In today's fast-paced financial landscape, the need for flexible yet secure payment solutions is more critical than ever. Whether for personal financial management, small business operations, or specific transactional needs, understanding and utilizing a blank check template can significantly streamline your processes and enhance financial control. This comprehensive guide will delve into the world of blank check templates, explaining their utility, differentiating them from other financial instruments, and providing practical advice on their use.

What is a Blank Check?

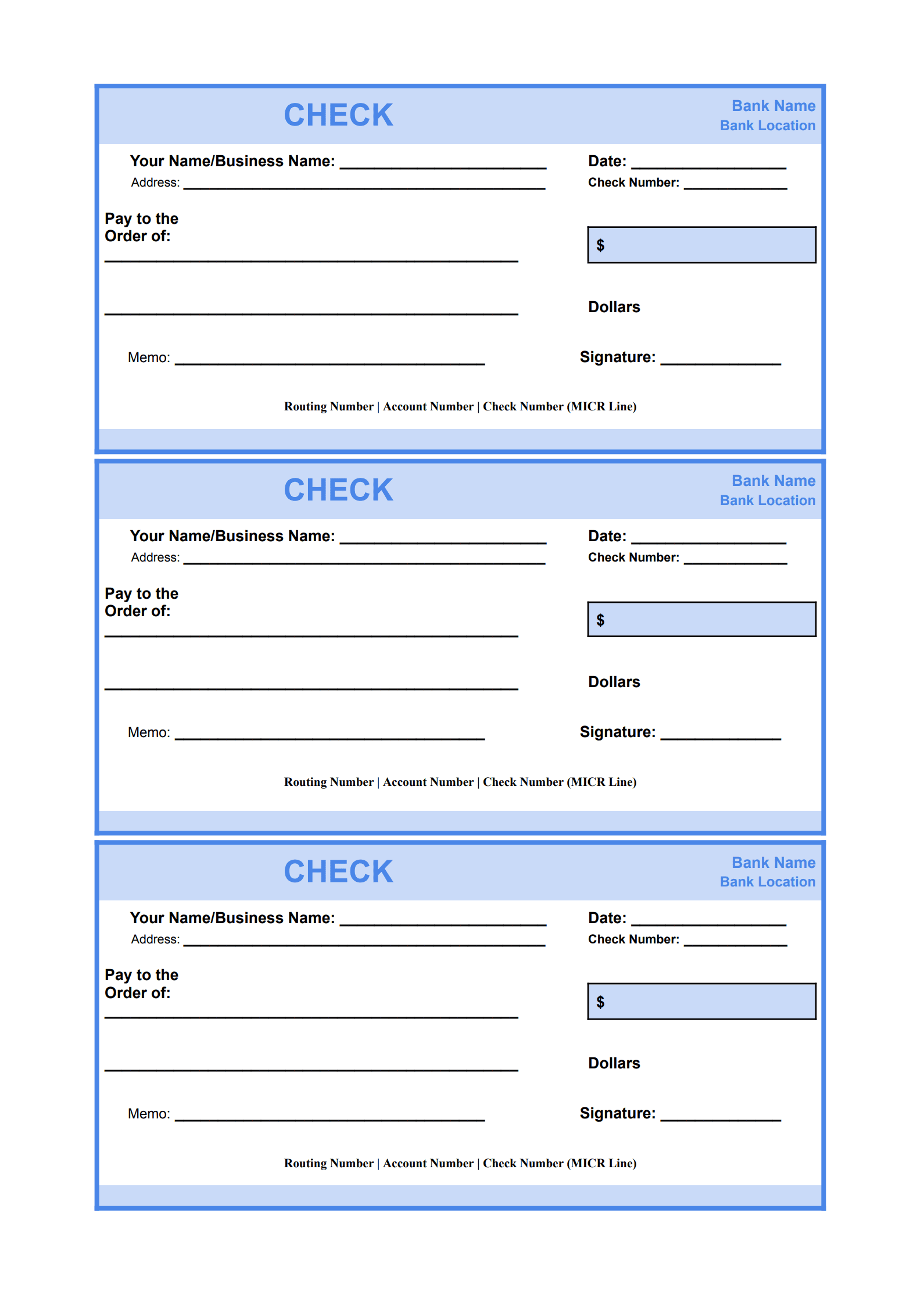

In its most direct sense, a blank check is a physical check that has been signed by the account holder but has the payee's name, the date, and the monetary amount left unfilled. This allows the person receiving the check to complete these details. While offering immense flexibility, this practice carries significant risks as the recipient could theoretically fill in any amount. As for its function, blank checks serve as a blueprint for creating legally valid checks.

