A donation agreement becomes particularly valuable when individuals, organizations, or institutions give or receive gifts—whether monetary, real estate, physical items, or services—with specific terms attached. This often occurs in charitable fundraising, estate planning, grant writing, nonprofit operations, or even business sponsorships. For example, if a company donates $100,000 to a nonprofit with the understanding it will fund scholarships, both parties need legal clarity to avoid future misunderstandings.

Whenever a donation involves conditions, expectations, or future actions, a written agreement is crucial. Verbal promises can be easily forgotten or misinterpreted—especially when tax deductions, public acknowledgments, or recurring donations are involved.

What Is a Donation Agreement?

A donation agreement—also referred to as a donation contract or gift agreement—is a formal, legally binding document that outlines the terms and conditions under which a donor voluntarily gives money, property, or services to a recipient. Typically used by individuals, corporations, foundations, and nonprofit organizations, these agreements provide critical clarity in philanthropic transactions by setting mutual expectations from the outset.

At its core, a donation agreement defines the nature of the gift—whether it is unconditional (a gift given freely with no obligations for how it's used) or conditional (subject to specific terms, such as funding a scholarship, naming a building, or supporting a particular program). Conditional donations may include contingencies, performance benchmarks, or revocation clauses in case the terms are not met.

A comprehensive donation agreement will typically contain the following key components:

- Identification of the parties: Full legal names and contact information of both the donor and the recipient (which could be a nonprofit, educational institution, or other entity).

- Detailed description of the donation: Whether it's a sum of money, real estate, artwork, services, or other tangible or intangible assets, the document specifies exactly what is being donated.

- Delivery and transfer terms: The method, timeline, and responsibilities involved in transferring the gift—such as bank deposit instructions, delivery of property, or installment schedules.

- Usage stipulations: If the gift is restricted, the agreement will outline precisely how the recipient is allowed—or required—to use it. For example, a donation may be earmarked exclusively for research funding or building renovations.

- Acknowledgment and recognition: Optional clauses that detail how the donor will be recognized publicly, such as naming rights or inclusion in donor lists—unless anonymity is preferred.

- Legal disclaimers and liabilities: Provisions that protect both parties in the event of misuse, breach of agreement, or unforeseen circumstances, including the possibility of refunding or reallocating funds.

- Tax implications: Language confirming that the recipient is a tax-exempt entity under applicable laws (such as Section 501(c)(3) in the U.S.), and noting that the donor is responsible for obtaining independent tax advice regarding deductibility.

- Recordkeeping and reporting: For ongoing or conditional gifts, reporting requirements (such as annual updates or financial disclosures) may be required to satisfy donor expectations or grant compliance.

- Signatures and execution: Formal acknowledgment by both parties, often with a date, title, and signature block, which solidifies the document as enforceable.

Such agreements protect both sides, ensuring transparency, compliance with tax laws, and alignment of expectations—particularly when the donation is substantial or ongoing.

Donation Agreement Template Samples

Now that you understand the essential components of a donation agreement, we offer three types of donation agreements for you to customize according to your needs. Choose the format that best suits your requirements!

