A pay stub, often referred to as a payslip or earnings statement, is more than just a piece of paper; it's a critical financial document for every employee. It provides a detailed, transparent breakdown of your gross earnings, itemized deductions, and ultimately, your net pay for a specific work period. For employers, pay stubs ensure compliance with labor laws and accurate record-keeping. For employees, they offer clarity into their compensation, facilitate financial planning, and serve as verifiable proof of income for everything from loan applications to rental agreements. Understanding your pay stub is key to managing your personal finances effectively.

What Exactly is a Pay Stub?

A pay stub is a document issued by an employer to an employee, typically at the end of each pay period, detailing the components of their wages. It comprehensively lists:

- Gross Pay: Your total earnings before any deductions are taken out. This includes your regular wages, overtime pay, bonuses, commissions, and any other forms of compensation.

- Deductions: Amounts subtracted from your gross pay. These can be mandatory (like federal, state, and local income taxes, Social Security, and Medicare) or voluntary (such as health insurance premiums, 401(k) contributions, or union dues).

- Net Pay (Take-Home Pay): The amount of money you actually receive after all deductions have been subtracted from your gross pay.

Beyond these core components, pay stubs often include employer contributions to benefits (like health insurance or retirement plans), year-to-date (YTD) totals for earnings and deductions, and information on accrued leave balances (like Paid Time Off or sick leave).

What are the Differences between Pay Stub and Similar Financial Documents

While a pay stub provides a snapshot of your earnings and deductions, it's often confused with other financial documents. Understanding the distinctions is important:

Pay Stub vs. W-2 Form:

- A pay stub is issued every pay period and shows details for that specific period, along with YTD totals. It's a running record.

- A W-2 Form is an annual tax document issued by an employer at the end of the calendar year (by January 31st) that reports an employee's annual wages and the amount of taxes withheld for the entire year to the IRS. It's solely for tax purposes.

Pay Stub vs. Bank Statement:

- A pay stub details how your pay was calculated from gross to net, including all deductions. It explains the "why" behind the amount deposited.

- A bank statement shows the transactions in your bank account, including the net pay amount that was deposited. It confirms the "what" (amount received) but doesn't detail the breakdown of earnings and deductions.

Pay Stub vs. 1099 Form:

- A pay stub is provided to employees (W-2 earners) who have taxes withheld by their employer.

- A 1099 Form (specifically 1099-NEC for non-employee compensation) is issued to independent contractors or freelancers. It reports gross payments made to them, but no taxes are withheld by the payer. Contractors are responsible for their own taxes.

Glossary of Professional Expressions in Pay Stub

Navigating a pay stub template becomes easier with an understanding of common terms:

Gross Pay: Total earnings before any taxes or deductions.

Net Pay: The "take-home" amount after all deductions.

Deductions: Amounts subtracted from gross pay.

Withholding: The portion of an employee's wages that an employer deducts and pays directly to the government on the employee's behalf to cover tax liabilities.

Federal Income Tax (FIT): Tax levied by the U.S. federal government on individual income.

State Income Tax (SIT): Tax levied by individual states on income (not all states have it).

Local Income Tax: Tax levied by a city, county, or other local government.

FICA: Federal Insurance Contributions Act. This includes Social Security and Medicare taxes.

Social Security (SS or OASDI): Federal program that provides retirement, disability, and survivor benefits.

Medicare (Med): Federal health insurance program primarily for people aged 65 or older.

401(k) Contribution: Money deducted from gross pay and invested in an employee's retirement account. Can be pre-tax or post-tax (Roth).

Health Insurance Premium: The amount paid for health insurance coverage.

FSA (Flexible Spending Account) / HSA (Health Savings Account): Tax-advantaged savings accounts used for healthcare expenses.

YTD (Year-to-Date): Cumulative totals from the beginning of the calendar year up to the current pay period.

PTO (Paid Time Off): A combined pool of vacation, sick, and personal days.

Accrued: The amount of leave time earned.

Used: The amount of leave time taken.

Balance: The remaining amount of leave time available.

