Federal tax filing and submission starts with Form 1040. This guide provides a step-by-step description of Form 1040, including where to get it, plus easy directions for filling out the document without getting stressed.

The guide includes steps on how to complete Form 1040, as well as deadlines and necessary schedules. Plus, we will let you in on why PDF Agile is the go-to tool for digital signatures and the absolute best way to complete your Form 1040 online.

Mastering Form 1040: Your Step-by-Step Guide to Completing and Filing Taxes

Tax filing might appear as confusing as reading secret messages, yet you can master it through proper understanding. The IRS uses Form 1040 to reveal your income, deductions, credits, and current tax situation, depending on whether you owe money or are getting a tax return. This article reveals everything you need to know about getting Form 1040 and its step-by-step completion guide. PDF Agile streamlines form signing and filling processes perfectly.

What is Form 1040?

Each year, a majority of American taxpayers submit Form 1040, which is the U.S. Individual Income Tax Return. This basic form has two pages. However, people with additional income sources from business ventures, real estate investments, or investment returns use additional schedules.

Retired individuals typically choose form 1040-SR, which provides bigger text but requires similar information to the standard form 1040. The standard form 1040, along with 1040-SR, serves most tax filers, but nonresident aliens need to use 1040-NR, while 1040-X helps when amending a tax return.

Make sure to select the right form based on your tax situation. Filing the wrong version may cause delays in processing your return. Always check for updates to tax forms.

How to Get Your Copy

Getting your form 1040 is super easy:

1. Download from the IRS website Visit IRS.gov/Form1040 for the updated PDF version. That’s the official 2024 version you’ll need for your 2024 income, filed in 2025.

2. Tax Software If you use TurboTax, H&R Block, or another program, it’ll automatically pull in the right form and schedule for you.