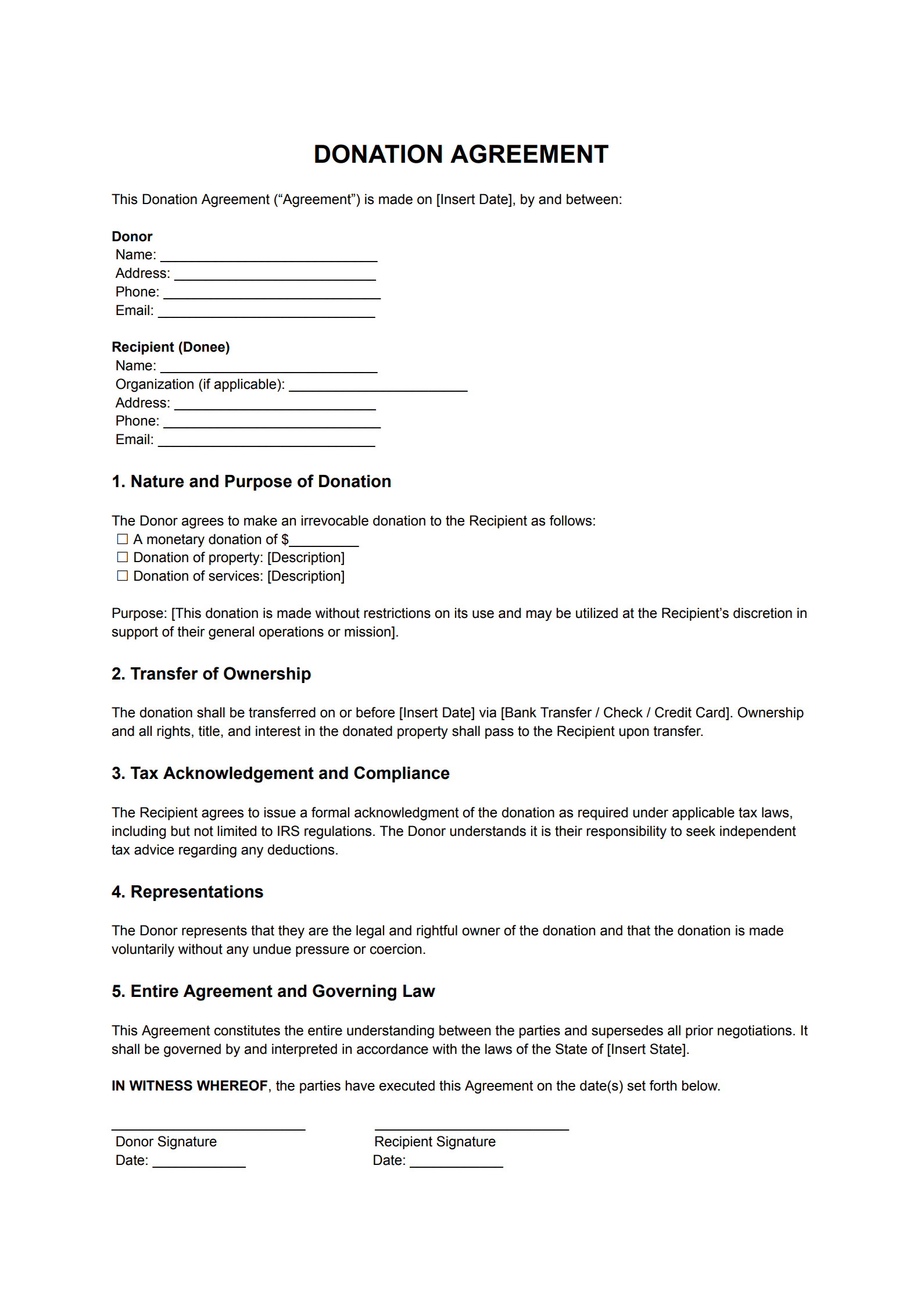

1. General Unrestricted Donation Agreement Template

This agreement is used when a donor contributes money, property, or services without placing any limitations on how the recipient may use the gift. It’s ideal for general fundraising, operational support, or when the donor fully trusts the recipient organization to allocate the donation as needed. The simplicity of this agreement makes it suitable for one-time contributions and situations where flexibility is important.

Here’s a practical example to help illustrate the concepts more clearly.

Specific example:

Blank format:

DONATION AGREEMENT

This Donation Agreement (“Agreement”) is made on [Insert Date], by and between:

Donor

Name: ____________________________

Address: __________________________

Phone: ____________________________

Email: ____________________________

Recipient (Donee)

Name: ____________________________

Organization (if applicable): _______________________

Address: __________________________

Phone: ____________________________

Email: ____________________________

1. Nature and Purpose of Donation

The Donor agrees to make an irrevocable donation to the Recipient as follows:

☐ A monetary donation of $_________

☐ Donation of property: [Description]

☐ Donation of services: [Description]

Purpose: [This donation is made without restrictions on its use and may be utilized at the Recipient’s discretion in support of their general operations or mission].

2. Transfer of Ownership

The donation shall be transferred on or before [Insert Date] via [Bank Transfer / Check / Credit Card]. Ownership and all rights, title, and interest in the donated property shall pass to the Recipient upon transfer.

3. Tax Acknowledgement and Compliance

The Recipient agrees to issue a formal acknowledgment of the donation as required under applicable tax laws, including but not limited to IRS regulations. The Donor understands it is their responsibility to seek independent tax advice regarding any deductions.

