A payroll receipt — also known as a pay stub or salary slip — is one of the most essential records in any workplace. It provides detailed proof of an employee’s earnings, deductions, and total net pay for a specific pay period. Both employers and employees rely on payroll receipts to ensure payment accuracy, maintain transparency, and comply with labor and tax laws.

In this article, you’ll learn what a payroll receipt is, why it matters, what key details to include, and how you can easily create your own using our free fillable PDF template from PDF Agile.

1. What Is a Payroll Receipt?

A Payroll Receipt is a formal record that summarizes how an employee’s pay was calculated for a given period. It lists hours worked, pay rates, overtime, deductions, and final net pay — providing complete visibility into how the payment amount was derived.

Essentially, it acts as both a legal payment confirmation and a financial record for employees and employers alike. Employers use it to track payroll operations, while employees rely on it for loans, personal budgeting, and tax filing purposes.

2. Why Every Employer and Employee Needs a Payroll Receipt?

When payroll records are incomplete or inconsistent, issues like underpayment, tax errors, or compliance violations can quickly arise. A clear and well-documented payment receipt prevents these problems before they happen.

Payroll Receipt For Employers

- Demonstrates compliance with federal and state labor laws.

- Promotes transparency and trust with employees.

- Simplifies tax preparation, audits, and recordkeeping.

Payroll Receipt For Employees

- Ensures payments are accurate and timely.

- Provides an official record for personal finance or visa applications.

- Helps track deductions for taxes, insurance, or retirement plans.

In short, a payroll receipt is a vital communication tool that keeps both sides aligned — preventing confusion and disputes.

