Introduction

When one decides to transfer ownership of properties like real estate, they need to do a deed for the transfer to be official. A deed refers to a document officially transferring the name and title of the property from one individual to another. Read through to learn more about quitclaim deeds, how they function, the necessary details one needs to include in the document, and a run-through of a quitclaim deed example.

Quitclaim deed defined

Quitclaim deeds can be one of the more straightforward options to transfer real estate properties to a new owner. In context, the owner of the property or the grantor can provide this type of deed and translate the whole interest to the recipient’s property or the grantee. While there may be money involved in the process, it is not a requirement. Additionally, there is no title search and title insurance involved to verify the property owner. As such, quitclaim deeds are useful in transferring between family members and spouses.

How does it work?

Quitclaim deeds work by allowing an owner to transfer commercial or residential properties to a recipient without the assurance that the title involved is free of any defects. In the absence of the ownership guarantee, another involved party, like a lender or bank, can take a legal claim on the involved property without the knowledge of a recipient. Now, the recipient gets the ownership of the property using the quitclaim deed, and the title ends up with defects. In this case, the transferring party will not be held liable for possible damages the recipient will experience.

What are quitclaim deeds for?

When you look at a quitclaim deed example, you will see that the document comes in various purposes. Here are some of them.

- Transfers among family members. In most cases, quitclaim deeds are useful to transfer properties between family members. It could mean property transfers between siblings, children, parents, and other closely related family members.

- Addiction or removal of a spouse from a title. Whether it is because of marriage or divorce, an owner of the property can have the quitclaim deed to remove a spouse from or add to the property title.

- Changes in the owner’s name. Property owners can use a quitclaim to change names during the duration of the ownership. While the changes on the title may not be necessary once the owner decides to change names, it can still be beneficial to do so. Also, there are various ways why an owner changes names, including marital status.

- Legal ownership transfers to a corporation or an LLC. As the holding of real properties in the protection of corporations becomes more common, a quitclaim is usually utilized to transfer property ownership to these entities. Also, most corporations use this type of deed since it involves transfers among closely related businesses and entities.

The elements of quitclaim deeds

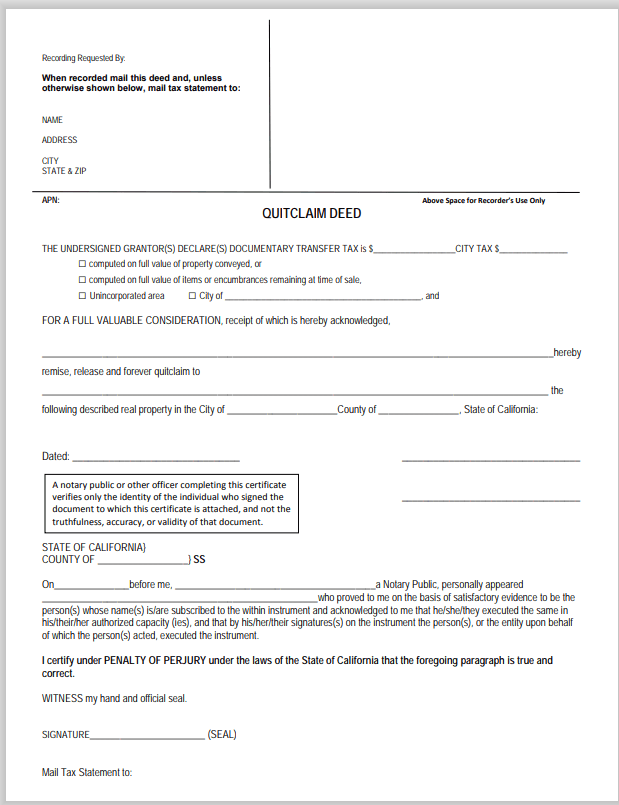

Every county has a different approach to structuring a quitclaim deed example. However, there are primary elements that are common to most legal deeds.

- Title. The document needs to have a title. In this case, it is a “Quitclaim Deed.”

- Date executed. This refers to the exact date of the legal document’s completion, signing, and execution.

- Grantor. It refers to the person responsible for transferring their rights to the property to another person. The word “person” here could mean an LLC, corporation, natural person, trustee, or any entity legally owning a property.