4. Representations

The Donor represents that they are the legal and rightful owner of the donation and that the donation is made voluntarily without any undue pressure or coercion.

5. Entire Agreement and Governing Law

This Agreement constitutes the entire understanding between the parties and supersedes all prior negotiations. It shall be governed by and interpreted in accordance with the laws of the State of [Insert State].

IN WITNESS WHEREOF, the parties have executed this Agreement on the date(s) set forth below.

_________________________ _________________________

Donor Signature Recipient Signature

Date: ____________ Date: ____________

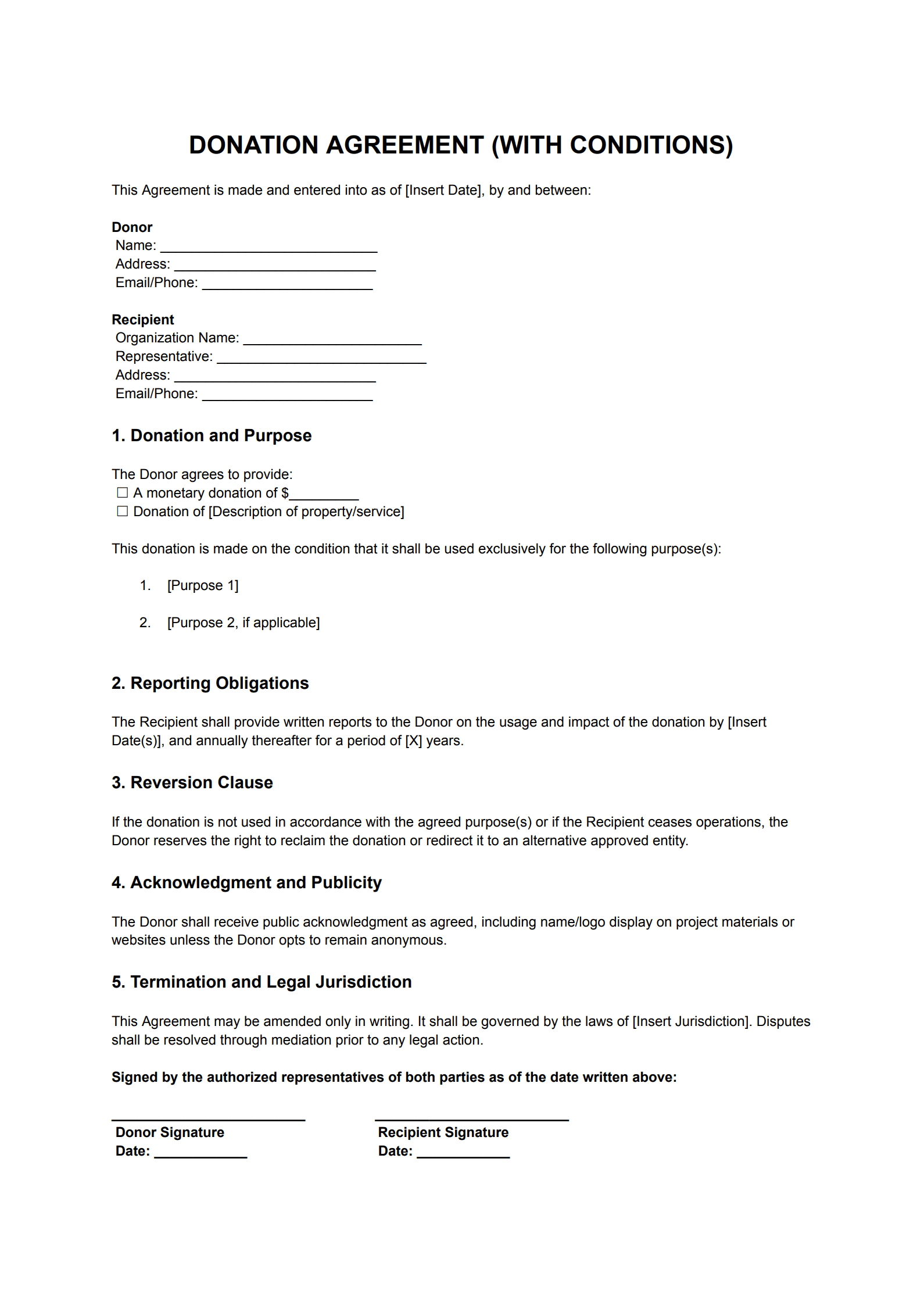

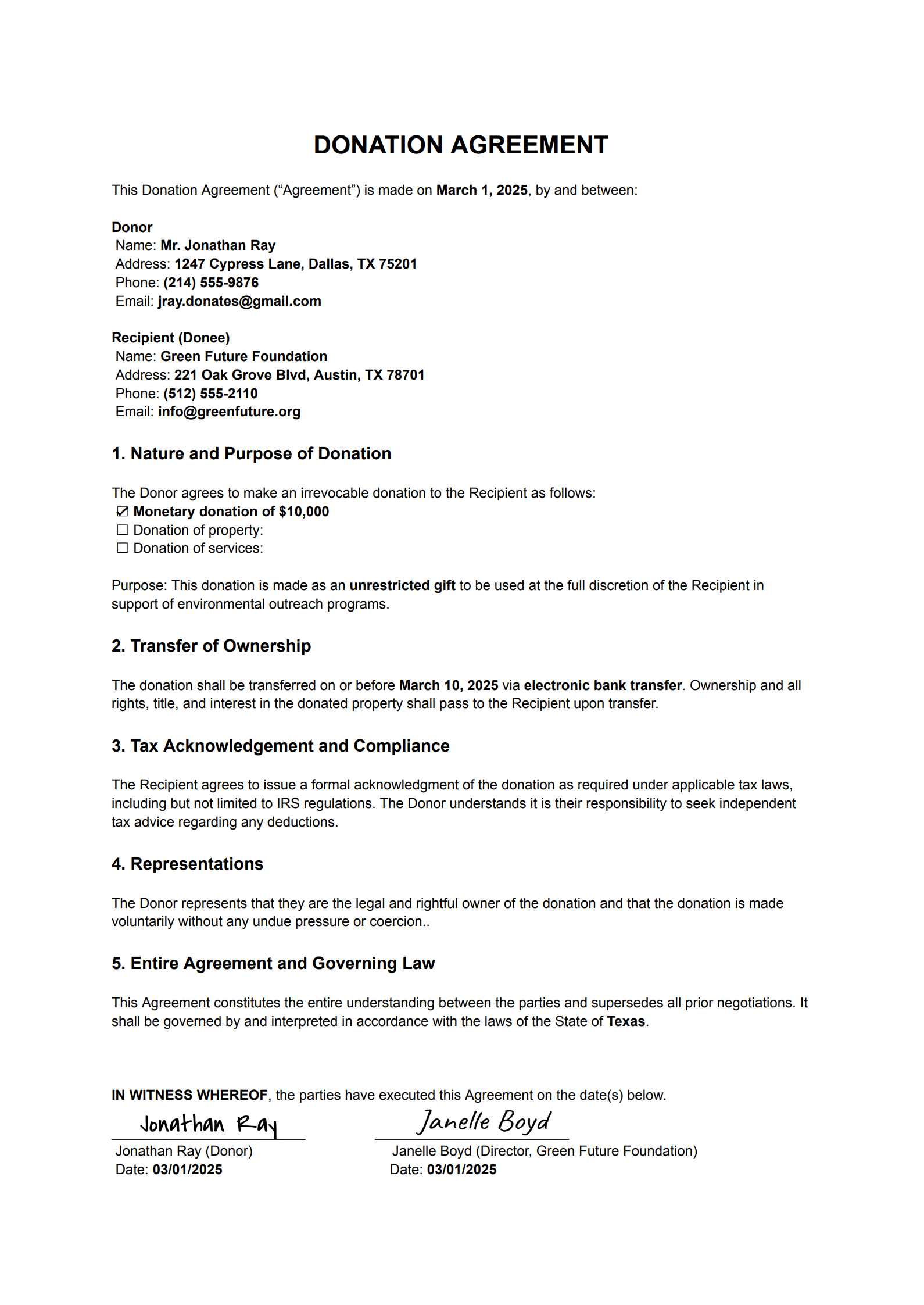

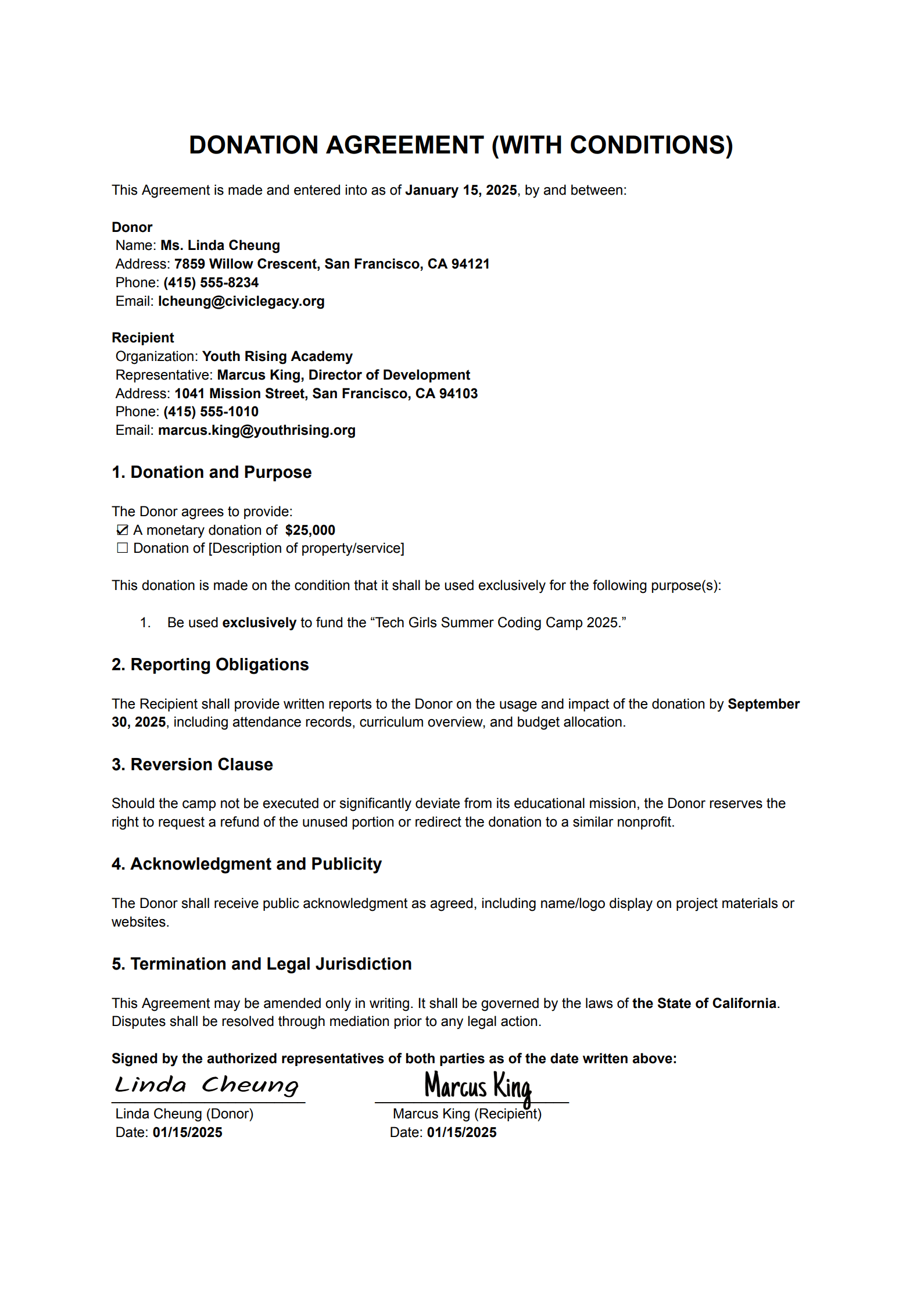

2. Conditional Donation Contract Sample

A conditional donation agreement outlines specific terms and requirements that must be met by the recipient in order to retain and use the donation. These conditions could include using the funds for a particular project, meeting reporting obligations, or achieving certain outcomes. This type of contract provides the donor with more control and accountability, ensuring that their contribution is used exactly as intended.

We’ve also included a real-world example to make things easier to understand!