3. Tax pro Working with an accountant? They’ll hand you the printed form or handle everything digitally on their end.

Step-by-step on how to fill out Form 1040

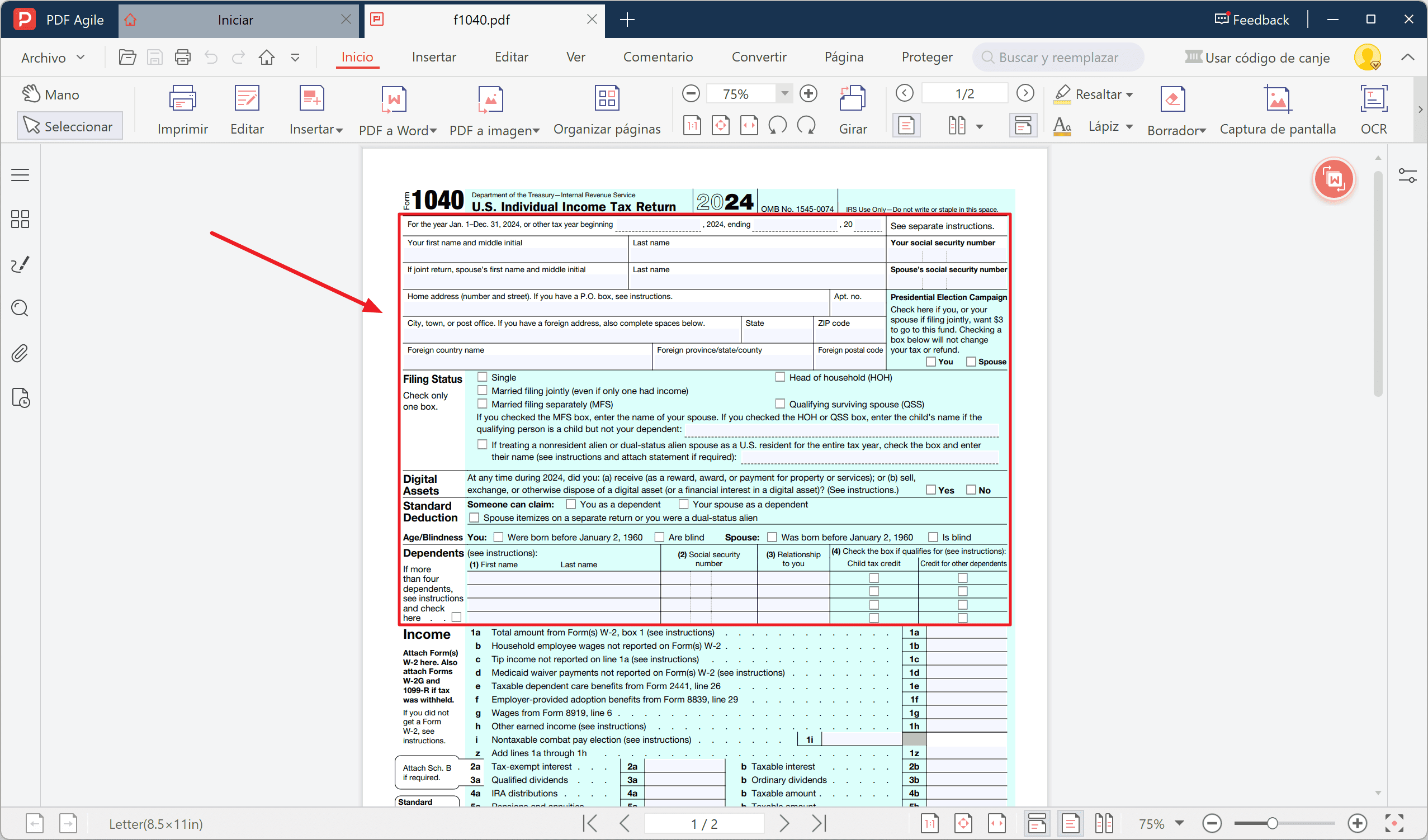

Step One: Personal Info

Fill in your name, Social Security number, address, and tax filing status (single, married filing jointly, etc.). Those with dependents should include their personal information with Social Security numbers, as well as the dependency relationship.

