If you think preparing a personal financial statement is not important, think again. No matter what your income is and how much you save, a personal financial statement can help you see a clear picture of your liabilities and assets. A personal financial statement is an important document that can help you visualize your financial situation in the best way possible. Moreover, your financial statement can also help you get a loan if required.

But if you have never prepared a personal financial statement yet and would like to know how to prepare a personal financial statement template to get started, this guide will be helpful to you. Here, you will not only find a simple personal financial statement template, but learn how to prepare one without any hassle. Keep reading.

What is a Personal Financial Statement?

Simply put, a personal financial statement is a piece of financial document that can tell you your net worth. It will highlight all your finances in the simplest form. Just like financial statements are important for businesses to understand their net worth, personal financial statements are prudent for individuals who want to know their financial status and health. With the help of a financial statement, you will get to know your financial stability or creditworthiness, which is required in case you are applying for a loan.

You may require a personal financial statement if you want to apply for loans or connect with lenders to start a business. Generally, financial institutions prefer taking a look at personal financial statements and checking whether you will be able to repay the loan amount or not. Not just this, if you are thinking of buying an existing business, you will require a personal financial statement then as well. There could be a myriad of reasons why you want to create a personal financial statement, but what you need to understand is it is essential.

Who Creates Personal Financial Statements?

Personal financial statements for everyone and anyone who would like to have a detailed picture of their financial stability and health. Any individual can create it. But typically, personal financial statements are created by entrepreneurs. They prepare it so that on behalf of their personal financial statements, they can apply for loans or attract potential investors. But all in all, it is created by individuals.

Please note that a financial statement prepared by a business and an individual will be different. Some individuals can prepare personal financial statements to keep track of their financial position, while others can prepare them to start a business. Since to start a business, entrepreneurs would like to apply for loans, a personal financial statement can work as a piece of document that can get them the loan amount their desire. Once a business starts, the same entrepreneur can think of preparing both personal and business financial statements.

Components of Personal Financial Statements

A personal financial statement will have specific vital components. Below, you will find the list of components and their explanation.

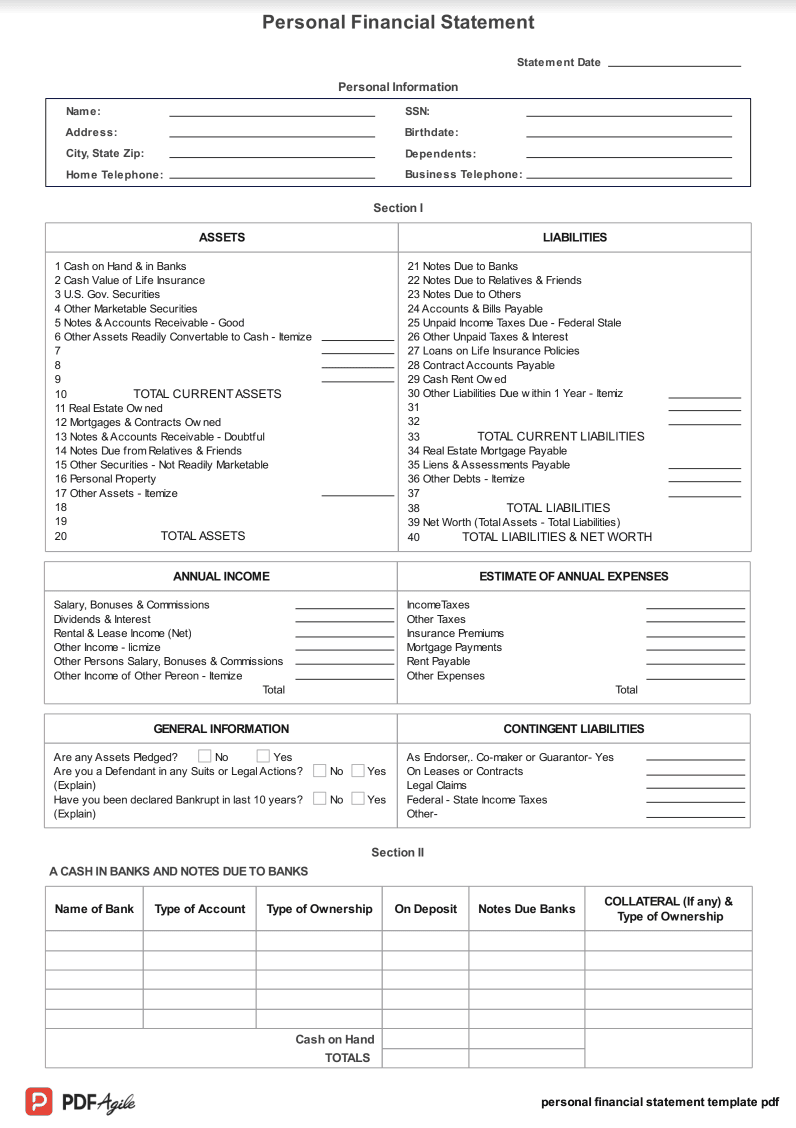

1. Personal Information: First, a personal financial statement is incomplete without the individual's bio. Therefore, there has to be a legal name, and it has to be the full name. You also need to include communication details, such as an address, contact number, and email ID. If you have a fax number, you can include that too. This section helps the financial institution know about you in detail. In case you are an entrepreneur, it is better to include your business's name as well.