Specific example:

Blank format:

DONATION AGREEMENT (WITH CONDITIONS)

This Agreement is made and entered into as of [Insert Date], by and between:

Donor

Name: ____________________________

Address: __________________________

Email/Phone: ______________________

Recipient

Organization Name: _______________________

Representative: ___________________________

Address: __________________________

Email/Phone: ______________________

1. Donation and Purpose

The Donor agrees to provide:

☐ A monetary donation of $_________

☐ Donation of [Description of property/service]

This donation is made on the condition that it shall be used exclusively for the following purpose(s):

[Purpose 1]

[Purpose 2, if applicable]

2. Reporting Obligations

The Recipient shall provide written reports to the Donor on the usage and impact of the donation by [Insert Date(s)], and annually thereafter for a period of [X] years.

3. Reversion Clause

If the donation is not used in accordance with the agreed purpose(s) or if the Recipient ceases operations, the Donor reserves the right to reclaim the donation or redirect it to an alternative approved entity.

4. Acknowledgment and Publicity

The Donor shall receive public acknowledgment as agreed, including name/logo display on project materials or websites unless the Donor opts to remain anonymous.

5. Termination and Legal Jurisdiction

This Agreement may be amended only in writing. It shall be governed by the laws of [Insert Jurisdiction]. Disputes shall be resolved through mediation prior to any legal action.

Signed by the authorized representatives of both parties as of the date written above:

