What is an LLC operating agreement?

All companies that fall into the category of a Limited Liability Company should make it a priority to draw up a Limited Liability Company Agreement. The LLC Operating Agreement is an ideal way to ensure that the company runs smoothly and prevent any problems or difficulties in the company.

It will outline how the business will operate, especially regarding its daily operations, functions, as well as duties of each member. The agreement is a legal document and will hold all parties, signing such an agreement accountable but will also serve as a protection for those members.

The lack of this agreement could deem the business invalid. This is because that would make the individual members personally liable. It is, therefore, important to ensure that all members are protected in the event of any lawsuit.

Apart from that, the business owner or manager would not have any control over the business, especially its daily operations. It will also make it much easier to hand over the business should the owner wish to sell it.

Thus, the contents of the LLC Operating Agreement, or an LLC Agreement, will contain the guidelines of how the company should run on a daily basis. By using this template, any business could easily draw up their own operating agreement. The template will provide all the details to enter and cover all aspects of the business needed to draw up an LLC Agreement. Some of these elements are:

- To enter all the details of the staff members: that is, their job descriptions, their salaries, their signatures, and their contributions. The contributions to members include their capital contributions as well as their percentage interests. Most importantly, it also indicates the size of the company in terms of numbers.

- The procedures for conflicts and disagreements, as well as

- The procedures for terminating employees due to resignation or other reasons. The other reasons might include the procedures in the case of dissolution, death, or disability.

- The details of how the company will use and distribute its assets. This includes the sharing of profits as well as the members of the investment.

- The overall strategy of how the owner or manager will run the business. This includes the rules of how the business would operate. Simply put, it is the structure of management.

- The dates of annual meetings should be included as well.

To understand all aspects of a business and run it at its optimum, it is always best practice to draw up an LLC Operating Agreement at the very start of a business. The contents are not set in stone and can always be changed along the way. This is especially true when new events or incidents occur. These changes should be added as amendments and are, therefore, also part of the legal document.

Once all parties sign the document, it becomes legally binding and replaces any other regulations that were in place before its existence. This is especially true when novel issues arrive. Each individual member needs to have a copy of the document to preserve it in a safe place. The agreement is a legal, binding contract between all members.

Why does a business need this agreement?

A business or company can easily draw up this agreement by using this template. It is vital for a company to draw up such an agreement, and a template will make it much easier. It is not a requirement by law in all states in the US, especially if the membership does not exceed one, but it would serve any business well to draw one up.

It will guide the business owner to set out a clear path of how the business should run. It will also make it clear to all members, especially with a multi-owner business. With such an agreement in place, the business owner or manager will have more control over the business. The agreement will minimize disputes and misunderstandings as well.

The agreement can be for a single-owner or a multi-owner business. If the owner or manager is not present to run the business for some reason, the stand-in has a clear set of guidelines to follow.

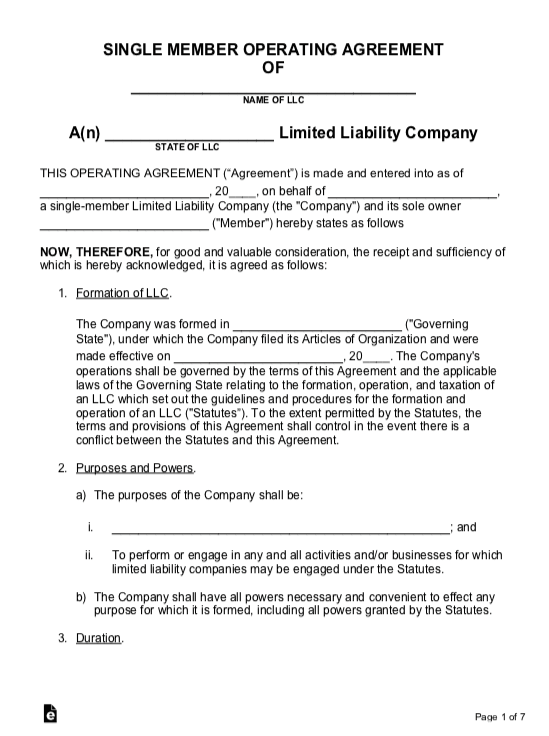

- A Single-Owner LLC Operating Agreement

A single-owner LLC Operating Agreement is much simpler to compile. This is especially true for taxation. However, it is also necessary as it will aid in running a well-organized business. It will help in the organization, planning, and decision-making of the business. As a single owner of a business, you can use a free LLC Operating Agreement Template to compile a single-owner LLC Operating Agreement for your own purposes as well. See below for example of a

