The process of completing Form 709 sounds tricky, but if you know what goes where, it’s a breeze. This article provides a simplified explanation of achieving the US Gift Tax Return, using an IRS Form 709 example for practical reference.

This guide outlines the complete process of data collection and signature placement on Form 709, thereby eliminating any confusion related to the IRS.

Understanding the Purpose of IRS Form 709

Gift giving typically seems straightforward to most people, even though the IRS requires disclosure of gifts exceeding $19,000 in 2025. That’s what Form 709 is for. The actual name of this tax document is the United States Gift (and Generation-Skipping Transfer) Tax Return since it monitors all gifts exceeding the annual exclusion limit.

The obligation to report your gift activity does not require immediate payment of cash to the IRS. You get a lifetime shelter of $13.61 million, so most folks never pay a dime. Individuals whose spouses are not U.S. citizens may give gifts totaling $190,000 for 2025 without any penalties. Form 709 is about tracking, not taxing—unless you’re a billionaire.

So, here’s exactly how to fill out Form 709 and an IRS Form 709 example:

Step 1: Gather Your Info

First, get your Social Security number, address, and the donee’s name and Social Security number. Next, record what you gave them, when, and how much it was worth on that specific date of the gift transaction. This information will be essential when filling out Form 709 accurately.

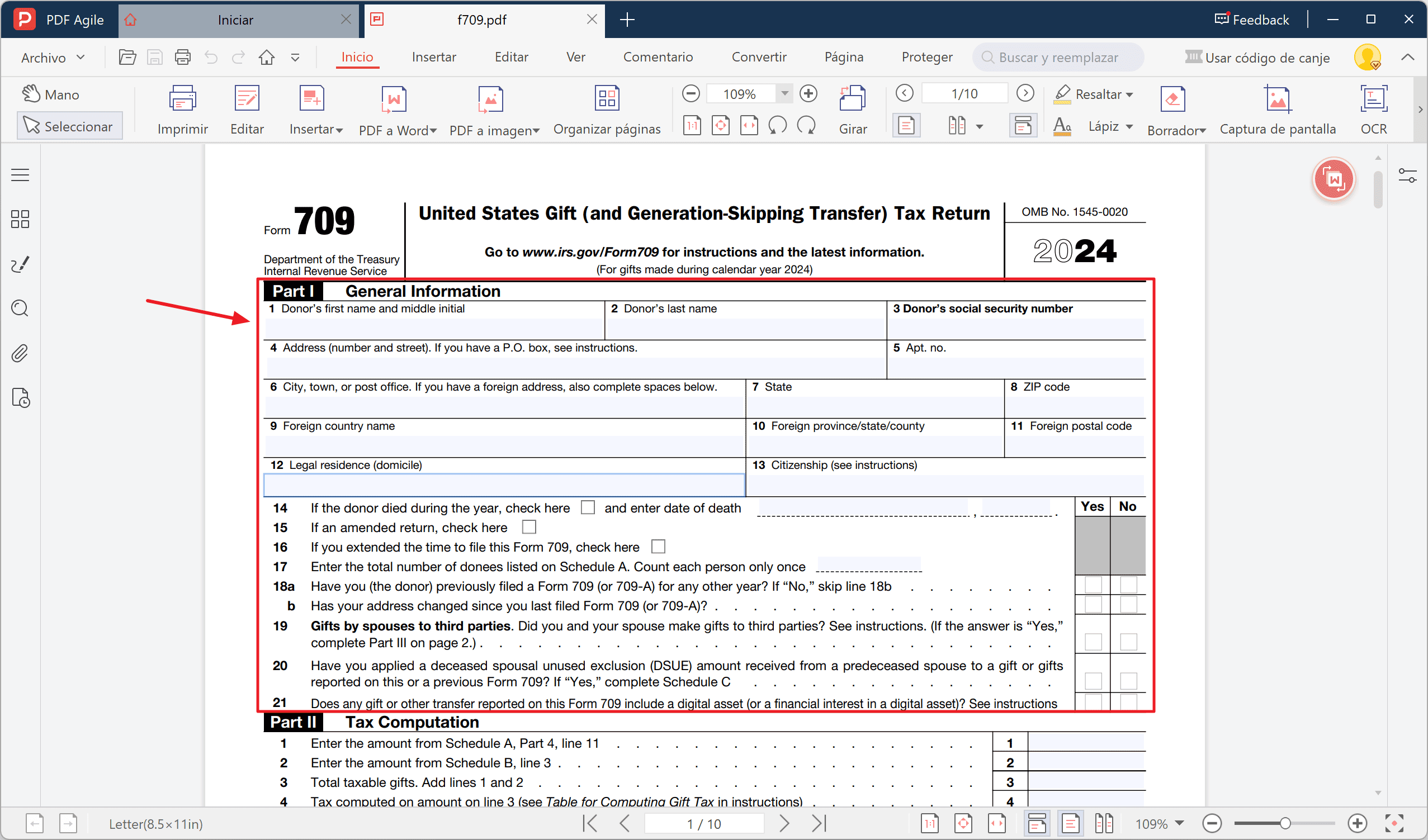

Step 2: General Information (Part I)

