The salary certificate, often interchangeably referred to as a salary letter or proof of employment letter, is a vital document used to officially verify an employee’s income and employment status. This formal HR document is usually requested by employees for essential legal and financial purposes outside of the workplace.

Understanding the required format and best practices for writing this letter ensures compliance, accuracy, and professionalism.

1. What is a Salary Certificate?

A salary certificate is a formal document issued by an employer to an employee, confirming their current employment, designation, and most importantly, their compensation structure. It serves as an official, authenticated source of income verification.

Primary Uses for a Salary Certificate:

- Loan and Credit Applications: Banks and financial institutions require this certificate to assess an applicant's debt-to-income ratio for mortgages, car loans, or personal credit cards.

- Visa and Immigration: Governments and embassies often require proof of financial stability and secure employment to issue visas (tourist, work, or permanent residency).

- Housing and Rental Agreements: Landlords may request it to ensure a prospective tenant has sufficient income to cover monthly rent payments.

- New Employment or Background Checks: Though less common, a new employer may request it as part of the final verification process.

The certificate is only valid if it is printed on the company's official letterhead and signed by an authorized signatory (typically the HR manager, finance officer, or CEO).

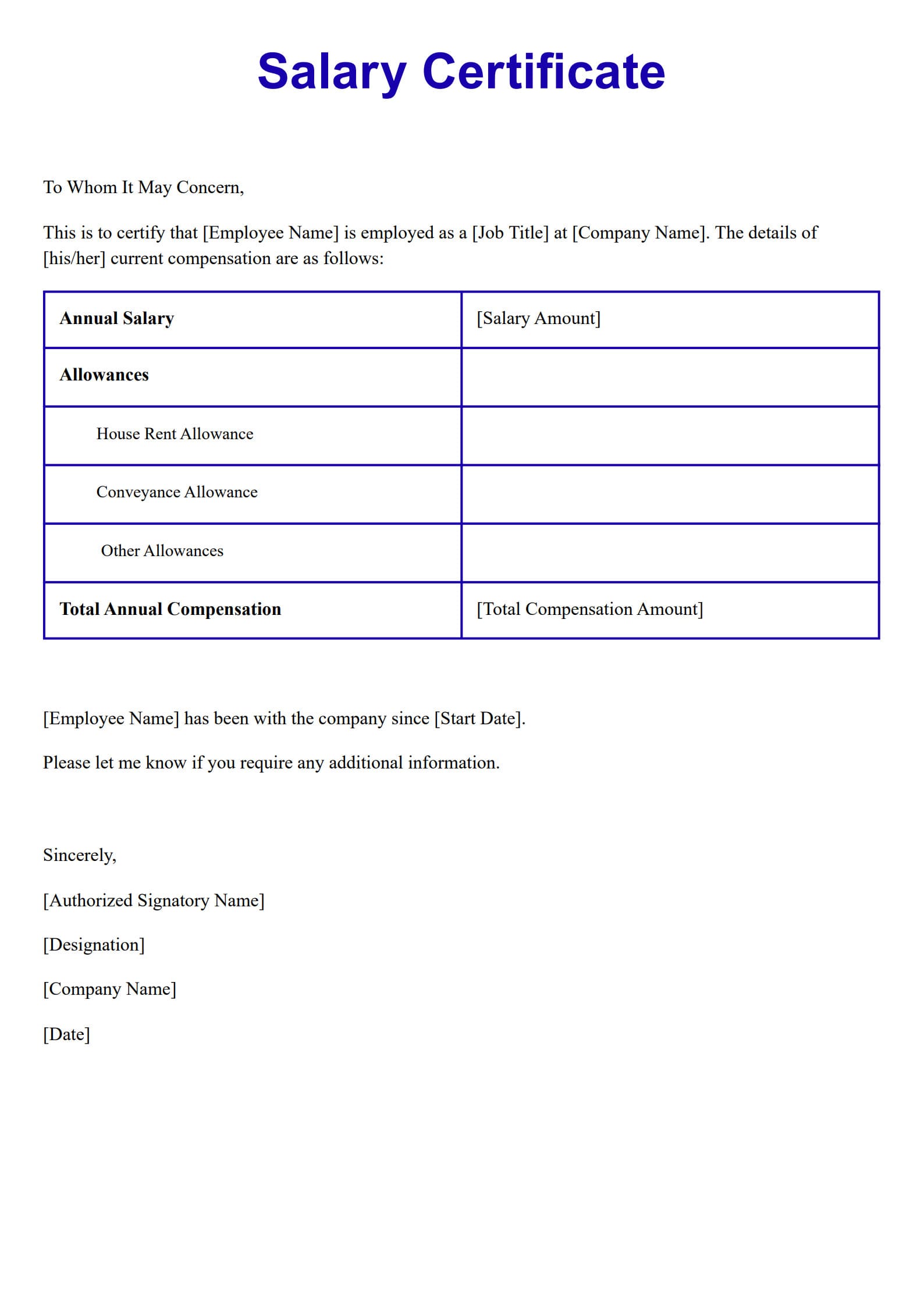

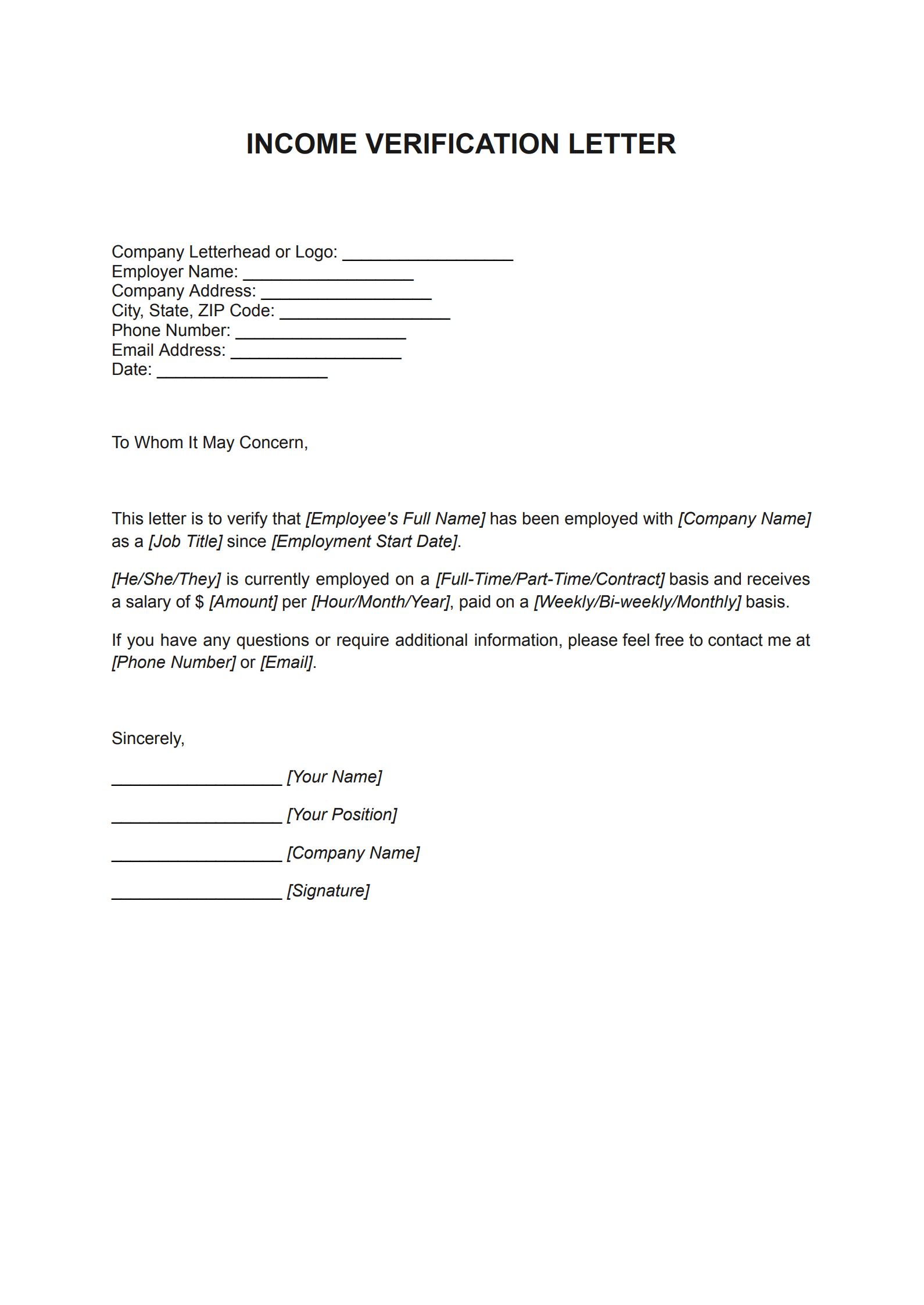

2. What is the Salary Certificate Format Like?

A standardized salary certificate format ensures it is instantly recognizable and meets the requirements of external institutions (like banks or embassies). The format should be highly professional, avoiding unnecessary jargon or decorative elements.