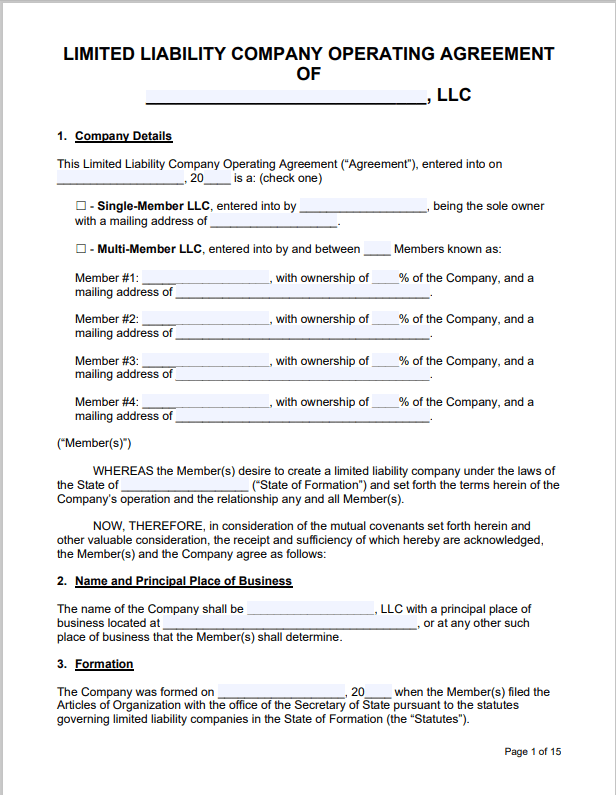

- A Multi-Owner LLC Operating Agreement

Most of the discussion here targets multi-owner businesses. The LLC Operating Agreement Template mentioned here is, therefore, the quickest and easiest way to draw up a multi-owner LLC Operating Agreement. See below for an example of a multi-owner LLC Operating Agreement template.

- An LLC Operating Agreement for Protection

Furthermore, it is important for a business to draw up an LLC Operating Agreement regardless of whether your state requires it or not. Should you live in a state that requires this agreement, it is easy to draw up as you will find an operating agreement template on their website. The template could also be used even if your state does not require it.

The most important aspect of drawing up this agreement is to protect the personal liability of the members of a Limited Liability Company. Thus, in the event of litigation, the agreement will protect the personal assets of members from the collection. That means that the individual members will not be directly affected by any legal suit.

Therefore, it is vital to note that, should a business not have this agreement, the state default rules will apply. The business will be open to state interference because it will be under the state’s default rules. It, therefore, makes the business vulnerable as it does not have a written and signed document. An LLC Operating Agreement is a legal document that states that the Limited Liability Company is a stand-alone legal entity and that the default state law, therefore, does not apply.

The agreement is an important legal document that will assist the business in its financial, tax, and legal operations. This could be especially beneficial to a sole proprietorship or a single-owner business. The operating agreement is often a requirement for opening bank accounts, investments, or obtaining financing.

For loan applications, the agreement might be required as an attachment to a business plan. It will assist the business with getting decent tax or legal assistance. In general, even though a legal document such as a business plan is not an absolute necessity, an LLC Operating Agreement is a much-needed legal document for any business. It is even more needed for a business that is a Limited Liability Company.

Writing an LLC Operating Agreement

As mentioned already, this agreement is not that difficult to draw up as you can do this easily with an operating agreement template. Most of the details that you would need for such an agreement will be laid out in the template, and it would just be a matter of completing the form. However, it is important that the business owner or manager include the following:

- The first indication on the form will be who the owner (or owners) is. This is recorded on the basis of contributions such as money, property, and time.

