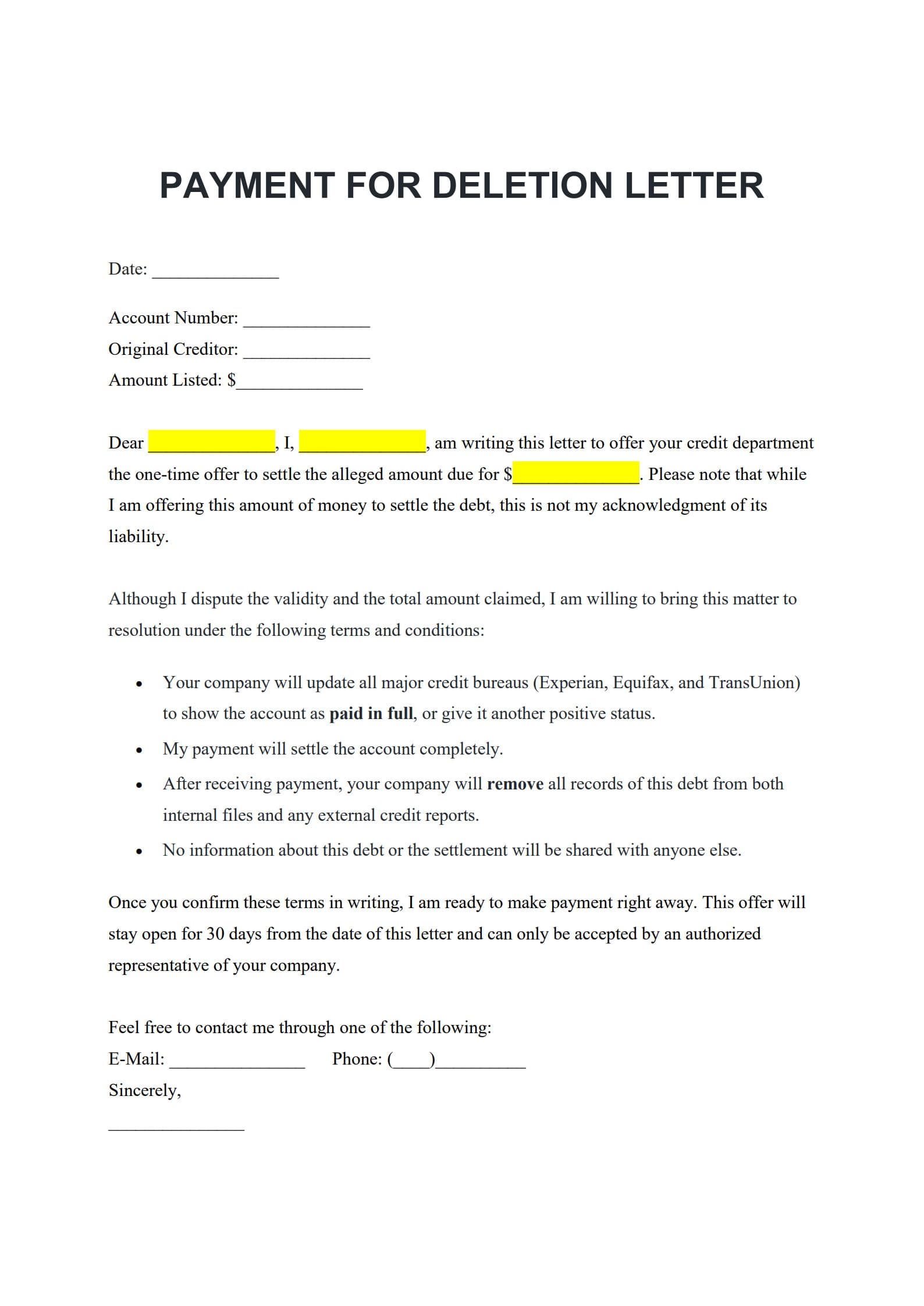

When managing your personal credit, communication with creditors must be handled carefully and professionally. A clear, well‑structured Payment for Deletion Letter gives you a fair chance to negotiate, document terms, and potentially improve your credit record while resolving outstanding debts.

With PDF Agile’s Free, Editable, and Printable Payment for Deletion Letter Template, you can easily draft, customize, and send compliant requests to creditors or collection agencies — ensuring accuracy, transparency, and professionalism every step of the way.

1. What Is a Payment for a Deletion Letter?

A Payment for Deletion Letter (often called “Pay for Delete Letter”) is a written request sent to a creditor or collection agency asking them to remove a negative account or delinquency from your credit report in exchange for full or partial payment of the debt.

This type of correspondence serves as a negotiation tool — giving you a chance to improve your credit history while resolving outstanding balances.

2. When Should You Use a Payment for Deletion Letter?

You should consider sending a pay for delete letter when:

- A collection account or charge-off is significantly lowering your credit score.

- You are able and willing to settle the debt either in full or through a negotiated partial payment.

- The creditor or collector has not yet reported the account as “paid” but remains open to negotiation.

- It’s most effective to send the letter before you make any payments, so you can document the agreement clearly and request written confirmation.

