The security deposit receipt is one of the most important documents exchanged at the beginning of a tenancy. It serves as legal proof that a tenant has submitted funds to the landlord, protecting both parties and laying the groundwork for a transparent rental agreement.

Understanding the components of this receipt, along with state-specific regulations, is essential for every landlord and property manager.

1. What is a Security Deposit Receipt?

A security deposit receipt is a formal, written acknowledgment provided by the landlord (or their agent) to the tenant upon receiving the security deposit payment.

Its purpose is twofold:

Security Deposit Receipt for the Tenant:

It serves as indisputable proof of payment, detailing the amount paid, the date, and the reason for the funds. This document is essential for the tenant when requesting the return of their deposit at the end of the lease.

Security Deposit Receipt for the Landlord:

It confirms the specific date the funds were received, which often dictates the start date for legal requirements regarding where the funds must be held (e.g., in a separate escrow account) and when they must be returned.

In many jurisdictions, providing a receipt for the security deposit is a legal requirement for the landlord.

2. What is the Difference between a Rental Deposit and a Security Deposit?

The terms "rental deposit" and "security deposit" are often confused or used interchangeably, but there is a distinct difference in purpose:

| Feature | Security Deposit | Rental Deposit (Pre-Paid Rent) |

| Primary Purpose | To protect the landlord against tenant damages, cleaning costs beyond normal wear and tear, and unpaid rent or utility bills. | To pay for the rent of a specific period (e.g., the last month of the lease). |

| Refundable Status | Generally Refundable. The balance is returned to the tenant after move-out, minus any legally justifiable deductions. | Non-Refundable (as long as the tenant occupies the unit). The fund is applied directly to rent owed for the period it covers. |

| Legal Restrictions | Highly regulated by state and local laws regarding maximum amount, storage (escrow account), and return timeline. | Less strictly regulated than security deposits, but still part of the lease agreement. |

Key Takeaway: Always ensure your lease and receipt clearly define the funds received. A security deposit is a refundable contingency, whereas a payment for the last month's rent is an application of rental income.

3. How Much Would a Landlord Charge for a Security Deposit?

The amount a landlord can legally charge for a security deposit is strictly governed by state and, sometimes, local municipal laws.

Most states cap the maximum security deposit amount based on the monthly rent. Common caps include:

- One Month's Rent: Common in states like Massachusetts and Washington.

- One and a Half Month's Rent: Common in New Jersey.

- Two Months' Rent: Historically common in many jurisdictions for standard tenants.

- Three Months' Rent: Sometimes allowed for tenants with pets or higher perceived risk, though this is less common now.

Important Note: Landlords must always research and comply with the laws in their specific jurisdiction. Charging more than the statutory maximum, even if the tenant agrees to it, is illegal and can result in severe penalties, including forcing the landlord to return the entire deposit immediately.