Mandatory Components of a Standard Salary Certificate:

| Component | Detail Required | Purpose |

| Official Letterhead | Company Logo, Legal Name, Full Address, Contact Details. | Establishes the document's authenticity and source. |

| Date of Issue | The exact date the letter was generated. | Determines the validity period (most institutions require a certificate issued within the last 30-90 days). |

| Recipient Address | Formal address to the third party (e.g., "To Whom It May Concern," or the specific bank/embassy). | Provides formality and direction. |

| Employee Details | Full Legal Name, Employee ID, Current Designation/Title, Date of Joining. | Confirms the employee's identity and tenure. |

| Compensation Details | Monthly/Annual Gross Salary, Basic Salary, Allowances (HRA, travel, etc.), and currency. | The core information used for financial assessment. |

| Signature Block | Name, Designation, and Signature of the Authorized Signatory (e.g., HR Manager). | Authenticates the information provided. |

| Company Seal/Stamp | Official company seal placed over the signature. | Provides a final layer of legal validation. |

3. Customize with Salary Certificate Format PDF (Editable)

Using a template, especially an editable PDF or Word document, streamlines the HR process, guarantees consistency, and reduces the risk of omitting critical information.

Tips for Customizing Your Employment and Salary Certificate Template:

- Mandatory Letterhead Integration: Ensure the template leaves sufficient space to be printed on your company's physical or digital letterhead, making the branding prominent.

- Use Specific Currency: Always state the currency clearly (e.g., "USD 5,000" or "INR 50,000"). If the employee is paid in one currency but needs the certificate in another (for a foreign visa application), the letter should state the salary in the official payroll currency.