_________________________ _________________________

Donor Signature Recipient Signature

Date: ____________ Date: ____________

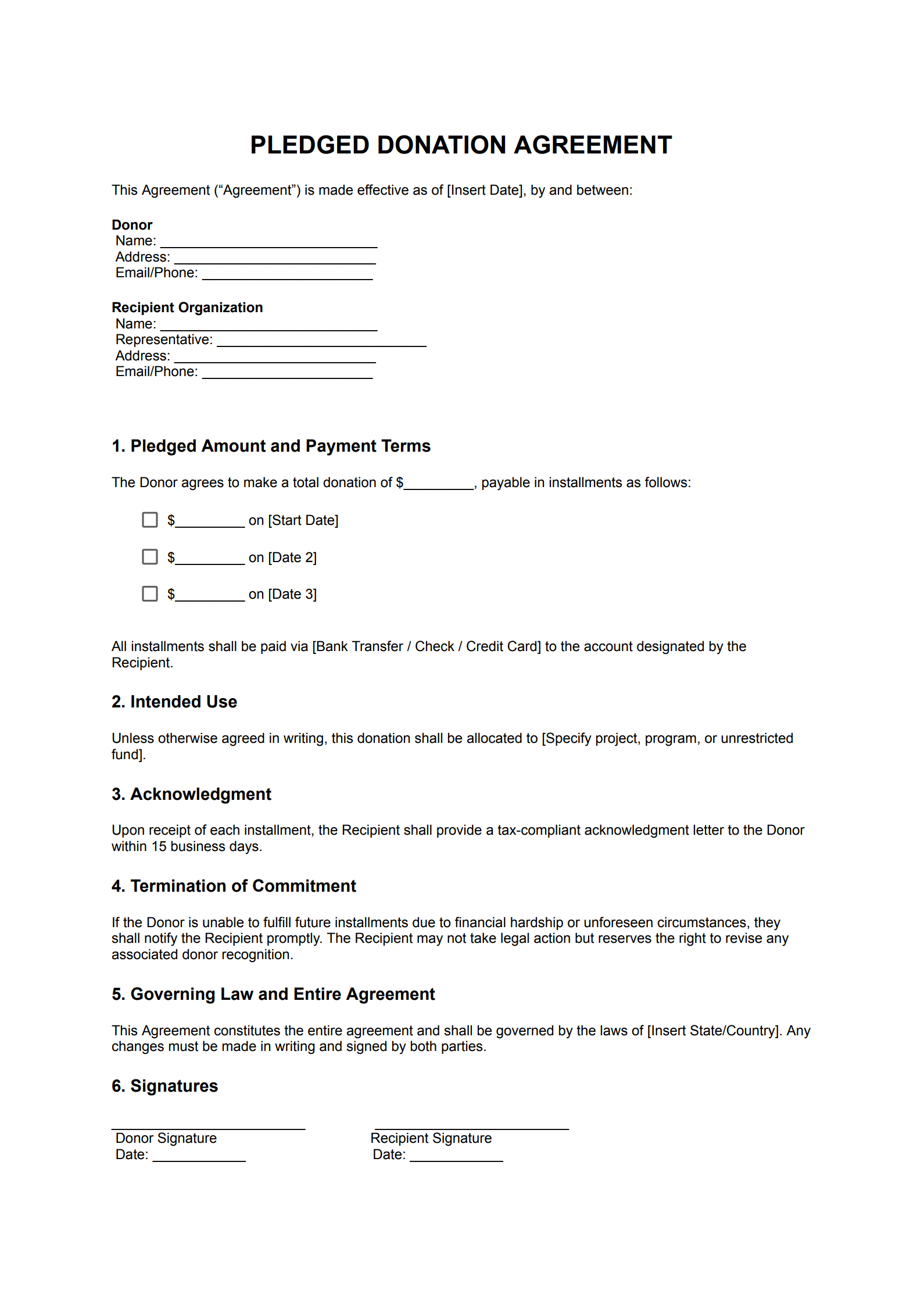

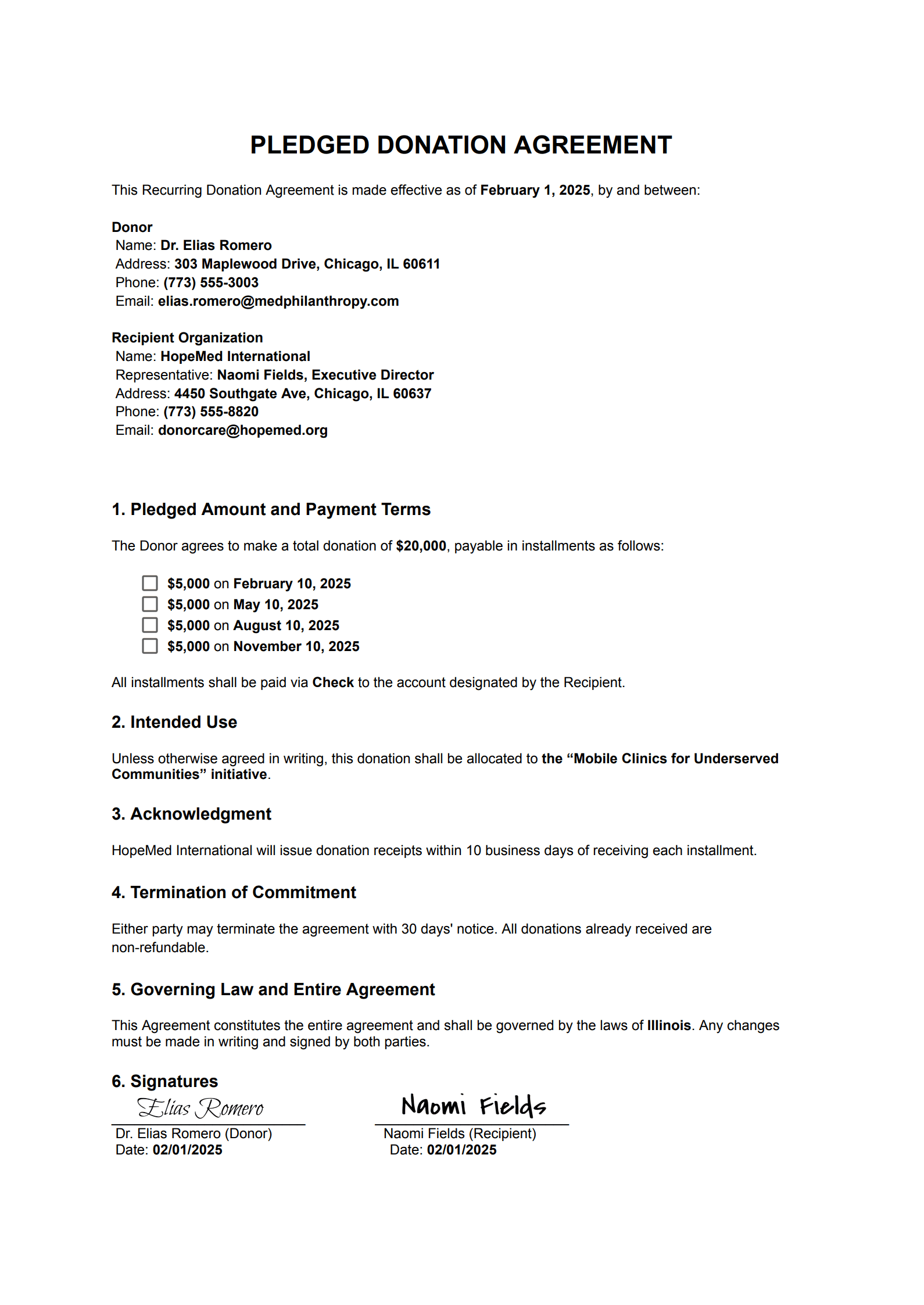

3. Recurring Donation Agreement Template

This agreement is designed for donors who wish to provide ongoing support over a set period—often in monthly, quarterly, or annual installments. It details the total pledged amount, payment schedule, and how the funds should be used. Recurring donation agreements are especially useful for long-term partnerships or campaign-based giving, and they help both parties plan more effectively for future contributions.

Also here is a practical example offered to you for better understanding!

Specific example:

Blank format:

PLEDGED DONATION AGREEMENT

This Agreement (“Agreement”) is made effective as of [Insert Date], by and between:

Donor

Name: ____________________________

Address: __________________________

Email/Phone: ______________________

Recipient Organization

Name: ____________________________

Representative: ___________________________

Address: __________________________

Email/Phone: ______________________

1. Pledged Amount and Payment Terms

The Donor agrees to make a total donation of $_________, payable in installments as follows:

$_________ on [Start Date]

$_________ on [Date 2]

$_________ on [Date 3]

All installments shall be paid via [Bank Transfer / Check / Credit Card] to the account designated by the Recipient.

2. Intended Use

Unless otherwise agreed in writing, this donation shall be allocated to [Specify project, program, or unrestricted fund].

3. Acknowledgment

Upon receipt of each installment, the Recipient shall provide a tax-compliant acknowledgment letter to the Donor within 15 business days.

4. Termination of Commitment

If the Donor is unable to fulfill future installments due to financial hardship or unforeseen circumstances, they shall notify the Recipient promptly. The Recipient may not take legal action but reserves the right to revise any associated donor recognition.

5. Governing Law and Entire Agreement

This Agreement constitutes the entire agreement and shall be governed by the laws of [Insert State/Country]. Any changes must be made in writing and signed by both parties.

6. Signatures

_________________________ _________________________

Donor Signature Recipient Signature

Date: ____________ Date: ____________

How to Use the Donation Agreement Template with PDF Agile