Distinguishing Checks from Similar Financial Instruments

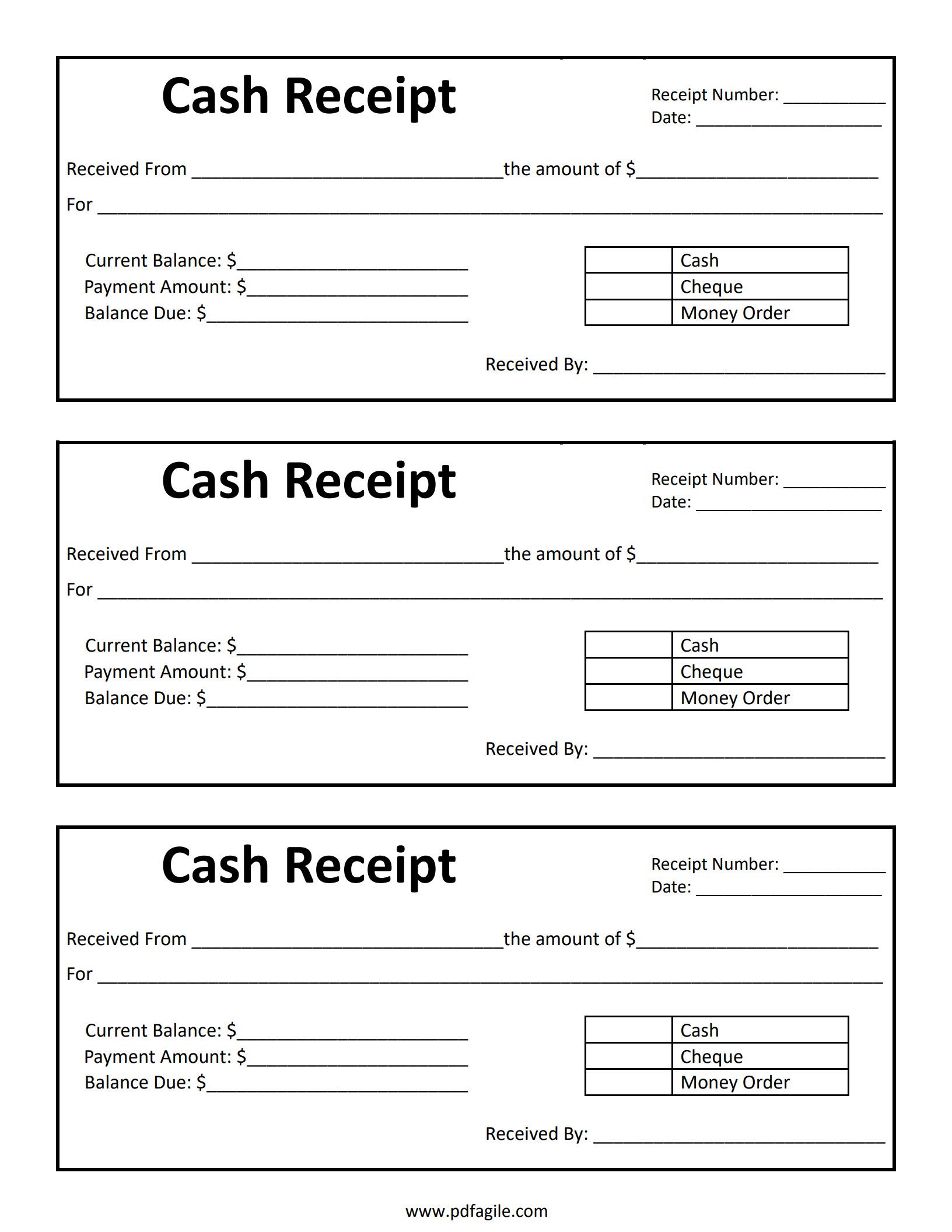

Understanding the nuances between different payment methods is crucial for making informed financial decisions. While checks, money orders, and cashier's checks all facilitate payments, they differ significantly in their issuance, security, and typical use cases.