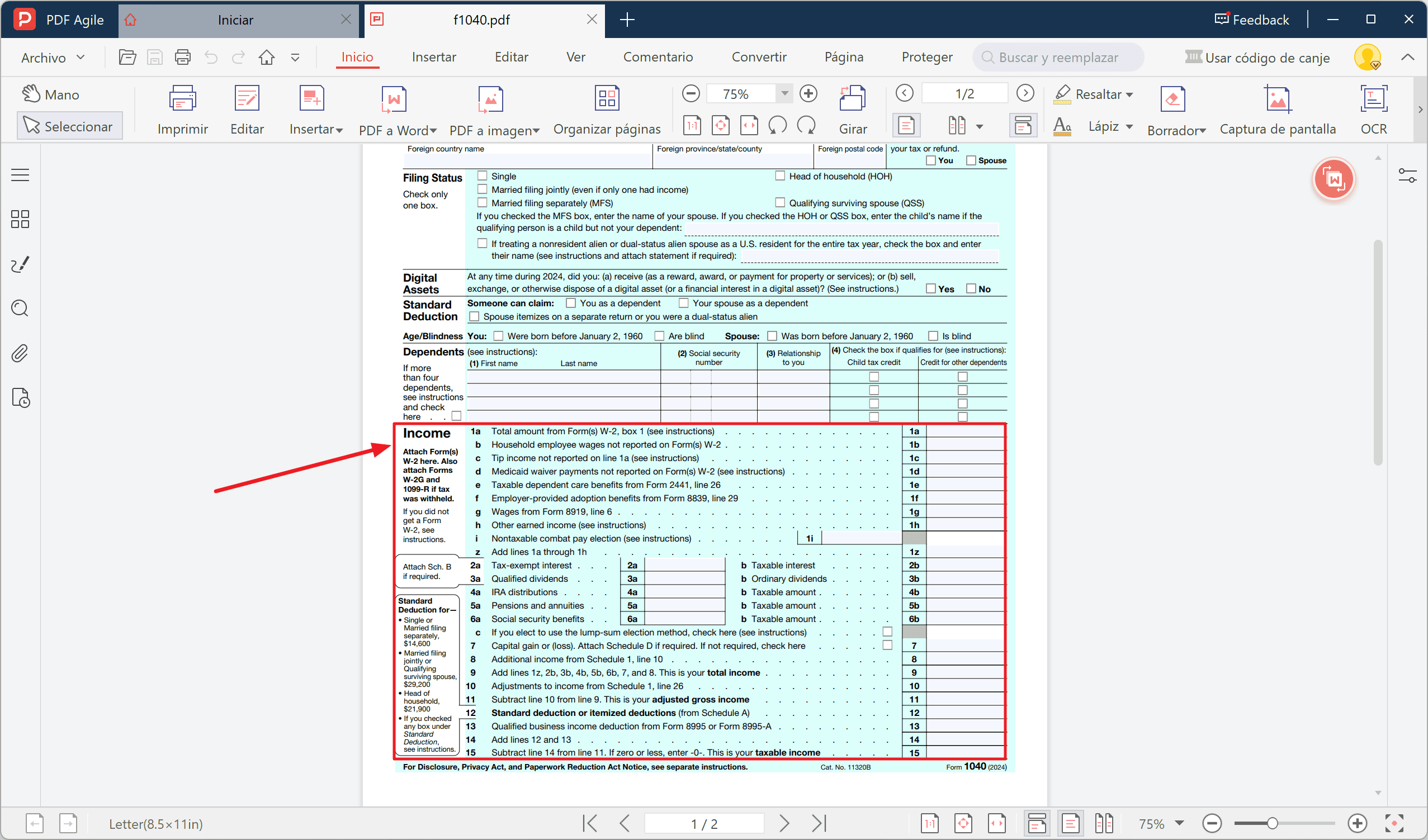

Step Two: Income

All earnings you received throughout the year, such as W-2 wages, interest payments, retirement distributions, and Social Security benefits, must be recorded here. If you have side-gig income or rental revenue, you will report that on Schedule 1 and then transfer the total to line 8 of your Form 1040.

