Donating to charity is one of the most meaningful ways to give back to the community.However, tracking contributions accurately is crucial—for both donors and charitable organizations. A Goodwill Donation Receipt simplifies the process by documenting essential donor details, item descriptions, and estimated values. With a structured receipt, individuals and organizations can manage records, maintain transparency, and ensure compliance with tax regulations.

1. What Is a Goodwill Donation Receipt?

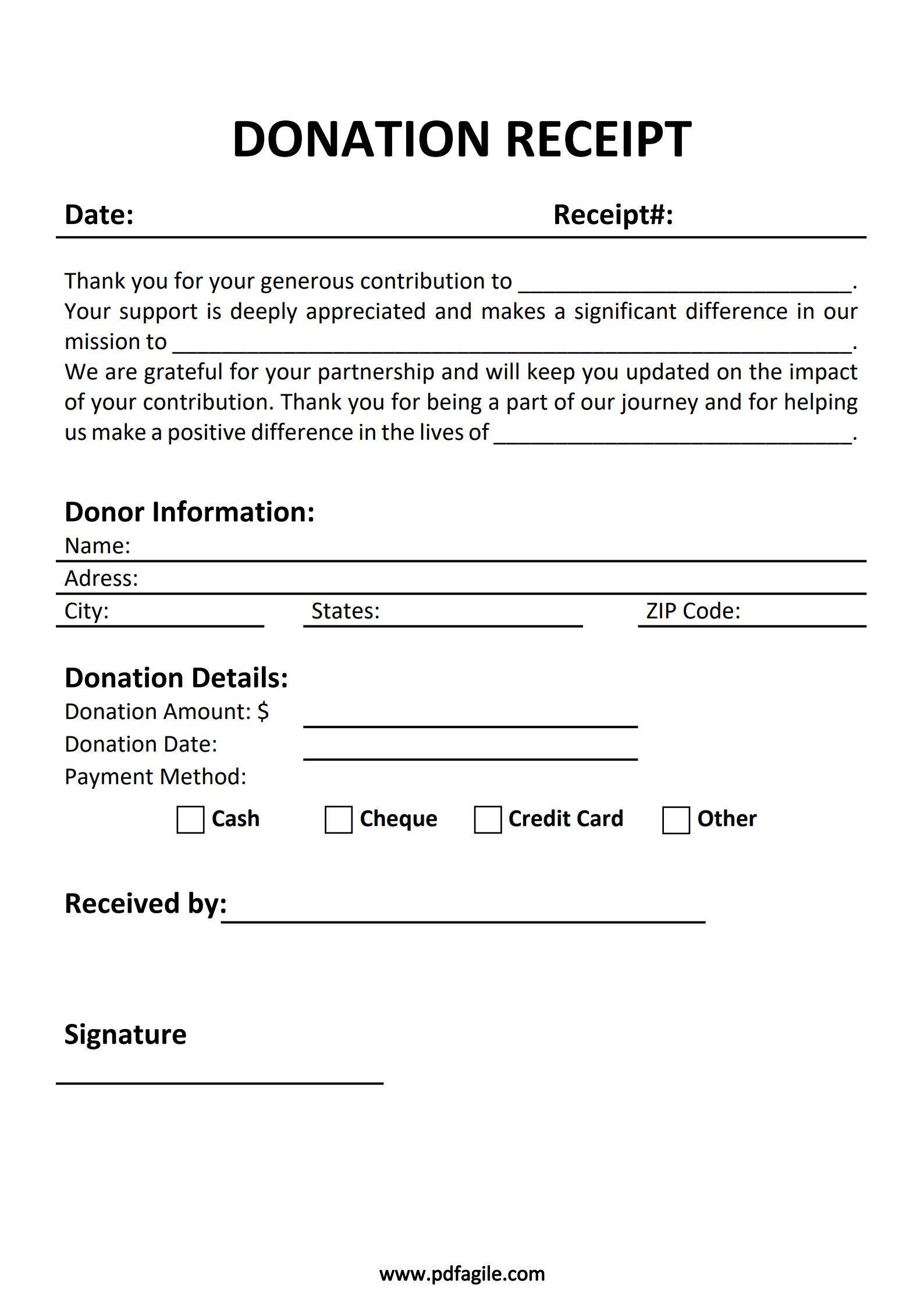

A Goodwill Donation Receipt is an official record issued to acknowledge donated items or monetary contributions to nonprofit organizations such as Goodwill. It typically includes donor information, the date of donation, and details of contributed goods or cash amounts. This receipt serves as proof of donation, which can be useful for tax deduction purposes or for keeping track of charitable activities.

2. How a Goodwill Donation Receipt Helps Streamline Charitable Giving

Using a standardized donation receipt simplifies every step of the giving process:

- Provides official proof of donation for tax or record‑keeping purposes.

- Ensures transparency between donors and charitable institutions.

- Facilitates organization and tracking of multiple contributions.

- Supports charitable compliance through accurate documentation.

- Simplifies reporting for both individuals and nonprofits.

Ultimately, donation receipts create accountability, helping both donors and organizations maintain integrity in the giving process.