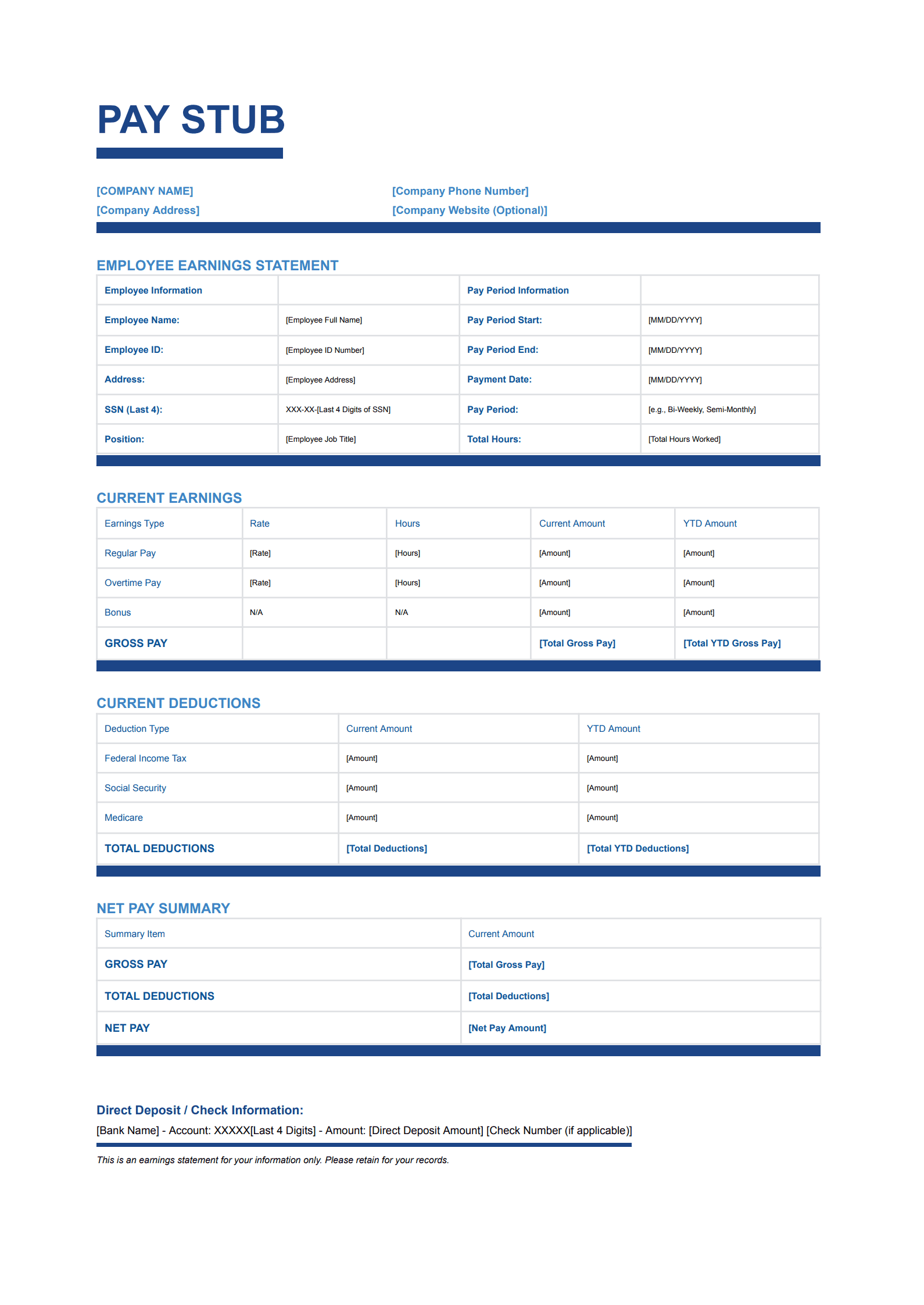

1. Personal Check (or Business Check): This is the most common form of check, drawn directly against an individual's or business's checking account. The payer writes the check, and funds are withdrawn from their account once the check is deposited and cleared. Its security relies on the payer having sufficient funds.

