Tax forms like the 1098 and 1099 often seem complicated, turning tax season into a headache. Deciphering tax paperwork can feel overwhelming, but accuracy is crucial. Mistakes, such as leaving out information or entering incorrect numbers, can lead to penalties and delays in receiving your tax refund.

The Form 1098 primarily reports information about mortgage interest payments. It details the amount of interest paid throughout the year, as well as potentially deductible points and mortgage insurance premiums. The government uses Form 1099 to track various types of income outside of traditional employment, such as freelance earnings, dividends, and income from side businesses. Knowing the difference between these forms is essential for accurate tax reporting.

Key Differences Between Form 1098 and Form 1099

While the names are similar, Form 1098 and Form 1099 serve distinct purposes in your tax return. Understanding these differences is key to proper tax filing.

1. Purpose and Function

Form 1098: This form provides specific details about mortgage interest payments you've made. If you paid $600 or more in mortgage interest during the past year, you should receive Form 1098. This form outlines the total interest paid and may also include information about deductible points and mortgage insurance premiums, which can reduce your taxable income.

Form 1099: This is a series of forms used to report various types of income other than standard wages. For example, Form 1099-NEC reports payments to independent contractors, Form 1099-INT reports interest income, and Form 1099-DIV reports dividend income. If you earned non-employee compensation, interest, dividends, or other miscellaneous income, you will likely receive one or more of these forms.

2. Who Issues Them

Form 1098: You will receive Form 1098 directly from your mortgage lender, which could be a bank, credit union, or other financial institution. This form is typically sent out by the end of January following the tax year.

Form 1099: The issuer of Form 1099 depends on the specific type of income. If a business paid you as an independent contractor, they will send you Form 1099-NEC and also report this payment to the IRS. Brokerage firms issue Form 1099-DIV to individuals who received dividends. Your bank will provide Form 1099-INT if you earned interest. Generally, anyone who paid you a certain amount of money (typically $600 or more for many types of income) that is not considered wages must report this to you and the IRS using a 1099 form.

3. What Information You’ll See

Form 1098: The total mortgage interest you paid during the year is reported in Box 1 of Form 1098. Additionally, Box 2 should show any points you paid on the mortgage, and Box 5 typically contains the amount you paid in mortgage insurance premiums.

Form 1099: Each type of 1099 form has different boxes relevant to the income being reported. On Form 1099-NEC, nonemployee compensation is in Box 1. For Form 1099-INT, interest income is in Box 1, and any early withdrawal penalties may be reported in Box 2.

Understanding that Form 1098 primarily deals with potential deductions related to homeownership costs, while Form 1099 reports various types of income you received, is crucial for accurate tax reporting.