You should then access Form 709 Part I on page 1 within the PDF file. The first section of the 709 PDF requires you to enter your name, Social Security number, tax year, home address, and whether gift splitting applies to your spouse. Ensure all details are correct before proceeding to the next sections.

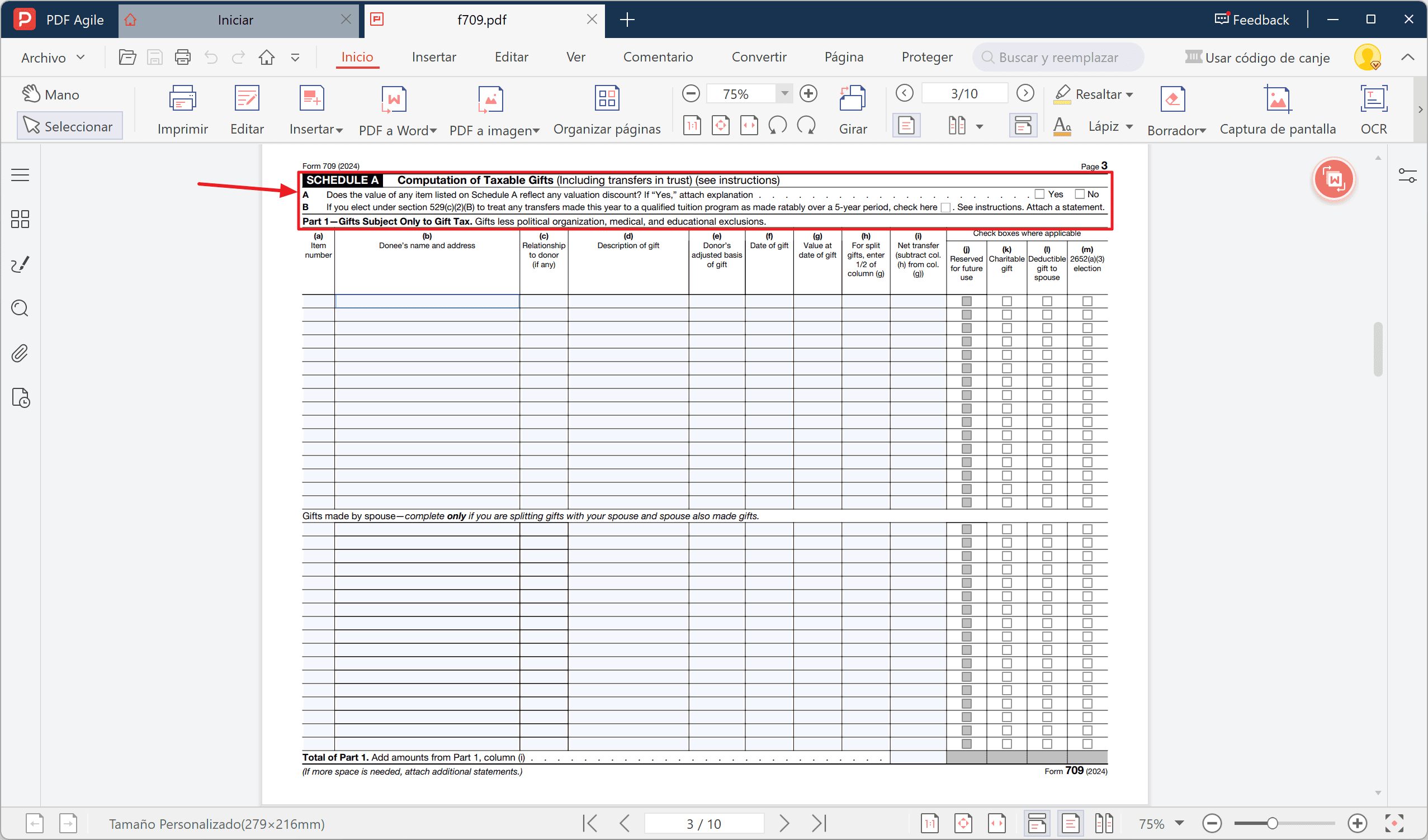

Step 3: Compute Your Taxable Gifts (Schedule A)

Next is Schedule A, where you chronicle each gift over the $18,000 barrier. For example, let's say you gave your mom $118,000 for her milestone birthday. You'd list "cash gift," her name, the date, and the fair market value. Be sure to double-check the calculations and then subtract the $18,000 exclusion. Voilà—$100,000 of net taxable gifts for the year.

