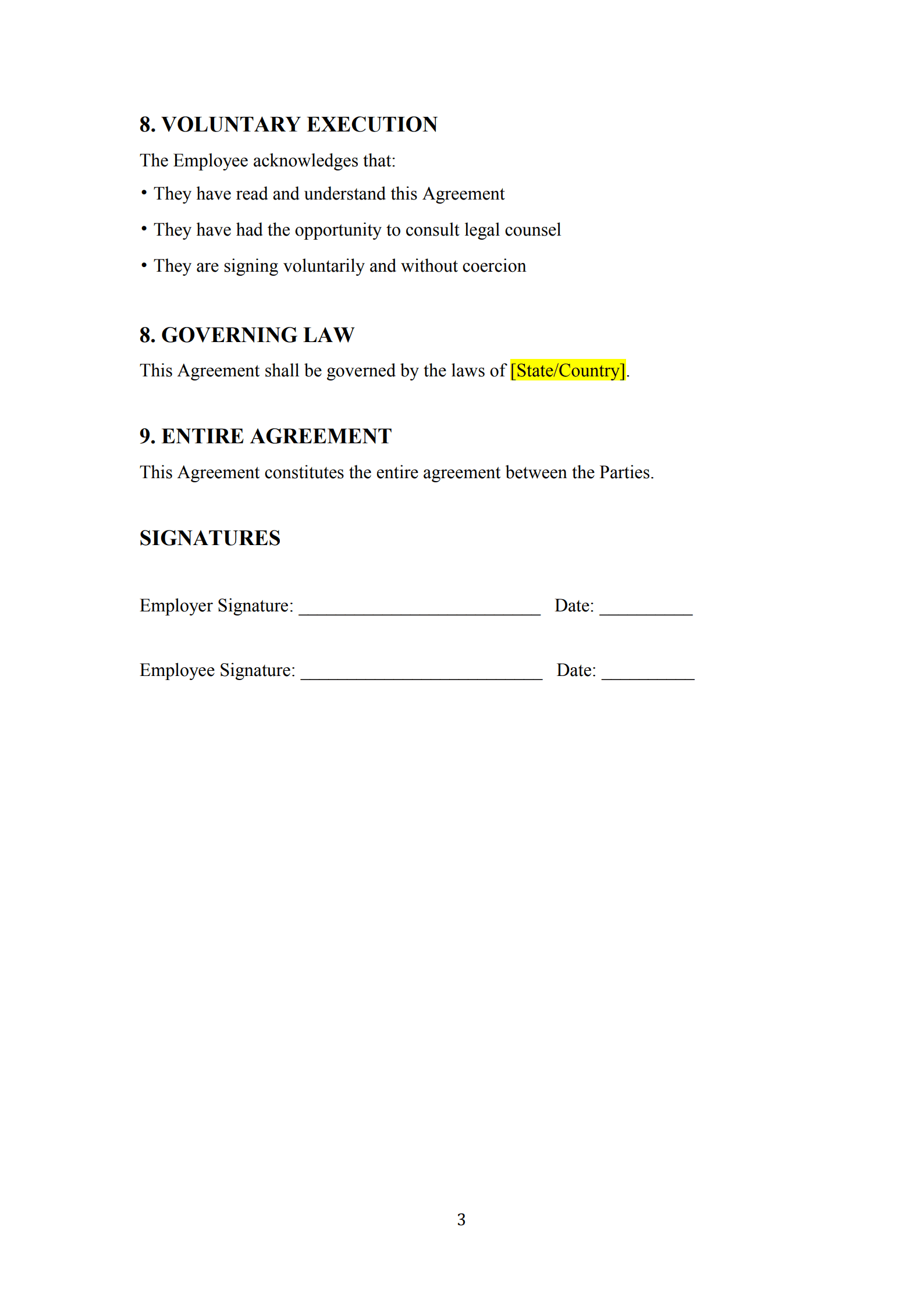

- Governing Law and Signatures – Legal jurisdiction and acknowledgment by both parties.

3. When to Use a Severance Pay Agreement?

You should use a severance pay agreement when:

- Terminating employees due to layoffs, restructuring, or downsizing.

- Offering voluntary exit packages to senior or long‑term staff.

- Managing mutual separation agreements where both parties agree to end employment.

- Resolving employment disputes amicably with compensation.

Having this agreement in place protects both sides and documents the terms of separation professionally.

4. Why Compensation Agreement is Important for Both the Company and the Employee?

A severance pay agreement provides benefits for both parties:

For the company:

- Minimizes risk of future legal claims or wrongful termination suits.

- Reinforces ethical and professional HR practices.

- Protects business reputation through confidentiality and non‑disparagement terms.

For the employee:

- Offers financial security during the job transition period.

- Clarifies continuation of benefits and tax responsibilities.

- Provides an official record of the terms of separation.

This mutual clarity helps both sides move forward positively and efficiently.

5. Best Practices When Using a Severance Package Agreement Template

Step 1: Use clear and simple language so all terms are easily understood.

Step 2: Tailor payment and benefit sections to fit employment level and company policies.

Step 3: Consult local labor laws to ensure compliance with mandatory severance or notice requirements.

Step 4: Include a release and acknowledgment clause confirming the employee has had time to review or seek legal advice.

Step 5: Keep signed records securely for internal and legal reference.

With PDF Agile, you can swiftly fill, edit, and digitally sign the document—all in one secure platform.