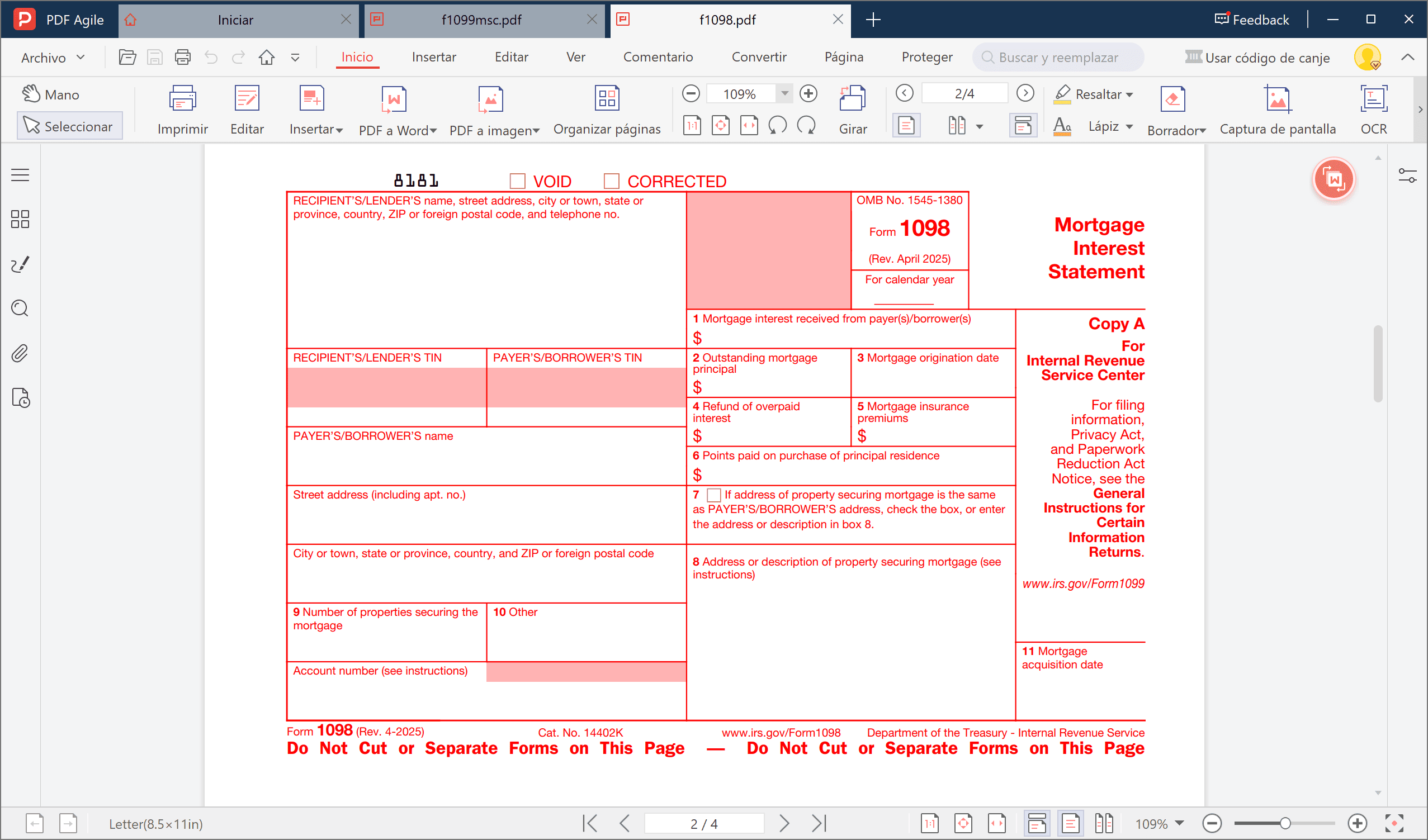

How to Fill Out the 1098 Form (for Lenders)

The following steps are generally for mortgage lenders who are preparing Form 1098 to send to borrowers and the IRS:

1. Gather Your Info:

Collect all necessary information, including the names, addresses, Taxpayer Identification Numbers (TINs), and account numbers for both the lender and the borrower.

2. Basic Details Section

- Enter the lender’s name, address, and TIN in the top-left corner.

- Fill in the borrower’s name, address, and account number in the top-right.

3. Box-by-Box Walkthrough

- Box 1 (Interest Received): Enter the total mortgage interest received from the borrower during the year.

- Box 2 (Outstanding Mortgage Principal): Report the outstanding principal balance on the mortgage at the beginning of the year.

- Box 3 (Origination Date): Provide the date the mortgage was originally issued in MM/DD/YYYY format.

- Box 4 (Refund of Overpaid Interest): If any interest was overpaid and refunded to the borrower, enter that amount here.

- Box 5 (Mortgage Insurance Premiums): If the borrower paid mortgage insurance premiums, list the total amount here. This may be deductible for the borrower.

- Box 6 (Points Paid on Purchase): If the borrower paid points when they took out the mortgage to buy the home, this amount goes here.

4. Review and Send

Double-check all entered information, especially TINs and dollar amounts, for accuracy. Send Copy B of the form to the borrower by January 31st of the following year. Copy A must be filed with the IRS by the end of February if filing on paper, or by the end of March if filing electronically.

5. Using PDF or Tax Software

Many software programs are available to help simplify the process of preparing and filing Form 1098 electronically, which can save time and reduce errors.

I take PDF Agile as an example. You can insert a blank 1098 form into PDF Agile and then type into each box before saving it for transfer. It's that simple. The whole process avoids printing and scanning through its stress-free operation.

