For businesses, contractors, and freelancers, the Certificate of Liability Insurance (COI) is an indispensable tool. It serves as quick, reliable proof that an individual or company carries the necessary insurance coverage to protect against financial risks arising from their operations.

This guide defines the COI, explains its importance in contracting, and outlines how to understand and utilize standardized templates.

1. What is the Liability Insurance Certificate?

A Certificate of Liability Insurance (COI) is a standardized document issued by an insurance broker or agent on behalf of the insured policyholder. It is a formal summary that provides evidence of an active insurance policy at a glance.

Crucially, a COI is not the insurance policy itself; it is only a snapshot of the policy. It proves that the policyholder (the Insured) has coverage in place on the date the certificate was issued.

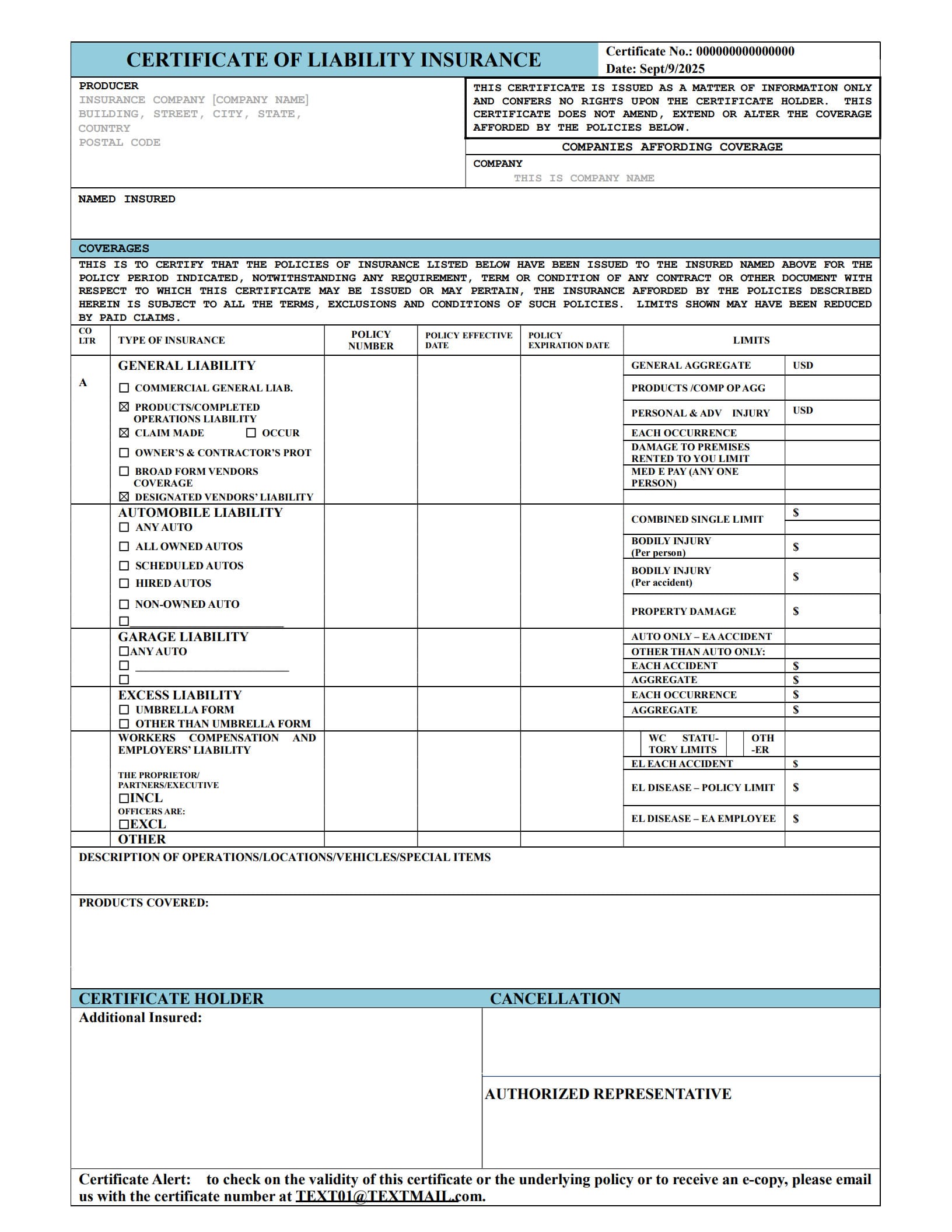

The most common standardized COI form used in the United States and Canada is the ACORD form. Using a standard ACORD template ensures that the document is instantly recognizable and contains all the necessary legal and financial data required by clients, lenders, or governmental agencies.