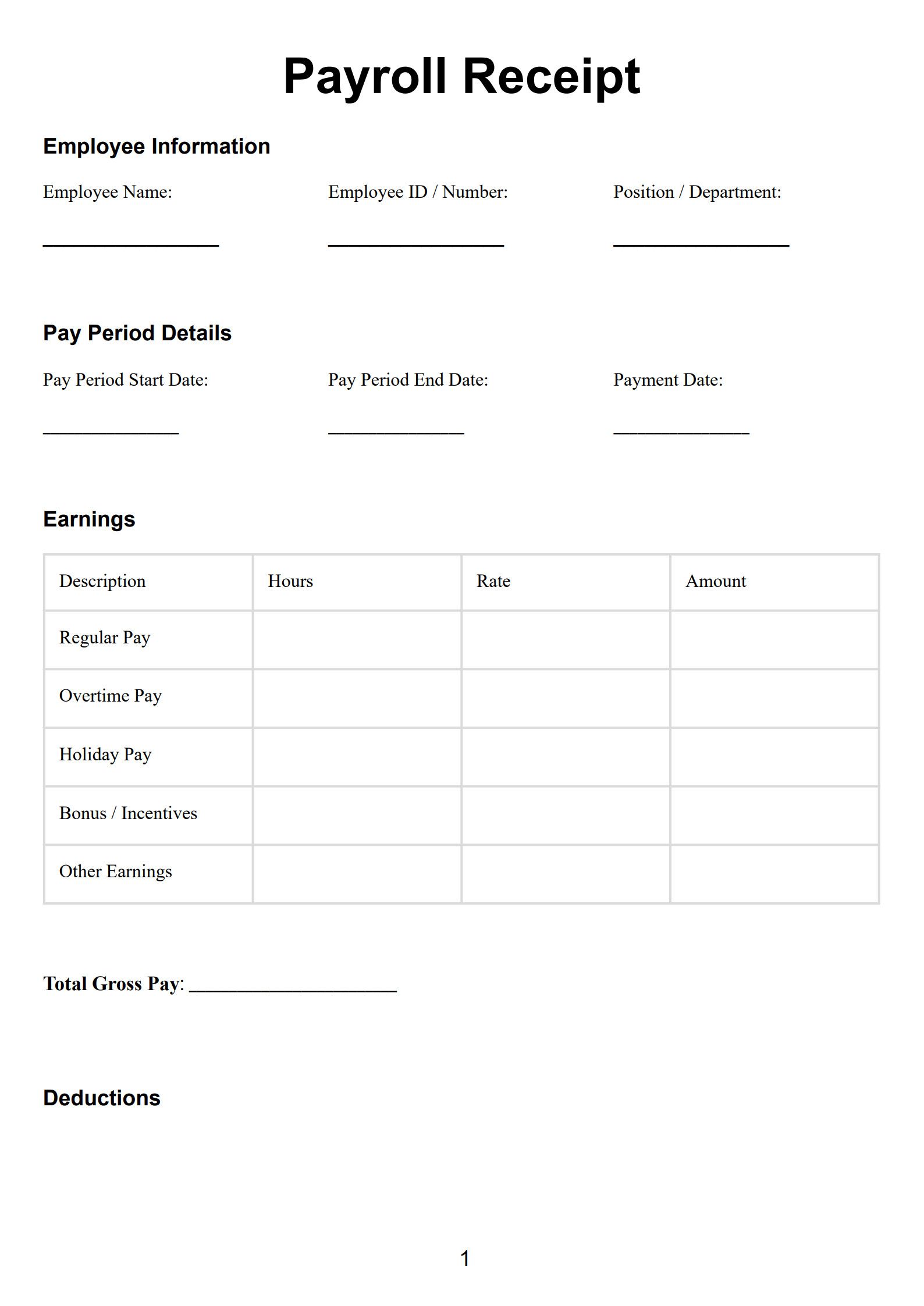

3. Key Sections of a Payroll Receipt Form

A professional payroll receipt contains several critical components. The template provided by PDF Agile includes all the standard fields needed for payroll accuracy and compliance.

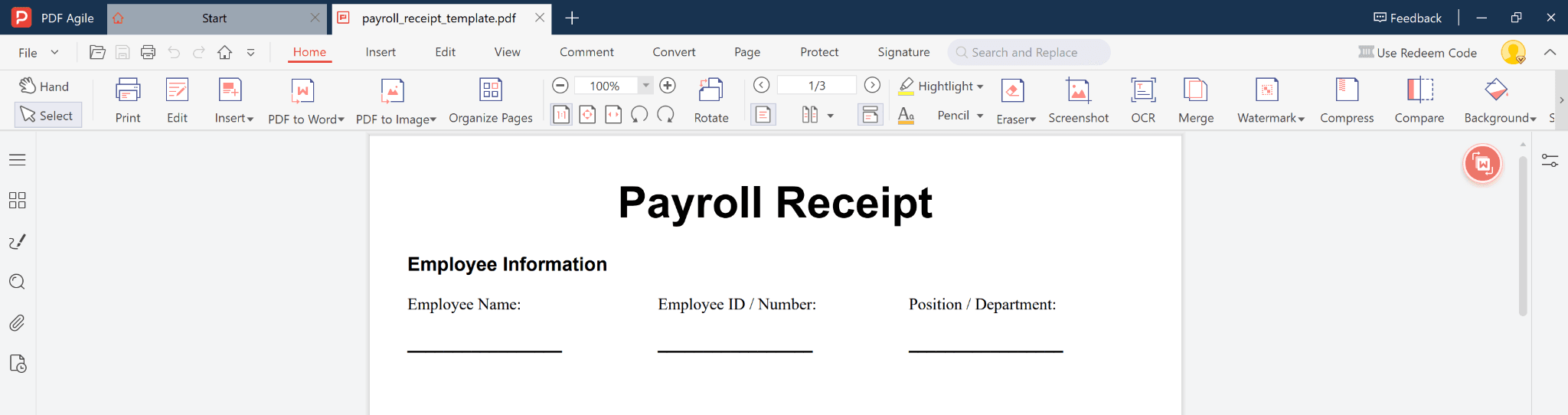

a. Employee Information

Capture essential details such as Employee Name, ID/Number, Position, and Department. This ensures every record is traceable to the correct staff member.