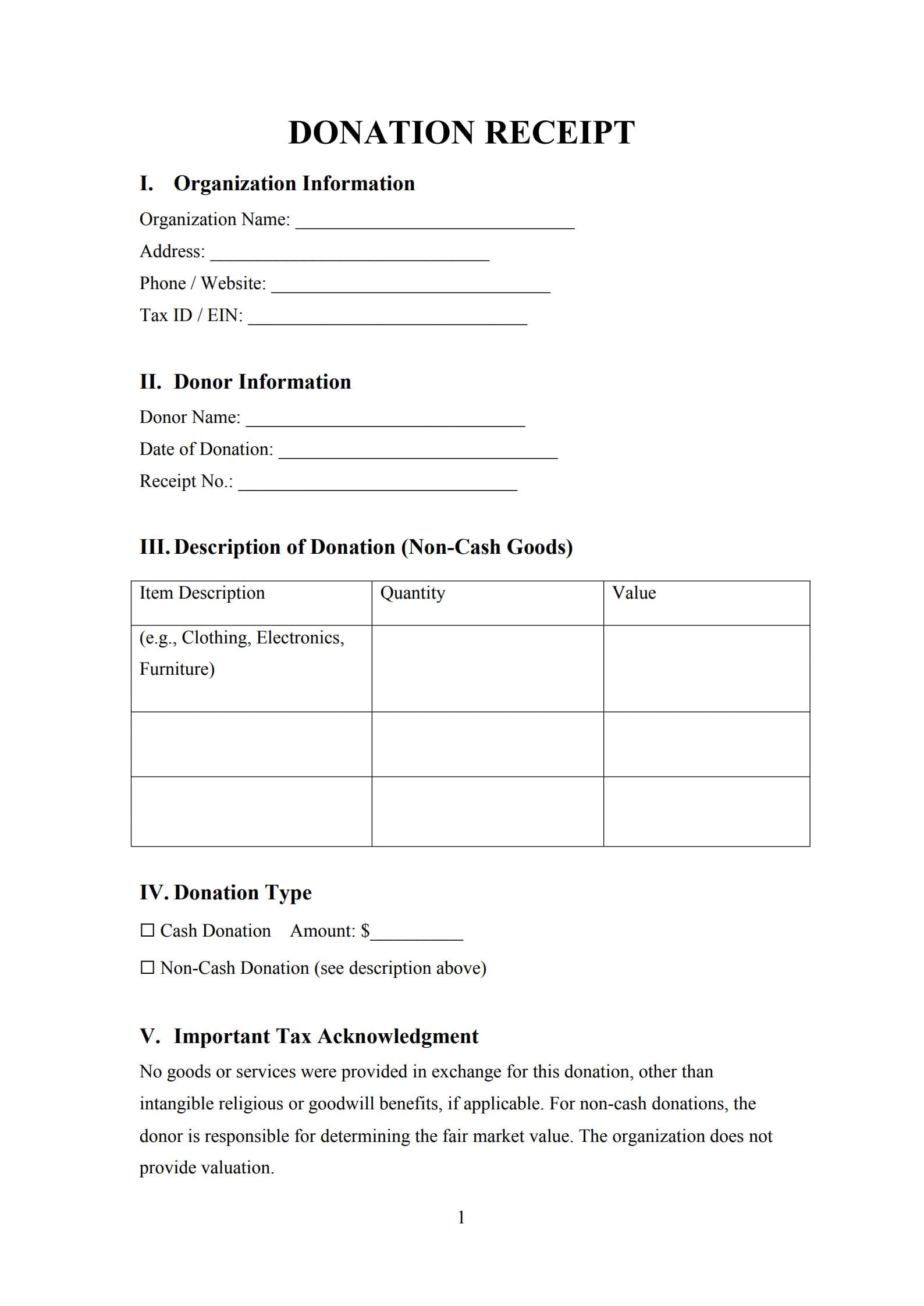

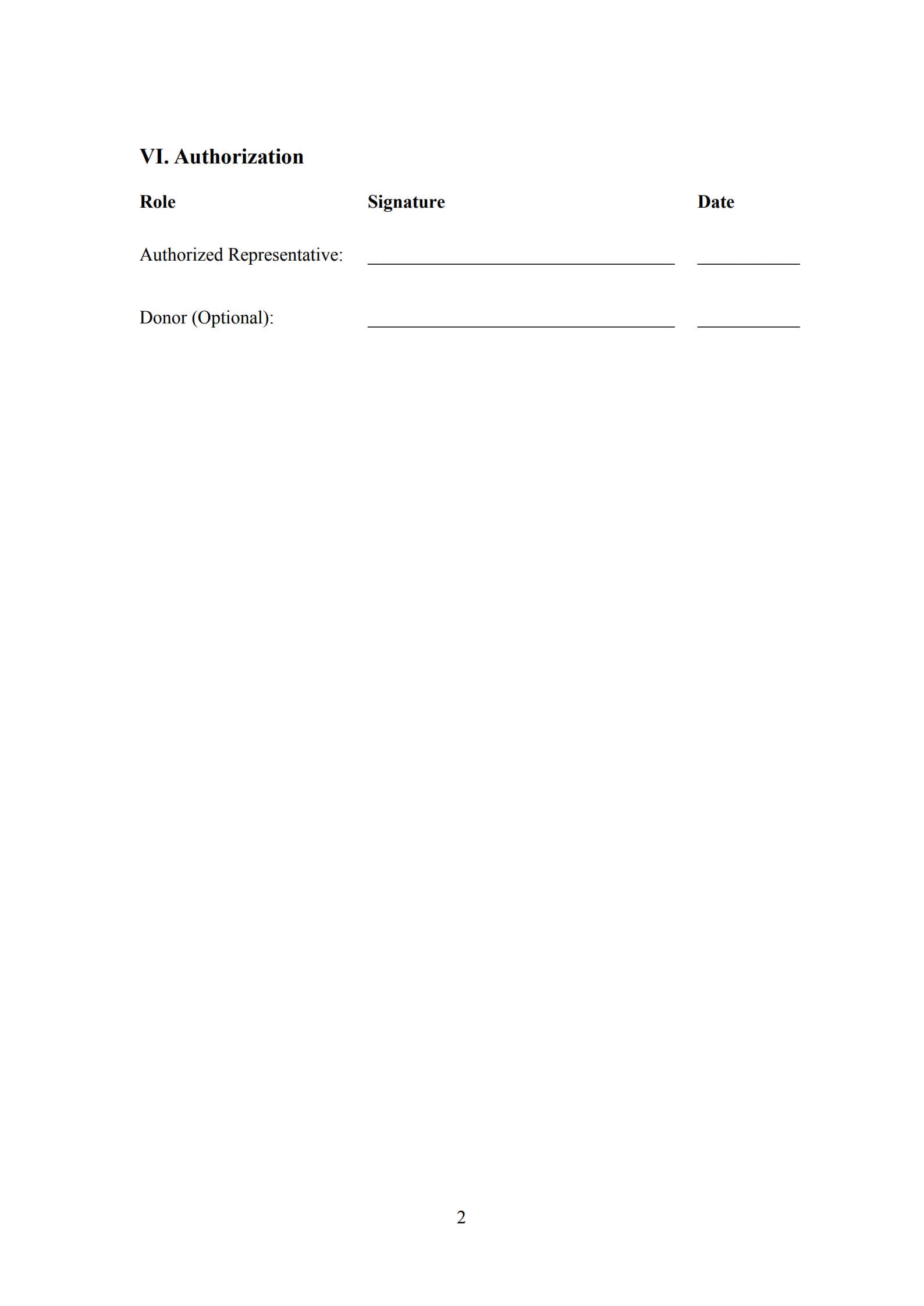

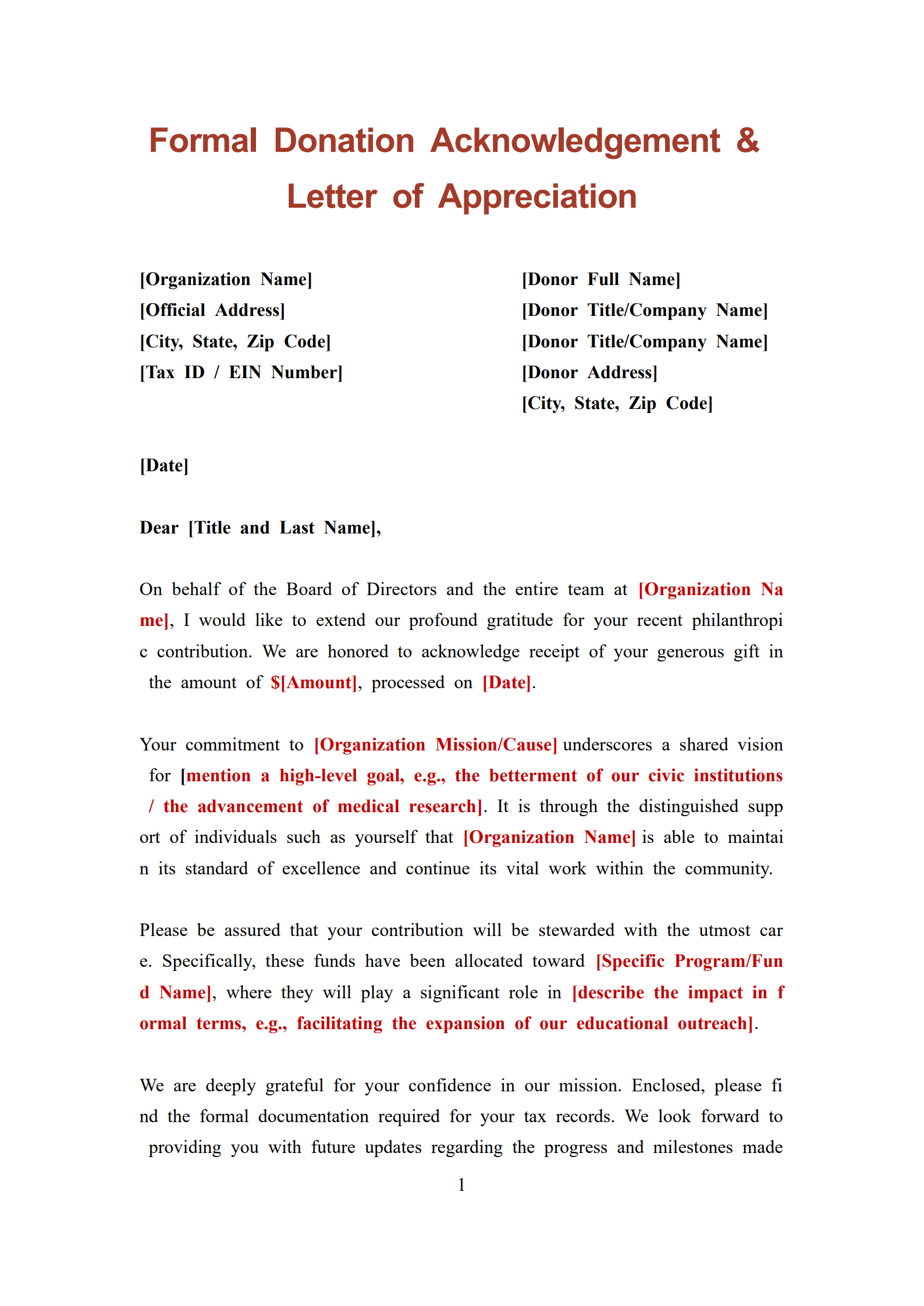

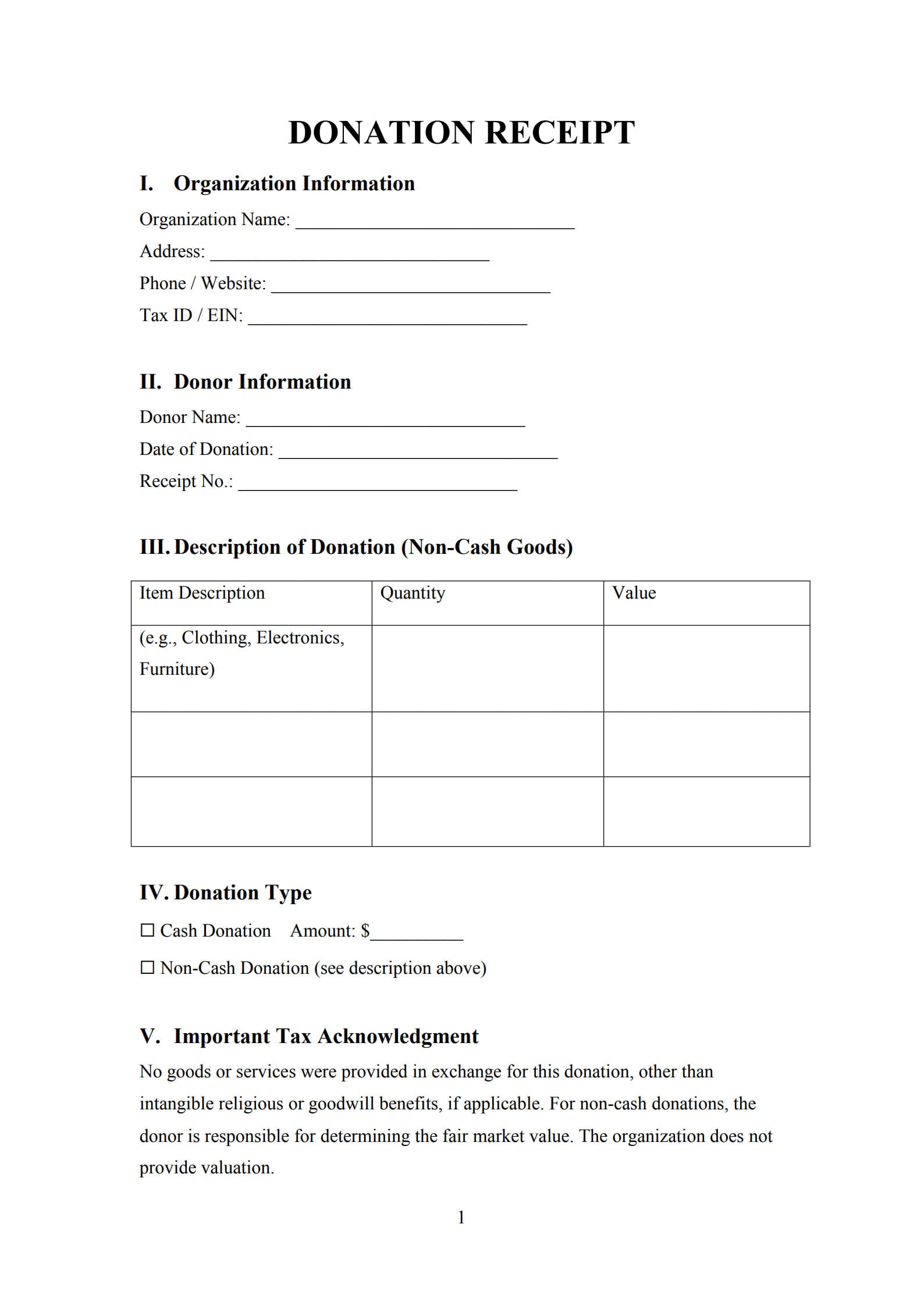

3. Essential Details a Goodwill Donation Receipt Should Include

A comprehensive donation receipt should cover the following key areas:

- Donor Information: Full name, address, and contact details.

- Date and Location of Donation: When and where the donation took place.

- Description of Items Donated: Details such as clothing, electronics, furniture, or monetary contributions.

- Estimated Value of Donations: Approximate fair market value for tax or record purposes.

- Authorized Signatures: From both the donor and the receiving organization.

These components ensure clarity, provide legal credibility, and facilitate accurate record‑keeping.