Step 4: Schedules B, C & D (If They Apply)

- Schedule B loops in any gifts from past years.

- Schedule C claims a deceased spouse’s unused exclusion.

- Schedule D only appears if you’re making generation-skipping gifts (such as to grandkids or trusts).

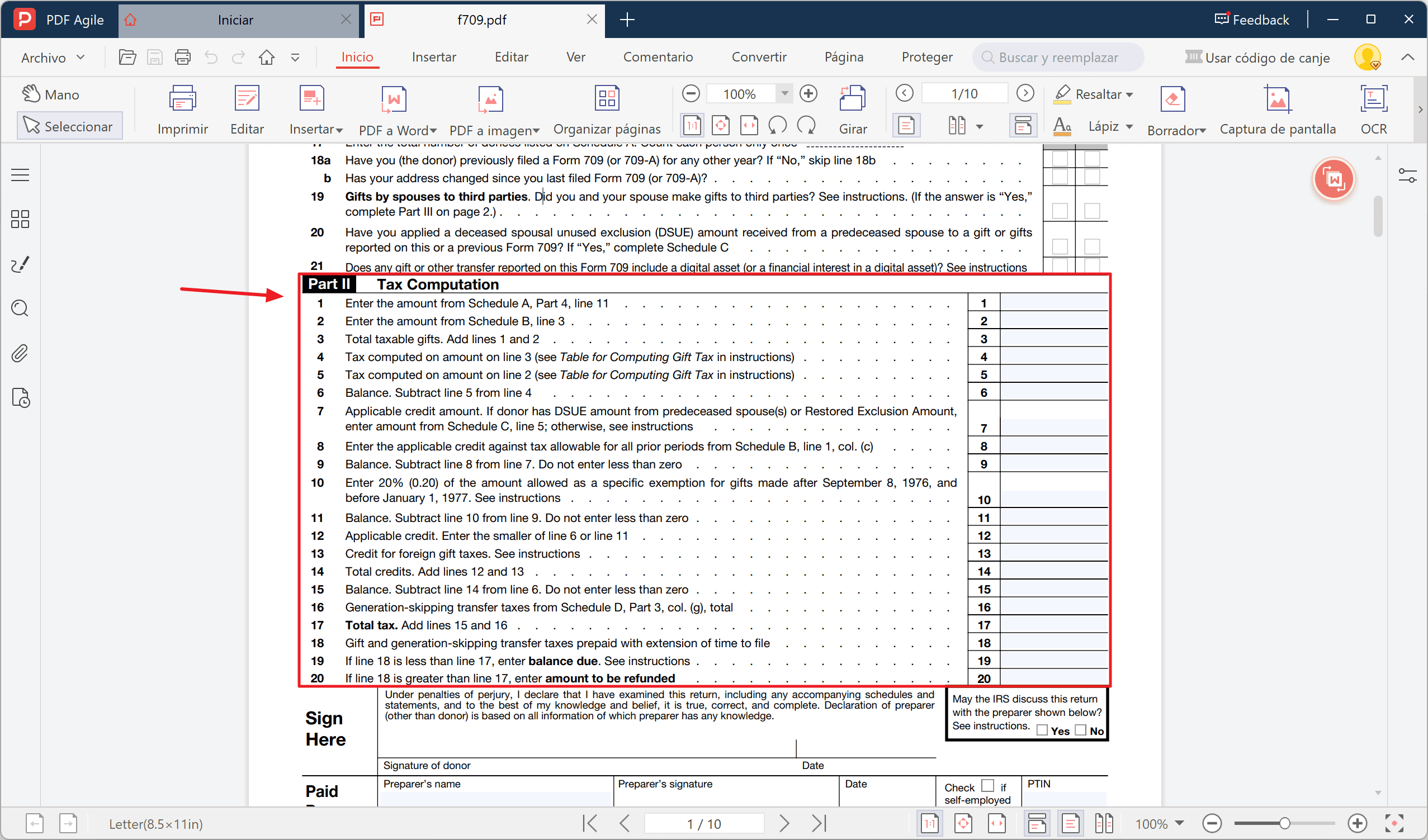

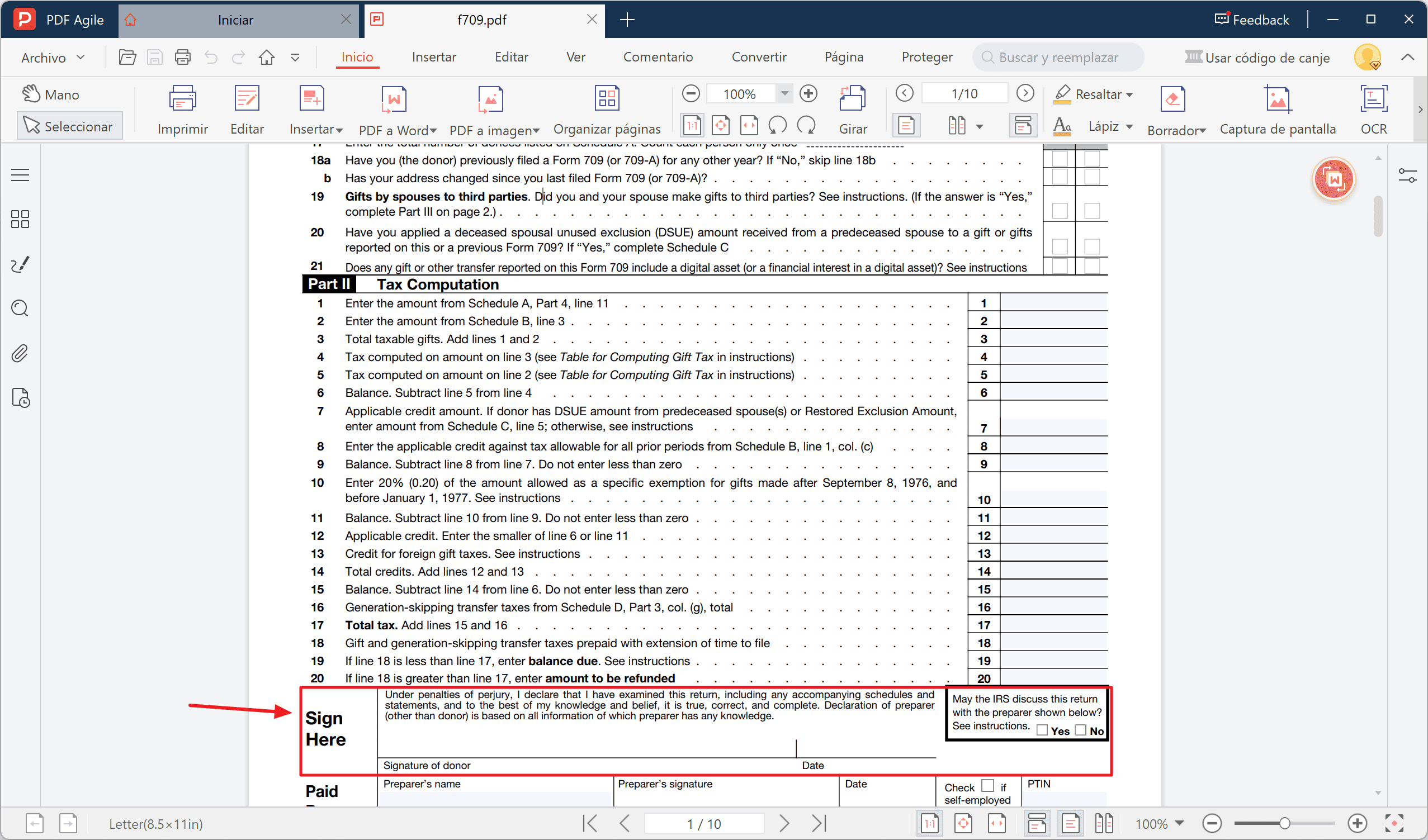

Step 5: Tax Computation (Part II)

Return to page 1 and activate Part II of the debt calculation program. In this section, you'll need to refer to the provided tax table or unified credit, taking into account any prior gifts. Using the information, you calculate current and prior gifts before determining tax obligations.

Step 6: Sign & File

Almost there. Complete this form by signing it, then sending it to your IRS regional service center by mail while keeping a copy in your files. Be sure to double-check all the information before submission. Form 8892 enables you to request an additional six months to file your taxes until Tax Day, but does not grant an extension for taxation obligations.