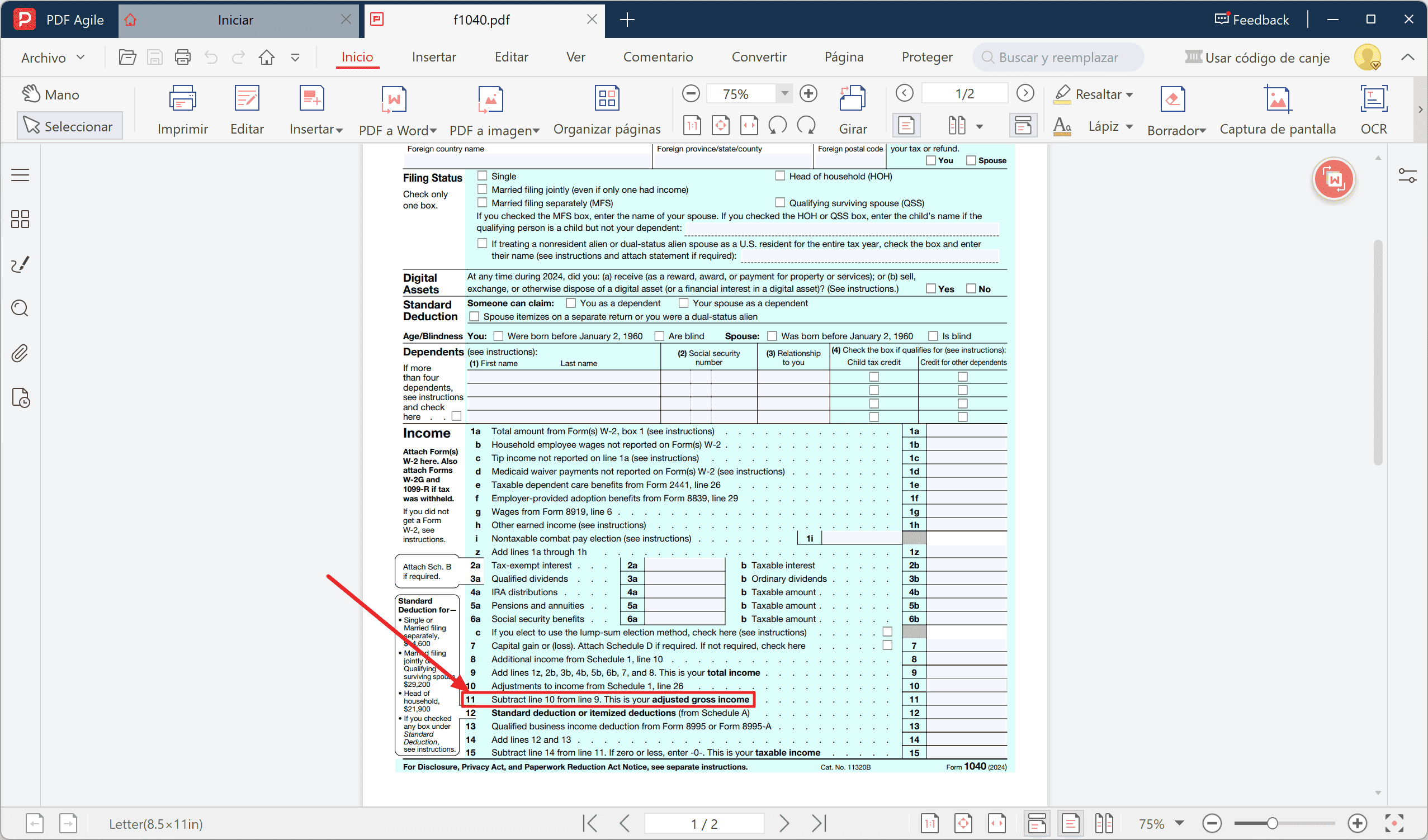

Step Three: Adjusted Gross Income (AGI)

Next, subtract any “above-the-line” deductions—IRA contributions, health savings account deposits, self-employment tax, student loan interest, and educator expenses.

The resulting number becomes your AGI and appears on line 11. This figure is significant because numerous tax deductions and credits are derived from it.