2. Money Order: A prepaid financial instrument that functions similarly to a check but is purchased for a specific amount. Money orders are often used by individuals who may not have a bank account or prefer not to use personal checks. They are typically available for smaller amounts (often capped around $1,000) and can be purchased at various locations like post offices, grocery stores, and retail outlets for a small fee. They offer more security than cash as they are pre-paid and can be tracked.

3. Cashier's Check: Issued and guaranteed by a bank, a cashier's check is drawn against the bank's own funds, not the payer's personal account. The bank effectively "certifies" that the funds are available. This makes cashier's checks highly secure and preferred for large transactions, such as real estate purchases or vehicle payments, as the recipient is guaranteed payment. They typically involve higher fees than money orders and are only obtainable from a bank or credit union.

4. Certified Check: Similar to a cashier's check, a certified check is a personal check from your account that the bank guarantees. The bank verifies that sufficient funds are in your account to cover the check and typically sets aside those funds, stamping the check as "certified." While secure, it differs from a cashier's check in that the funds are still drawn from your account, not the bank's.

Some Professional Expressions You Need to Know about Checks

Drawer: The person or entity who writes and signs the check.

Payee: The person or entity to whom the check is made out and who will receive the funds.

Drawee: The bank or financial institution on which the check is drawn (the bank that will pay the funds).

Routing Number: A nine-digit number that identifies the financial institution on which a check is drawn. It's crucial for directing payments to the correct bank.

Account Number: The specific account number at the financial institution from which the funds will be withdrawn.

MICR Line: (Magnetic Ink Character Recognition) A line of special characters at the bottom of a check, printed in magnetic ink, that includes the routing number, account number, and check number. This allows for automated processing by banks.

Endorsement: The signature or stamp on the back of a check by the payee, transferring ownership of the funds or authorizing deposit.

Clearing: The process by which funds are transferred from the drawer's account to the payee's account, usually involving multiple banks.

Bounced Check (Insufficient Funds): A check that cannot be honored by the drawee bank because there are not enough funds in the drawer's account to cover the amount.