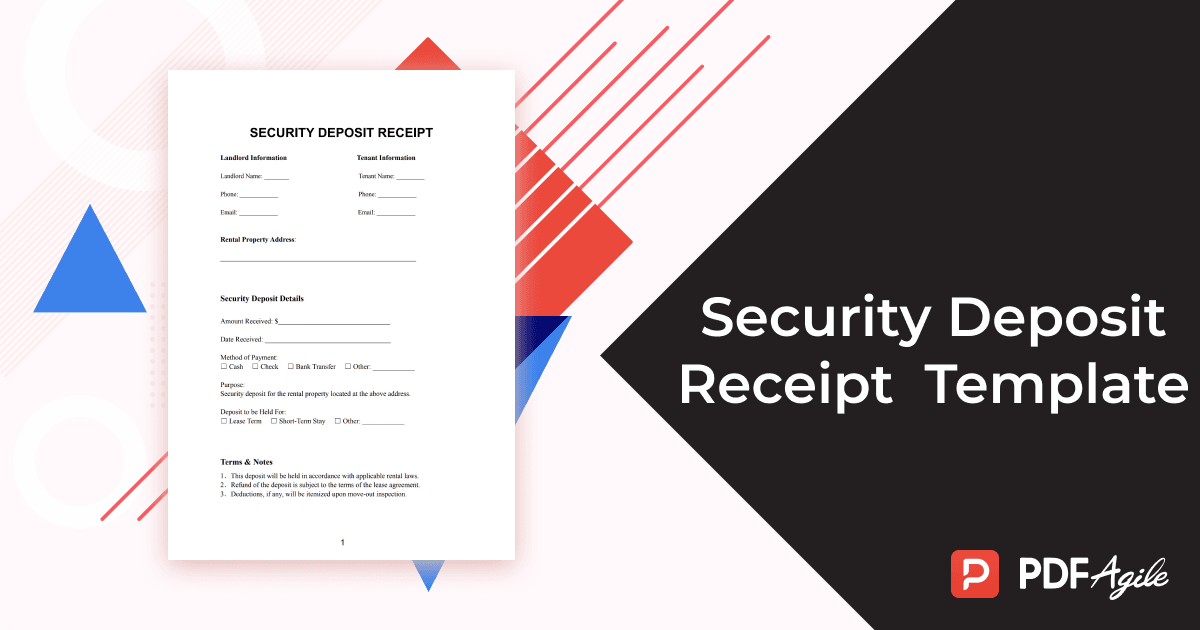

4. How to Write a Receipt for a Security Deposit?

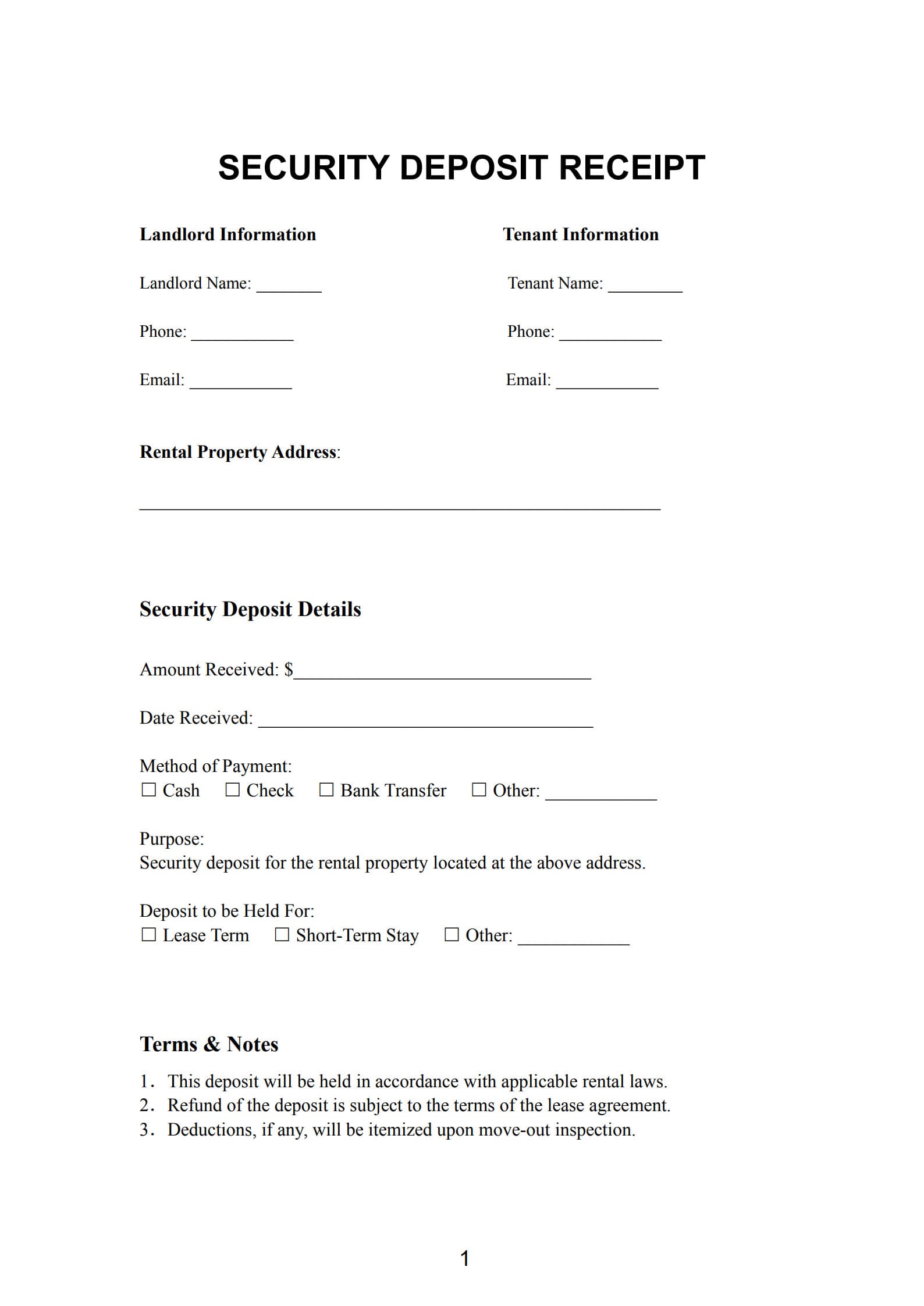

A valid security deposit receipt must contain specific, detailed information to serve its legal purpose.

The receipt should include the following core components:

- Header: Clearly titled "Security Deposit Receipt."

- Date of Payment: The exact date the funds were received.

- Property Information: The full address of the rental unit (including unit number, if applicable).

- Parties Involved:

- Full legal name of the tenant(s) who provided the payment.

- Full legal name and contact information of the landlord or agent receiving the payment.

- Payment Details:

- Amount Received: The total amount of the security deposit in both numerals (e.g., $1,500.00) and written words (e.g., One Thousand Five Hundred Dollars and Zero Cents).

- Payment Method: How the payment was made (e.g., cash, check #123, money order, or electronic transfer).

- Purpose of Payment: Explicitly state that the funds are for the "Security Deposit for the lease term commencing [Start Date]."

