In today's fast-paced world, financial transactions and legal processes often require proof of income. Whether you're applying for a loan, renting an apartment, or processing a visa application, an income verification letter can be a crucial document. This letter serves as an official statement of your earnings, providing assurance to the requesting party about your financial stability. In this guide, we'll explore the nuances of income verification letters, their types, components, and how to draft them effectively. We'll also provide you with ready-to-use templates to simplify the process.

What Is an Income Verification Letter?

An income verification letter is more than just a piece of paper; it's a formal document that carries significant weight in financial and legal matters. This letter is typically issued by an employer, but it can also be prepared by self-employed individuals, banks, or government agencies. The primary purpose of this letter is to confirm an individual's income, providing details such as salary, employment status, and the duration of employment.

For employees, this letter is usually issued by the human resources department or a direct supervisor. It includes specific information about the employee's earnings, such as base salary, bonuses, commissions, and any other forms of compensation. For self-employed individuals, the letter might be prepared by an accountant or based on financial records, providing a summary of annual income.

Several types of income verification letters based on the applicant’s employment situation:

- Employer-Issued Verification Letter A formal letter written by an employer verifying the employee’s income, job status, and tenure.

- Third-Party Verification Letter Issued by an accountant, lawyer, or HR manager acting on behalf of the individual.

- Self-Employed Income Letter A document written by a freelancer or business owner verifying their own income, often supported by tax returns or bank statements.

Each type serves a specific context but shares similar components and formatting.

Key Components of an Income Verification Letter

An effective income verification letter should be clear, concise, and comprehensive. It should include the following components:

- Header: The header of the letter should include the issuer's name, address, and contact information. This information is crucial for verifying the authenticity of the letter and providing a point of contact for any follow-up questions.

- Date: The date on which the letter is issued should be clearly stated. This helps in determining the relevance and timeliness of the information provided.

- Recipient Information: The letter should be addressed to the recipient or organization requesting the verification. This includes the recipient's name and address, ensuring that the letter reaches the intended party.

- Salutation: A formal greeting addressing the recipient sets the tone for the letter. It shows respect and professionalism, making the letter more credible.

- Employee Information: The letter should include the full name, job title, and employment status of the employee. This information helps in identifying the individual and understanding their role within the organization.

- Income Details: Specific details about the employee's income should be provided, including salary, bonuses, commissions, and any other forms of compensation. This information is crucial for assessing the individual's financial standing.

- Employment Duration: The length of time the employee has been with the company should be mentioned. This helps in understanding the stability and continuity of the individual's income.

- Closing: A formal closing statement concludes the letter, expressing willingness to provide further information if needed. This shows openness and cooperation, enhancing the credibility of the letter.

- Signature: The letter should be signed by the issuer, with space for the issuer's signature and printed name. This adds a personal touch and confirms the authenticity of the information provided.

How to Write an Income Verification Letter: Step-by-Step

Writing an income verification letter involves several steps to ensure accuracy, completeness, and professionalism. Let's walk through the process:

1. Gather Necessary Information: The first step is to gather all relevant details about the employee's income, employment status, and duration. This includes information such as base salary, bonuses, commissions, and any other forms of compensation. It's essential to have accurate and up-to-date information to ensure the credibility of the letter.

2. Use Company Letterhead: If applicable, use the company's official letterhead for a professional appearance. The letterhead should include the company's logo, name, and address, providing a formal and credible context for the letter.

3. Draft the Letter: Start with the header, including the issuer's name, address, and contact information. Follow with the date, recipient information, and a formal salutation. Provide detailed information about the employee's income, employment status, and duration. Conclude with a formal closing statement and space for the issuer's signature.

4. Review and Edit: Check for any grammatical errors, typos, or inconsistencies. Make any necessary edits to ensure the letter is clear, concise, and professional.

5. Sign and Send: Once the letter is finalized, sign it and send it to the recipient via email or postal mail. Ensure that the letter reaches the intended party in a timely manner, providing them with the necessary information for their financial or legal processes.