Different Usages of Blank Check Template

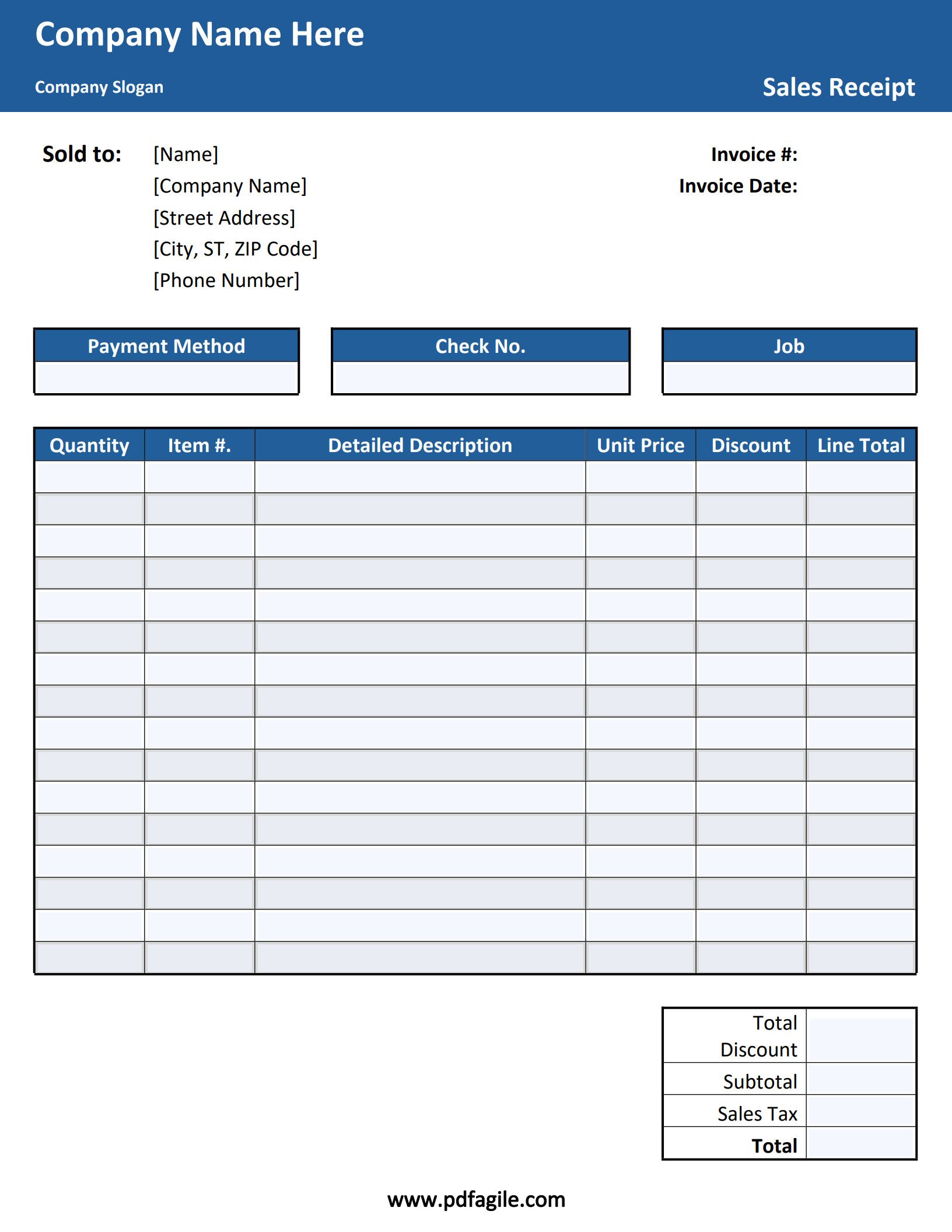

While the underlying format remains consistent, blank check templates are often customized for specific usage scenarios to enhance professionalism and organization.

Personal Check: it can be used for individual expenses, paying bills, or transferring funds between personal accounts. A clean, straightforward design with ample space for handwritten details. It would feature an individual's name and address prominently.

Business Check: it can also be used for business expenditures, payroll, vendor payments, or client refunds. Often includes the company logo, specific branding elements, and dedicated sections for invoice numbers or department codes in the memo line. The design would be professional and often more compact for bulk printing.

Frequently Asked Questions

Q1: Is it safe to use a blank check template?

A1: Using a blank check template to print your own checks is generally safe, provided you use secure software, quality check stock, and maintain strict control over the blank paper and printed checks. However, physically signing a check and leaving the amount and payee blank (a literal "blank check") is highly risky and strongly discouraged due to potential for fraud.

Q2: Can I print checks on regular paper using a template?

A2: While technically possible, it is not recommended for official use. Banks use Magnetic Ink Character Recognition (MICR) technology to process checks. To be fully legitimate and easily processed, checks should be printed on specialized check paper with security features and MICR ink for the routing and account numbers.

Q3: What are the benefits of using a blank check template?

A3: Key benefits include cost savings (compared to ordering pre-printed checks), increased flexibility and customization, improved efficiency in check writing (especially for businesses), and better control over your check stock.

Q4: Do I need special software to use a blank check template?

A4: While some templates can be edited with basic word processing software, PDF editors like PDF Agile often provide more advanced features, security options, and easier integration with accounting systems.

Free Download: Your Customizable Blank Check Template

Need a quick and easy way to create a professional Blank Check Template? Download our free, customizable template by clicking the Use Template button on this page. Simply add your specific information and print them out.