By now, you should be well-equipped to create your own donation agreement. So, what comes next? It’s time to put your knowledge into action—using the right tool. That’s where PDF Agile comes in. This powerful PDF editor makes it easy to turn static templates into fully editable, customized, and professional-grade documents in just a few steps.

Step 1: Download or Copy the Template Start by copying the preferred template above or downloading a blank version from your organization’s database.

Step 2: Open PDF Agile Launch PDF Agile and select “Open PDF” to upload your blank agreement, or choose “Create New PDF” if starting from scratch.

Step 3: Use the Editing Tool Activate the Text tool to fill in donor and recipient details, dates, donation amounts, and conditions. You can also drag and drop form fields (like checkboxes and signatures) for easier input.

Step 4: Add Digital Signatures Insert secure digital signatures for both parties using PDF Agile’s Sign tool, and include timestamps for legal documentation.

Step 5: Save and Share Save your customized donation agreement as a secure, non-editable PDF or export it as a Word file. Share via email or cloud storage directly from the app.

PDF Agile not only streamlines document preparation but also ensures compliance, reduces printing needs, and adds a professional polish!

Why Use a Donation Agreement Template?

Using a donation agreement template isn’t just about paperwork—it’s about protecting relationships and intentions. When money, valuable goods, or services change hands, especially with long-term expectations or conditions, assumptions can quickly lead to confusion or even legal conflict. A formal agreement brings clarity to both the donor and recipient by setting mutual expectations, solidifying compliance with local and federal tax laws, and ensuring that gifts are used as intended.

Moreover, for organizations relying on donor funding—like nonprofits or schools—these contracts strengthen trust, increase transparency, and can even serve as proof for grant eligibility or financial audits. With a reusable template, you avoid starting from scratch and focus more energy on building meaningful philanthropic partnerships rather than navigating document logistics.

Free Download: Your Customizable Donation Agreement Template

Need a quick and easy way to create a donation agreement template? Download our free, customizable templates by clicking the Use Template button on this page. Simply add your specific information and print them out.