Whenever a company reports its earnings, be it $1 billion or $2 billion, that doesn't mean the company has the same amount in the bank. When a business creates a financial statement, it will include non-cash items as well. This is done to show the financial health of an organization.

But herein lies the problem. Since everything gets included in accrual accounting, business needs something robust that tells them exactly how much cash is coming in and going out. And to understand the cash inflow and outflow, there is something called simple cash flow. And to prepare a cash flow statement, you will need a simple cash flow template to let you create the cash flow without any hassle. Keep reading to find out how a cash flow is created.

What is a Cash Flow Statement?

Before searching for a cash flow statement template, it is essential to understand what a cash flow statement is. Just like a balance sheet and income statement, there is another important financial document that every company needs to prepare. This financial document is known as the cash flow statement. With the help of a cash flow statement, an organization can determine how much cash is coming in and is available in the bank and how much cash is going out from the company and to where.

Simply put, it's the cash flow that tells you the company's money in the bank and whether its financial status is healthy enough to keep running the business. The cash flow statement will help a business how it is operating and if the financial status isn't healthy, it will help the organization understand what needs to be done to improve further. A cash flow statement can also help a company dive deeply into its financial, investing, and operating activities.

Please note that a cash flow statement will be different from other financial statements because the purpose it solves is different. It will basically record every financial transaction that a company does. Apart from payment, a cash flow statement can also help the company learn about incurred liabilities.

Cash Flow Statement Essentials

You have now understood what cash flow is and why it is crucial. But there are a few essentials about cash flow that you must know about. Since it provides a detailed overview of what is happening within the organization regarding money, filling it up correctly is essential. A cash flow statement will be created for a particular period. This can be done monthly, quarterly, or annual evaluation. Even if you have recorded everything properly in an excel sheet, you need something that will give you a clear picture.

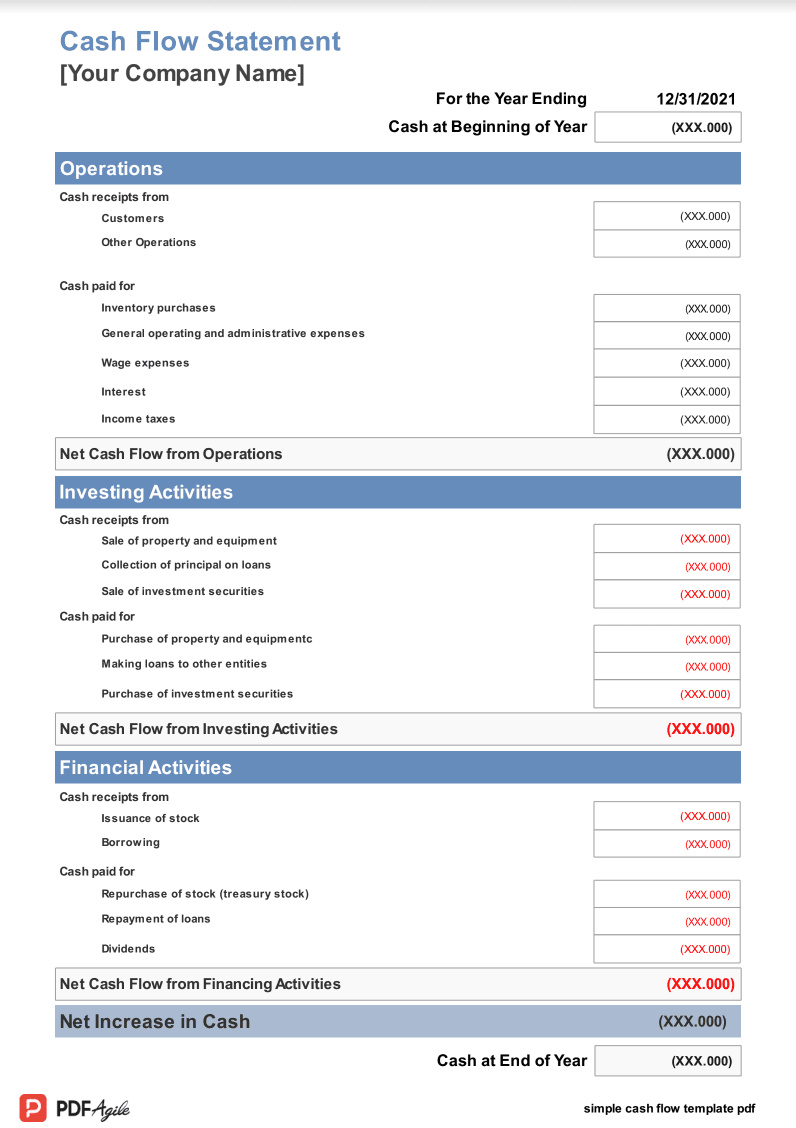

We have repeatedly been emphasizing the fact that it reflects on the performance of a company. So, there will be three critical elements of a cash flow statement, which are as follows:

Operating Activities

Operating activities are essential for an organization. This is required to run the business. Now, operating activities can be paying salaries to the employees, selling products, paying operational expenses, and purchasing inventory items. Operating activities tell you about the net cash flow from operations, which is critical for a company. In a balance sheet, you have current assets and liabilities; operating activities are associated with them. And the operating activities are also associated with an income statement's revenue and expense elements.