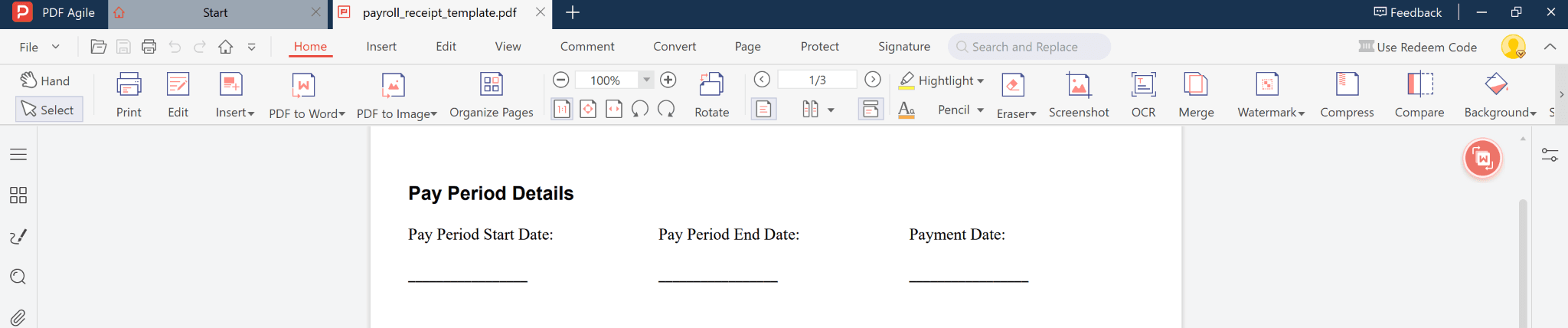

b. Pay Period Details

Define the payroll period (Start Date, End Date, and Payment Date). This section marks the exact timeframe for which the employee is being compensated.

c. Earnings

Break down all sources of income, typically including:

- Regular Pay

- Overtime Pay

- Holiday Pay

- Bonuses or Incentives

- Other Earnings

The Total Gross Pay reflects the amount before any deductions are applied.