Income Verification Letter Template Samples

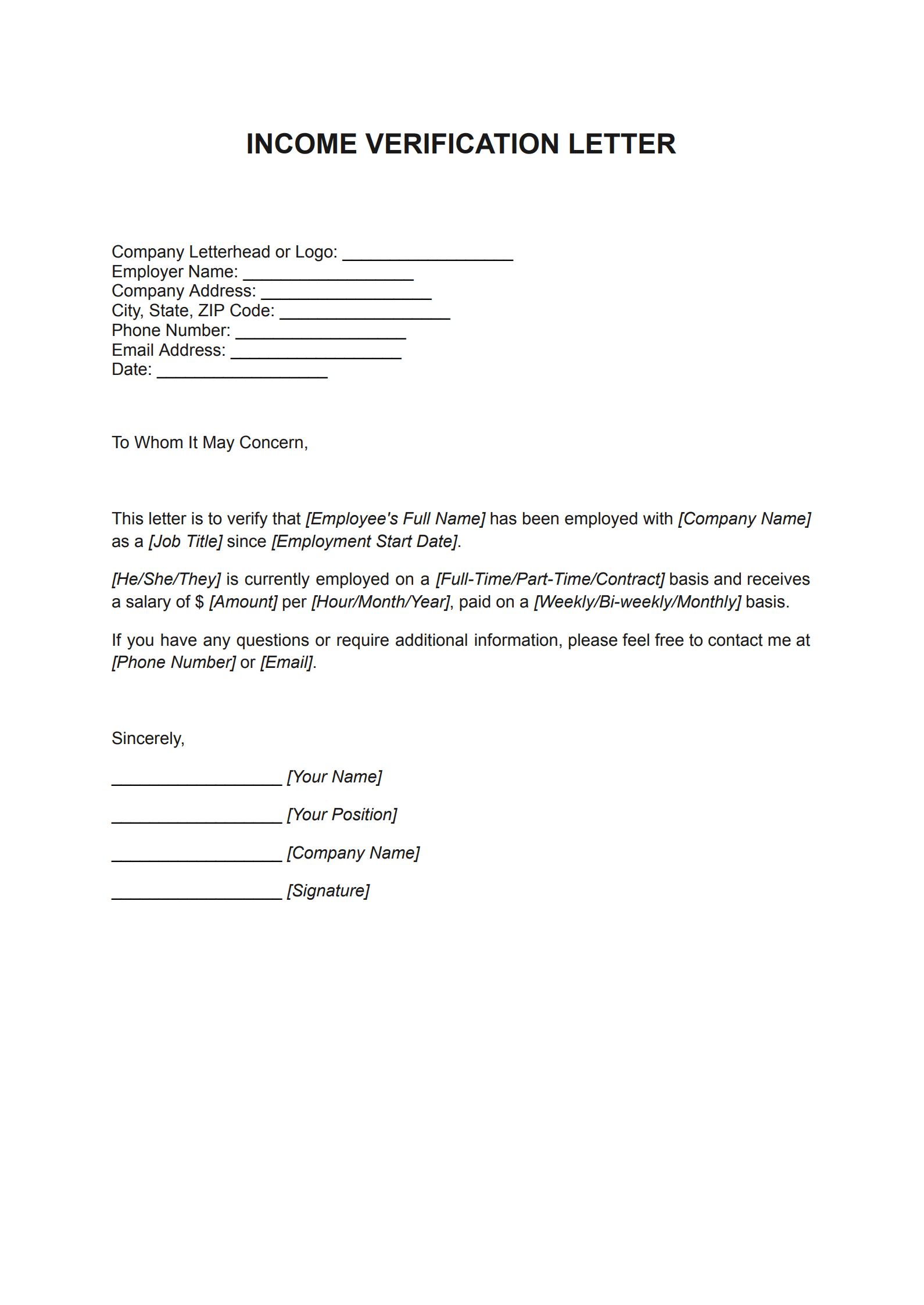

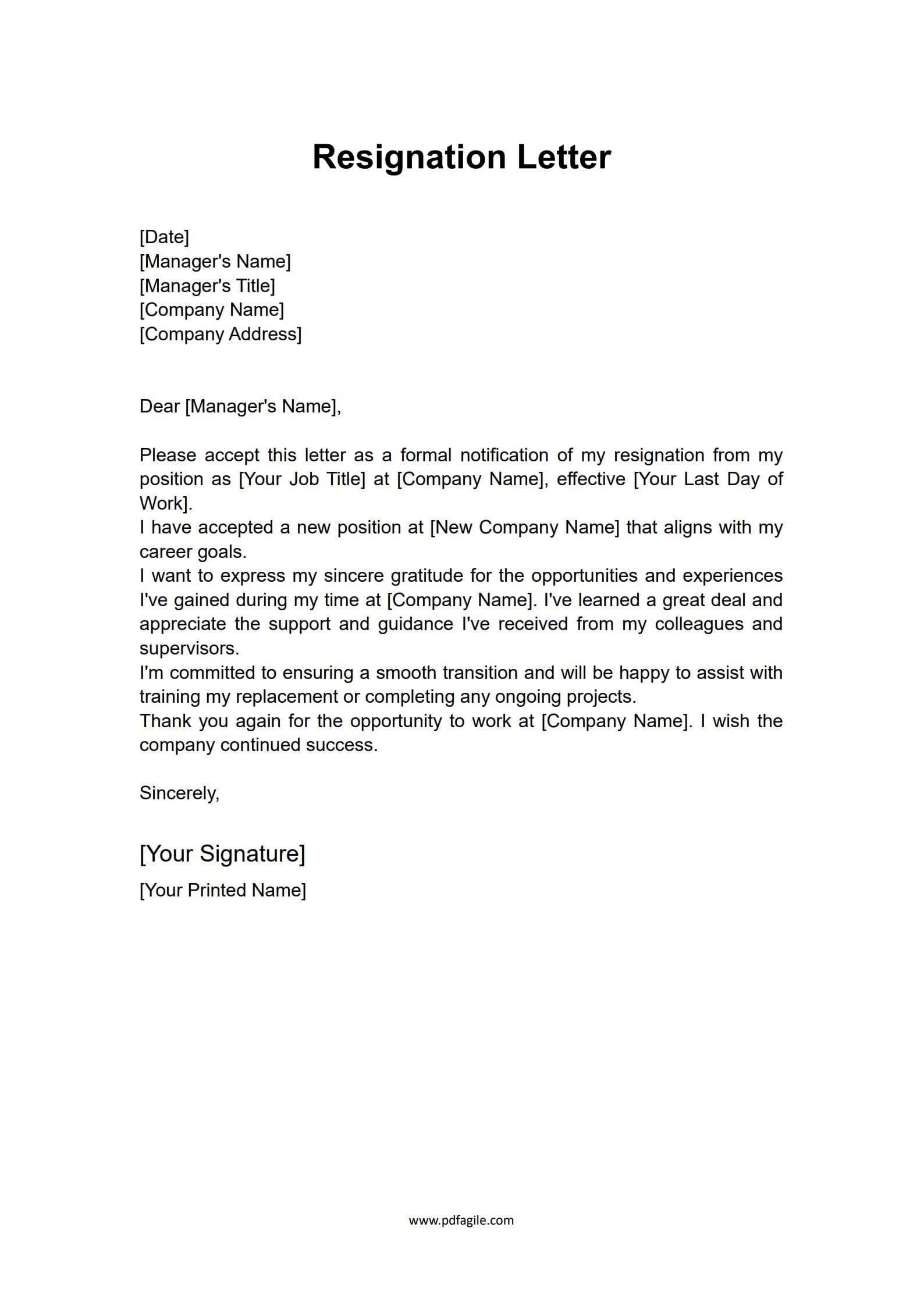

1. Employer-Issued Income Verification Letter Template

This format is typically used by companies to confirm an employee's income details. It's a formal letter that reflects the professional relationship between the employer and the employee. The letter is usually drafted by the HR department or a supervisor and includes essential details such as the employee's job title, salary, and duration of employment. It serves as an official document that can be used for various purposes like loan applications, rental agreements, or visa processing.

[Company Letterhead or Logo]

[Employer Name]

[Company Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

To Whom It May Concern,

This letter is to verify that [Employee's Full Name] has been employed with [Company Name] as a [Job Title] since [Employment Start Date].

[He/She/They] is currently employed on a [Full-Time/Part-Time/Contract] basis and receives a salary of $[Amount] per [Hour/Month/Year], paid on a [Weekly/Bi-weekly/Monthly] basis.

If you have any questions or require additional information, please feel free to contact me at [Phone Number] or [Email].

Sincerely,

[Your Name]

[Your Position]

[Company Name]