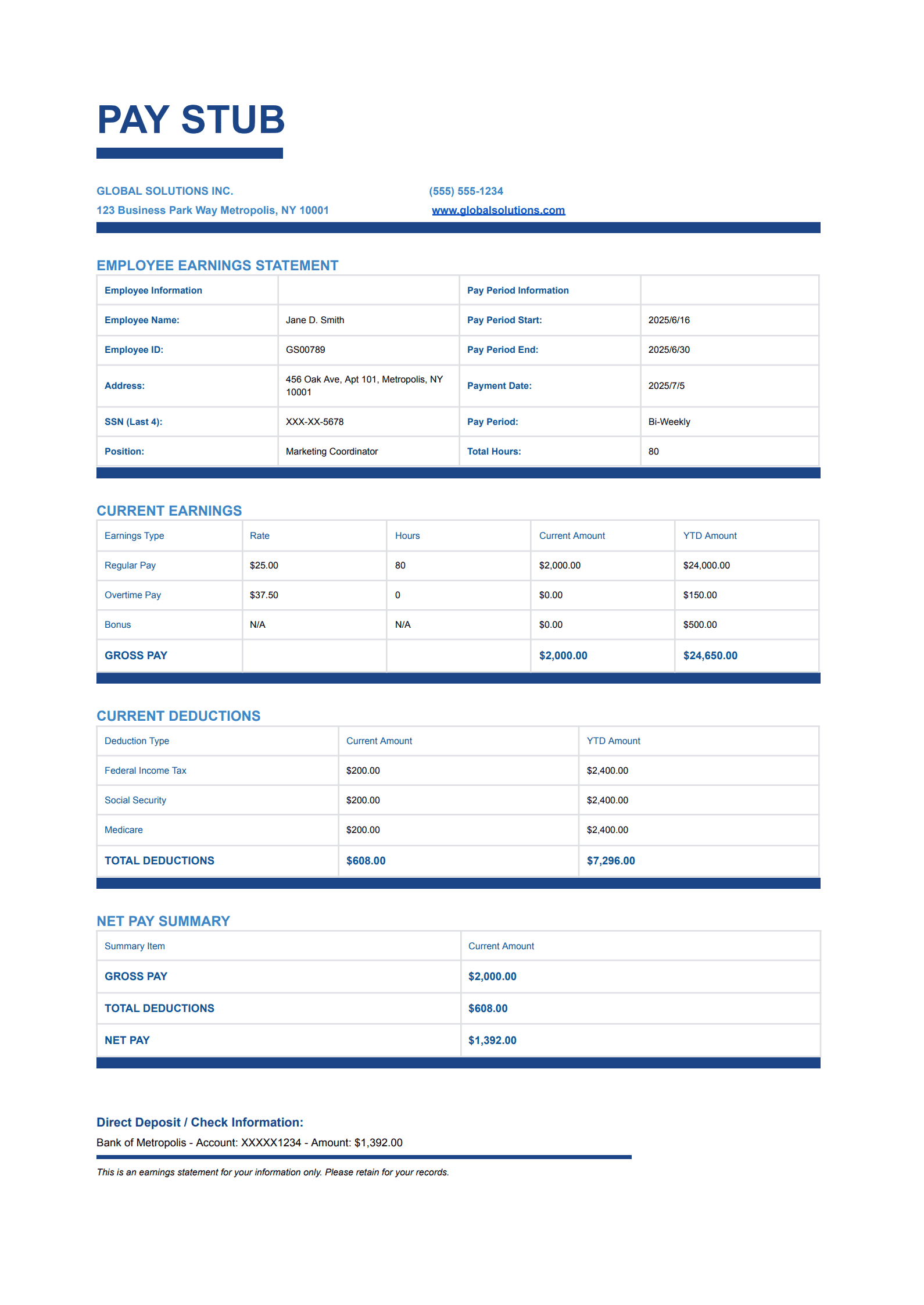

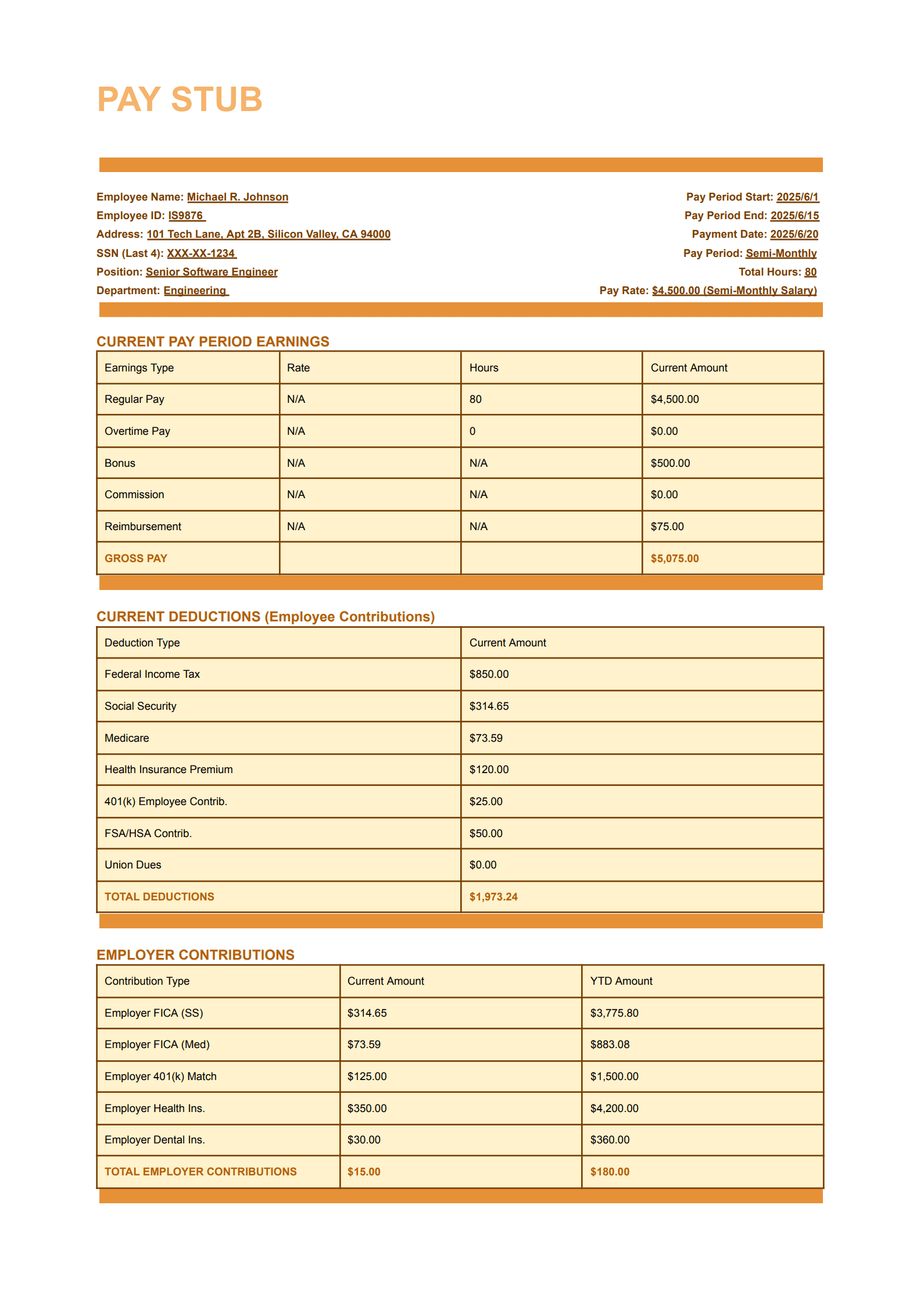

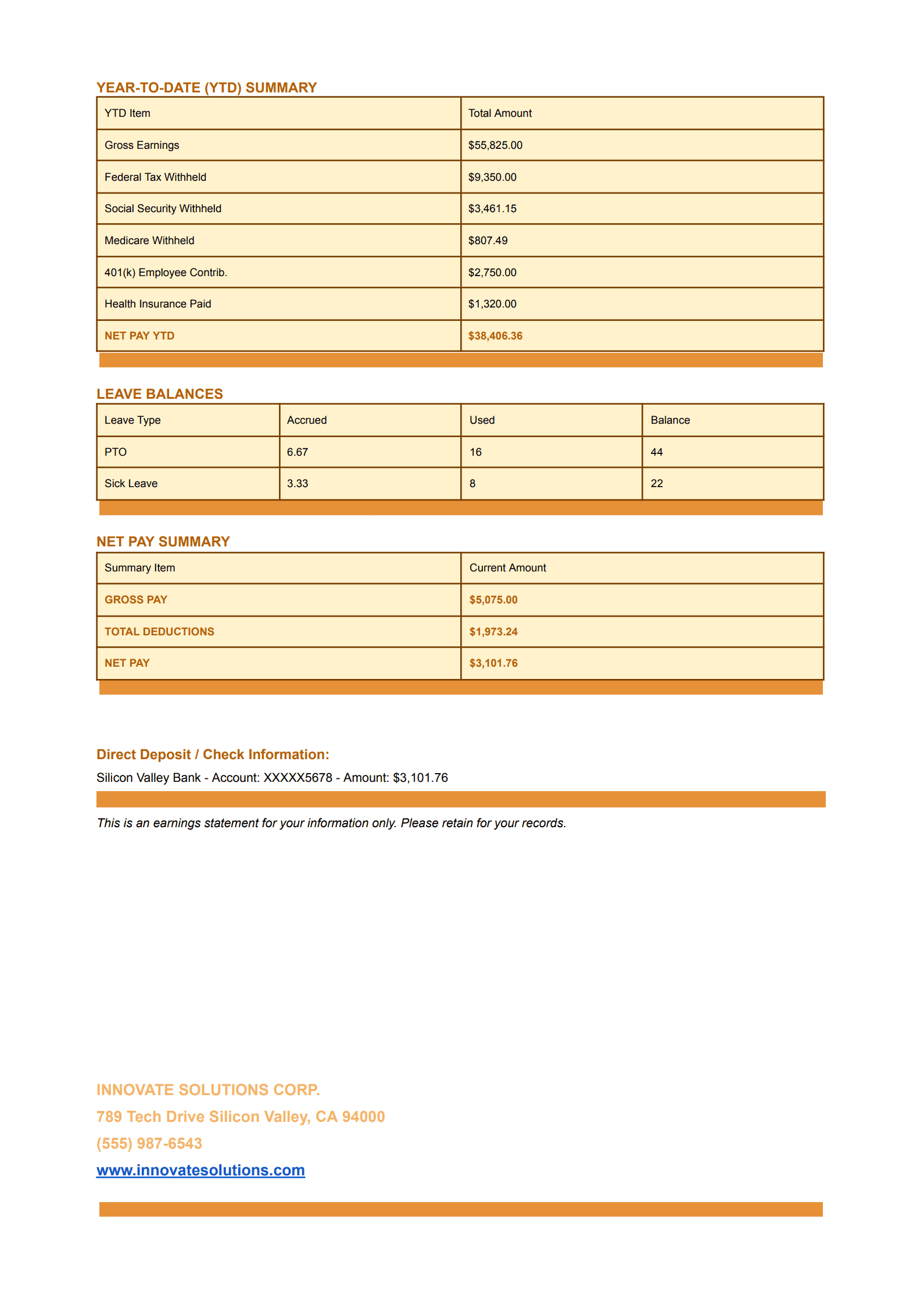

Samples of Pay Stub for Your Better Understanding

Here are real-world examples, bringing our Pay Stub Templates to life. Jane, a diligent marketing coordinator, reviewing her bi-weekly pay stub to ensure her deductions are correct for tax season. Or Michael, a senior software engineer, meticulously examining his detailed earnings statement, understanding how his 401(k) contributions and company benefits add up. These examples illustrate the precision and transparency our templates offer, helping you navigate your financial landscape with confidence, just like Jane and Michael.