3. Legal Considerations Before Sending a Pay for Delete Letter

While pay for delete agreements are fairly common in credit negotiations, credit reporting agencies (CRAs) such as Experian, Equifax, and TransUnion discourage the practice because it can compromise the accuracy of your credit file.

Some creditors will refuse to remove accurate negative information even if you pay in full.

Before sending your pay to delete letter:

- Review your credit report carefully for errors or duplicate entries.

- Understand that not all creditors are legally required to delete accurate data.

- Request all agreements in writing before making any payment.

- Keep a copy of all correspondence for your records.

Tip: If a creditor declines, you can still ask them to update your status to “Paid as Agreed” or “Settled in Full,” which can still improve your credit profile.

4. Customize with Free Payment for Deletion Letter Template

PDF Agile makes it easy to create, edit, and personalize your Pay for Delete Letter professionally.

Follow these steps to get started:

Step 1 – Download the Free Pay for Deletion Letter Template

Click “Use Template” on the right side of this page and quickly download the Payment for Deletion Letter Template to your device. The file is fully editable in PDF Agile.

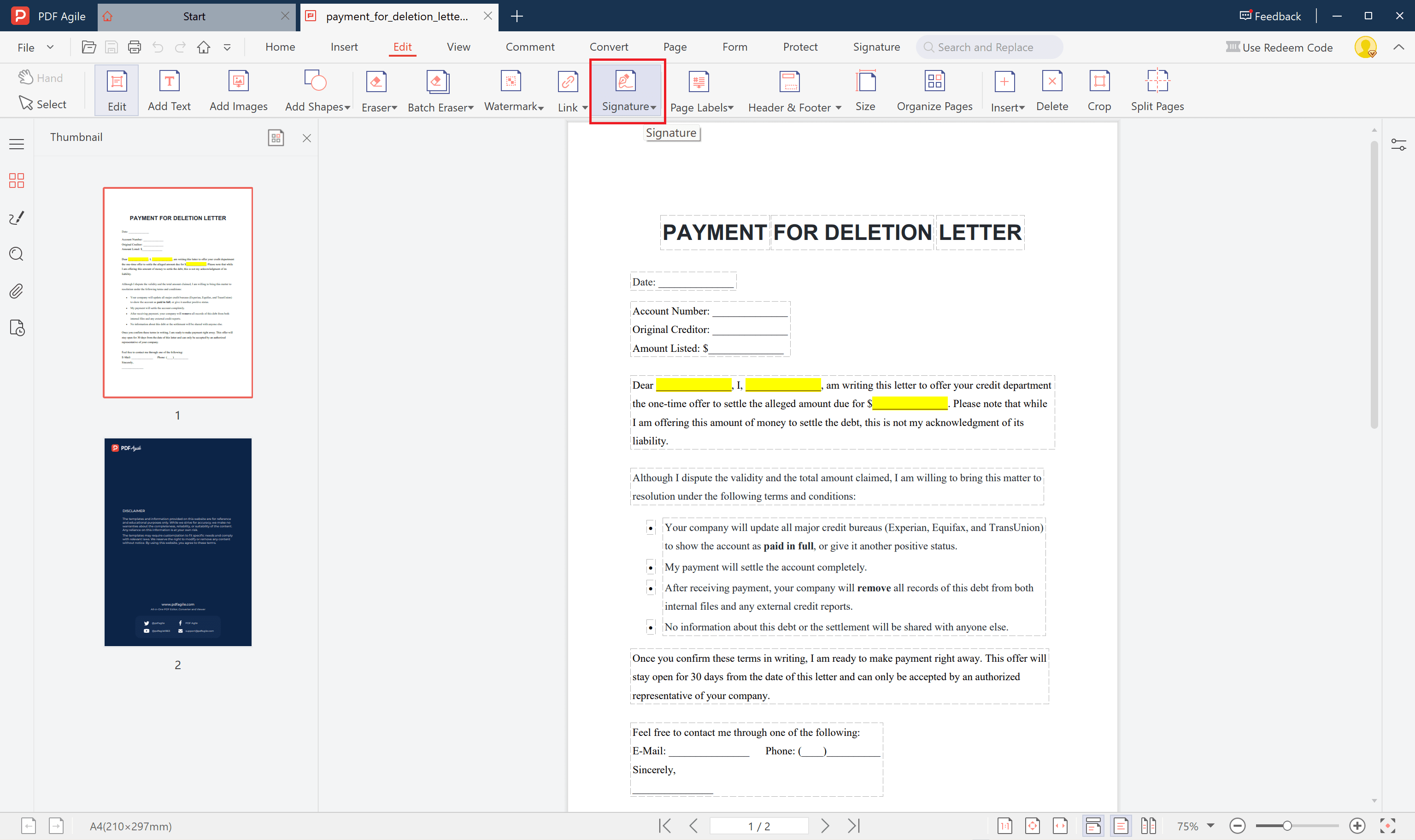

Step 2 – Open in PDF Agile

Launch PDF Agile and open the downloaded template. Edit the letter directly in PDF Agile’s text editing mode:

- Modify wording to match your payment proposal.

- Add or remove clauses depending on your situation.