How to Fill Out the 1099 Form

Form 1099 has various versions, each used to report a different type of income. If you are issuing a 1099 form, you need to fill it out. If you are receiving one, you will use the information on it to prepare your tax return. Here are instructions for some of the most common 1099 forms:

1099-NEC (Nonemployee Compensation)

This form is used to report payments to freelancers, gig workers, and other independent contractors.

- Payer Info: In the top-left section, enter your business name, address, and Employer Identification Number (EIN) or Social Security Number (SSN).

- Recipient Info: On the right side, enter the contractor’s name, address, and their TIN (SSN or EIN).

- Box 1 (Compensation): Record the total amount paid to the contractor during the tax year.

- Box 4 (Federal Income Tax Withheld): If you withheld any federal income tax (backup withholding) from the contractor’s payments, enter that amount here.

- Boxes 5-7: These are for state tax information, if applicable. Some states require reporting and withholding of state income tax.

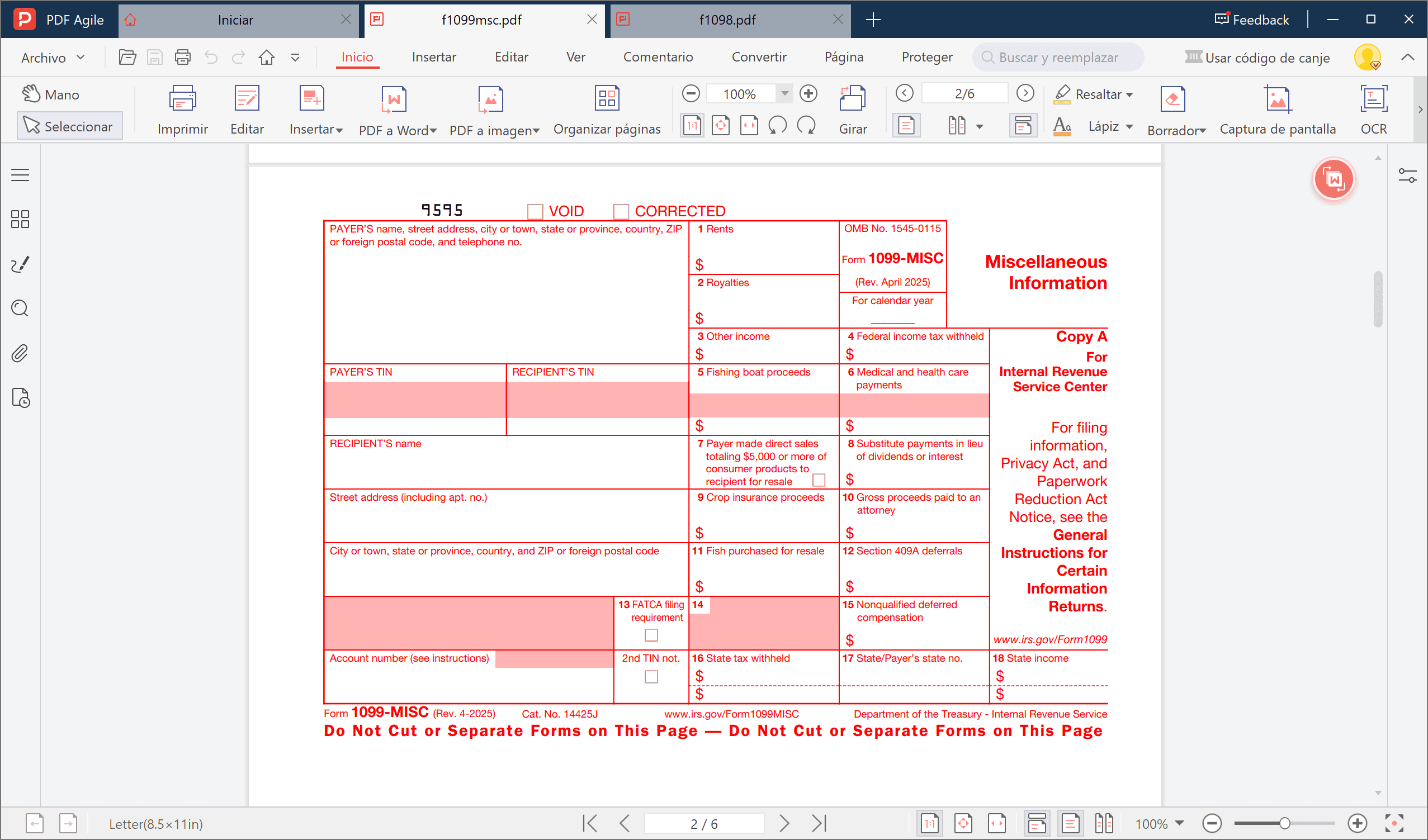

1099-MISC (Miscellaneous Income)

While primarily used for rents and royalties now, it can also cover other types of income.

- Box 1 (Rents): If you paid $600 or more in rent, enter the total amount here.

- Box 2 (Royalties): Report royalties of $10 or more in this box.

- Box 3 (Other Income): Use this box for prizes, awards, or other income that doesn't fit into other boxes.

- Box 4 (Federal Income Tax Withheld): Enter any backup withholding.

- Rest of the Boxes: The purpose of the remaining boxes varies depending on the specific type of miscellaneous income. Refer to the IRS instructions for Form 1099-MISC for details.

1099-INT (Interest Income)

Your bank or other financial institution will use this form to report interest income you've earned.

- Box 1 (Interest Income): Enter the total amount of interest paid to you that was $10 or more for the year.

- Box 2 (Early Withdrawal Penalties): If you incurred any penalties for early withdrawal of funds, the amount will be listed here.

- Boxes 3-4: These boxes may show interest on U.S. savings bonds and Treasury obligations (Box 3) and any backup withholding (Box 4).

Deadlines and Filing