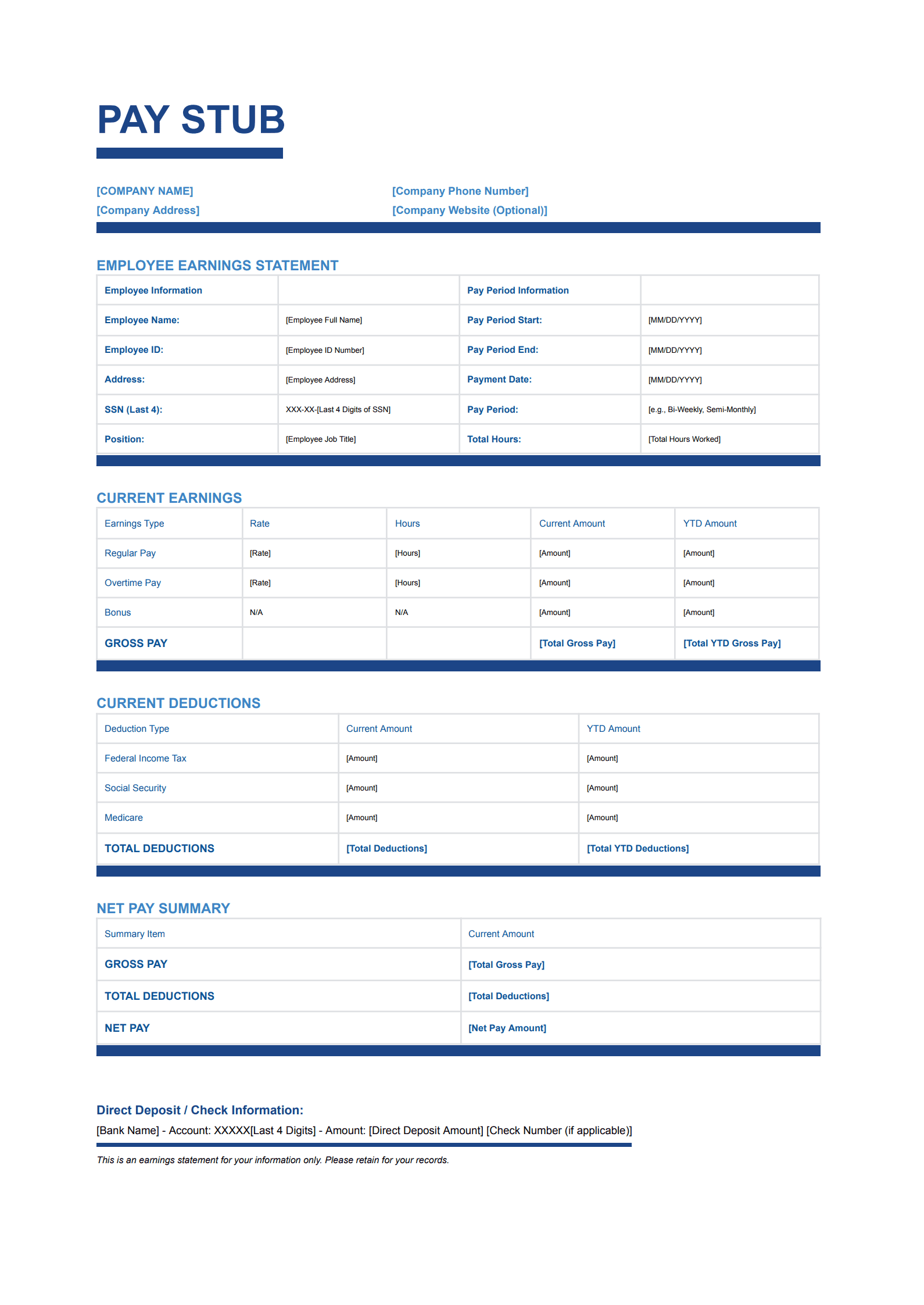

Type 1: Standard Employee Pay Stub Template

This template is designed for a clear and concise overview of an employee's gross pay, deductions, and net pay for a given period.