- Use your digital signature to complete the document securely.

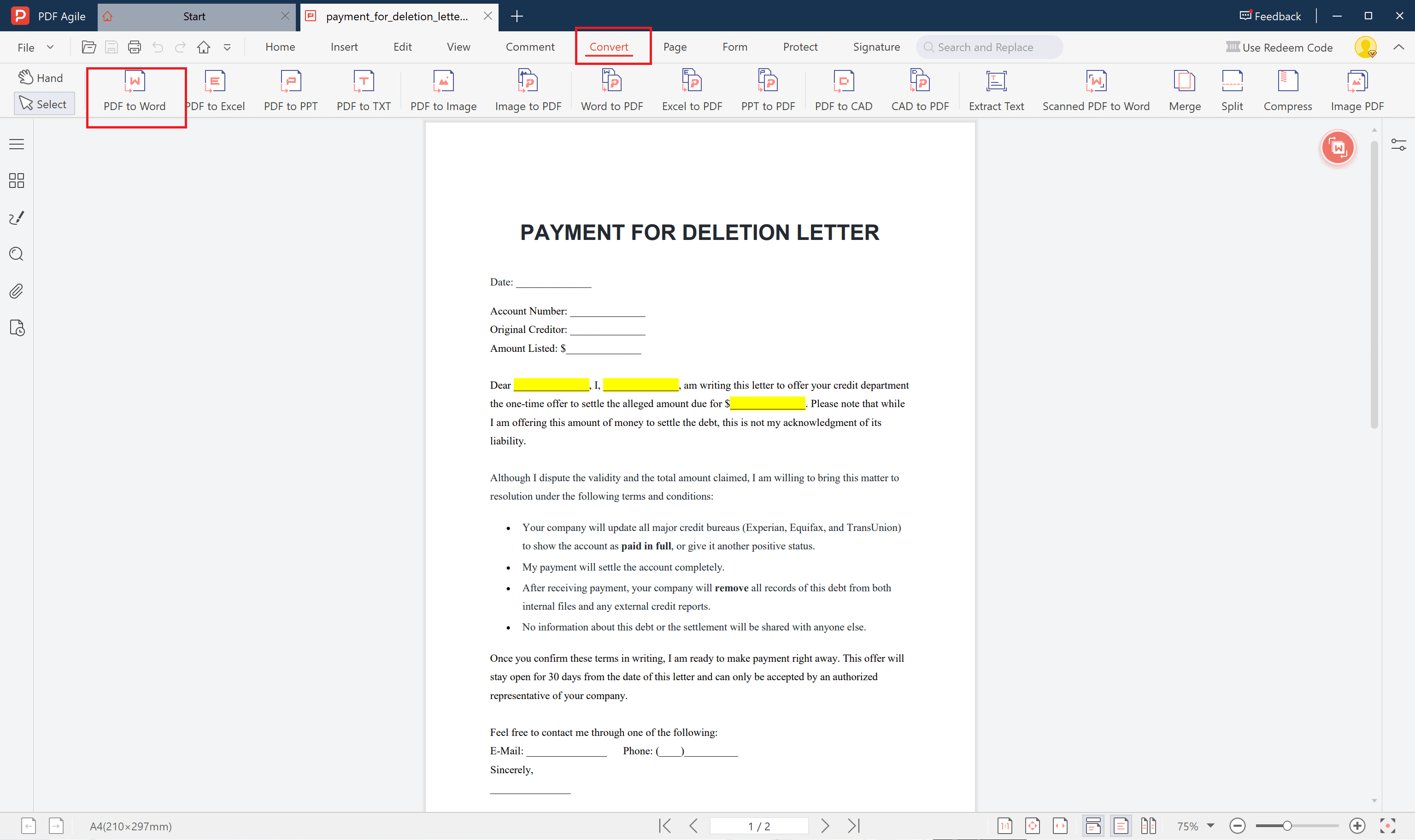

Step 3 – Save or Export

Save the customized file as a PDF or export it to Word if needed for further modifications.

Step 4 – Send and Track

Print and mail your letter by certified post or send it electronically (if accepted).

Retain proof of delivery and monitor your credit report for changes after the creditor’s reply.

With PDF Agile, you can complete this entire process in minutes—no formatting issues, no lost quality.

5. FAQs about Payment for Deletion Letter

5.1 Does paying for delete actually work?

It can work, but it depends on the creditor’s internal policies. Some are willing to delete records after payment; others will only update the status.

5.2 Is pay for delete legal?

It is not illegal to request it, but credit bureaus discourage the practice. Creditors are not obligated to remove accurate entries.

5.3 How long does it take for deleted accounts to disappear?

If approved, deletions usually appear within 30–45 days after the creditor reports the change to the credit bureaus.

Conclusion

A Payment for Deletion Letter empowers consumers to negotiate debt settlement proactively and protect their financial credibility.

Using PDF Agile’s Free, Editable, and Printable Template, you can document your agreement clearly, maintain written proof, and communicate with creditors professionally.

This streamlined process promotes accountability, helps rebuild your credit record, and ensures every negotiation is handled with accuracy and confidence.