FAQs about Severance Pay Agreement

1. Is severance pay the same as a final paycheck?

No. A final paycheck covers completed work and unused leave. Severance pay is additional compensation, typically offered as a goodwill gesture or legal settlement after termination.

2. What is the standard for a severance agreement?

There’s no universal rule, but many companies offer one to two weeks of pay for every year of service, depending on tenure, role, and company policy.

3. How are taxes handled on a lump‑sum payment?

Severance pay is generally considered taxable income and may be subject to income tax and social security withholdings like regular wages. Confirm details with a payroll or tax professional.

4. What happens if an employee refuses to sign the deal?

If the employee declines to sign, the employer usually isn’t obligated to provide severance pay unless required by contract or company policy. The final paycheck must still be paid per local law.

5. Can the company stop payments if the person starts a new job?

Only if the agreement specifically allows for that condition. Unless stated, new employment doesn’t automatically stop severance payments.

6. Do I get severance pay if I resign?

Generally not, unless the employment contract or company policy provides for voluntary separation benefits or the resignation was mutually negotiated.

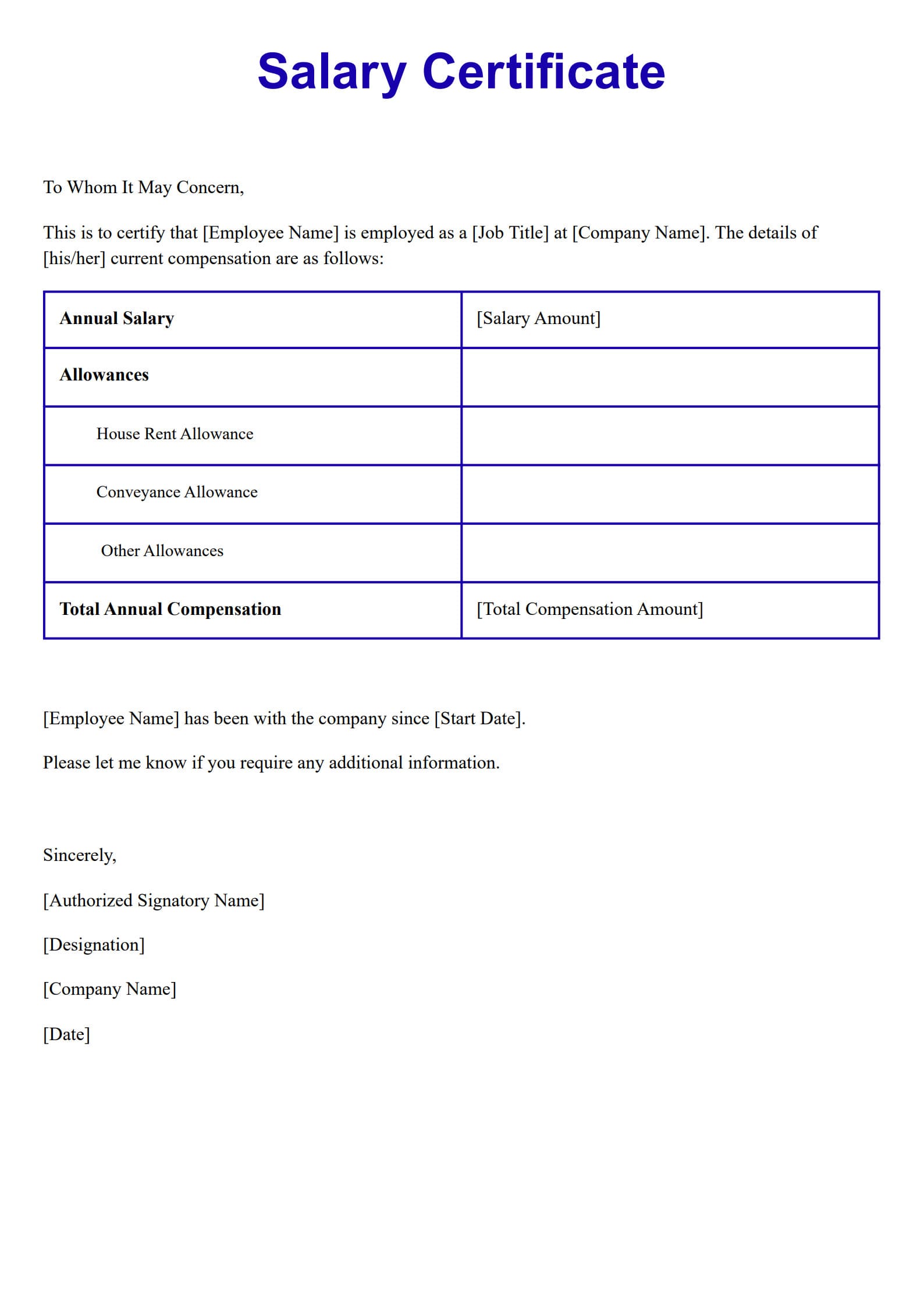

Free Download: Printable Severance Pay Agreement Template

You can download the Severance Pay Agreement mentioned above by clicking Use Template button on this page. Customize it to fit your specific needs and preferences.

Conclusion

A Severance Pay Agreement formalizes the end of employment with clear financial, legal, and confidentiality terms. It protects employers from future claims while giving employees peace of mind during transition.

With PDF Agile’s printable and editable template, you can easily produce tailored severance agreements that meet legal standards and reflect your company’s professionalism and fairness.