Real-Life Gift Scenarios: Walking Through the What-Ifs

Your decision to buy a vintage guitar from a yard sale for your best friend provides the condition for this scenario. Its market value? About $5,000. Because the gift value falls beneath the 2025 annual exclusion, you can skip filing Form 709 altogether. But what if you decided to spoil them and threw in another $20,000 cash gift? Suddenly, you’ve crossed the line and will need to fill out Form 709.

Now, flip the script. When you give away stock you acquired in college that has appreciated to $50,000, you need to calculate its adjusted basis and fair market value. To determine this type of gift, you must find the adjusted basis, which is the original purchase amount and the market value at the time of donation.

The last thing you want is the government calculating your taxes on these gifts, as they can ultimately result in an unexpected invoice afterward.

Both digital assets, along with other holdings, must be reported. Your friend would need to file a report if you were to send them an expensive gift. The procedure is similar to handling cash, as you must create a list with appraisal values, including tax exclusions, and file Form 709 if required.

After You File: What Happens?

Once you slip your envelope into the mail, addressed to the IRS service center (note that electronic uploads are not accepted), there’s a brief waiting game. The IRS will log your return in its system. During this process, the IRS will likely contact you for additional details, so keep your records readily accessible. The simpler you present your information to the IRS, the better your chances are of success.

The IRS stores your Form 709 within your profile to keep track of the amount of available $13.61 million umbrella protection you have utilized. Once you perform edge-over reporting, the IRS will provide notice for gift tax liability assessments. The good news? On the first page of Form 709, you will find both a functional table and unified credit mathematical calculations to receive fair treatment.

If you’re liable for gift tax, the IRS will issue a notice outlining the amount you owe. Payment is usually due within 30 days, and missing the deadline can result in interest or penalties. Prompt action is essential to avoid additional charges.

Record-Keeping & Audit Protection

In this stage, you show your expertise as a researcher. The documentation you should keep should have appraisals, valuation statements, alongside bank records that demonstrate the gift, and a copy of your filed Form 709. You need to duplicate the documentation so that you are not caught off guard when the IRS investigates your gift, as you already possess all the required proof ready to present.

Three rings in a basic binder system work exceptionally well as a record storage system. Apply different sections to separate each annual gift. The binder will include the printed Form 709, along with supporting documentation and recorded notes for valuation research methods. Place the professional report of anything complex that needs clarification, including business interests, inside your tax file binder.

Advanced Considerations: When Life Gets a Bit Hairy

Some gifts do not fit traditional tax classification systems. If you gift a partial interest in a family-limited partnership, you will need a valuation that factors in the minority interest and the lack of marketability. That's when you call in a business valuation expert; their report slides right into Schedule A, Part 1, line 5.

And then there’s generation-skipping transfers. Perhaps you'd like to contribute $100,000 to your grandchild’s education trust. That goes on Schedule A, Part 2, and if you’re not careful, GST tax can sneak up, though there’s a separate GST exemption that mirrors your lifetime gift-tax exemption. It’s like juggling two umbrellas, but the principle is the same: value, list, subtract exclusions, file Form 709.

Additionally, don’t overlook the impact of charitable gifts. Contributions to qualifying charities are typically exempt from the gift tax, but the proper documentation is critical. You must include the charity's name, tax ID number, and the amount given on Form 709 to ensure compliance with IRS guidelines.

FAQs

Q: Do I Need to File Form 709 Every Year?

The IRS will only consider gifts after someone receives more than $19,000 in a single year. When your gifts are under this limit, you are exempt from reporting to the tax authorities. If you exceed this threshold, you'll need to file Form 709 to report the excess.

Q: What If I Miss the April 15 Deadline?

A late filer should submit Form 8892 before Tax Day to gain a six-month extension to file Form 709 despite not postponing the tax obligation. However, it's important to file the extension request on time to avoid penalties or late fees for failure to file.

Conclusion

Form 709 remains straightforward, as all you need to do is collect your gift details and fill in the blanks, deducting $19,000 from each done, and then applying your $13.61 million exemption. The government will receive explicit confirmation of your generous giving through the presentation of your IRS Form 709.

Form 709 serves as a reporting requirement for individuals who wish to notify the IRS about their substantial contributions. Documentation involves minimal time, as it mainly involves formalizing written documents to fulfill administrative requirements. Following the steps of early information collection and maintaining clean records, coupled with a mid-year review, allows you to handle Form 709 without stress. Proper preparation will make you an expert handler of Form 709, enabling you to focus on creating heartwarming moments for others. Besides, PDF Agile is here to help you with filling out your form.