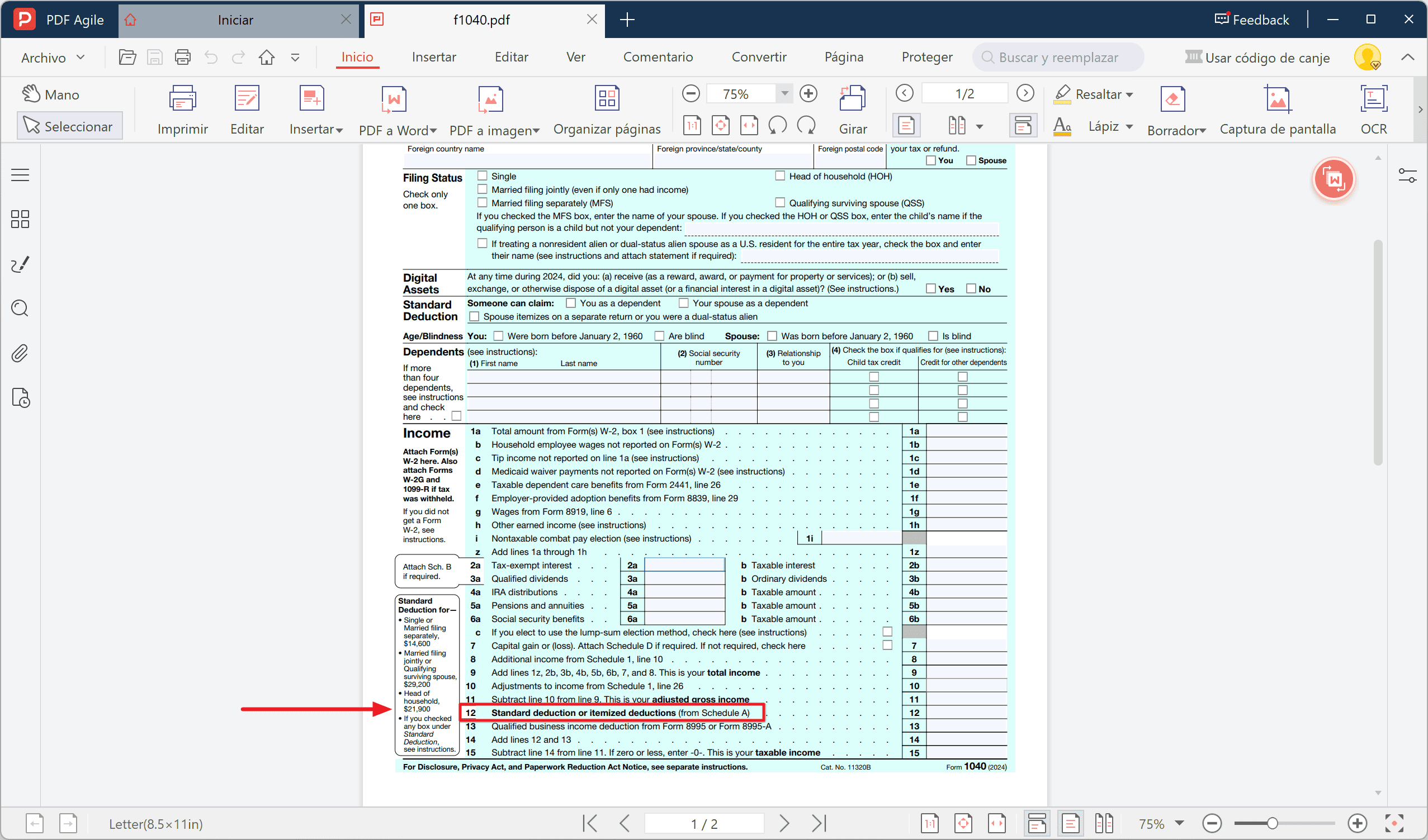

Step Four: Deductions and Taxable Income

You have the option to choose between the standard deduction and itemizing. For 2024, the standard numbers are $14,600 (single), $29,200 (married filing jointly), or $21,900 (head of household).

If your itemizable expenses—mortgage interest, charitable gifts, medical costs—go itemized on Schedule A. Subtract your deduction of choice from your AGI to get your taxable income on line 15.