2. Why is Liability Insurance Certificate Important?

The COI is fundamental to managing business relationships and fulfilling contractual obligations, primarily due to risk transfer and compliance:

- Risk Mitigation (The Client’s View): When a client hires a contractor, they need assurance that if the contractor accidentally causes injury or property damage, the financial liability will be handled by the contractor's insurance, not the client themselves. The COI provides this proof.

- Contract Compliance: Most formal contracts (e.g., construction, services, rental agreements) require the service provider to maintain a minimum level of liability coverage and to present a valid COI before work begins.

- Legal Protection: For the policyholder, providing a COI demonstrates due diligence. For the client, requiring a COI is a mandatory part of protecting their assets and avoiding costly lawsuits.

- Verification of Coverage: It allows third parties (like building managers or clients) to quickly verify key policy details: who is insured, what coverage they have, the policy limits, and the effective dates.

3. How to Create a Certificate of Liability Insurance with Templates?

COIs are not created by filling out a blank template; they are generated and issued exclusively by the policyholder’s insurance agent or broker. The process for "creating" one involves the agent populating a standard form (like an ACORD template) with the policy data.

3.1 Learn from Liability Insurance Certificate Sample

Understanding the key fields of a COI is essential for verifying coverage. When reviewing a COI provided by a contractor, you should check the following sections:

| COI Section | Purpose | What to Verify |

| Producer | The contact information of the insurance agency that issued the certificate. | That the producer is a licensed agent. |

| Insured | The name and address of the business/person carrying the policy. | That this matches the party you hired. |

| Policy Dates | Effective and Expiration dates. | That the policy is currently active. |

| Limits | The maximum amount the policy will pay out. | That the limit meets the minimum required by your contract (e.g., $1,000,000). |

| Description of Operations | Briefly explains the work being done. | That the policy covers the scope of work (e.g., "Roofing work at 123 Main St."). |

| Certificate Holder | The entity requesting the COI (i.e., the client). | Ensure your own name/company name is accurately listed here. |

3.2 Customize with General Liability Insurance Certificate Template

You cannot customize the insurance data yourself, but you customize the request sent to your agent. When using a general liability insurance certificate template (the standard ACORD form), your agent will fill in:

- Your Policy Details: The policy number, effective dates, and limits for General Liability, Auto Liability, Workers' Compensation, etc.

- The Certificate Holder’s Details: The name and address of the party requiring the proof.

- Special Conditions: If your contract requires the client to be named as an "Additional Insured," this must be noted in the form's "Description of Operations" box or attached as an endorsement, and your agent must ensure this is reflected.

Key Action: When you need a COI, send your insurance agent the full legal name and address of the party who needs to be the Certificate Holder and confirm the required liability limits.

Free Download: Printable Certificate of Liability Insurance Template

You can download the certificate of liability insurance template mentioned above by clicking the “Use Template” button on this page. Customize it to fit your specific needs and preferences.

4. Conclusion

The Certificate of Liability Insurance is a fundamental document in business operations, acting as a quick verification tool for risk management. While the document itself must be generated by a licensed insurance professional, understanding its structure—particularly the limits, dates, and the role of the Certificate Holder—is essential for fulfilling contractual obligations and protecting your business interests.

5. FAQs about Certificate of Liability Insurance Template

5.1 What does liability insurance cover?

General Liability Insurance (often called Commercial General Liability or CGL) covers third-party claims of bodily injury and property damage resulting from your business operations, products, or premises.

- Example: A contractor accidentally drops a ladder, damaging the client's fence (property damage) or injuring a passerby (bodily injury). The CGL policy covers the resulting legal and settlement costs, up to the policy limit.

5.2 Who needs public liability insurance?

Public liability insurance (a common term outside the U.S. for CGL) is needed by virtually any business that interacts with the public or operates on someone else's property.

This includes:

- Contractors and sub-contractors (plumbers, electricians, roofers, painters).

- Retail businesses and restaurants (protecting against slip-and-fall incidents).

- Service professionals (consultants, IT repair services) whose work might unintentionally cause harm.

5.3 What is the limit of liability insurance?

The limit of liability is the maximum amount of money the insurance company will pay out during the policy period for a covered claim. COIs typically show two types of limits:

- Per Occurrence Limit: The maximum the policy will pay for any single incident.

- General Aggregate Limit: The maximum the policy will pay out for all covered losses over the policy year.

Common limits are $1,000,000 per occurrence and $2,000,000 in general aggregate.

5.4 What is the minimum requirement for liability insurance?

The minimum requirement for liability insurance is usually determined by the client or contract requiring the COI, not by a universal law.

- Standard Business-to-Business: Most large clients (e.g., property management firms, government agencies) typically mandate a minimum of $1,000,000 per occurrence.

- State Regulations: Some states mandate minimum CGL limits only for specific licensed trades or professions.

Always check the insurance clause in your contract before requesting a COI, as the minimum required limit must match the figures shown on the certificate.