- Grantee. This refers to the person responsible for receiving the ownership rights of properties being transferred. Additionally, they could mean entities, corporations, or family members.

- Habendum. This generally means the meat to the quitclaim deed. In most cases, the habendum clauses typically start with “to have and to hold.”

- Consideration. Here lie the things the grantee offers to the grantor in exchange for the ownership rights. In some cases, deeds can be enforceable without consideration. However, it may be prone to conflicts later on. It can be ideal to consult with a tax accountant before finalizing the transfer, as there could be tax issues around here.

- Legal description. You can see here the list of descriptions about the property being transferred. While the format will vary depending on the state, legal descriptions could mean bounds and meters, lot and block, and rectangular survey.

- Signatures. Some states only require the grantor’s signature on the quitclaim deed. Also, there must be a notarization of the document. In some cases, there needs to be a witness while the grantor signs the document.

- Prepared by. Here you will see the name of the person who prepared the document. It could be the lawyer or the grantor.

A quitclaim deed vs. a warranty deed

In most cases, deeds are different in what they guarantee or state during property transfer from the grantor to the grantee. A quitclaim deed is famous for getting the property transferred between trusted parties efficiently and faster. As a potential new owner, it is essential to note that the grantee inherits property as-is.

On the other hand, warranty deeds are common in purchase and sale transactions. Moreover, they provide more protection to involved parties. However, these deeds can take longer and are more formal than quitclaim deeds. Unlike quitclaim, a warranty deed involves a legal clause and monetary compensation, which protects buyers against future title issues or liens. In most cases, warranty deeds are useful when buying a primary residence.

The pros of quitclaim deeds

- Affordability. Since a quitclaim deed is typically very common, you need not have a lawyer to formulate one. Instead of spending hundreds of dollars on legal fees, various quitclaim deeds are affordable, even less than a hundred dollars. You just have to ensure that the quitclaim deed example you use complies with the state’s laws.

- Easy filing. Accomplishing a quitclaim deed is straightforward once you purchased a form and input the necessary information. The grantor should sign the document and notarize it. In most states, the grantee also needs to sign the deed. After signing, you just need to submit the document to the county clerk for the transfer to be official.

- Flexibility. Quitclaim deeds are beneficial in various situations. People can use it to add a spouse’s name to the property or transfer the property to a company or a trust.

The cons

- No Guarantee. Quitclaim deeds only transfer the grantee’s share of the owned property to the grantor. This will not be an issue in cases where there is only a single owner or when an owner relinquishes the partial share, as in the case of a divorce proceeding. However, if the involved property is tied with liens, a quitclaim deed will not guarantee that the new owner will be freed from those complications.

- Potentially Fraudulent. The probability for people to create fake quitclaim deeds is higher. Ensure to inspect the legitimacy of ownership claims if you have doubts about the transaction. Since a quitclaim deed can also involve funds, you cannot waste your money on a faked document. Surely, transfers can happen between close-related entities and families. However, it can still be beneficial to verify the legitimacy of the deed.

- Irreversible Action. Once you accomplish and file the quitclaim deed, you will not own the property anymore. Furthermore, there’s no recourse if you change your decision about the transfer. You can only have the ownership of the property only if the new owner volunteers to give it back, still using a quitclaim deed.

FAQs

Q1: How long are quitclaim deeds valid?

A1: In general, a quitclaim deed is permanent. Hence, you can’t just easily cancel it once you decide to. After signing and filing it, there is no turning back as you cannot revoke it unless the court determines that you formulated it under the undue influence of another individual.

Q2: Does a quitclaim deed affect mortgages?

A2: Quitclaim deeds do not eliminate a person’s mortgage responsibilities. Suppose you have single ownership of your house, then add your spouse to the title; the spouse’s name will not suddenly appear on the mortgage. In essence, adding someone to mortgage loans is generally impossible.

Q3: Is a lawyer necessary for quitclaim deeds?

A3: In general, a lawyer is not necessary for creating a quitclaim deed unless you choose to consult one. You can check on a quitclaim deed example online, which you can use to create the document. It’s fast and easy. You can even edit some of them by just downloading the template.