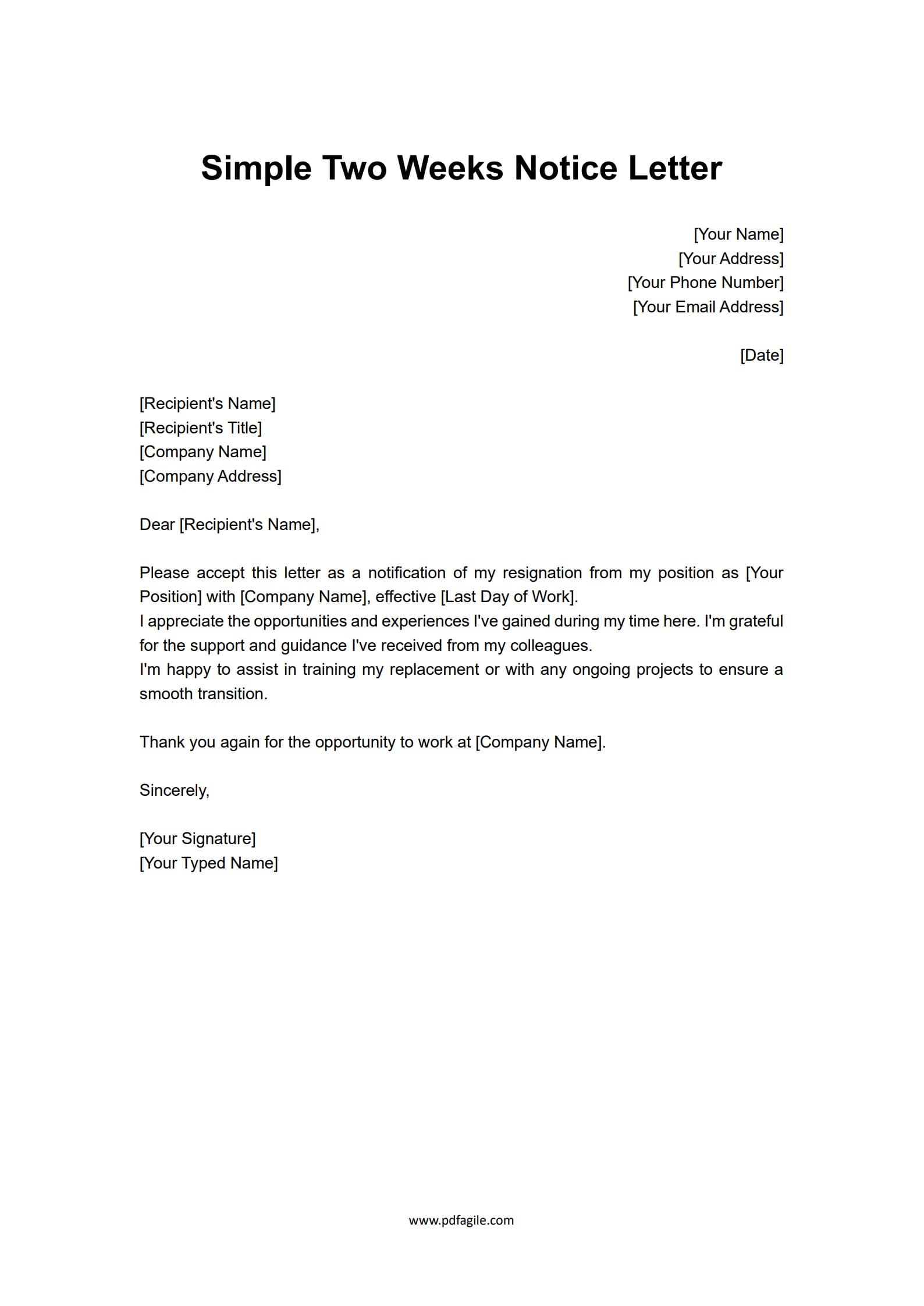

[Signature] 2. Self-Employed Income Verification Letter Template

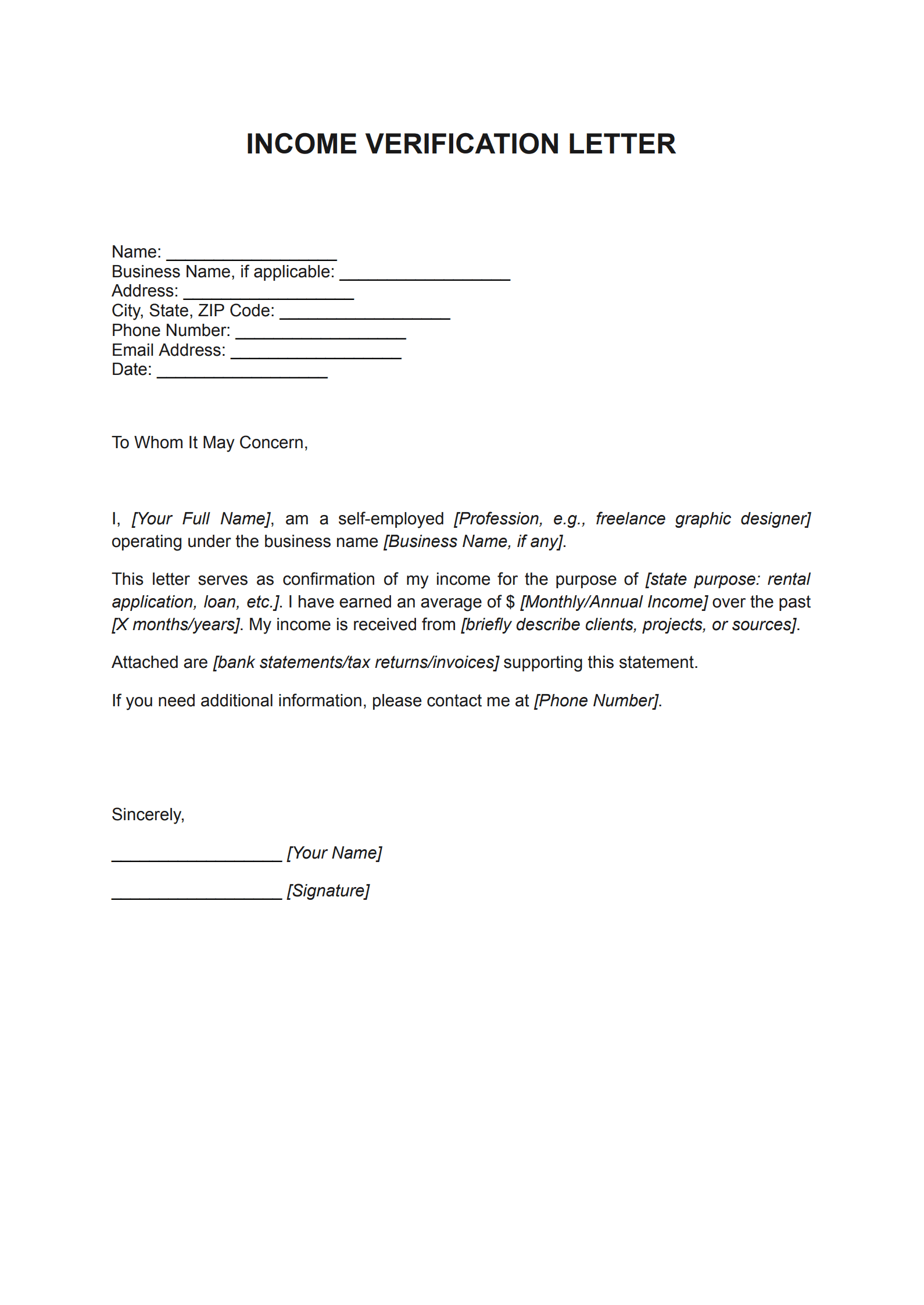

For freelancers, consultants, and small business owners, this format is a way to verify income without a traditional employer. It's often prepared by the individual or their accountant and includes a summary of annual income verified by financial records. This letter is crucial for self-employed individuals who need to provide proof of income for financial transactions, loan applications, or other official purposes. It reflects the individual's professionalism and financial stability.

[Your Name]

[Your Business Name, if applicable]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

To Whom It May Concern,

I, [Your Full Name], am a self-employed [Profession, e.g., freelance graphic designer] operating under the business name [Business Name, if any].

This letter serves as confirmation of my income for the purpose of [state purpose: rental application, loan, etc.]. I have earned an average of $[Monthly/Annual Income] over the past [X months/years]. My income is received from [briefly describe clients, projects, or sources].

Attached are [bank statements/tax returns/invoices] supporting this statement.

If you need additional information, please contact me at [Phone Number].

Sincerely,

[Your Name]

[Signature]

Why Use an Income Verification Letter Template?

Using a professional income verification letter template provides multiple benefits:

✅ Ensures accuracy and professionalism in tone and structure

✅ Maintains consistency across multiple requests

✅ Improves credibility when applying for rentals, loans, or financial programs

✅ Helps meet legal and documentation requirements for official purposes

Whether you're an employee, freelancer, or HR professional, using a ready-made proof of income letter ensures you present trustworthy information in a clear and concise way.

Conclusion

An income verification letter is a crucial document that can facilitate various financial and legal processes. By following this guide and using the provided templates, you can ensure that your income verification letters are comprehensive, professional, and accurate. Whether you're an employer, a self-employed individual, or a financial institution, this guide provides valuable insights and practical tools to simplify the process of drafting an income verification letter.

Free Download: Your Customizable Income Verification Letter

Need a quick and easy way to create a professional Income verification letter? Download our free, customizable templates by clicking the Use Template button on this page. Simply add your specific information and print them out.