- Specify "Gross" vs. "Net": Most financial institutions require the gross salary (salary before deductions) to assess loan eligibility. The template must clearly label this figure as "Gross Monthly Salary."

- Date Validation Field: Include a field for the validity period or a statement that "This certificate is valid for 30 days from the date of issue."

4. How to Write a Salary Letter for Employees?

The process of writing the final salary certificate, or letter, requires meticulous attention to detail and clear, unambiguous language.

- Formal Tone: Maintain a direct, professional, and courteous tone throughout. The letter is a statement of fact, not a personal recommendation.

- Acknowledge the Request: Start with a standard salutation like "To Whom It May Concern" or address the specified institution directly.

- Define Status and Tenure: Clearly state the employee's current job title and the date they officially started their employment with the company (Date of Joining).

- Detail Compensation: This is the most critical section. List the breakdown of the salary (Basic, HRA, Medical, and Gross Annual/Monthly Income) in a clear, bulleted or tabulated format. Avoid ambiguity that could lead a bank to miscalculate income.

- Sign and Seal: Have the authorized manager sign the letter and apply the official company seal/stamp. This signature verifies the accuracy and legitimacy of the provided financial data.

Conclusion

The salary certificate is a simple yet high-stakes document, acting as the employee's key to accessing credit, achieving immigration goals, or securing a tenancy. By utilizing a free, standardized, and properly customized template, HR departments can efficiently provide accurate, professional, and compliant documentation that fully supports their employees' external needs.

Free Download: Editable Salary Certificate Template

You can download the salary certificate template mentioned above by clicking Use Template button on this page. Customize it to fit your specific needs and preferences.