- It should also include the distribution percentage of shares.

- It should show if there is any special ownership allocation.

- All the staff members: If the staff component changes at any time, the LLC Operating Agreement needs to be amended and all the existing members have to sign the new document with the new member giving written consent as well.

- The business should include the distribution of profits in the agreement. It is necessary to record the disbursement of profits to members within the LLC Operating Agreement for tax purposes.

- Members are responsible for paying taxes on their income. The latter is an important aspect, as pass-through taxation means that each member of the business pays a share of the business taxes based on their personal salaries.

- This agreement protects business members against liabilities and business debt. Members are, therefore, not responsible for the debt or liabilities of the company.

- The business has the choice of creating a simple structure or inserting as many rules and regulations as it wishes. As already mentioned, creating this agreement is not that difficult. You can simply use this free template.

How do you write this agreement?

It is easy to write up or draw up this agreement. All that the business owner needs is a free Operating Agreement Template. The first step is to know whether your state requires an operating agreement by law. It is easy to find a template for this purpose on their website.

The template will provide the following details:

The names of all the parties to the Limited Liability Company. The names have to be the legal names of all members.

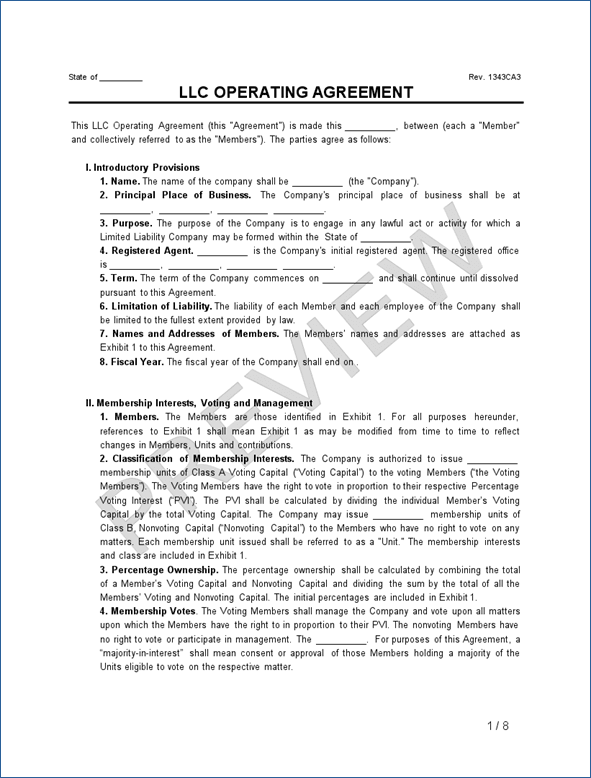

This is followed by the Introductory Provisions in the free template. Some of the details include:

- When the owner started the business, the date and term

- The purpose of the business

- The names and addresses of members, which are attached as an exhibit

The membership interests and voting, as well as the management of the business – that, is:

The membership interests include its classification as well as

the percentage of ownership,

their voting rights, and more.

The management part is important if the business has a manager.

The capital contributions include the money, services, or property each member contributes to the business.

The form allows businesses to add the distribution of profits and losses.

The compensation part of the form addresses the salaries. It addresses whether members qualify for expenditure reimbursement, and legal and accounting services.

The records and reporting include:

- The bookkeeping

- The records of members and all documents relevant to the running of the business.

- The full accounting of each fiscal year and so forth

Dissolution and liquidation are included on the form for businesses to indicate how the business will be dissolved without legal disputes.

The template allows a business to make provisions for indemnification. This protects members from liabilities and also includes insurance for members, the business, as well as the property.

The last part includes confidential information such as intellectual property, trade secrets, capital contributions, and general confidential information that should not be made public. It will also state the consequences or penalties associated with a breach.

As indicated, you can do this yourself by using a template. The LLC Operating Agreement Sample or LLC Operating Agreement Example below gives you an indication of how easy it is to fill in your own details and information. These are legal documents, and businesses can be assured that they are legally binding. Below is one from an LLC Operating Agreement Example. It will give you some idea of what to expect when writing your operating agreement.