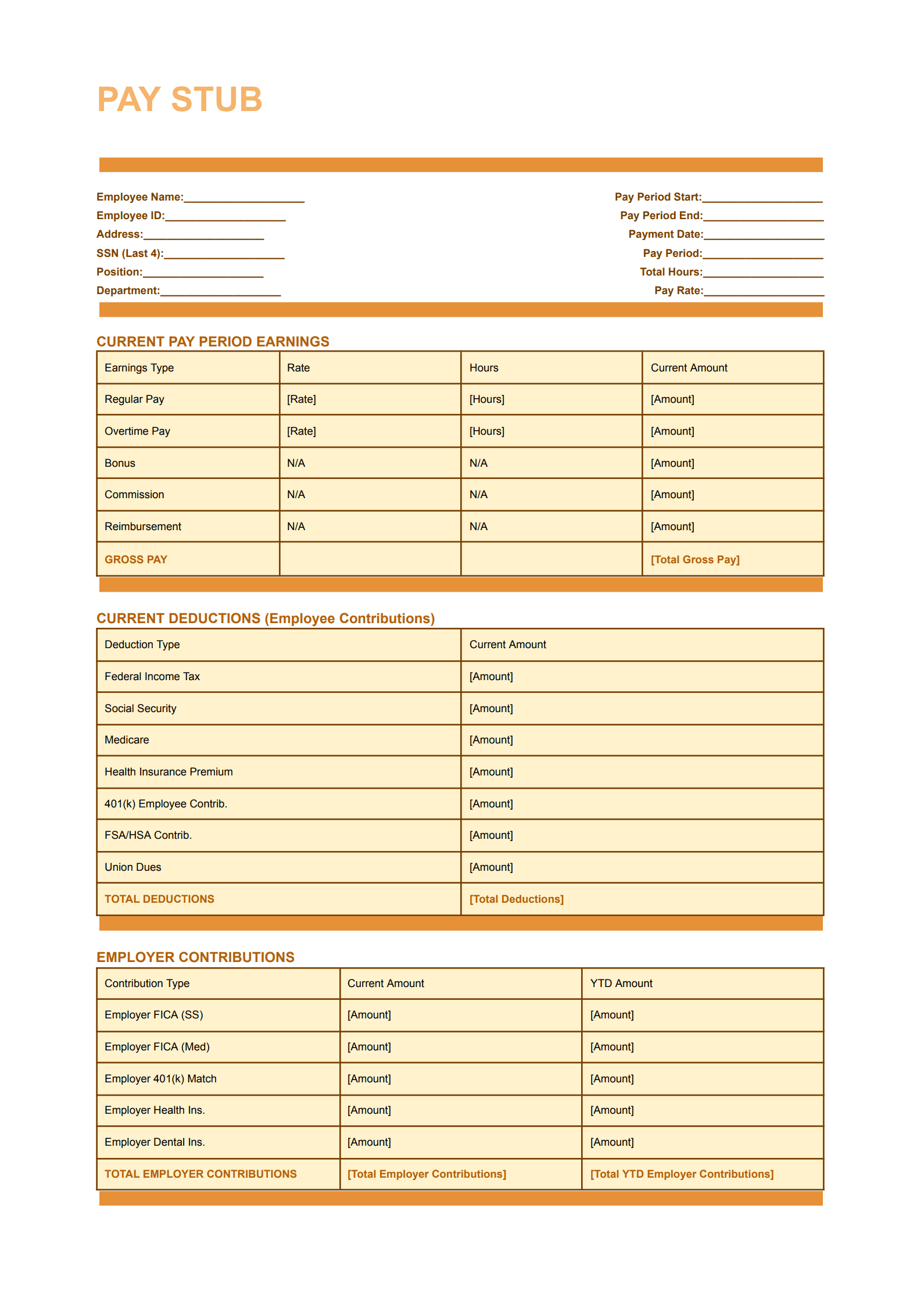

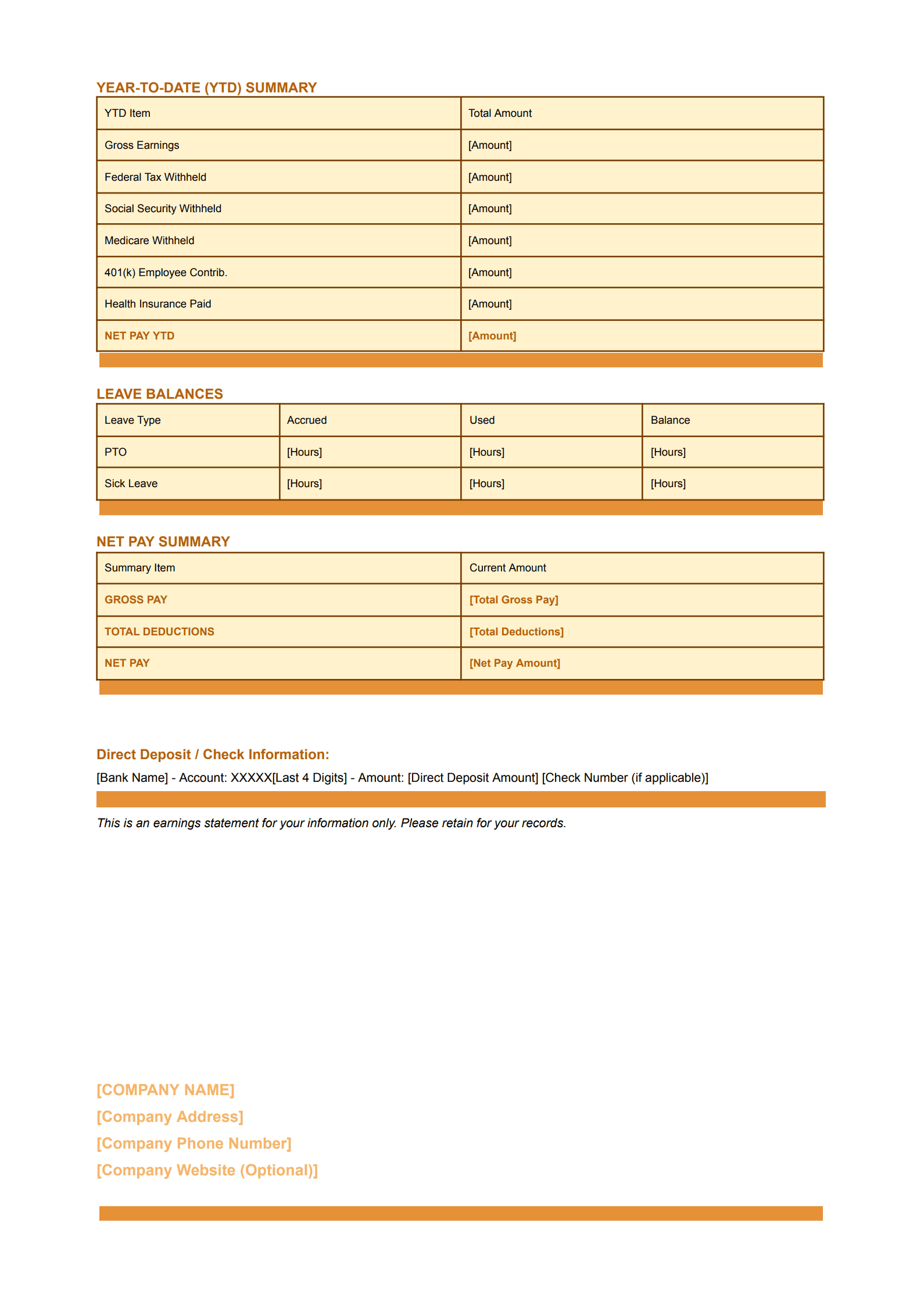

Type 2: Detailed Employee Pay Stub Template (with Benefits & YTD Summary)

This template offers a more comprehensive view, including employer contributions, detailed benefit breakdowns, and possibly leave balances, providing a richer financial overview.

FAQs About Pay Stubs

Q1: Why do I need to keep my pay stubs?

A1: Pay stubs are vital for several reasons: proof of income for loans or rentals, verification of correct pay and deductions, tracking accrued leave, and reconciling your annual W-2 form for tax purposes. They are your official record of earnings.

Q2: Can I use a pay stub as proof of employment?

A2: Yes, pay stubs are widely accepted as proof of employment and income, particularly for securing loans, renting an apartment, or verifying your financial standing. Lenders and landlords often request multiple recent pay stubs to assess your stable income.

Q3: Are employers legally required to provide pay stubs?

A3: In the United States, most states require employers to provide pay stubs or some form of wage statement. The specific requirements (e.g., paper vs. electronic, what information must be included) vary by state. Always check your local labor laws.

Free Download: Printable Pay Stub Templates

You can download the Pay Stub Templates mentioned above by clicking Use Template button on this page. Customize it to fit your specific needs and preferences.