2. Balance Sheet: Next comes the balance sheet, which will have two additional important components: assets and liabilities. The balance sheet determines your net worth. So, to calculate this, you will have to add all your liabilities and assets separately and subtract liabilities from assets. Then you have the net worth. To help you understand better, let's assume that the $100,000 is your assets, and $65,000 is the liabilities. Subtract liabilities from assets, and you have a net worth of $35,000.

Creating a balance sheet is essential; as said, it has two critical components. Take a look below:

Assets

You will have to list all your assets and mention them in the balance sheet. Assets can be of multiple types, such as accessible cash. Accessible cash will be cash that is available on hand and checking account balances. Assets will be a balance of all saving accounts, the total balance of retirement accounts, if any, accounts and notes receivable, properties, automobiles, real property, firearms, life insurance policies, and so on.

You must mention all the property names if you have real estate properties. What type of properties do you have, when have you purchased them, the cost when you bought them and what is the value at present. You might also have to include the property's address and, in some cases, the mortgage holder's name. Some other details may be required as well. In the case of life insurance, you will have to list all the beneficiaries, the company of the life insurance, etc.

Liabilities

Just like assets, there will also be a list of liabilities, which you need to enter into the balance sheet. Your liabilities can be unpaid account amounts. For this, you will first have to research your unpaid accounts and determine the due amount in total. In case you own money from institutions, you will also have to mention that. Anything that you own from a credit union, bank, etc.

There can be unpaid installment accounts, such as payments that you pay in installments. Life insurance loan, if you have taken that, mortgage that you own for real estate properties, yet again, if applicable, unpaid taxes, and any other liabilities you have. You need to add them all up and mention the total amount as your total liability.

Other Information

In the financial statement, there's another vital component that you must not skip, which is your source of income. Your source of income can be anything. If you are earning through real estate, mention that. If you invest money in something and make money from that, you need to mention that, also your salary will be part of it, and any other income that you can think of, such as freelancing, part-time job, etc.

Your personal financial statement needs to be signed, and you must mention the date when you created the statement. You will also have to give your social security number, if applicable.

How to Write a Personal Financial Statement?

By now, you have learned what all will be there in a personal financial statement; now, let's find out how to fill up a free personal financial statement form.

Step 1: The first essential thing that you need to do is create a spreadsheet and start listing assets and liabilities. Create two separate columns for both.

Step 2: Now that you have two columns ready, start filling up the assets' column. This one needs to have the assets' name and individual worth. If you are staying in a rented apartment or house, don't include that. Also, skip all the minor things you think shouldn't be included.

Step 3: Once the assets' column is filled, move on to the liabilities' column. Here as well, you need to mention the money that you need to pay and to whom. This can be your credit card bills, home loans, car loans, personal loans, etc. Apart from this, unpaid federal or state tax, small claims, etc., will be included here.

Step 4: Now, add all the assets and figure out the value. If you are using an Excel sheet, just select the values under the asset tab and see the total value. You can enter that amount in the total asset tab. Similar to this, use the same trick to calculate your liabilities. Whatever the number is, mention it as total liabilities.

Step 5: For the final step, you need to subtract total liabilities from total assets, and you will have the net worth amount. This is your value.

If you want to submit your personal financial statement to a banking or financial institution, you may be asked to add your source of income.

Conclusion

It is always better to prepare a personal financial statement as a habit. You never know when you might want to apply for a loan. And if not a loan, your personal financial statement can help you understand your net worth. This clears a lot of things. For example, you know how much money you will have in your bank.

For accurate financial planning, individuals must start the habit of preparing personal financial statements. With this note, we hope this guide will help you understand how crucial personal financial statements are and why you should prepare them. Even if you don't want to prepare a statement every month, do make a quarterly personal financial statement. We have shared a personal financial statement template with you, which you can use for your perusal.

Please remove the company logo “Score” completely. Just mention Personal Financial Statement and add a different color than the current one. Please don’t add Notes on Preparation part. Remove Notes on Preparation completely. You can use different font to make the template look different.