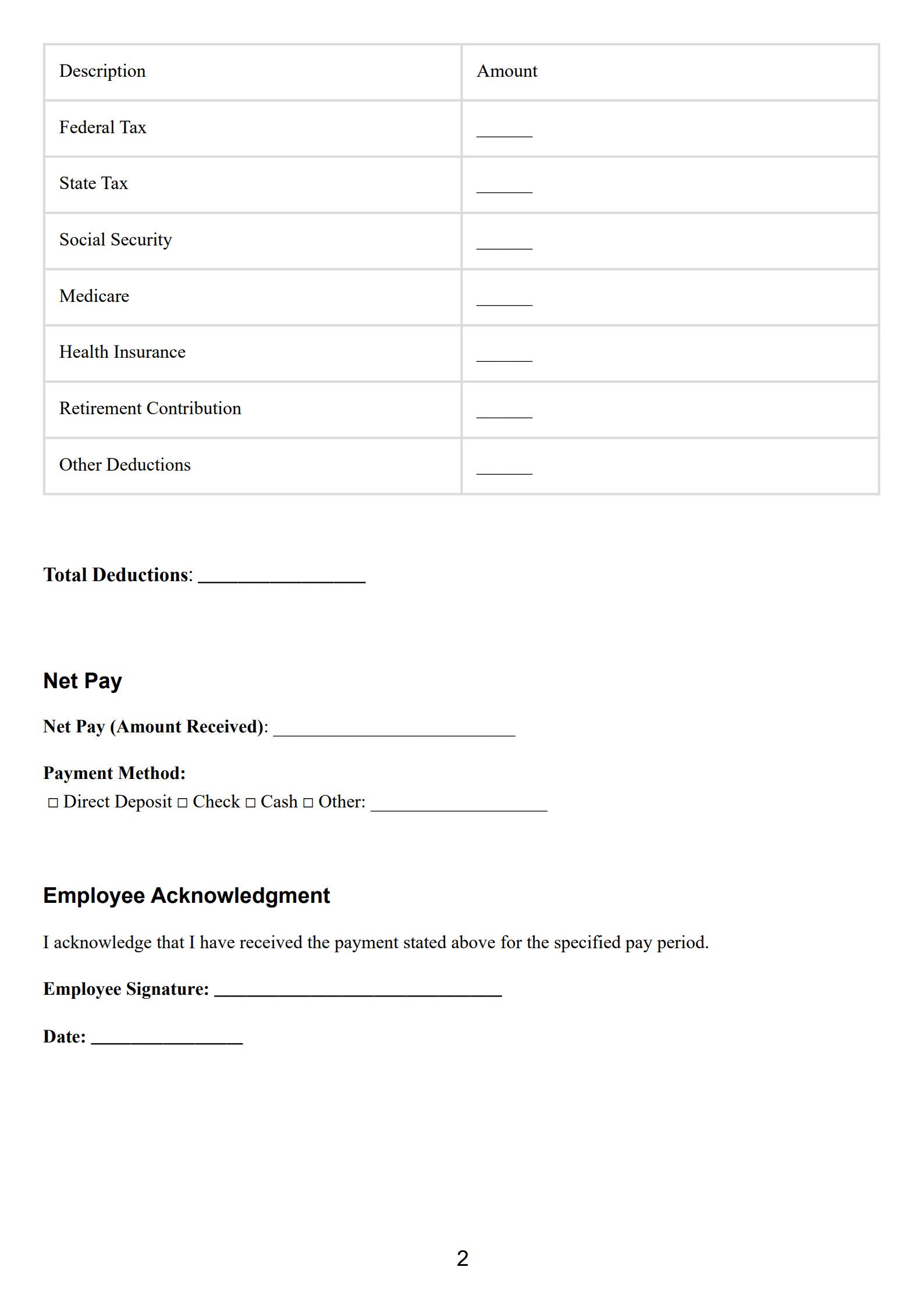

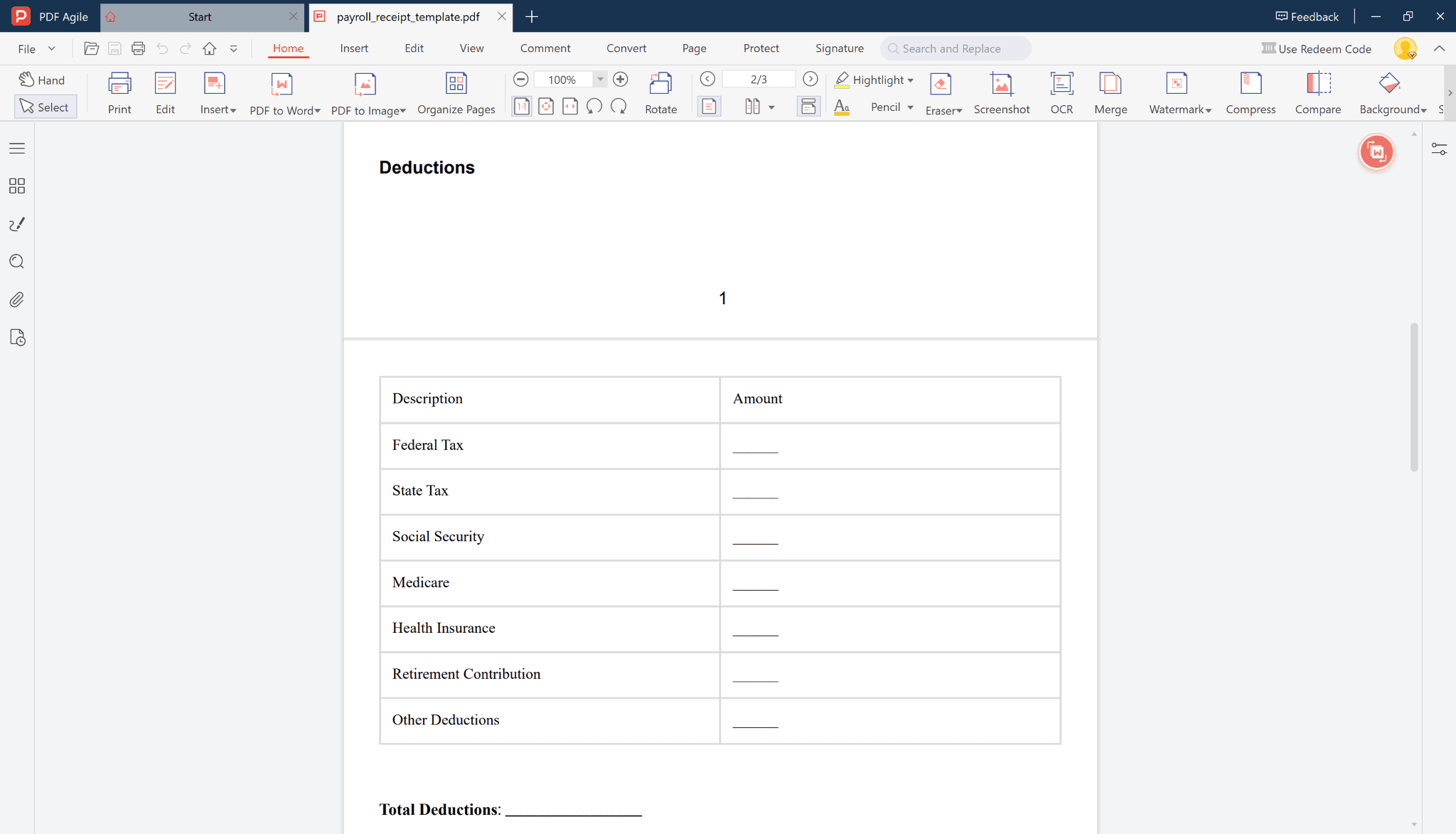

d. Deductions

Clearly itemize all withholdings such as:

- Federal and State Taxes

- Social Security

- Medicare

- Health Insurance

- Retirement Contributions

- Other Deductions