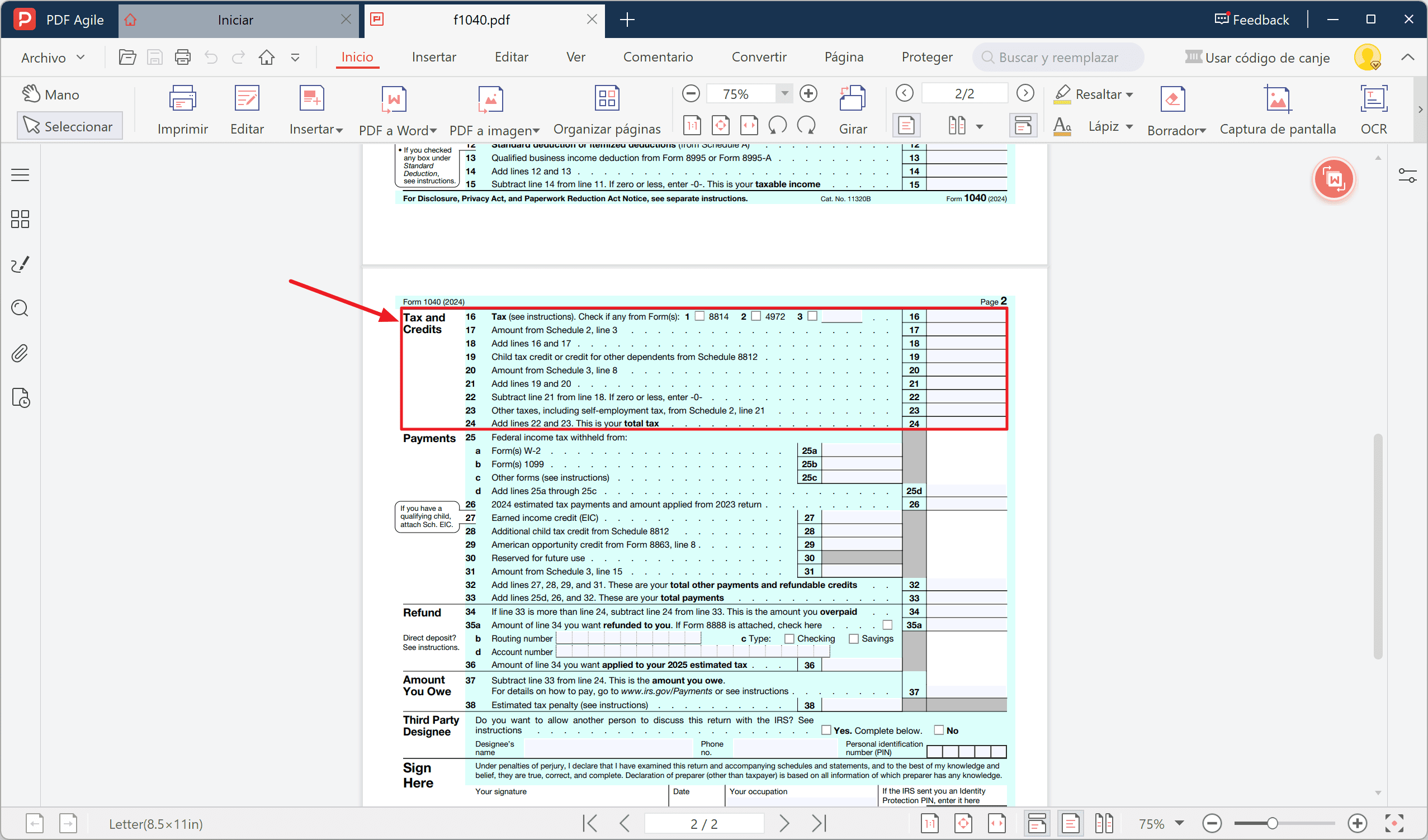

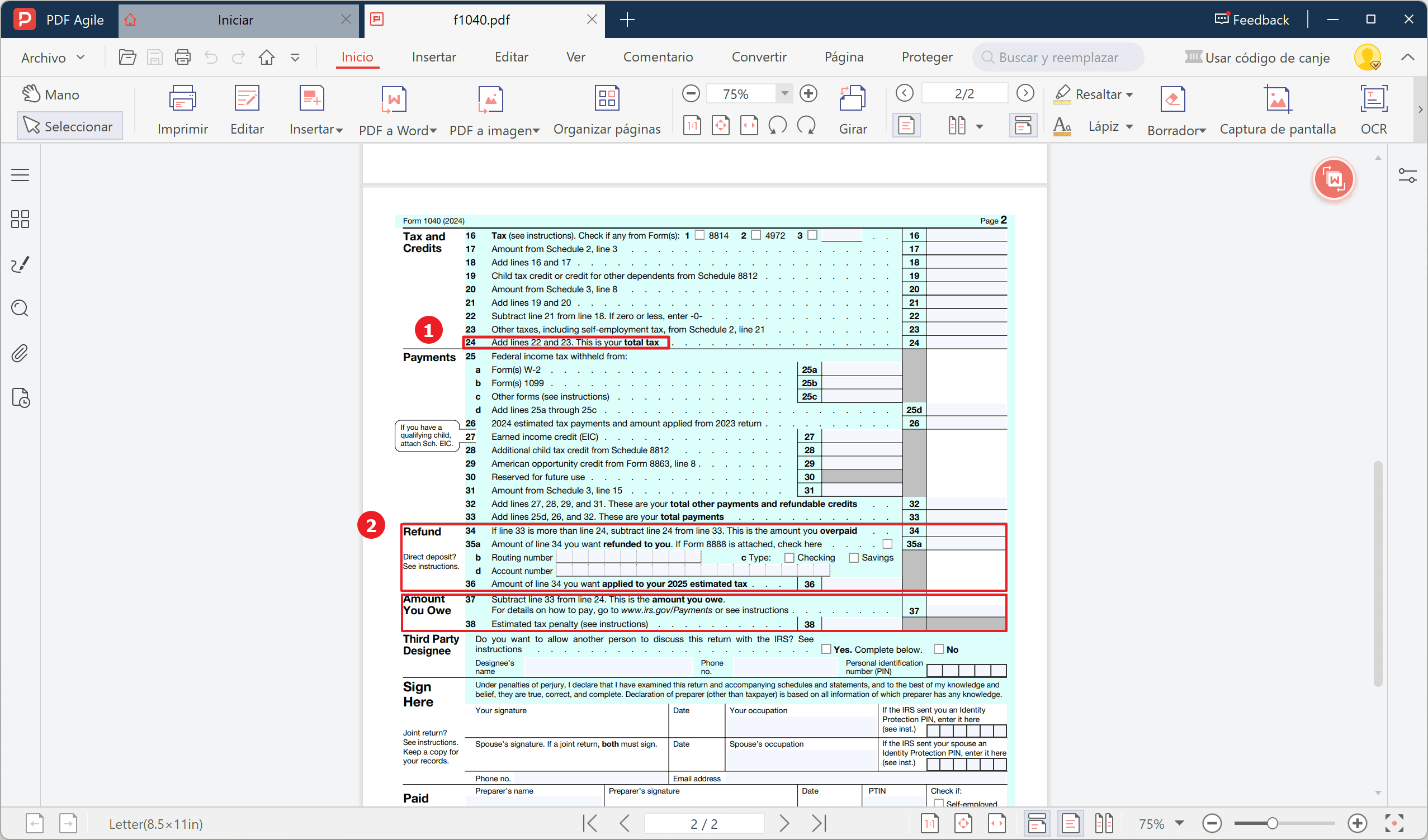

Step Five: Calculate Your Tax and Credits

Check your initial tax amount by consulting the IRS tax tables, and then apply any eligible tax credits (such as the Child Tax Credit) found using Schedule 3. The calculated taxes should be reduced by any available credits, including Child Tax Credits, education credits, and foreign tax credits, which may be claimed on Schedule 3.