4. Steps to Customize a Goodwill Donation Receipt to Fits Your Needs

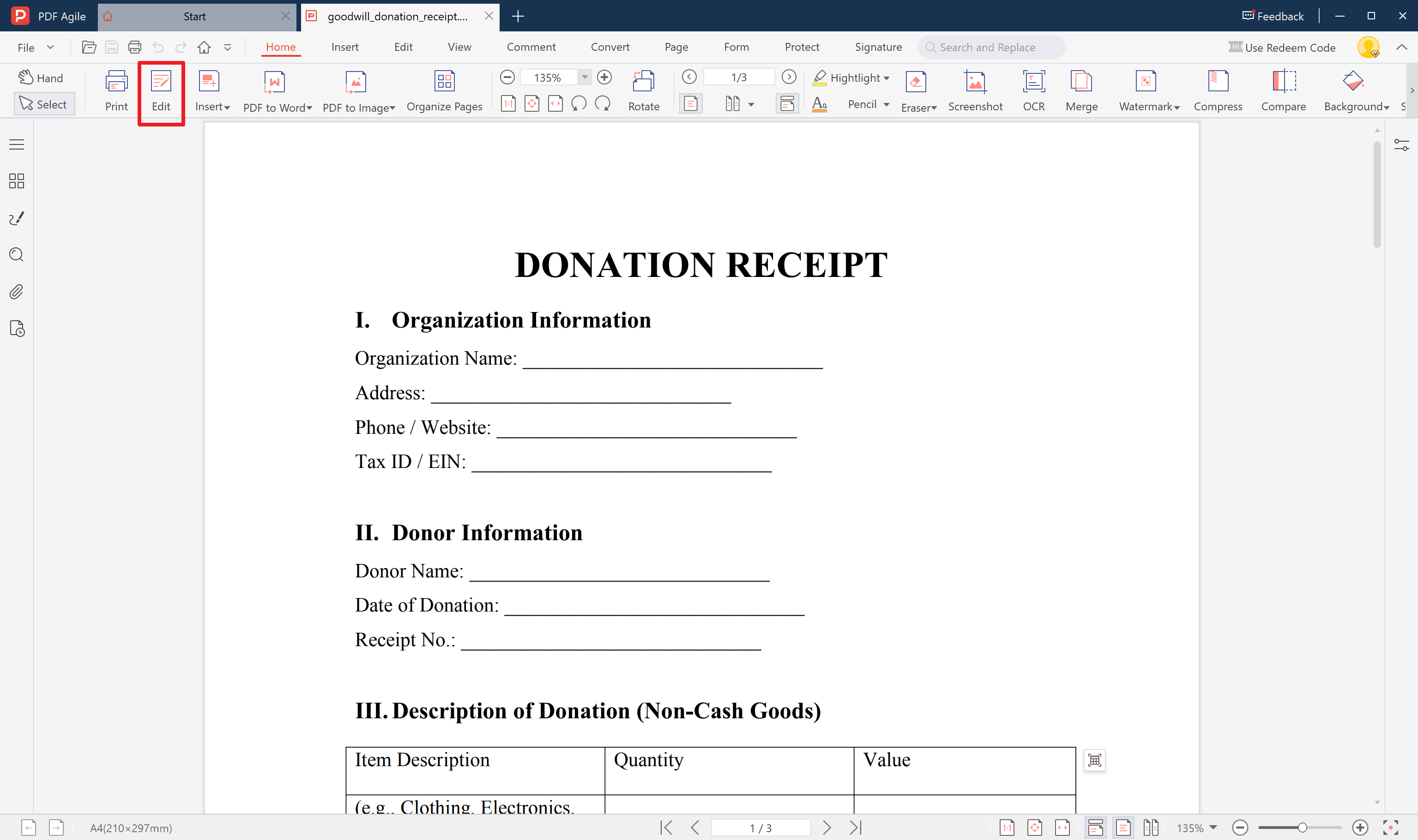

Using a Goodwill Donation Receipt template from PDF Agile, you can tailor the receipt easily to suit your requirements:

- Download the editable donation receipt template from PDF Agile.

- Add your organization’s logo and contact information for professional branding.

- Adjust or remove unnecessary fields based on your donation acknowledgment process.

- Include electronic signature fields for convenient digital issuance.

- Save and distribute the receipt electronically or in print as needed.

A customizable receipt ensures flexibility while maintaining consistency and professionalism in documentation.

5. Tips for Organizing and Tracking Contributions Using a Goodwill Donation Receipt

- Centralize records by storing all issued receipts in a secure digital folder.

- Use consistent file naming conventions for easy retrieval and archiving.

- Categorize donations by type or campaign to simplify reporting.

- Back up digital records regularly to prevent data loss.

- Review entries periodically to verify data accuracy and completeness.

With an organized receipt management system, both donors and nonprofits can ensure transparency and efficiency in handling contributions.

6. FAQs about Goodwill Donation Form

Q1: What exactly is the role of a Goodwill donation receipt?

It serves as an official document acknowledging your contributions, providing proof for recognition and tax purposes.

Q2: Do I need a Goodwill donation receipt to claim tax deductions?

Yes, donation receipts or equivalent acknowledgments are typically required to verify charitable gifts when claiming deductions with tax authorities.

Q3: Are digital Goodwill donation receipts acceptable for official use?

In most cases, digital receipts with valid electronic signatures are acceptable, provided they clearly identify the donor and the charity.

Q4: How long should donation records be retained after receiving the receipt?

It’s recommended to keep donation receipts for at least three to seven years, depending on your country’s tax regulations.

Free Download: Printable Goodwill Donation Receipt

You can download the Goodwill Donation Receipt mentioned above by clicking Use Template button on this page. Customize it to fit your specific needs and preferences.

Conclusion

A Goodwill Donation Receipt brings structure, clarity, and accountability to the charitable giving process. Whether you’re a donor seeking accurate acknowledgment or a nonprofit managing numerous contributions, a customizable receipt ensures that documentation remains easy, accurate, and compliant. With PDF Agile, you can create, edit, and organize donation receipts efficiently—streamlining your generosity while maintaining complete records.