Recipients of all types of 1099 forms should generally receive them by January 31st of the year following the tax year. The deadline for businesses to file 1099 forms with the IRS is typically February 28th if filing by paper, or March 31st if filing electronically (for the tax year 2024, these deadlines are generally applicable for forms filed in 2025, but always verify with the IRS for the specific year). Failing to meet these deadlines can result in penalties, so it's wise to establish a system to ensure timely filing. Tax preparation software can assist with this process.

FAQs

Q: Do I need to file a 1098 form if I paid less than $600 in interest?

No, you (as the borrower) do not file Form 1098. This form is issued by the lender to you and the IRS when you have paid $600 or more in mortgage interest during the tax year. The IRS generally does not allow deductions for mortgage interest below this threshold.

Q: I did some side gigs and made under $600. Will I get a 1099-NEC?

Typically, no. Payers are not required to issue a Form 1099-NEC if the total payments to a nonemployee contractor during the year are less than $600. However, you are still required to report this income on your tax return, even if you don't receive a 1099 form.

Q: Can points on my mortgage be deducted if I get a 1098 form?

Generally, yes. If you paid points when you obtained your mortgage, the amount paid will be listed in Box 2 of Form 1098. These points are usually deductible as home mortgage interest over the life of the loan, or sometimes fully in the year they were paid, depending on specific rules.

Q: What if I lose my 1099 form before filing?

Don’t worry. Your first step should be to request a duplicate form from the payer. Many payers also provide electronic copies through online portals. If you cannot obtain a copy, you can still file your return by estimating your income as accurately as possible, but be sure to keep detailed records of how you arrived at those figures.

Q: Is it possible to e-file both 1098 and 1099 forms?

Yes, both Form 1098 and the various Form 1099s can be filed electronically with the IRS. The IRS encourages electronic filing due to its speed, security, and instant confirmation of receipt.

Conclusion

Understanding the roles of Form 1098 and Form 1099 is a fundamental aspect of tax compliance. Form 1098 primarily helps you identify potential deductions related to mortgage interest, while Form 1099 reports various types of income you've earned outside of traditional employment.

Familiarizing yourself with the different boxes on these forms will make the tax process smoother and less stressful. Utilizing PDF or tax preparation software can further simplify the task of handling these forms, helping to ensure accuracy and efficiency in your tax filings.