Introduction

Individuals and corporate entities constantly request for loans on a day-to-day basis. Loans can be obtained from traditional financial institutions like commercial and merchant banks.

Personal loans can also be obtained from individuals. If you are a lender of money, you might want to secure the repayment of your loan by the debtor through the use of a loan agreement contract.

This guide explains what this contract is and when to use it. You will also get to see what elements exist in a typical loan agreement template like our free-to-download version here.

What is a loan agreement?

A loan agreement is a contract between two parties, namely; a lender or creditor and a borrower or debtor. The lender agrees to loan the borrower a certain sum of money with or without interest. And the borrower agrees to pay back this loan according to the agreed terms and conditions, including the repayment schedule.

A loan agreement contract is a document that legally binds the loan transaction between the creditor and the debtor. It acknowledges that a loan transaction has occurred, identifies the creditor and debtor in the transaction, and holds the debtor and/or their estate liable for repaying the debt.

When to use a loan agreement?

A loan agreement can be used at any time a loan transaction is being contemplated. You can use a loan agreement for a personal loan to family members and friends.

A loan agreement can also be used in a business setting. An individual can legally bind a business entity to a loan obtained by using a loan agreement contract. Also, a business entity can loan money to another business and document this transaction via a loan agreement contract.

There are different real-world scenarios where a loan agreement can be used. What is important is that there must be a lender of funds and a receiver or borrower of these said funds. This is the primary element in any loan agreement and must be contained in the loan agreement contract document along with other clauses or elements.

Important Elements / Clauses for Loan Agreements

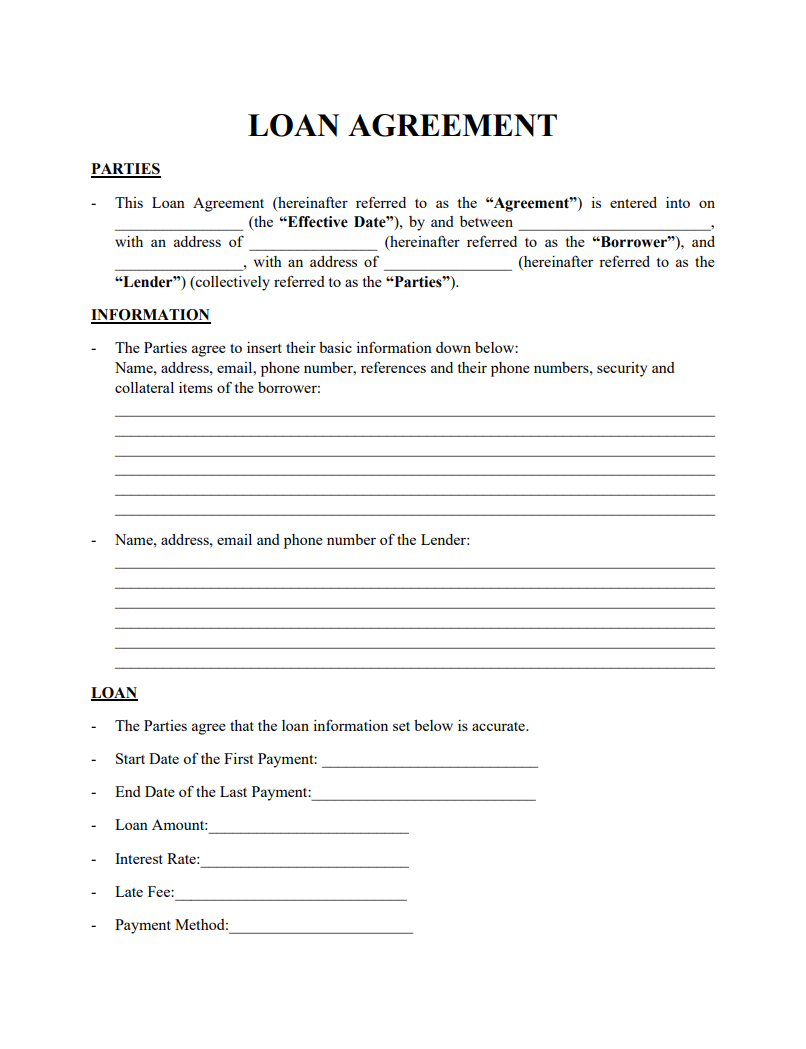

Every loan agreement contract must have some key elements and clauses. These elements are also available in our loan agreement template and include the following:

#1. Information on Parties to the Contract: This includes the following;

- The name and address of the creditor.

- The name and address of the debtor.

- The current photograph of the debtor.

- Debtor references.

- Details of debtor collateral.

#2. Terms of the Loan Agreement: The loan agreement should meticulously document the terms and details of a loan. These terms and details include;

- The date of disbursement of the loan.

- The amount of loan disbursed.

- Details of the interest on the loan

The terms of your loan can either be accepted or rejected by a prospective borrower. If accepted, you know that the debtor is willing to meet their commitment to paying the loan. However, if a prospective borrower does not accept the terms of your loan agreement contract, then you know that the person or entity is incapable of meeting your loan requirements.

#3. Repayment structure: Another element in every loan agreement contract is the repayment structure or schedule. This states when the debtor should pay the principal and interest on a loan.

#4. Penalties for Late Repayment: A loan agreement should indicate the penalties for late or default repayments. Prospective borrowers need to agree to pay these penalties as a condition for receiving the loan.

#5. Signatures: All parties to the loan agreement need to append their signatures and the date of signing the contract. The signing of the contract makes it legally binding to all parties. Witnesses to the loan agreement can also append their signatures and date, although this is not a mandatory requirement for legalizing the contract.

FAQ

Q1: Is a loan agreement a binding contract?

A1: Yes. A loan agreement is a contract that binds a creditor and debtor. According to an agreed payment timeline, the debtor agrees to pay back debt with or without interest.

Q2: Is it necessary to have a witness for a loan agreement?

A2: No. Having witnessed for a loan agreement is not a mandatory requirement. However, a witness to a loan contract can prove useful in a legal proceeding.

Q3: Can I use this loan agreement template for personal loans?

A3: Yes. Our loan agreement template can be used to document business and personal loans.

Q4: Can amendments be made to this loan agreement template?

A4: Yes. You can edit parts or all of our loan agreement templates to suit your purpose. Our free template is available for download in editable PDF format. However, you should seek legal counsel to ensure that your revised version adheres to local law.