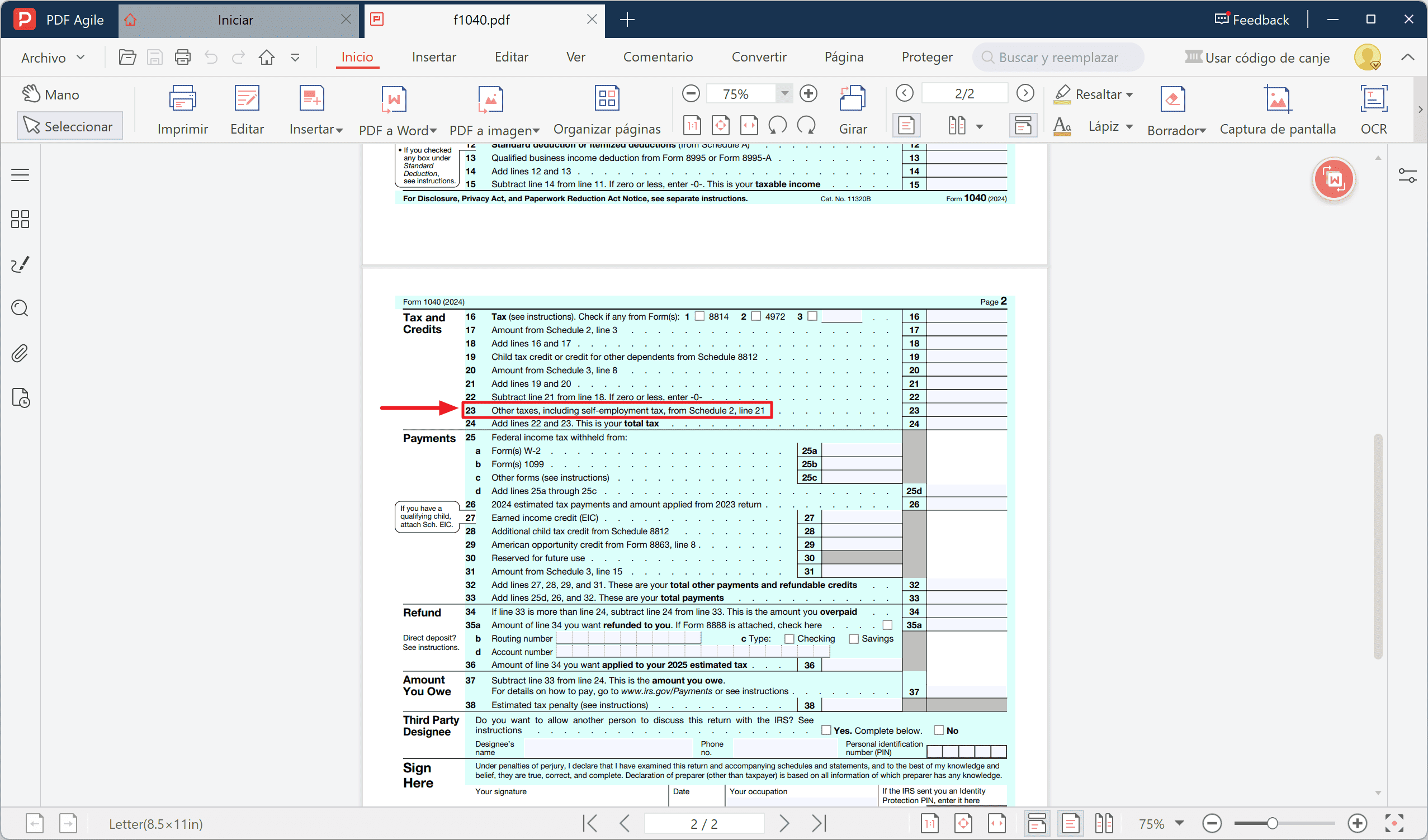

Step Six: Other Taxes

Self-employment tax, household employment tax, the Alternative Minimum Tax—if any of that applies, itemize it on Schedule 2 and add it.

Step Seven: Refund or Amount Due

Compare your total tax to what was already withheld (from W-2s) or estimated payments. If you overpaid, line 35 indicates your refund; if not, line 37 shows what you owe—due by April 15 (or October 15 with an extension, although payments are still due by April 15).

Handy Schedules You Might Need

- Schedule 1: Extra income (unemployment, prize winnings) and adjustments (HSA, educator expenses).

- Schedule 2: Other taxes like self-employment and AMT.

- Schedule 3: Additional credits (foreign tax, education) and payments.

- Schedule A: Itemized deductions (mortgage, medical, state taxes).

- Schedule C: Profit/loss from a business or side gig.

- Schedule E: Rental and royalty income.

Filing Options and Deadlines

The fastest filing method is electronic, as it confirms receipt from the IRS and allows for faster direct deposit refunds. Individuals with an adjusted gross income (AGI) below $84,000 should consider using IRS Free File, whereas TurboTax or H&R Block's commercial software is designed for users with higher AGIs.

The process of paper filing involves printing your pages and signing them before sending your document through the mail to the specified IRS address, which operates at a slower rate with increased chances of errors. You must submit your return by April 15 unless this date lands on a weekend or a federal holiday. You should file Form 4868 to get an additional six months until October 15 as an extension from April 15, but keep in mind that you must still pay your entire tax bill by April 15 to stay penalty-free.

While electronic filing speeds up the process and ensures quick confirmation from the IRS, some individuals still prefer the traditional paper filing method. The key difference lies in processing speed and error rates, with e-filing generally providing a smoother and faster experience, especially for those with simpler tax situations.

Why Choose PDF Agile for Your Form 1040

Let’s be honest: printing, signing, scanning—it’s a hassle. PDF Agile streamlines tax form completion because users can fill out every field on their form 1040 through the simple computer interface, alongside digital signature insertion, before exporting.

The time it takes to prepare tax forms using PDF Agile is significantly faster than handling physical papers, resulting in clear, IRS-approved documents. The digital signature system stands out as exceptional since it eliminates the mess and uncertainty associated with pen-based signatures and scanning. Once you try PDF Agile, you’ll never go back.

With PDF Agile, you can easily integrate your Form 1040 with other tax software, streamlining the process further. The tool's compatibility with cloud storage services ensures that all your documents are securely saved, accessible from anywhere, and ready for submission, providing an extra layer of convenience for busy users.

FAQs

Q: Do I always need to file a Schedule 1?

Nope. Only if you have additional income or above-the-line adjustments not listed on the main 1040 lines. Schedule 1 is not required for everyone, just for specific situations.

Q: What if I mess up?

File Form 1040-X to amend. PDF Agile allows for easy correction, enabling you to clarify changes before sending the modified pages. The tool makes amending your tax documents quick and error-free.

Q: Can I e-sign my return?

The answer is yes for users who e-file via different software. If you have a paper file, PDF Agile’s digital signature counts-just attach the signed PDF if you e-file electronically via a provider that accepts PDFs.

Conclusion

Filing your taxes through Form 1040 requires no tedious work. The combination of a simple, step-by-step method and appropriate schedules, alongside PDF Agile as your filing and signing tool, allows for easy completion of your return. Start your tax preparation process early. Seeking the advice of a tax professional is always sage advice when your organization faces hurdles. Here’s to a stress-free tax season!