Are you embarking on a business venture with a partner? Whether you're starting a small startup or joining forces with a friend or family member, a well-crafted partnership agreement is essential to protect your interests and ensure a smooth and successful collaboration.

Imagine the peace of mind that comes from knowing your partnership is legally protected and your rights are secured. A partnership agreement outlines the terms and conditions of your business relationship, preventing misunderstandings and resolving disputes before they arise. Don't let uncertainty cloud your entrepreneurial journey. By creating a comprehensive partnership agreement, you can lay a strong foundation for your business and focus on achieving your shared goals.

What are Partnership Agreements Exactly?

A partnership agreement is a legal contract that outlines the terms and conditions of a business relationship between two or more individuals or entities. It serves as a roadmap, guiding your decisions and protecting your interests throughout the life of the partnership.

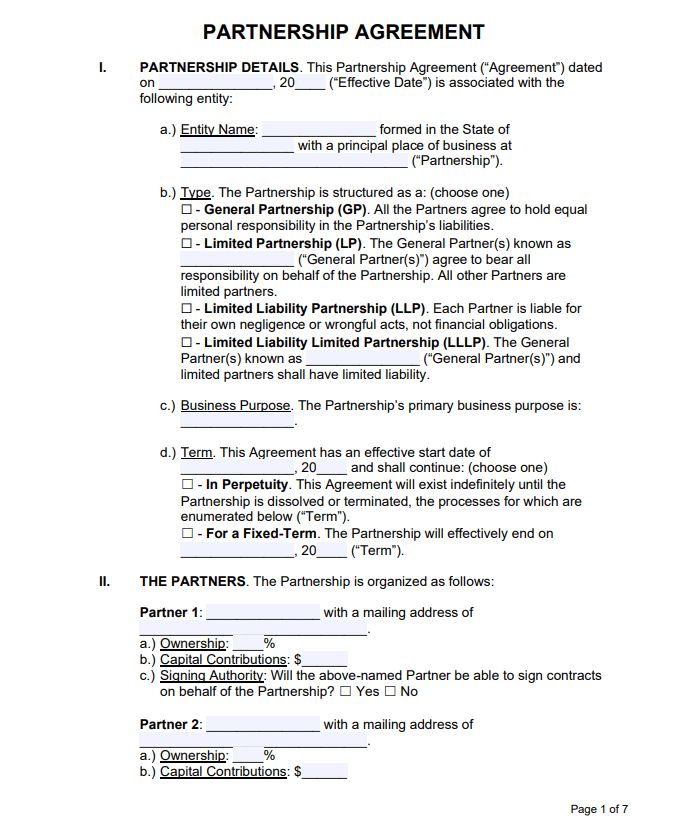

Key Elements of a Partnership Agreement:

- Partnership Type: Specify the type of partnership (e.g., general partnership, limited partnership).

- Business Purpose: Clearly define the goals and objectives of the partnership.

- Capital Contributions: Outline the financial contributions of each partner.

- Profit and Loss Sharing: Determine how profits and losses will be divided among the partners.

- Management and Decision-Making: Establish rules for managing the business and making important decisions.

- Dispute Resolution: Specify how disputes between partners will be resolved.

- Exit Strategy: Plan for potential scenarios where a partner may leave the partnership.

By understanding these key elements, you can create a comprehensive partnership agreement that protects your interests and ensures a successful collaboration.

Why do we need a Partnership Agreement in Business?

A partnership agreement is essential for several reasons:

- Protecting Your Interests: A well-drafted agreement can safeguard your ownership rights, financial obligations, and decision-making power within the partnership.

- Avoiding Disputes: By clearly outlining the terms and conditions of your relationship, you can prevent misunderstandings and conflicts that can arise in business partnerships.

- Ensuring Legal Compliance: A partnership agreement helps you comply with relevant laws and regulations, protecting your business from legal issues.

- Facilitating Collaboration: A clear and transparent agreement can foster trust and cooperation among partners, leading to a more productive and successful partnership.

- Providing a Foundation for Growth: A solid partnership agreement can provide a stable foundation for your business, allowing you to focus on growth and expansion.

By investing the time and effort to create a comprehensive partnership agreement, you can lay the groundwork for a successful and enduring business relationship.

How to Create a Partnership Agreement?

Step 1: Identify the Parties

Clearly define the names and roles of each partner involved in the partnership.

Step 2: Determine the Business Structure

Choose the appropriate legal structure for your partnership, such as a general partnership, limited partnership, or limited liability company (LLC).

Step 3: Define Capital Contributions

Specify the financial contributions of each partner, including cash, property, or other assets.

Step 4: Outline Profit and Loss Sharing

Determine how profits and losses will be divided among the partners. This can be based on equal shares, capital contributions, or other agreed-upon criteria.

Step 5: Establish Management and Decision-Making Procedures

Outline how the business will be managed and how important decisions will be made. Consider factors such as voting rights, management roles, and dispute resolution mechanisms.

Step 6: Address Dispute Resolution

Specify how disputes between partners will be resolved, such as through mediation, arbitration, or litigation.

Step 7: Consider Exit Strategies

Plan for potential scenarios where a partner may leave the partnership, including buyout provisions, dissolution procedures, and the transfer of ownership interests.

Step 8: Seek Legal Advice

Consult with an attorney to ensure that your partnership agreement complies with all applicable laws and regulations.

How to Use the Partnership Agreement Template?

Approach 1: Online Editing with PDF Agile

- Download the Template: Download the partnership agreement PDF template from PDF Agile.

- Open in PDF Agile: Open the template in the PDF Agile software.

- Edit and Customize: Use PDF Agile's editing tools to fill in the blanks, add notes, and customize the template to your specific needs.

- Save and Share: Save your completed partnership agreement and share it with your partners for review and signing.

Approach 2: Handwriting the Template

- Download and Print: Download the template and print it out on paper.

- Fill in the Blanks: Use a pen or pencil to fill in the blanks and write your ideas directly on the template.

- Review and Revise: Once you've completed the template, review your ideas and make any necessary revisions.

FAQs

Q: Should I consult with an attorney?

A: It is highly recommended to consult with an attorney to ensure that your partnership agreement is legally sound and tailored to your specific needs.

Q: What if my partner and I disagree on certain terms of the agreement?

A: If you and your partner cannot agree on certain terms, it is important to discuss the issues openly and try to find a mutually beneficial solution. If you are unable to reach an agreement, you may need to consider mediation or arbitration.

Q: What happens if a partner wants to leave the partnership?

A: Your partnership agreement should outline the procedures for a partner leaving the partnership, including buyout provisions and the transfer of ownership interests.

Q: Can I use the partnership agreement template for other types of business relationships?

A: While the template is specifically designed for partnerships, it can be adapted for other types of business relationships, such as joint ventures or limited liability companies (LLCs). However, you may need to modify certain sections to reflect the unique characteristics of your business structure.

Free Download: Printable Partnership Agreement Template Template

To help you get started, we have created a free, printable partnership agreement template. You can download the template by clicking the Use Template button on this page.

You can also explore more templates in PDF Agile Template Center.