Inverting Activities

Inverting activities can be selling and purchasing assets, for example, equipment and property, selling and buying investment securities, lending money to other parties, etc. In the balance sheet, you have something called long-term assets; inverting activities are related to that.

Financial Activities

Financial activities are repurchasing stocks or issuing stocks, repaying loans to creditors or borrowing money from them. Financial activities help you understand a business's long-term liabilities as well as equity in a balance sheet.

If you have these elements already prepared, then all you will need is an easy cash flow template, and you will be able to prepare the cash flow statement conveniently.

Benefits of Using a Cash Flow Statement

Cash flows are crucial for businesses because, through cash flow statements, one can learn about their cash-related activities. Here are some reasons why a company should always prepare cash flow statements.

Spending Activities Insights

As a company, it is pretty evident that there will be cash transactions. Cash flow helps in analyzing a profit and loss statement as well. Let's say your company has spent money on some equipment or has taken a loan from the bank. Without recording it, it will become hard for you to figure out how much money you need to pay and how much money will be left. It basically gives you a clear picture of your cash transaction.

Short-Term Planning

Since cash flow statements tell you how much money you have, it makes it easier for companies to do short-term planning. Let's say there is an upcoming project, and you know you need to invest in a few pieces of equipment. With a cash flow statement ready, you will know whether you can buy the new equipment or not, or think of models that will fit your budget and plan accordingly.

Cash Planning

Whenever a company decides to spend cash, they always do the planning. And to do accurate planning, a cash flow statement can come in very handy. You will be able to compare the actual spending with the budget estimated and find out why the expenditure is on the higher side if that's the case. Planning becomes streamlined with a cash flow statement.

Increase Cash Inflow

Since a cash flow statement tells you about what's the inflow and outflow of cash, you will be able to see whether your business is in profit or loss because if the outflow is more than the inflow, then there's something that the company is doing wrong and must find ways to increase cash inflow. Let's assume that your company is spending more money on inventory, and then you can decide on a fixed amount for the inventory expense.

Better Knowledge of Cash Balance

Cash flow statements are sort of educational documents as well. Through cash flows, you can enhance your knowledge about your business. Understand every bit of your spending so that you can have better control over it. Let's say the cash flow statement shows you that you have an excess of cash; if yes, you can think of investing opportunities.

Long-Term Planning

Just like short-term planning, cash flow statements make long-term planning possible. A company's growth is based on multiple things, one of which is accurate financial planning. You can think of long-term goals and have a solid financial positioning if you follow the right track. And with a cash flow statement, you're planning for the future will become stable.

How to Construct a Cash Flow Statement?

Below, you will find a step-by-step guide on preparing a cash flow statement without making any errors. Just follow the steps and download a legit cash flow statement template, which will be easy to fill and understand. Now, let's get started:

Step 1: Starting Balance

The first thing you will have to add to a cash flow statement is the starting balance that you have right at the beginning of a financial year. You must add cash and cash equivalents to the starting balance. You can easily find this statement in your income statement. Starting balance is mandatory; hence add it as it is.

Step 2: Operating Activities

Once the starting balance is added, you must enter all the operating activities. This section will tell you how much money your company has made or generated via operations. There will be two ways for this:

1. Direct Method: One way to calculate the operating activities is to take the direct method. This is pretty straightforward. You will calculate everything you have generated from operations and then subtract it from the cash disbursements.

2. Indirect Method: For the indirect method, you will have to figure out the net income, which will be there in the income statement. Then you need to adjust the accruals you made during the reporting time; this will be the "undo" section.

The result for both will be the same, just that the way you do the calculation will vary.

Step 3: Investing Activities

This section will register all your investing activities. If you have bought or sold long-term assets, such as equipment, facilities, or properties, you will mention them here. This section will not have any debts.

Step 4: Financial Activities

This section will have every detail of your financial activities, inflows and outflows. From debt to equity financing, you will mention everything here. Even if you have raised some cash or have paid to debtors, you will also mention them here.

Step 5: Ending Balance

Just like you have a starting balance, you will also have an ending balance.

And that's how you will prepare a cash flow statement. We hope this guide will help you create one, and to get started, download an easy-to-understand and simple cash flow statement template.