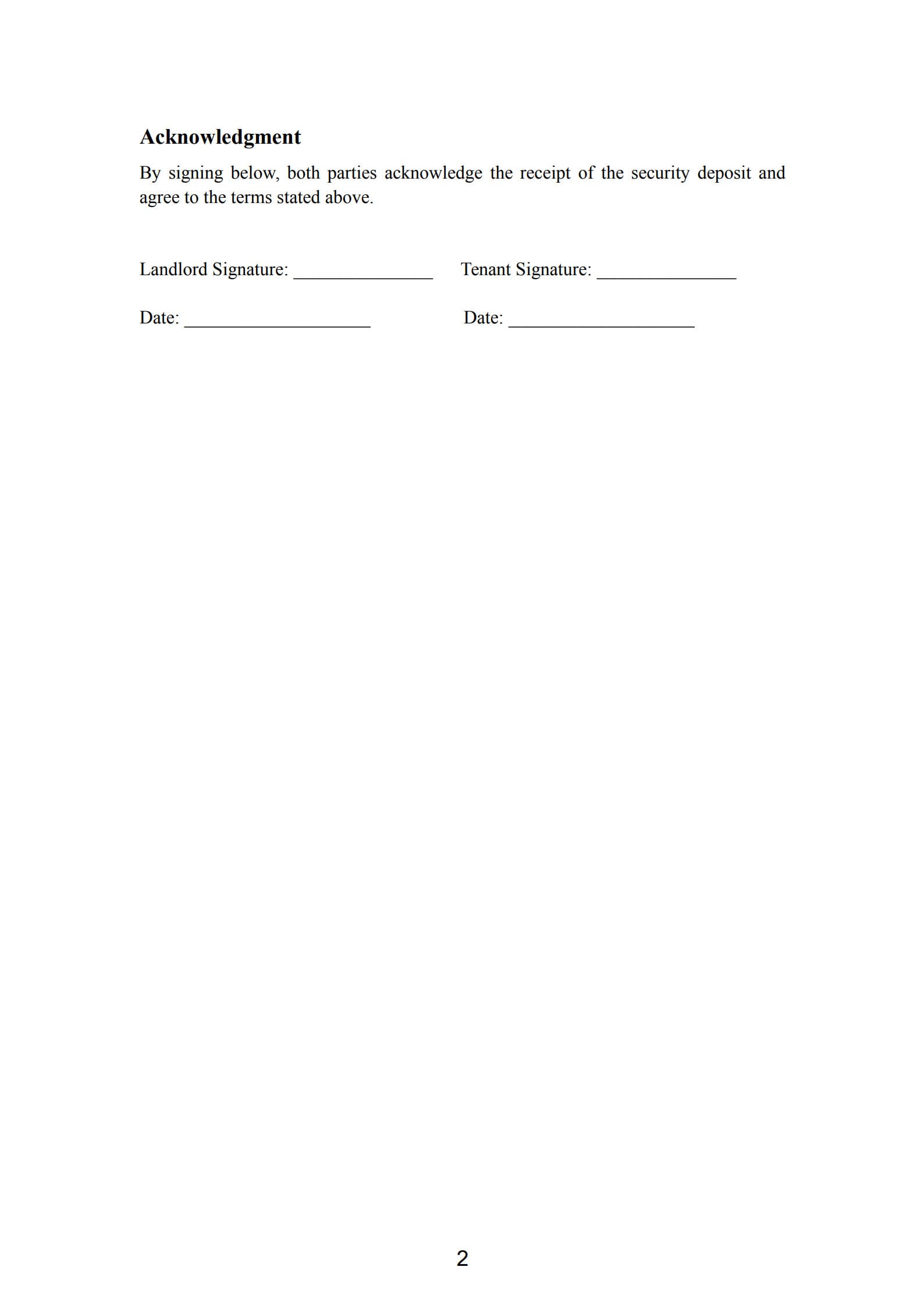

- Signatures: Signatures of both the tenant(s) and the landlord/agent receiving the payment.