The Total Deductions field ensures transparency about where each dollar goes.

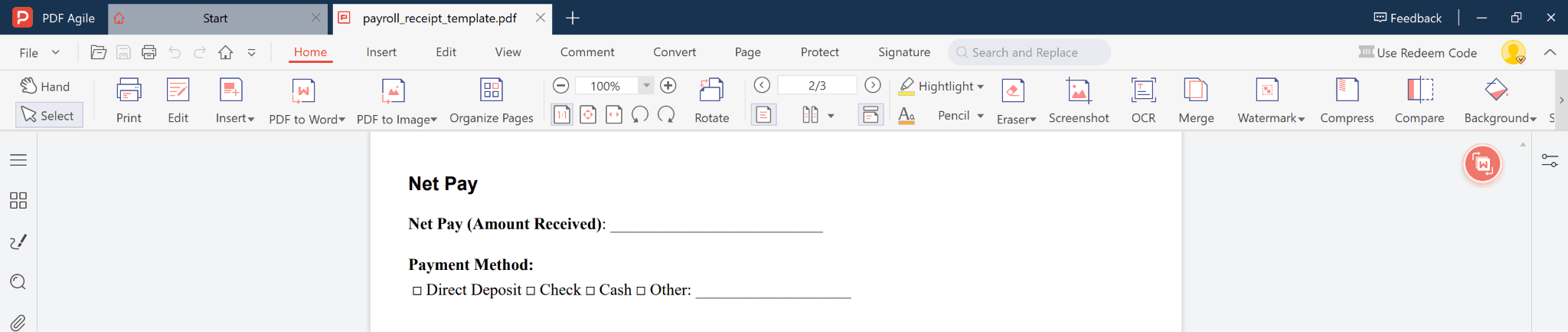

e. Net Pay

This section shows the final take-home pay after deductions, along with the payment method — whether by Direct Deposit, Check, or Cash.