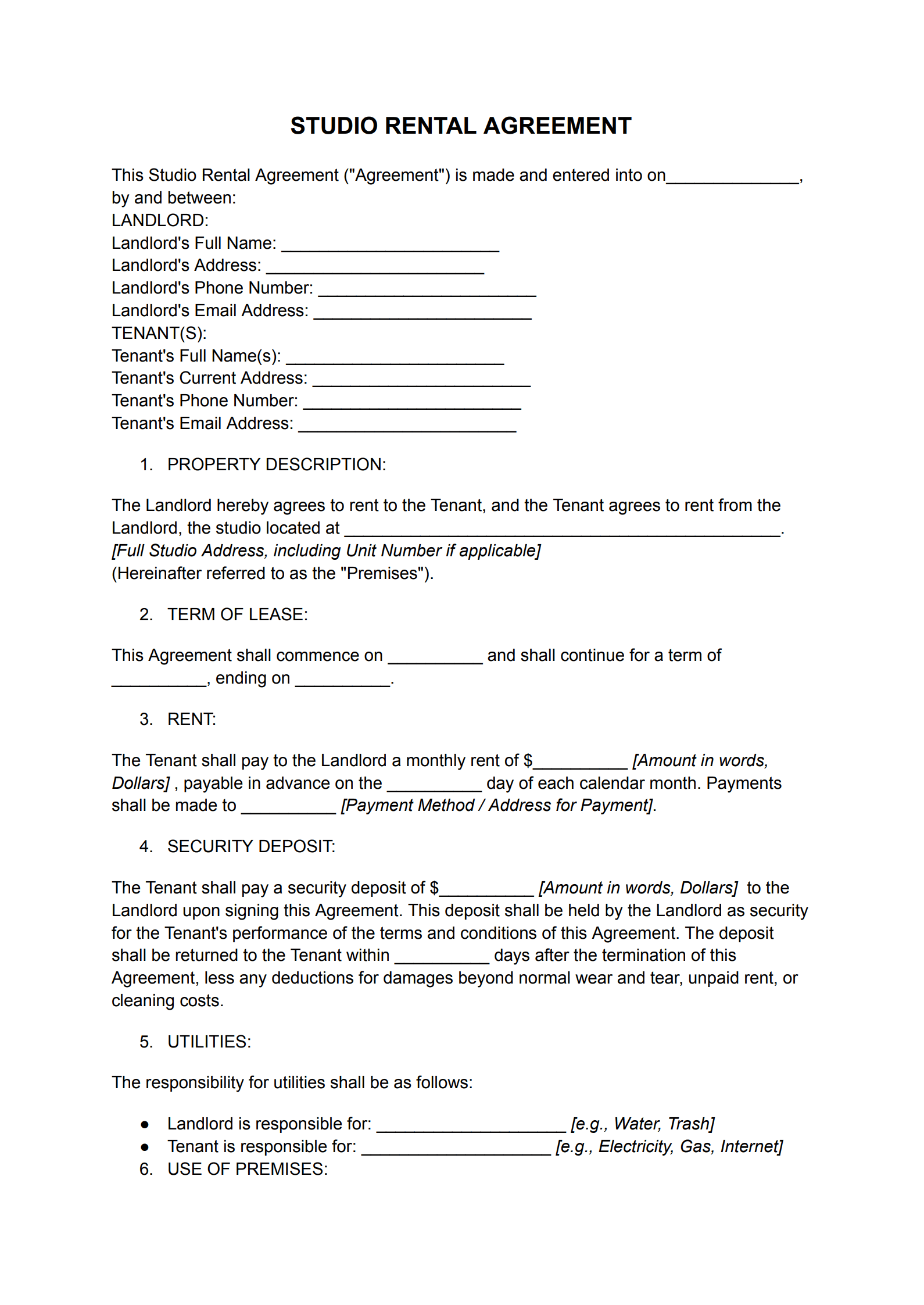

5. Customize with Security Deposit Receipt Template

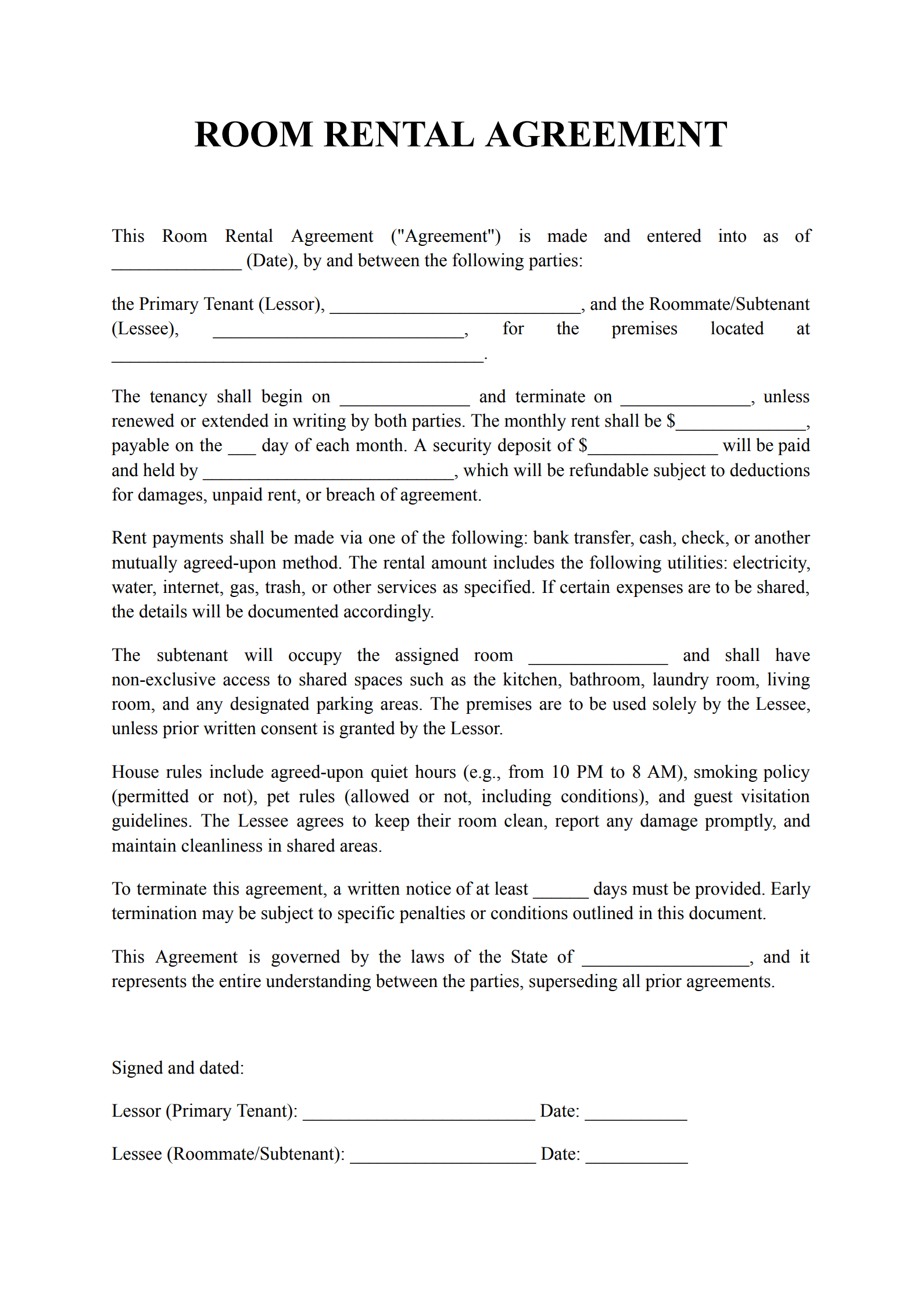

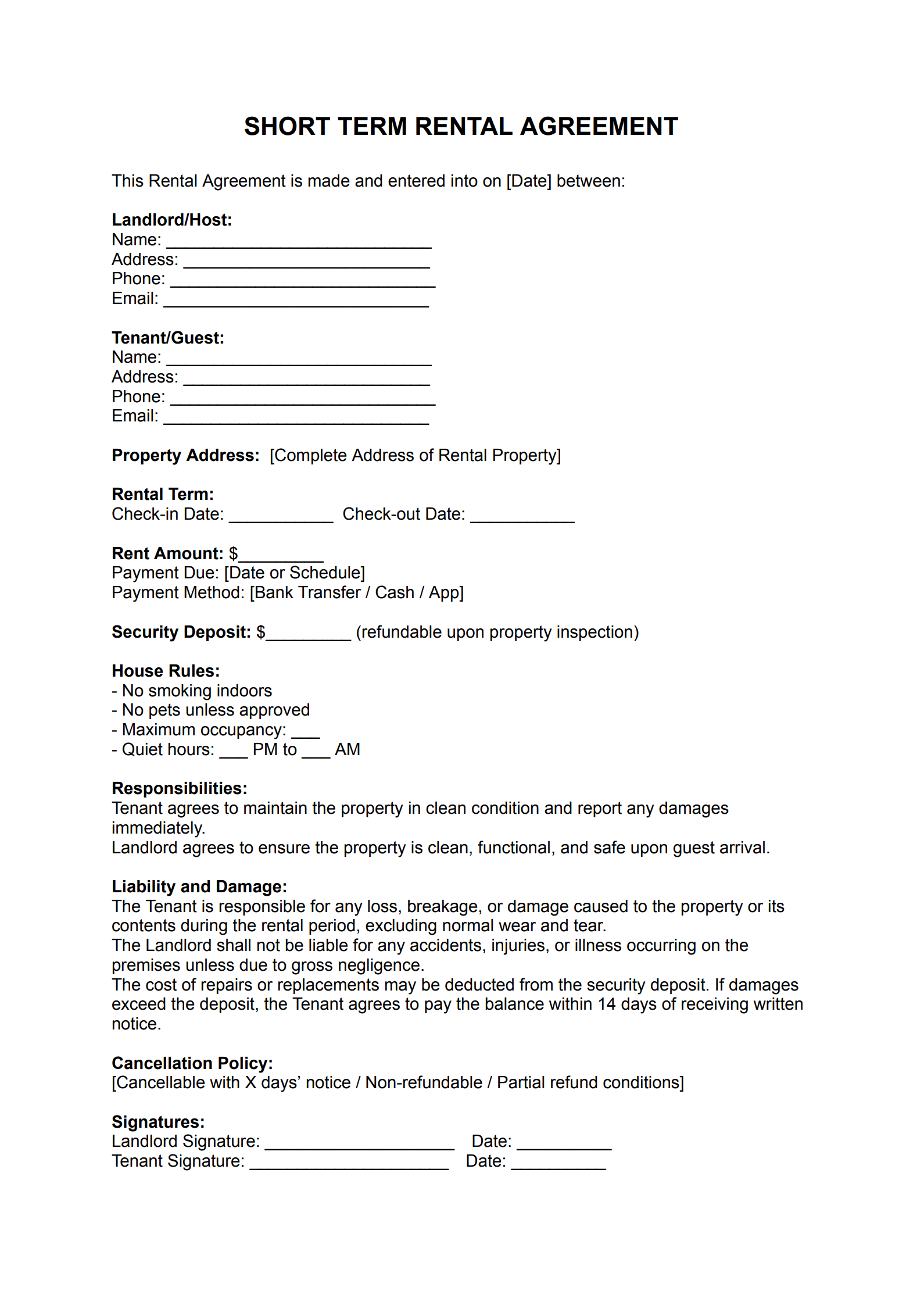

Using a standardized template is the best way for landlords and property managers to ensure all necessary legal and financial details are consistently captured every single time a security deposit is collected.

A customizable template helps:

- Maintain Records: Ensures a uniform, clear record for every tenant file, simplifying accounting and end-of-lease reconciliation.

- Demonstrate Compliance: Provides verifiable proof that the landlord fulfilled their legal obligation to acknowledge receipt of the funds.

- Reduce Disputes: By clearly documenting the amount and payment method, it leaves no room for tenant confusion or later dispute regarding the initial payment.

By using a template, you simply fill in the blank fields, ensuring no critical piece of information is accidentally omitted.

Free Download: Printable Security Deposit Receipt Template

You can download the Security Deposit Receipt Template mentioned above by clicking the “Use Template” button on this page. Customize it to fit your specific needs and preferences.