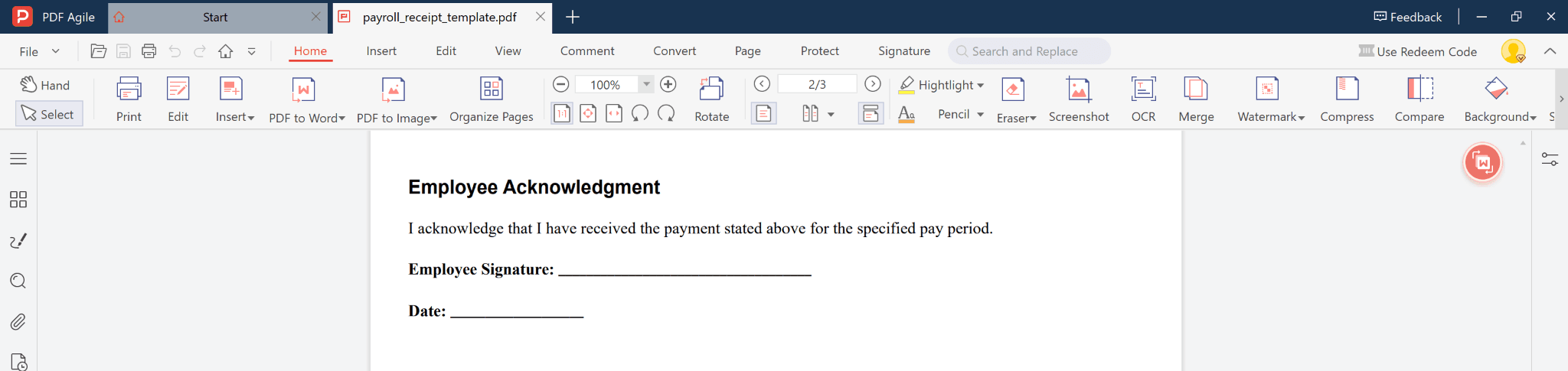

f. Employee Acknowledgment

A space for the employee’s signature and date confirms receipt and agreement with the payment details provided. This helps maintain accountability and mutual trust.