6. FAQs about Security Deposit Receipt

6.1 Why is it important to provide a security deposit?

The security deposit serves as financial insurance for the landlord. Its primary importance is to cover costs associated with tenant breach of the lease agreement, specifically:

- Repairing damages to the unit beyond normal wear and tear (e.g., large holes in walls, broken fixtures).

- Cleaning costs necessary to return the unit to its condition at the start of the tenancy.

- Unpaid rent, utilities, or other fees contractually owed when the tenant vacates.

6.2 What is proof of payment for the security deposit?

Proof of payment refers to any documentation that confirms the security deposit was transferred from the tenant to the landlord. The most essential proof is the security deposit receipt itself, signed by both parties.

Other valid forms of proof include

- A canceled check with the landlord's endorsement.

- A bank statement showing a direct electronic transfer.

- A money order stub showing the amount paid.

6.3 How long does it take for a security deposit to come back?

The legal timeline for the return of a security deposit varies greatly by state, but is generally stipulated as a period following the tenant vacating the property and surrendering the keys.

- Common Timeframes: Typically range from 14 days (e.g., in Colorado) to 30 days (common in most states) or up to 60 days in some complex commercial scenarios.

- Deductions: If the landlord makes deductions for damages, they must typically provide a detailed, itemized list of charges and the remaining balance of the deposit within the same legal timeframe.

6.4 What is the maximum amount a landlord can request as a security deposit?

The maximum amount is determined by the rental laws of the state and municipality where the property is located.

- Most jurisdictions set the maximum limit at one, two, or three months' rent. For instance, in California, the limit is two months' rent for an unfurnished apartment.

- Some areas may allow a slightly higher amount if the tenant has a pet (often called a "pet deposit") or if the lease term is less than six months.

- Landlords must not exceed this statutory limit.