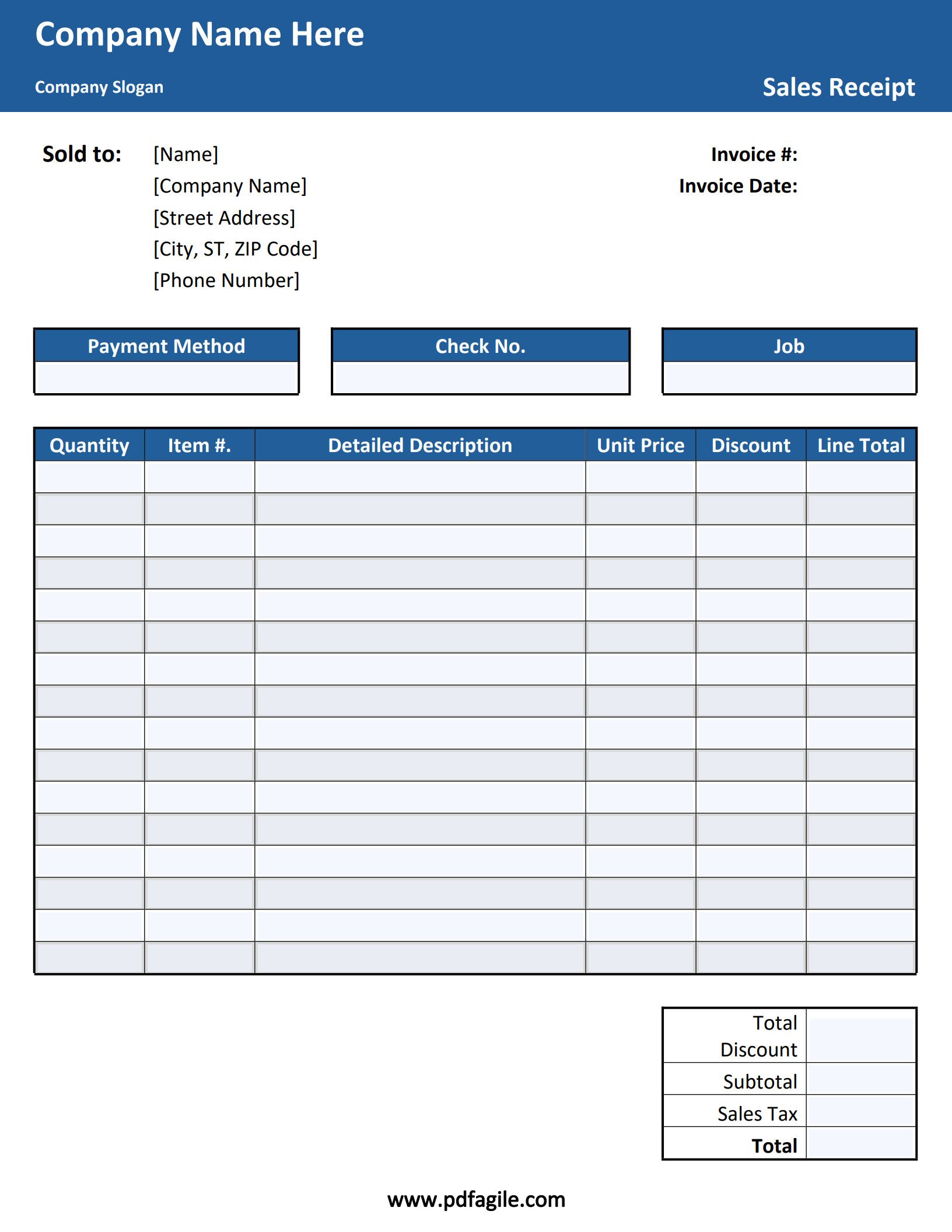

4. How to Use the Free Editable Payroll Receipt Template

You can easily customize this payroll receipt using PDF Agile, a flexible PDF editing software. Follow these steps:

- Download the free fillable Payroll Receipt template.Open it in PDF Agile.

- Enter details for the employee, pay period, and payment breakdown.Double‑check calculations: ensure Total Gross Pay – Total Deductions = Net Pay.

- Review and sign electronically if needed.

- Save or print the completed file for distribution or HR records.

Tip: Save each version with a clear naming format, such as: PayrollReceipt_EmployeeName_Month_Year.pdf

5. Best Practices for Payroll Documentation

To keep your payroll process efficient and compliant, consider the following best practices:

- Maintain digital and printed backups for each pay period.

- Verify tax and benefit deductions before finalizing payments.

- Update and store payroll versions securely to protect confidential data.

- Include signatures from both payroll representatives and employees for validity.

- Audit payroll receipts periodically to ensure consistency with reported hours and rates.

By implementing these measures, your payroll process stays legally compliant, error‑free, and transparent.

6. Common Payroll Receipt Mistakes to Avoid

Even experienced employers can make these avoidable mistakes:

- Using vague or missing descriptions (e.g., “Other Deductions” without details)

- Forgetting employee acknowledgment signatures

- Failing to update pay periods or version numbers

- Not keeping digital backups

Avoid these pitfalls to keep payroll documentation consistent and verifiable.

Conclusion

A detailed payroll receipt is more than just a pay stub — it’s a legal, financial, and operational tool that supports accountability and transparency in every organization.

By using PDF Agile’s free editable Payroll Receipt Template, you can quickly generate accurate, compliant, and printable pay records with zero formatting hassle. Start today, and make your payroll process smoother, faster, and more professional.